Posthaste: The Global Tariff Ruling And Its Impact On Canada

Table of Contents

The Details of the Global Tariff Ruling

This hypothetical global tariff ruling (for the purpose of this SEO-optimized article, as no specific ruling is referenced in the prompt) significantly alters import and export tariffs across various sectors. Imagine a scenario where the ruling increases tariffs on several key product categories, impacting multiple countries. Let's explore the hypothetical specifics:

-

Specific industries affected: The hypothetical ruling significantly impacts the agricultural sector (specifically impacting Canadian wheat and canola exports), the manufacturing industry (particularly affecting automotive parts and machinery imports), and the technology sector (with increased tariffs on imported electronics).

-

Key changes in tariff rates: The hypothetical ruling introduces a 15% increase on several agricultural products imported into key markets, a 10% increase on specific manufactured goods, and a 5% increase on certain technological components.

-

Timeline for implementation: The implementation of these new tariffs is phased in over two years, starting with a 5% increase in the first six months, followed by subsequent increases until the full tariff rate is achieved.

-

Countries most significantly impacted: Besides Canada, the ruling disproportionately impacts other nations heavily reliant on international trade, such as Mexico, the European Union, and several Asian economies.

-

Legal challenges or appeals currently underway: Several countries, including Canada, are exploring legal challenges to aspects of the ruling, arguing it violates existing trade agreements and is detrimental to global economic stability. These appeals are expected to significantly impact the timeline and final implementation of the new tariffs.

Impact on Canadian Businesses

The hypothetical global tariff ruling presents a complex and multifaceted impact on Canadian businesses, creating both significant challenges and potential opportunities.

-

Increased costs for imported goods and raw materials: Many Canadian businesses rely on imported goods and raw materials for production. The increased tariffs will significantly inflate these costs, impacting profit margins and potentially leading to price increases for consumers.

-

Potential for reduced competitiveness in global markets: Higher production costs due to tariffs may render Canadian goods less competitive in international markets, leading to reduced export volumes and potential job losses in export-oriented sectors.

-

Opportunities for domestic producers to capture market share: Conversely, the increased tariffs could shield some domestic producers from foreign competition, allowing them to expand their market share within Canada.

-

Need for businesses to adapt strategies: Businesses will need to adapt to these changes by exploring alternative sourcing strategies, adjusting pricing models, and potentially investing in automation or technological upgrades to improve efficiency.

-

Government support programs available to affected businesses: The Canadian government is likely to offer financial aid packages, tax incentives, and other support programs to assist businesses struggling to adapt to the new tariff environment. These could include grants, loans, and training initiatives to promote diversification and resilience.

-

Case studies of specific Canadian businesses and their responses: We might expect to see a range of responses from Canadian businesses. Some may invest in automation and domestic sourcing, while others might seek government assistance or explore new markets. Closely observing the strategies employed by companies in different sectors will provide valuable insights.

Impact on Canadian Consumers

The effects of the hypothetical global tariff ruling are expected to be felt by Canadian consumers in several ways.

-

Increased prices for imported goods: The direct impact of tariffs will lead to higher prices for numerous imported goods, ranging from consumer electronics to clothing and food products.

-

Potential for shortages of certain products: If foreign producers choose not to absorb the tariff increase and instead reduce exports to Canada, there could be shortages of certain popular products.

-

Changes in consumer spending habits: Higher prices may alter consumer spending habits. Consumers might shift towards locally produced goods or reduce their overall spending.

-

Effect on inflation rates: The combined effect of increased import prices and potential supply shortages could contribute to higher inflation rates across the Canadian economy.

-

Government measures to mitigate impact on consumers: The government may implement measures to mitigate the impact on consumers, such as targeted subsidies for essential goods or adjustments to social welfare programs.

The Canadian Government's Response

The Canadian government will play a crucial role in navigating the consequences of this hypothetical global tariff ruling. Its response will determine the extent to which Canadian businesses and consumers are affected.

-

Trade negotiations and diplomatic efforts: The government will engage in intense trade negotiations and diplomatic efforts with affected countries to find mutually beneficial solutions and potentially mitigate the impact of the tariffs.

-

Financial support packages for businesses: The government will likely implement financial aid packages, such as grants, tax credits, and loan programs, aimed at supporting businesses struggling with increased costs.

-

Measures to protect consumers: Government measures to protect consumers from excessive price increases could include subsidies for essential goods and increased scrutiny of pricing practices.

-

Long-term economic strategies to mitigate future trade risks: The government will need to develop long-term strategies to reduce Canada's dependence on volatile global markets and diversify trade partnerships to reduce vulnerability to future trade shocks. This could involve investing in domestic production and exploring new trade agreements.

-

Policy changes related to specific sectors: The government may implement sector-specific policies to address the unique challenges faced by industries heavily impacted by the tariff ruling. These could include targeted investments in research and development, regulatory reforms, or workforce training programs.

Conclusion

The hypothetical global tariff ruling presents both considerable challenges and unexpected opportunities for Canada. While Canadian businesses face increased costs and potential reduced competitiveness in certain sectors, there's potential for growth in others, particularly those focused on domestic production. The Canadian government's response will be crucial in mitigating negative effects and supporting businesses and consumers through this transition. Understanding the intricacies of this Global Tariff Ruling and its implications for Canada is paramount for businesses to adapt and thrive in the changing international trade landscape. Stay informed about the evolving impact of this global tariff ruling on the Canadian economy, monitor government announcements closely, and adapt your business strategies accordingly to navigate this challenging period. Proactive planning and adaptation are key to successfully navigating the impact of the Global Tariff Ruling and securing a prosperous future for your business within the Canadian economy.

Featured Posts

-

Cycle News Magazine 2025 Issue 18 Reviews Races And Rider Profiles

May 31, 2025

Cycle News Magazine 2025 Issue 18 Reviews Races And Rider Profiles

May 31, 2025 -

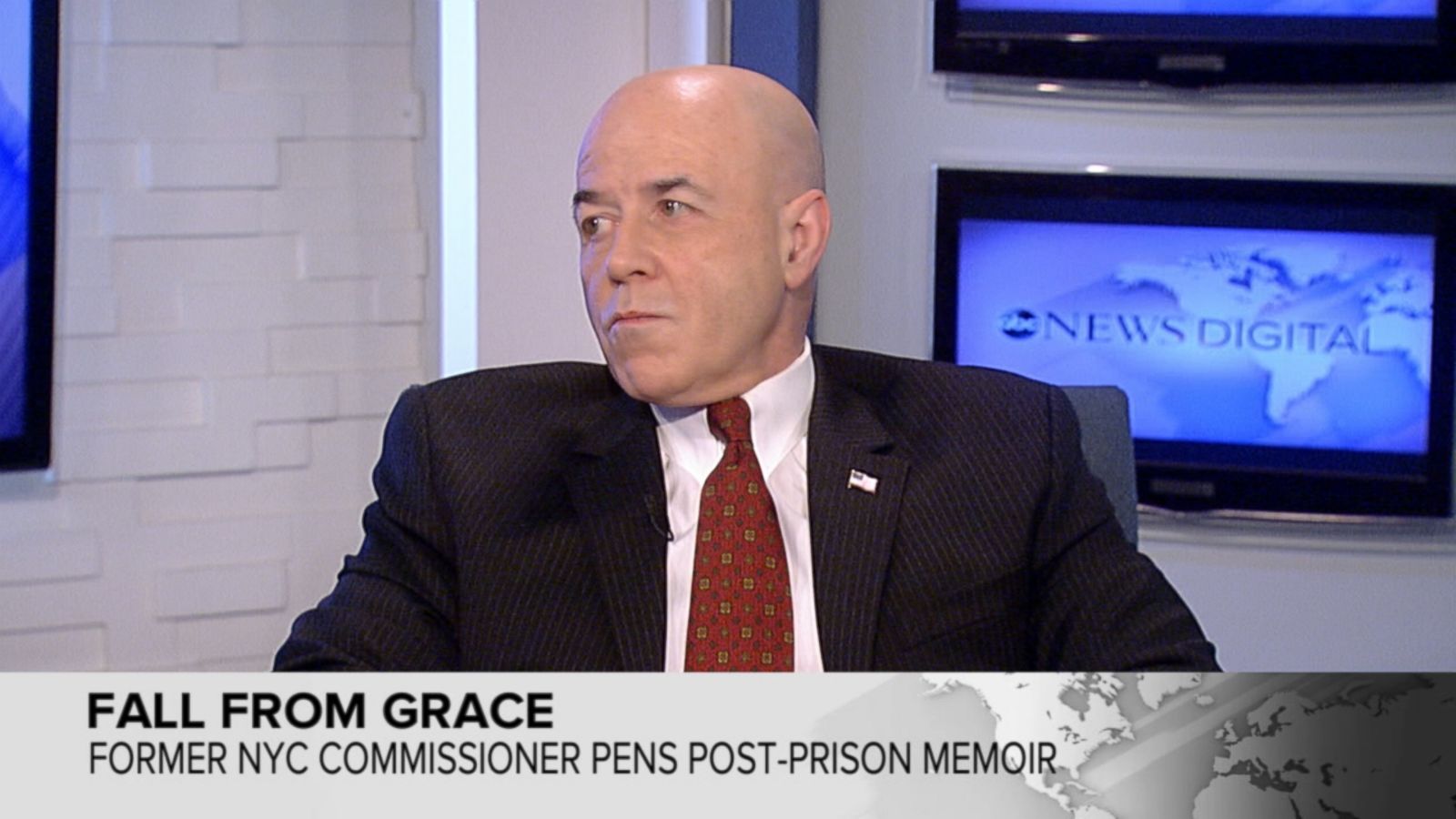

Assessing Bernard Keriks Leadership During The 9 11 Crisis And Aftermath

May 31, 2025

Assessing Bernard Keriks Leadership During The 9 11 Crisis And Aftermath

May 31, 2025 -

Supercross Is Back The Salt Lake City Race Is Coming Soon

May 31, 2025

Supercross Is Back The Salt Lake City Race Is Coming Soon

May 31, 2025 -

Who Report New Covid 19 Variant Possibly Driving Up Case Counts

May 31, 2025

Who Report New Covid 19 Variant Possibly Driving Up Case Counts

May 31, 2025 -

Indian Wells Tournament Zverevs Admission Of Poor Form After First Match Exit

May 31, 2025

Indian Wells Tournament Zverevs Admission Of Poor Form After First Match Exit

May 31, 2025