Posthaste: Understanding The Current Crisis In The Global Bond Market

Table of Contents

Rising Interest Rates: The Primary Catalyst

Rising interest rates are the primary catalyst behind the current global bond market crisis. The mechanics are straightforward: bond prices and interest rates share an inverse relationship. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon payments less attractive. This reduced demand leads to a decline in the price of existing bonds.

Central banks play a crucial role in this dynamic. Faced with persistent inflationary pressure, major central banks like the Federal Reserve (Fed) and the European Central Bank (ECB) have embarked on aggressive interest rate hike campaigns to cool down overheated economies. Their rationale is to curb inflation by making borrowing more expensive, thereby reducing consumer spending and business investment.

- Increased borrowing costs for governments and corporations: Higher interest rates translate to significantly increased costs for governments and corporations needing to borrow funds.

- Reduced demand for existing bonds: As new bonds offer higher yields, investors shift their focus, leading to a decrease in demand for existing bonds.

- Potential for defaults and credit downgrades: Higher interest rates can strain the finances of companies and even governments, increasing the risk of defaults and subsequent credit rating downgrades.

- Impact on fixed-income investments: The decline in bond prices directly impacts the value of fixed-income investments, creating losses for many investors.

For example, the Fed has implemented several interest rate hikes in 2023, significantly impacting bond yields and the overall market sentiment. These interest rate hikes, coupled with similar actions by other central banks, have contributed significantly to the current global bond market crisis. The implications of central bank policy on inflationary pressure are far-reaching and continue to unfold.

Inflationary Pressures and Eroding Purchasing Power

High inflation significantly impacts bond yields and investor confidence. Inflation erodes the purchasing power of future interest and principal payments, diminishing the real return on bond investments. Investors demand higher yields to compensate for the expected loss of purchasing power due to inflation.

- Diminished real returns for bondholders: Inflation eats away at the real return, meaning investors may receive a nominal return, but their purchasing power is less than anticipated.

- Increased demand for higher-yielding assets: Investors seek assets that offer returns exceeding inflation to protect their purchasing power, shifting their focus away from lower-yielding bonds.

- Flight to safety vs. search for yield: The tension between seeking safety in low-risk bonds and the need for higher yields creates market volatility.

- Impact on long-term bond strategies: Long-term bond strategies become more challenging to implement effectively in a high-inflation environment.

The current high inflation rates globally have significantly impacted real returns and investor confidence in the bond market. Investors are carefully assessing purchasing power and seeking bond yields that outpace inflation, leading to a re-evaluation of safe haven assets.

Geopolitical Instability and its Ripple Effect

Geopolitical events inject uncertainty into the bond market. Wars, trade disputes, and political instability create fear and risk aversion among investors. This uncertainty can trigger capital flight from emerging markets and increase demand for safe-haven assets.

- Increased risk aversion among investors: Geopolitical instability leads investors to seek safety, often pulling funds from riskier assets, including bonds from emerging markets.

- Capital flight from emerging markets: Emerging market debt becomes less appealing as investors flee to safer havens.

- Increased demand for safe-haven assets (e.g., US Treasuries): Investors flock to perceived safer assets, like US Treasuries, driving up their prices and reducing yields.

- Volatility and market uncertainty: Geopolitical events cause significant market volatility and uncertainty, making it difficult to predict market movements.

The ongoing geopolitical risk and global uncertainty significantly contribute to the current global bond market crisis. The impact on emerging market debt and the demand for safe haven assets are crucial elements of this complex situation. The resulting market volatility makes strategic investment decisions challenging.

The Impact on Different Bond Types

The current crisis impacts different bond types differently.

- Government Bonds: Generally considered safer, government bonds are still vulnerable to rising interest rates, though they may remain a preferred safe haven for some investors.

- Corporate Bonds: Corporate bonds, especially those with lower credit ratings (high-yield bonds or junk bonds), face higher default risks in a rising interest rate environment. Investment-grade bonds fare somewhat better but still experience price pressure.

- High-Yield Bonds: High-yield bonds are particularly vulnerable due to their higher risk profiles.

Navigating the Crisis: Strategies for Investors

Navigating this global bond market crisis requires careful consideration and strategic adjustments.

- Diversification across different asset classes: Diversifying beyond bonds into other asset classes like equities, real estate, or commodities can help reduce overall portfolio risk.

- Hedging strategies to protect against interest rate risk: Investors can use strategies like interest rate swaps or futures to hedge against potential losses from rising interest rates.

- Evaluating creditworthiness of issuers: Carefully assessing the creditworthiness of bond issuers is critical to minimizing default risk.

- Re-evaluating investment timelines: Investors may need to re-evaluate their investment timelines and adjust their strategies accordingly, potentially shifting towards shorter-term bonds.

Conclusion

The current global bond market crisis is a complex issue driven by a confluence of factors: rising interest rates, inflationary pressures, and geopolitical instability. These factors impact different bond types differently, requiring investors to adopt nuanced strategies. Understanding the intricacies of the global bond market crisis is crucial for informed investment decisions. Stay informed and adapt your strategies accordingly to mitigate risks and potentially capitalize on opportunities within the evolving global bond market. Continue learning about the global bond market crisis by exploring further resources.

Featured Posts

-

Wwe Wrestle Mania 41 Golden Belt And Ticket Sale This Memorial Day Weekend

May 24, 2025

Wwe Wrestle Mania 41 Golden Belt And Ticket Sale This Memorial Day Weekend

May 24, 2025 -

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 24, 2025

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 24, 2025 -

Pilbara Mining Debate Rio Tintos Counterarguments To Andrew Forrests Claims

May 24, 2025

Pilbara Mining Debate Rio Tintos Counterarguments To Andrew Forrests Claims

May 24, 2025 -

Canada Post Strike Averted Details Of The New Offer

May 24, 2025

Canada Post Strike Averted Details Of The New Offer

May 24, 2025 -

Glastonbury 2025 Lineup Leak Confirmed Performers And How To Buy Tickets

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Performers And How To Buy Tickets

May 24, 2025

Latest Posts

-

Get Ready Tulsa King Season 2 Blu Ray Featuring Sylvester Stallone

May 24, 2025

Get Ready Tulsa King Season 2 Blu Ray Featuring Sylvester Stallone

May 24, 2025 -

Sylvester Stallone In Tulsa King Season 2 Blu Ray Details Revealed

May 24, 2025

Sylvester Stallone In Tulsa King Season 2 Blu Ray Details Revealed

May 24, 2025 -

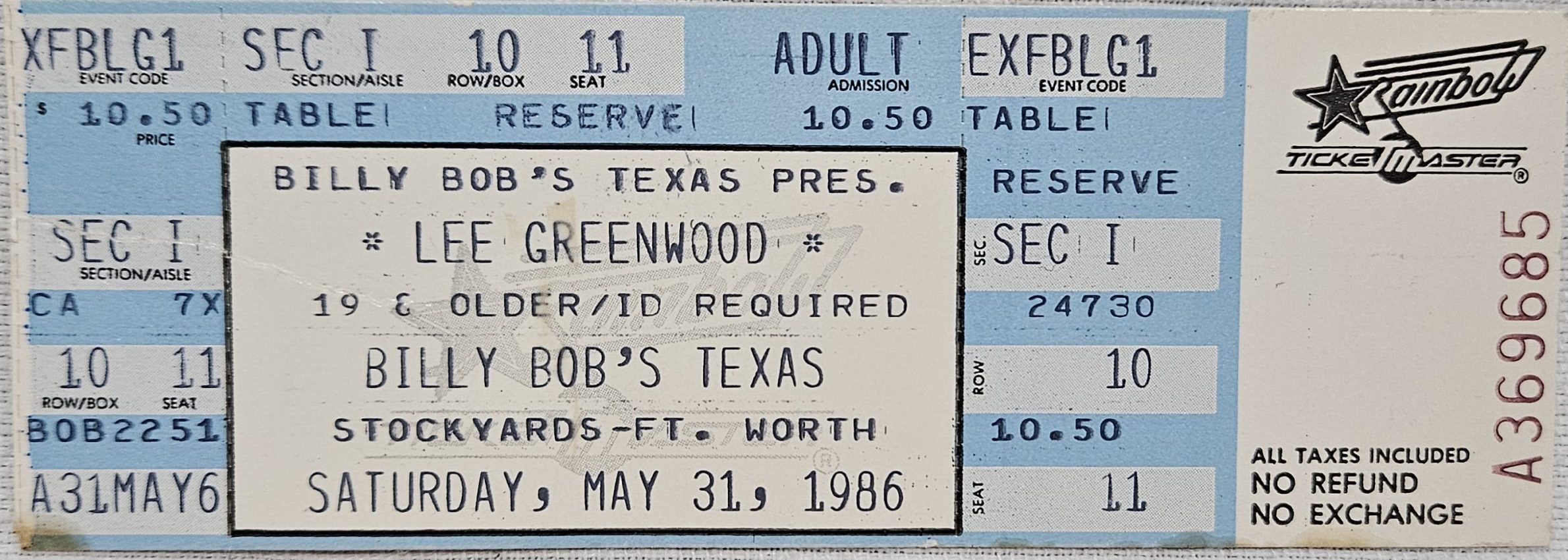

Fort Worth Stockyards Joe Jonas Surprise Show Delights Fans

May 24, 2025

Fort Worth Stockyards Joe Jonas Surprise Show Delights Fans

May 24, 2025 -

Exclusive First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 24, 2025

Exclusive First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 24, 2025 -

Unexpected Concert Joe Jonas Plays The Fort Worth Stockyards

May 24, 2025

Unexpected Concert Joe Jonas Plays The Fort Worth Stockyards

May 24, 2025