Posthaste: Understanding The Implications Of The Recent Tariff Decision For Canada

Table of Contents

Impact on Specific Canadian Industries

The Tariff Decision's impact reverberates across numerous Canadian industries, each facing unique challenges and opportunities.

Canadian Agriculture and Agri-Food

The Canadian agri-food sector, a cornerstone of the Canadian economy, is significantly affected by the tariff decision. Specific agricultural exports, such as lumber, wheat, and canola, face increased export costs due to the new tariffs. This tariff impact could lead to:

- Increased export costs: Higher tariffs make Canadian agricultural products less competitive in global markets.

- Potential market share loss: Competitors from countries not subject to the same tariffs could gain market share.

- Government support programs: The Canadian government may need to implement new or expand existing support programs to help farmers and producers cope with these increased costs. This could include direct financial assistance or market diversification initiatives. The success of these programs will heavily influence the long-term health of the Canadian agriculture sector.

Canadian Manufacturing Sector

The Canadian manufacturing sector is also facing significant headwinds. Manufacturers relying on imported materials will experience increased production costs due to the new import tariffs. Those exporting goods will face reduced competitiveness in international markets. This could result in:

- Increased production costs: Higher input costs reduce profit margins and make Canadian-made goods less price-competitive.

- Reduced competitiveness: This could lead to a loss of market share to manufacturers in countries with lower tariff barriers.

- Potential job losses: Companies may be forced to cut costs, leading to layoffs and plant closures.

- Relocation of manufacturing: Some manufacturers may consider relocating their operations to countries with lower production costs to maintain profitability. This poses a serious threat to Canadian manufacturing jobs and economic growth.

Canadian Energy Sector

The Canadian energy sector, particularly oil and gas exports, is also susceptible to the fluctuations caused by this Tariff Decision. The impact extends beyond direct tariffs and includes:

- Fluctuations in global energy prices: The tariff decision could exacerbate existing price volatility, making it harder for Canadian energy companies to plan for the future.

- Impact on investment: Uncertainty surrounding trade policies can discourage foreign investment in the Canadian energy sector.

- Potential for trade disputes: The tariff decision could trigger retaliatory measures from other countries, further complicating the situation for Canadian energy exporters. This makes diversification of export markets a crucial element for the Canadian energy sector's long-term viability.

Economic Consequences for Canada

The ramifications of the Tariff Decision extend far beyond specific industries, impacting the Canadian economy as a whole.

Canadian Inflation and Consumer Prices

Higher import costs due to the new tariffs are likely to fuel inflation, increasing the cost of living for Canadians. This could lead to:

- Impact on consumer spending: Higher prices may reduce consumer spending, slowing down economic growth.

- Cost of living increases: Canadians will face higher prices for a range of goods and services.

- Potential for government intervention: The government may need to intervene to mitigate the impact of inflation on vulnerable populations. This could include measures such as targeted financial assistance or adjustments to social programs.

Canadian GDP Growth and Investment

The Tariff Decision casts a shadow over Canada's economic outlook. Reduced consumer confidence and decreased business investment could lead to:

- Reduced consumer confidence: Uncertainty about the future can lead to decreased consumer spending.

- Decreased business investment: Businesses may postpone investments due to the uncertainty created by the tariffs.

- Potential for recessionary pressures: A combination of reduced consumer spending and business investment could lead to slower economic growth or even a recession. Monitoring key economic indicators such as GDP growth and business confidence will be crucial in understanding the full extent of the impact.

Canadian Job Market Impacts

The Tariff Decision threatens the Canadian job market, potentially resulting in:

- Sector-specific job losses: Industries heavily reliant on imports or exports will be particularly vulnerable.

- Increased unemployment: Job losses could lead to a rise in unemployment rates.

- Government retraining programs: The government may need to expand retraining programs to help workers displaced by the tariff decision find new jobs. The effectiveness of these programs in mitigating job losses will be a key factor in determining the long-term social and economic impact.

Government Response and Mitigation Strategies

Both the federal and provincial governments are taking steps to mitigate the negative consequences of the Tariff Decision.

Federal Government Actions

The Canadian federal government has implemented several measures to address the situation:

- Financial aid for affected industries: Direct financial assistance and tax breaks may be offered to help businesses cope with increased costs.

- Trade negotiations: The government is likely to engage in trade negotiations with other countries to address the tariff barriers.

- Lobbying efforts: The government is lobbying international organizations to resolve the trade disputes. The success of these efforts will play a vital role in determining the long-term implications of this tariff decision.

Provincial Initiatives

Several provinces are also taking steps to support their local businesses and industries:

- Provincial aid programs: Provinces may offer financial assistance or tax incentives to help businesses facing challenges.

- Diversification initiatives: Provinces might encourage businesses to diversify their products and markets to reduce reliance on sectors impacted by the tariffs.

- Regional economic development plans: Provinces may implement regional economic development plans to support industries most vulnerable to the impacts of this decision. Effective collaboration between federal and provincial governments is essential to ensuring the comprehensive support of affected regions and industries.

Posthaste: Key Takeaways and Call to Action

The recent Tariff Decision presents significant challenges for the Canadian economy, affecting various sectors and potentially leading to inflation, reduced economic growth, and job losses. The government's response, while crucial, will need to be carefully monitored for effectiveness. Understanding the long-term consequences of this Posthaste tariff decision is paramount for Canadian businesses and consumers. Stay informed on the latest developments related to this Posthaste tariff decision and its implications for Canada. Subscribe to our newsletter for updates and in-depth analysis.

Featured Posts

-

Analyzing Thompsons Unlucky Performance In Monte Carlo

May 31, 2025

Analyzing Thompsons Unlucky Performance In Monte Carlo

May 31, 2025 -

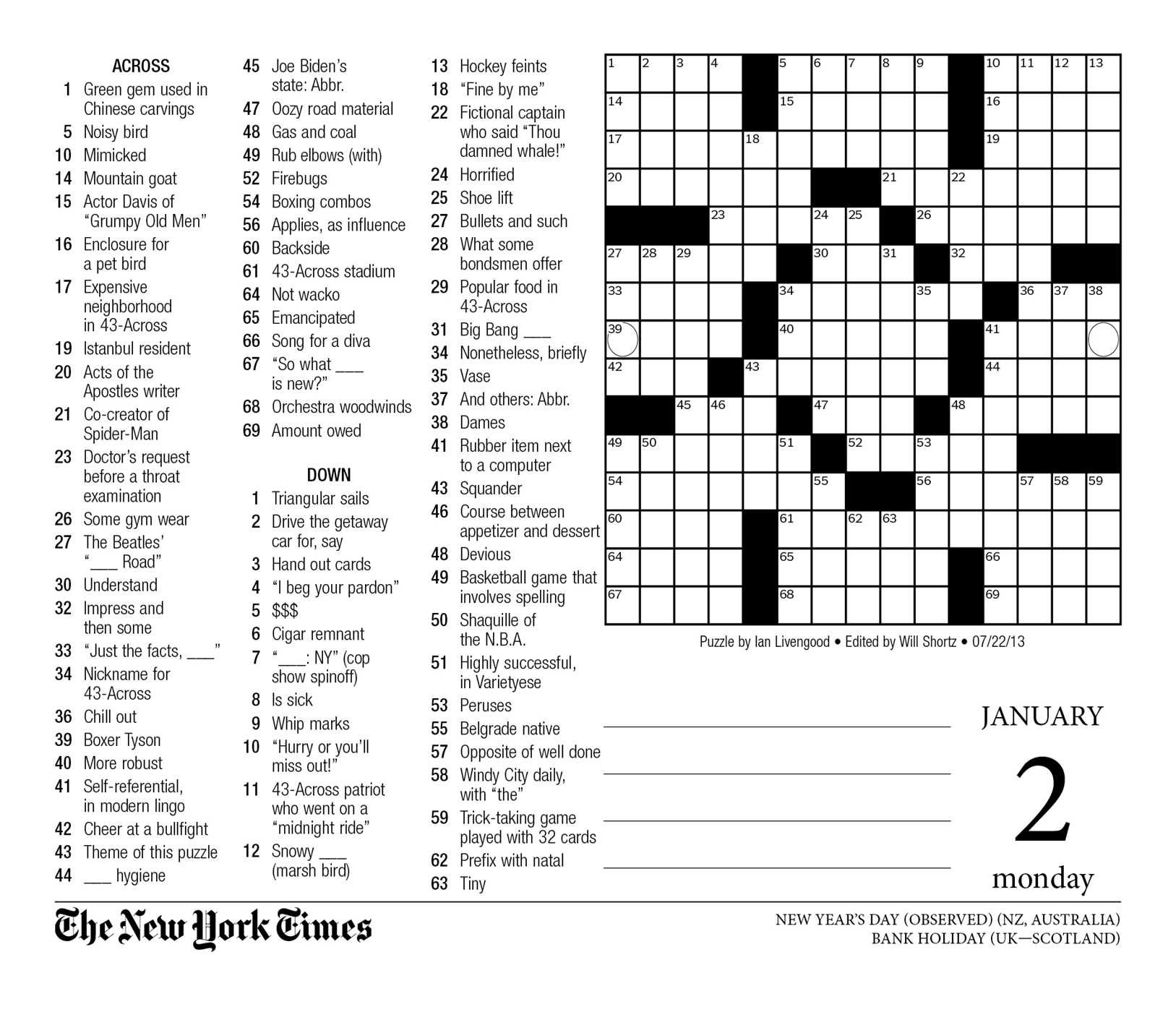

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 31, 2025

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 31, 2025 -

Sophia Huynh Tran Co Gai Gia The Lung Danh Trong Lang Pickleball Viet Nam

May 31, 2025

Sophia Huynh Tran Co Gai Gia The Lung Danh Trong Lang Pickleball Viet Nam

May 31, 2025 -

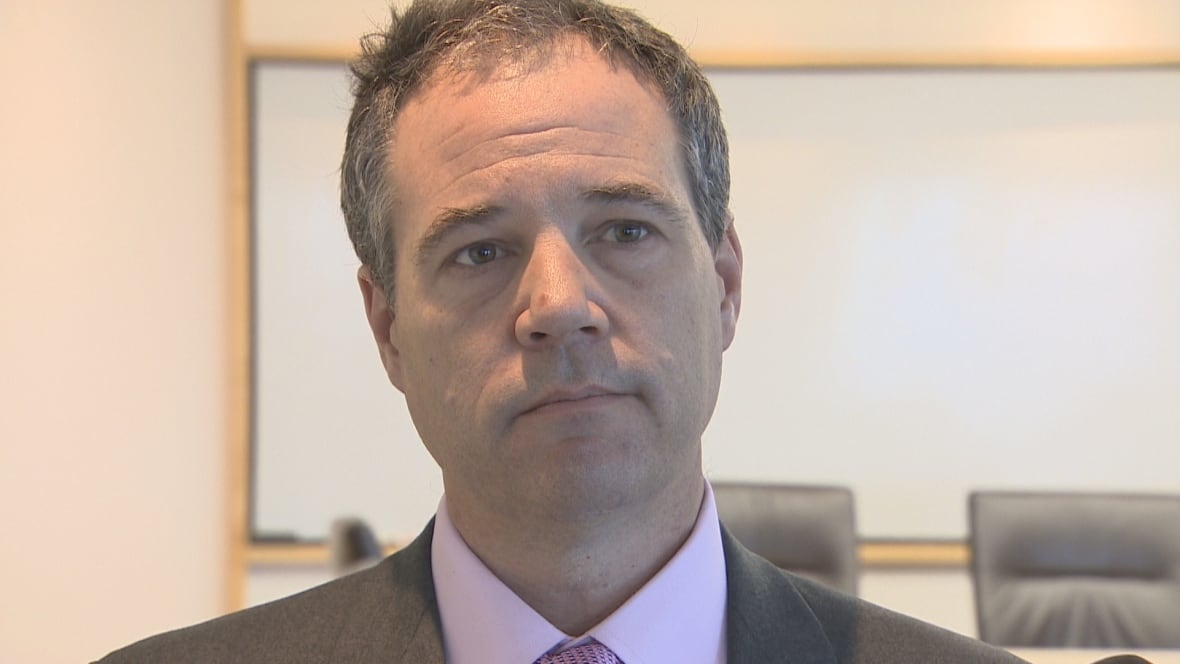

Nova Scotia Power Data Breach Federal Investigation Launched

May 31, 2025

Nova Scotia Power Data Breach Federal Investigation Launched

May 31, 2025 -

Bernard Keriks Wife Hala Matli And Their Children A Family Portrait

May 31, 2025

Bernard Keriks Wife Hala Matli And Their Children A Family Portrait

May 31, 2025