Posthaste: Understanding The Potential For A Canadian Home Price Correction

Table of Contents

Current State of the Canadian Housing Market

The Canadian housing market is currently characterized by high home prices and an affordability crisis. This situation is unsustainable in the long run, raising significant concerns about a potential correction.

High Home Prices and Affordability Crisis

Average home prices in major Canadian cities like Toronto and Vancouver remain significantly above average incomes. This creates a considerable affordability challenge for many Canadians seeking to enter the housing market or upgrade their current homes.

- Average home prices vs. average income: In many major cities, the average home price is now multiple times the average household income, requiring substantial down payments and lengthy mortgage terms.

- Percentage of disposable income needed for mortgage payments: A substantial portion of disposable income is now dedicated to mortgage payments, leaving less for other essential expenses. This impacts consumer spending and overall economic health.

- Regional variations in affordability: While major urban centers experience the most significant affordability issues, smaller cities and rural areas are also facing increasing pressure, albeit at a slower pace.

Interest Rate Hikes and Their Impact

The Bank of Canada's recent interest rate hikes have significantly impacted mortgage affordability. Higher interest rates increase monthly mortgage payments, reducing borrowing power and potentially cooling demand.

- Impact of interest rate hikes on mortgage payments: Even a small increase in interest rates can lead to a substantial jump in monthly mortgage payments, potentially putting homeowners under financial strain.

- Effect on demand: Higher interest rates discourage potential buyers, leading to a decrease in demand, which could put downward pressure on prices.

- Potential for forced sales: Homeowners facing significantly higher mortgage payments may be forced to sell their properties, further increasing supply and potentially accelerating a price correction.

Supply and Demand Dynamics

An imbalance between housing supply and demand continues to fuel price increases in many Canadian markets. While population growth and immigration increase demand, construction rates have not kept pace, contributing to a housing shortage.

- Analysis of new housing starts: The rate of new housing construction has not kept up with population growth and demand, particularly in major urban areas.

- Comparison of supply to demand in different regions: The supply-demand imbalance varies across Canada, with some regions experiencing more acute shortages than others.

- Impact of immigration on demand: Continued immigration to Canada significantly increases demand for housing, putting further pressure on already tight markets.

Factors Contributing to a Potential Correction

Several factors contribute to the growing likelihood of a Canadian home price correction. These factors act in concert to increase the risk of a significant market shift.

Overvaluation Concerns

Many analysts believe the Canadian housing market is overvalued, based on various valuation metrics. These metrics suggest that prices are not justified by fundamentals like rental income or income levels.

- Discussion of price-to-rent ratios: High price-to-rent ratios suggest that purchasing a home is relatively expensive compared to renting.

- Price-to-income ratios: High price-to-income ratios demonstrate the difficulty of affording homes relative to average incomes.

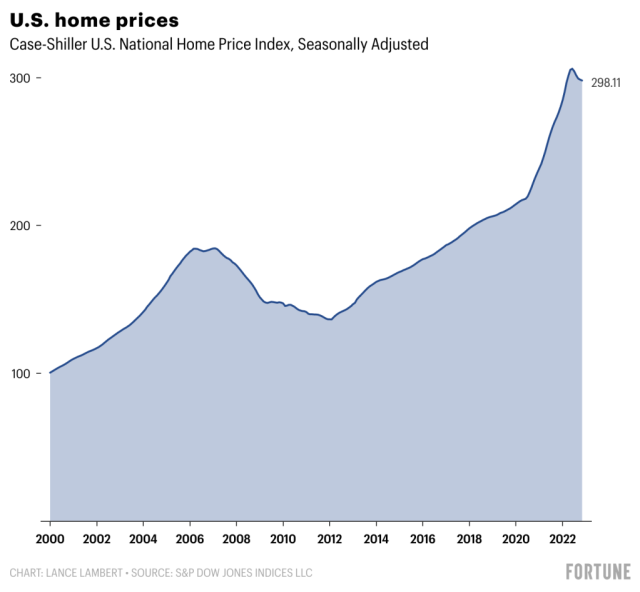

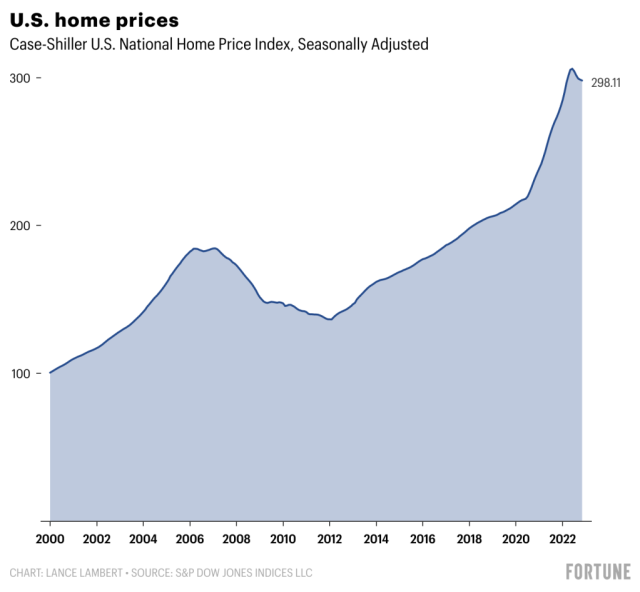

- Comparison to historical data: Comparing current price levels to historical averages reveals a significant departure from long-term trends.

Economic Uncertainty

Economic uncertainty, including inflation and potential recessionary pressures, creates further risk to the Canadian housing market.

- Impact of job losses on affordability: Job losses directly impact affordability, reducing households' ability to meet mortgage payments.

- Effect of inflation on construction costs and borrowing: Inflation increases construction costs and borrowing rates, affecting both supply and demand.

- Potential for decreased consumer confidence: Economic uncertainty can lead to a decrease in consumer confidence, further dampening demand for housing.

Government Policies and Regulations

Government policies like stress tests, mortgage rules, and foreign buyer taxes influence the Canadian housing market's stability. Changes to these policies could significantly impact prices.

- Effects of current policies on market stability: Current policies aim to mitigate risk and ensure market stability, but their effectiveness is subject to debate.

- Potential for future policy changes: The government may implement further measures to cool the market or address affordability concerns.

- Impact of foreign buyer taxes: Foreign buyer taxes have had some impact on demand in certain markets, but their overall effectiveness is debated.

Potential Scenarios and Their Implications

A Canadian home price correction could unfold in various ways, each with different implications for the economy and individuals.

Mild Correction vs. Sharp Decline

A mild correction might involve a gradual price adjustment of 5-10%, while a sharper decline could see prices drop by 20% or more.

- Potential percentage drops in home prices under different scenarios: The severity of the correction will depend on the interplay of economic factors and government policies.

- Impact on different market segments (condos, houses, etc.): Different housing segments might experience varying degrees of price changes.

Regional Variations

The impact of a correction is likely to vary across different regions of Canada, depending on local market conditions.

- Predictions for different regions: Major urban centers are generally considered more vulnerable to a significant price correction than smaller cities and rural areas.

- Impact on investors: Investors might experience significant losses depending on their leverage and market exposure.

- Effect on first-time homebuyers: A correction could create opportunities for first-time homebuyers but also increased uncertainty.

Impact on the Canadian Economy

A significant Canadian home price correction could have substantial implications for the broader Canadian economy.

- Impact on consumer spending: A drop in home values could reduce consumer confidence and spending.

- Effect on the construction industry: A decline in housing demand would negatively impact the construction sector and related industries.

- Potential ripple effects throughout the economy: The housing market's interconnectedness with other sectors could lead to widespread economic consequences.

Conclusion

The potential for a Canadian home price correction is a significant concern. High home prices, rising interest rates, economic uncertainty, and supply-demand imbalances all contribute to this risk. Understanding the various scenarios—ranging from a mild correction to a sharp decline—and their potential regional variations is crucial. A correction could have far-reaching economic consequences. To stay ahead of the curve in the Canadian housing market, regularly review market analyses, consult with financial professionals, and adapt your strategies accordingly to prepare for a potential Canadian home price correction and understand the implications of a Canadian home price correction.

Featured Posts

-

Die Rueckkehr Von Dexter Lithgow Und Smits In Neuen Rollen

May 22, 2025

Die Rueckkehr Von Dexter Lithgow Und Smits In Neuen Rollen

May 22, 2025 -

Where To Stream Peppa Pig Online For Free A Parents Guide

May 22, 2025

Where To Stream Peppa Pig Online For Free A Parents Guide

May 22, 2025 -

Own Dexter Original Sin On Steelbook Blu Ray Ahead Of Dexter Resurrection

May 22, 2025

Own Dexter Original Sin On Steelbook Blu Ray Ahead Of Dexter Resurrection

May 22, 2025 -

Arunas Early Exit At Wtt Chennai A Disappointing End

May 22, 2025

Arunas Early Exit At Wtt Chennai A Disappointing End

May 22, 2025 -

Danh Gia 7 Vi Tri Ket Noi Quan Trong Giua Tp Hcm Va Long An

May 22, 2025

Danh Gia 7 Vi Tri Ket Noi Quan Trong Giua Tp Hcm Va Long An

May 22, 2025

Latest Posts

-

Accident Involving Box Truck Shuts Down Section Of Route 581

May 22, 2025

Accident Involving Box Truck Shuts Down Section Of Route 581

May 22, 2025 -

Update Box Truck Crash On Route 581 Significant Traffic Disruption

May 22, 2025

Update Box Truck Crash On Route 581 Significant Traffic Disruption

May 22, 2025 -

Serious Box Truck Accident Leads To Route 581 Closure

May 22, 2025

Serious Box Truck Accident Leads To Route 581 Closure

May 22, 2025 -

Route 581 Traffic At Standstill Following Box Truck Collision

May 22, 2025

Route 581 Traffic At Standstill Following Box Truck Collision

May 22, 2025 -

Major Box Truck Crash Causes Route 581 Closure

May 22, 2025

Major Box Truck Crash Causes Route 581 Closure

May 22, 2025