Powell's Warning: How Tariffs Could Jeopardize The Fed's Objectives

Table of Contents

Inflationary Pressures from Tariffs

Tariffs, essentially taxes on imported goods, directly contribute to inflationary pressures within the economy. This occurs through two primary channels: increased import costs and supply chain disruptions.

Increased Import Costs

Tariffs immediately increase the cost of imported goods. This increase is passed along to consumers in the form of higher prices.

- Examples: Tariffs on steel and aluminum have led to higher prices for automobiles and construction materials. Tariffs on consumer electronics can increase the cost of everyday devices.

- Impact on Consumer Spending: Higher prices reduce consumer purchasing power, forcing consumers to cut back on spending. This dampens overall economic activity.

- Wage-Price Spirals: Increased costs for businesses can lead to upward pressure on wages, which can further fuel inflation, creating a problematic wage-price spiral. This makes the Fed's task of maintaining price stability even more challenging. Keywords: tariff inflation, import costs, consumer prices, price stability, inflation, Fed's mandate

Supply Chain Disruptions

Beyond direct cost increases, tariffs disrupt global supply chains. This leads to shortages, delays, and further price hikes.

- Examples: Tariffs on specific components can lead to shortages of finished goods, increasing their prices. Delays in shipments due to trade disputes can also disrupt production schedules.

- Impact on Businesses: Businesses face higher input costs, reduced production, and potentially lost sales due to supply chain disruptions. This instability makes business planning difficult.

- Challenges for the Fed: The Fed faces the difficult task of managing inflation when it is partly driven by external shocks like supply chain disruptions from tariffs. Monetary policy alone may not be sufficient to address these issues. Keywords: supply chain disruptions, global trade, import tariffs, inflationary pressures, monetary policy

Impact on Economic Growth and Employment

The inflationary pressures created by tariffs have a direct negative impact on economic growth and employment.

Reduced Consumer Spending

As discussed earlier, higher prices due to tariffs directly reduce consumer purchasing power. This decline leads to a decrease in overall consumer spending.

- Impact on GDP Growth: Reduced consumer spending directly translates to lower GDP growth, as consumer spending accounts for a significant portion of the US economy.

- Consumer Confidence: Uncertainty and higher prices erode consumer confidence, further reducing spending and investment.

- Potential for Job Losses: Slower economic growth can lead to businesses reducing investment, hiring freezes, and potential job losses. Keywords: economic growth, GDP, consumer spending, employment, job creation, recessionary risks

Retaliatory Tariffs and Trade Wars

The imposition of tariffs often provokes retaliatory tariffs from other countries, escalating into trade wars. These wars have devastating consequences for global economic growth and US employment.

- Examples: The trade war between the US and China resulted in retaliatory tariffs that negatively impacted various sectors in both countries.

- Impact on Specific Industries: Industries heavily reliant on exports, such as agriculture and manufacturing, are particularly vulnerable to retaliatory tariffs, leading to job losses and reduced production.

- Potential for Job Losses in Export-Oriented Sectors: Retaliatory tariffs reduce demand for US exports, leading to job losses in export-oriented sectors. Keywords: trade wars, retaliatory tariffs, global economy, international trade, unemployment

Challenges for the Federal Reserve's Monetary Policy

The inflationary pressures and economic uncertainty caused by tariffs present significant challenges to the Federal Reserve's monetary policy.

Balancing Inflation and Growth

The Fed faces the difficult task of balancing the need to combat inflation with the need to stimulate economic growth. Tariffs complicate this balancing act.

- The Trade-off: Raising interest rates to combat inflation risks slowing down economic growth and potentially triggering a recession. Conversely, maintaining low interest rates to support growth risks exacerbating inflation.

- Potential for Policy Mistakes: The uncertainty created by tariffs makes it harder for the Fed to accurately predict the impact of its policy decisions, increasing the risk of policy mistakes.

- Limitations of Monetary Policy: Monetary policy is a blunt instrument, and it has limitations in addressing issues stemming from trade policy, such as supply chain disruptions. Keywords: monetary policy, interest rates, inflation targeting, economic growth, Federal Reserve, Powell's testimony

Uncertainty and Volatility

The uncertainty surrounding tariffs creates volatility in financial markets, making it harder for the Fed to predict and manage the economy.

- Impact on Investor Confidence: Uncertainty about future trade policies can undermine investor confidence, leading to decreased investment and economic volatility.

- Stock Market Fluctuations: Tariff disputes can trigger stock market fluctuations, impacting investor portfolios and broader economic stability.

- Challenges in Forecasting Economic Indicators: The uncertainty makes it more difficult for economists and the Fed to accurately forecast key economic indicators, making effective policymaking more challenging. Keywords: economic uncertainty, market volatility, investor sentiment, monetary policy challenges, financial markets

Conclusion

In summary, Powell's warning regarding the risks posed by tariffs is a serious one. Tariffs increase inflation, negatively impact economic growth and employment, and create significant challenges for the Federal Reserve's monetary policy. The interplay between trade and monetary policy is complex, highlighting the interconnectedness of seemingly distinct economic spheres. The inflationary pressures caused by increased import costs and supply chain disruptions, coupled with the potential for retaliatory tariffs and trade wars, create a volatile and uncertain economic environment. This uncertainty hampers the Fed's ability to effectively manage the economy and achieve its objectives of price stability and full employment. Understand the full impact of Powell's warning on tariffs and their effects on the US economy. Stay informed and engage in the discussion! For further information, refer to the Federal Reserve's website and other resources on trade policy.

Featured Posts

-

Analisi Dell Impatto Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 25, 2025

Analisi Dell Impatto Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 25, 2025 -

The Hells Angels Power Politics And Global Reach

May 25, 2025

The Hells Angels Power Politics And Global Reach

May 25, 2025 -

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos Inside

May 25, 2025

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos Inside

May 25, 2025 -

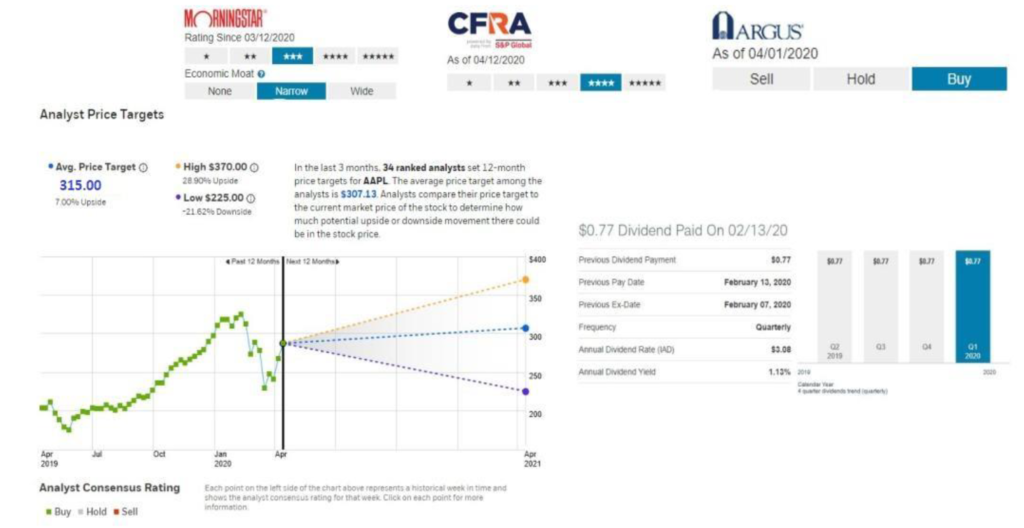

Is Apple Stock A Buy Before Q2 Earnings

May 25, 2025

Is Apple Stock A Buy Before Q2 Earnings

May 25, 2025 -

Avrupa Borsalari Buguen Nasil Kapandi

May 25, 2025

Avrupa Borsalari Buguen Nasil Kapandi

May 25, 2025

Latest Posts

-

Your Guide To The 5 Most Intense Action Episodes Of Lock Up

May 25, 2025

Your Guide To The 5 Most Intense Action Episodes Of Lock Up

May 25, 2025 -

Coriolanus Snow Casting Ralph Fiennes Considered Kiefer Sutherland A Fan Favorite

May 25, 2025

Coriolanus Snow Casting Ralph Fiennes Considered Kiefer Sutherland A Fan Favorite

May 25, 2025 -

Lock Up A Tv Guide To The 5 Best Action Episodes

May 25, 2025

Lock Up A Tv Guide To The 5 Best Action Episodes

May 25, 2025 -

Ralph Fiennes As Coriolanus Snow Analyzing Fan Reaction And Casting Speculation

May 25, 2025

Ralph Fiennes As Coriolanus Snow Analyzing Fan Reaction And Casting Speculation

May 25, 2025 -

Lock Up Tv Guide Top 5 Action Episodes

May 25, 2025

Lock Up Tv Guide Top 5 Action Episodes

May 25, 2025