Pre-Market Jump For Live Music Stocks Following Market Turmoil

Table of Contents

Factors Contributing to the Pre-Market Surge in Live Music Stocks

The pre-market rise in live music stocks isn't random; several interconnected factors are fueling this positive trend.

Pent-up Demand and Post-Pandemic Recovery

The pandemic brought the live music industry to a standstill. Now, pent-up demand is exploding.

- Increased concert attendance post-lockdowns: Venues are packed, exceeding pre-pandemic levels in many cases.

- Strong ticket sales: Demand significantly outweighs supply, leading to robust ticket sales and higher prices.

- Successful tours by major artists: The return of major tours from established and emerging artists has driven significant revenue.

- Festivals returning to full capacity: Large-scale music festivals are back in full swing, contributing significantly to the industry's resurgence.

- Growing consumer confidence in spending on entertainment: Consumers, having endured restrictions, are prioritizing experiences, boosting live music attendance.

Data from [cite a reputable source showing post-pandemic concert attendance and revenue figures] reveals a substantial increase in concert attendance and revenue, clearly illustrating this pent-up demand. The success of tours like [mention a successful recent tour] further underscores the industry's recovery.

Resilience of the Live Music Industry

The live music industry has proven remarkably resilient. Its inherent strength and adaptability have helped it navigate challenges and emerge stronger.

- Strong underlying fundamentals: The industry's foundation rests on the enduring human desire for live experiences.

- Adaptability to changing consumer preferences: The pandemic forced innovation, with virtual concerts and streaming events bridging the gap during lockdowns. This adaptability continues to benefit the industry.

- Diversification of revenue streams: Live music companies are diversifying beyond ticket sales, incorporating merchandise, sponsorships, and VIP experiences.

- Long-term growth potential: The global reach of music and the increasing disposable incomes in emerging markets suggest considerable long-term growth.

The industry's ability to embrace technology, such as virtual reality concerts and interactive experiences, positions it for continued growth and expansion. The diversification of revenue streams mitigates risk and contributes to financial stability.

Investor Sentiment and Market Speculation

Positive investor sentiment and market speculation are significantly impacting live music stock prices.

- Positive investor sentiment towards entertainment stocks: Investors see entertainment as a relatively safe haven in times of uncertainty.

- Speculation about future growth: The strong recovery and future growth potential are driving speculation and increased investment.

- Potential for increased mergers and acquisitions: Consolidation within the industry is anticipated, driving investment interest.

- Short-covering in the live music sector: Investors who bet against the sector are likely covering their short positions, adding upward pressure on prices.

The optimism surrounding the future of live music and the potential for lucrative mergers and acquisitions within the sector is contributing to the pre-market surge. This positive outlook is attracting both seasoned and new investors.

Analyzing Specific Live Music Stocks Performing Well

Several live music stocks are experiencing significant gains, showcasing the sector's overall strength.

Top Performers and Their Growth Potential

Let's examine some leading performers:

- [Stock Ticker 1]: [Company Name] – This company benefits from a diverse portfolio of artists and a strong digital presence.

- [Stock Ticker 2]: [Company Name] – This company focuses on [business model] and enjoys a strong market position.

- [Stock Ticker 3]: [Company Name] – This company is capitalizing on [specific market trend].

- [Stock Ticker 4]: [Company Name] – This company has a successful track record of artist development and event promotion.

- [Stock Ticker 5]: [Company Name] – This company is expanding its international reach and is showing considerable growth.

(Note: Replace bracketed information with actual stock tickers and company details.) Each company's unique business model and growth trajectory contribute to their individual success.

Risk Assessment and Investment Considerations

While the outlook is positive, investing in live music stocks involves inherent risks:

- Economic downturns: Recessions can impact consumer spending on entertainment.

- Competition: The industry is competitive, and new players and technologies constantly emerge.

- Artist cancellations: Unexpected cancellations due to illness or other unforeseen circumstances can disrupt events and impact revenue.

Diversification is crucial. Don't put all your eggs in one basket. Spread your investment across different stocks and sectors to mitigate potential losses. Thorough due diligence is essential before investing in any stock.

Long-Term Outlook for Live Music Stocks and the Entertainment Industry

The future of the live music industry looks bright.

Future Growth Drivers

Several factors will drive continued growth:

- Emerging technologies: The metaverse and virtual reality offer exciting new avenues for live music experiences.

- Expansion into new markets: Untapped markets in developing countries represent vast growth opportunities.

- Increased demand for live experiences: The desire for in-person experiences will remain strong.

- Growing popularity of specific music genres: The popularity of certain genres continues to drive demand.

These factors, combined with the industry's resilience and adaptability, position live music stocks for long-term growth.

Conclusion

The pre-market jump in live music stocks reflects a confluence of factors: pent-up demand, industry resilience, and positive investor sentiment. This presents a compelling investment opportunity, but careful due diligence is essential. Analyze individual companies, understand the risks, and consider diversifying your portfolio. Further research into specific live music stocks and the broader market is strongly recommended before making any investment decisions. Remember to stay informed about market trends to make well-informed decisions about your investment in live music stocks.

Featured Posts

-

India Proud Rajinikanth Acknowledges Ilaiyaraajas Contribution

May 30, 2025

India Proud Rajinikanth Acknowledges Ilaiyaraajas Contribution

May 30, 2025 -

Ekstrennoe Preduprezhdenie Mada Ekstremalnye Pogodnye Usloviya V Izraile

May 30, 2025

Ekstrennoe Preduprezhdenie Mada Ekstremalnye Pogodnye Usloviya V Izraile

May 30, 2025 -

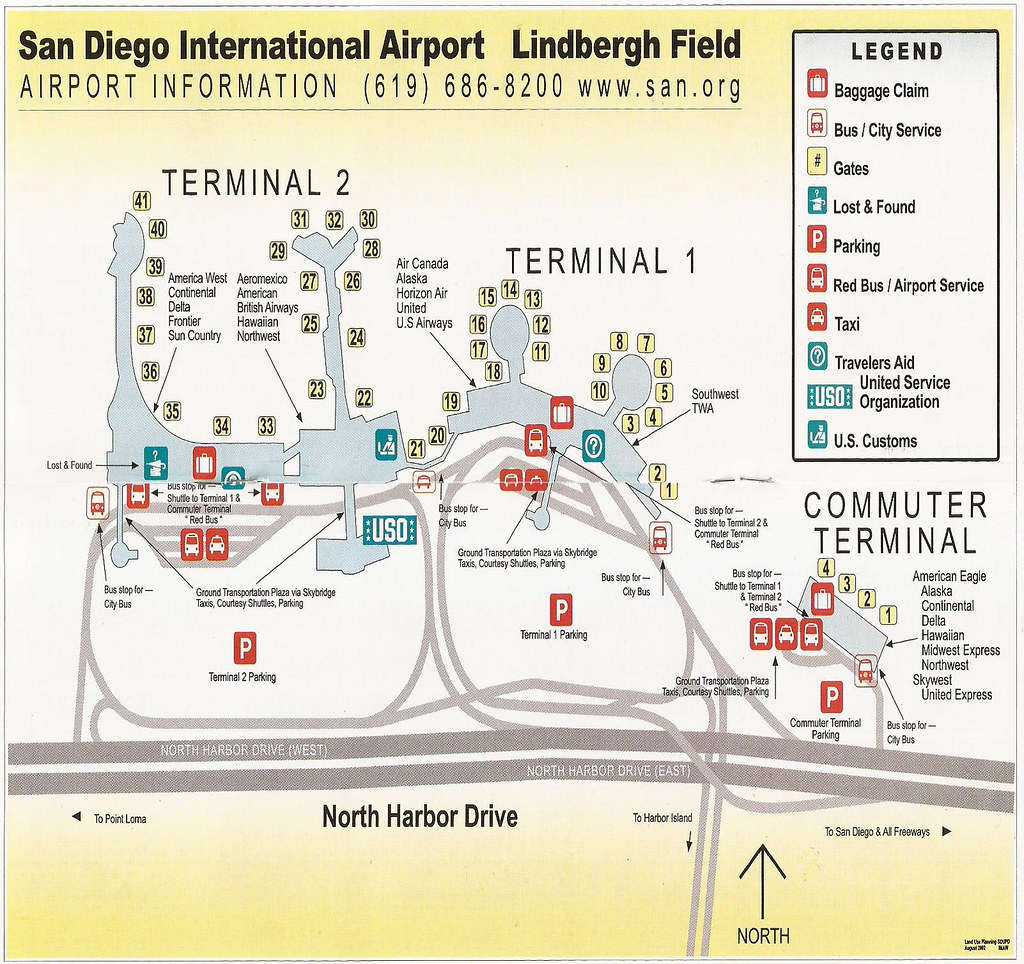

San Diego Airport Ground Stop Understanding The Implications

May 30, 2025

San Diego Airport Ground Stop Understanding The Implications

May 30, 2025 -

Precios De Boletos Ticketmaster Entendiendo Los Costos Adicionales

May 30, 2025

Precios De Boletos Ticketmaster Entendiendo Los Costos Adicionales

May 30, 2025 -

Polands Presidential Runoff Assessing The Rise Of Maga Style Populism

May 30, 2025

Polands Presidential Runoff Assessing The Rise Of Maga Style Populism

May 30, 2025