Principal Financial Group (PFG) Investment Analysis: 13 Analyst Ratings Reviewed

Table of Contents

Understanding Principal Financial Group (PFG): A Company Overview

Principal Financial Group (PFG) is a prominent global financial services leader, offering a diverse range of products and services focused primarily on retirement plans, insurance solutions, and investment management. Its long history and established market position make it a compelling subject for investment analysis. PFG's business model relies on providing comprehensive financial solutions to individuals and institutions, catering to a broad spectrum of financial needs.

- Key Services: Retirement plans (401(k)s, IRAs), life insurance, annuities, mutual funds, and asset management.

- Market Position: PFG competes with other large financial institutions globally, holding a significant share in its key markets.

- History & Milestones: Established in 1879, PFG has navigated numerous economic cycles, demonstrating resilience and adaptability. Significant milestones include expansions into new markets and the introduction of innovative financial products. Analyzing PFG financial performance over time reveals a history of consistent growth and profitability (although past performance is not indicative of future results). Understanding Principal investments and the PFG business model is crucial for a thorough investment analysis. Further research into Principal Financial Group stock performance is recommended.

Review of 13 Analyst Ratings: A Detailed Breakdown

To provide a comprehensive overview, we've consolidated data from 13 different analyst ratings on PFG stock. These ratings, sourced from various reputable financial institutions such as Morgan Stanley, Goldman Sachs, and others, offer a range of perspectives on the company's future performance. The following is a summarized breakdown of these ratings:

- Buy Ratings: 6 analysts issued a "Buy" rating, with an average target price of [insert average target price from your research].

- Hold Ratings: 5 analysts recommended a "Hold" rating, with an average target price of [insert average target price from your research].

- Sell Ratings: 2 analysts issued a "Sell" rating, citing [insert reasons mentioned by analysts].

Significant discrepancies in ratings often stem from differing perspectives on PFG's growth potential, sensitivity to macroeconomic factors, and competitive landscape. Analyzing the specific reasoning behind each PFG analyst rating provides crucial context for investors. The spread in target prices also indicates varying expectations for Principal Financial Group stock.

Key Factors Influencing Analyst Ratings

Analyst ratings for PFG are influenced by a multitude of factors, including:

- Financial Metrics: Analysts closely examine PFG financial ratios such as the Price-to-Earnings (P/E) ratio, Earnings Per Share (EPS) growth, dividend yield, and debt-to-equity ratio. These metrics offer insights into the company’s profitability, valuation, and financial stability.

- Macroeconomic Factors: Interest rate changes, inflation, and overall economic growth significantly impact PFG’s performance and analyst sentiment. For example, rising interest rates can favorably impact the profitability of certain PFG insurance products. Analyzing Principal Financial Group valuation in light of macroeconomic trends is vital.

- Competitive Landscape: The competitive intensity within the financial services sector impacts PFG's market share and profitability, directly influencing analyst opinions.

Strengths and Weaknesses of Principal Financial Group (PFG)

A balanced assessment of PFG requires acknowledging both its strengths and weaknesses:

Strengths:

- Strong brand reputation and established market presence.

- Diversified product offerings catering to a broad client base.

- Relatively strong financial stability and consistent profitability (historical data).

Weaknesses:

- Sensitivity to economic downturns and market volatility.

- Intense competition within the financial services industry.

- Potential impact of regulatory changes on its operations. Understanding PFG competitive analysis is crucial for assessing these risks.

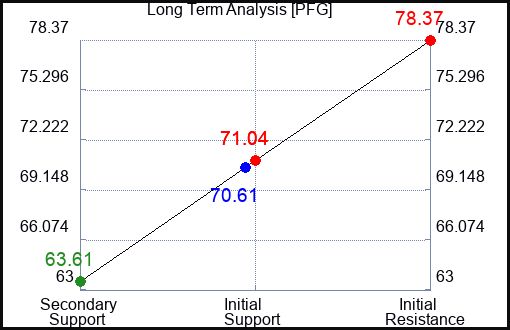

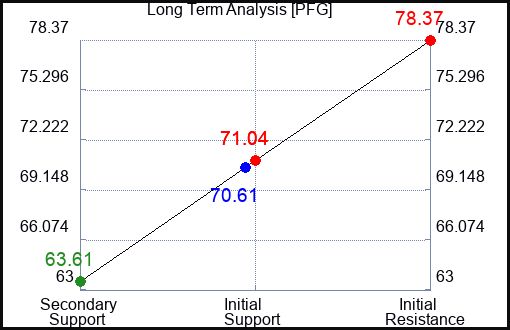

Future Outlook and Investment Implications

Based on the analyzed ratings and considering the company's strengths and weaknesses, PFG's future outlook presents a mixed bag. While the majority of analysts hold a positive outlook, the existence of "Sell" ratings highlights potential risks. The potential for growth and return on investment hinges on several factors, including macroeconomic conditions and PFG's ability to adapt to the changing competitive landscape. Different market scenarios – ranging from bullish to bearish – will naturally impact PFG's future performance. This PFG future outlook underscores the importance of diversification in any investment portfolio.

Conclusion: Making Informed Investment Decisions with Principal Financial Group (PFG) Analysis

The review of 13 analyst ratings on Principal Financial Group (PFG) reveals a range of opinions, highlighting the complexities involved in assessing investment opportunities. While a majority of analysts express confidence in PFG, the presence of "Sell" ratings underscores the need for cautious optimism. Before investing in Principal Financial Group, conduct thorough due diligence. Consider this analysis as one piece of the puzzle. Remember that understanding Principal Financial Group investment strategies, Principal Financial Group stock performance, and PFG’s financial reports through in-depth analysis is essential for informed decision-making. Learn more about Principal Financial Group investment strategies to build a robust investment plan.

Featured Posts

-

Over 7 Months Bonus For Singapore Airlines Staff Straits Times Details

May 17, 2025

Over 7 Months Bonus For Singapore Airlines Staff Straits Times Details

May 17, 2025 -

Where To Watch The Indiana Fever Preseason Games Featuring Caitlin Clark In 2025

May 17, 2025

Where To Watch The Indiana Fever Preseason Games Featuring Caitlin Clark In 2025

May 17, 2025 -

The Impact Of False Angel Reese Quotes On Public Perception

May 17, 2025

The Impact Of False Angel Reese Quotes On Public Perception

May 17, 2025 -

Piston Vs Knicks A Season Long Head To Head Comparison

May 17, 2025

Piston Vs Knicks A Season Long Head To Head Comparison

May 17, 2025 -

Uae Newborn Emirates Id Fees And Application Process March 2025

May 17, 2025

Uae Newborn Emirates Id Fees And Application Process March 2025

May 17, 2025