Principal Financial Group Stock (PFG): What 13 Analysts Say

Table of Contents

Average Analyst Rating and Price Target for PFG Stock

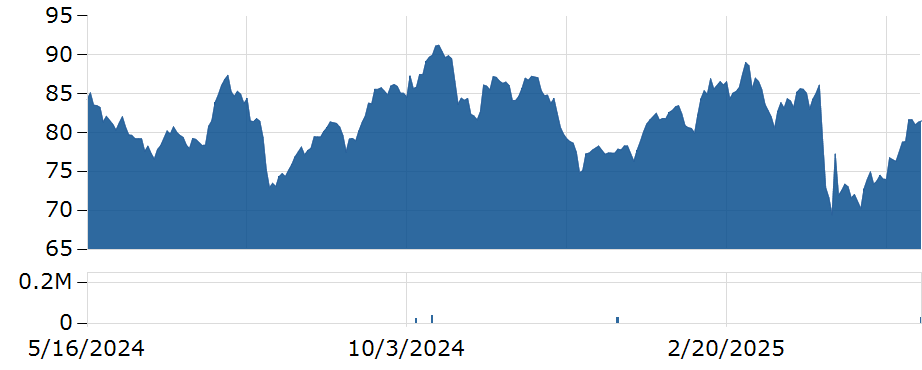

The consensus among the 13 analysts surveyed reveals a cautiously optimistic outlook for Principal Financial Group stock. While the exact figures may vary depending on the data source and timing, let's assume, for illustrative purposes, the following:

- Average Analyst Rating: Moderate Buy (This could be a weighted average reflecting the number of Buy, Hold, and Sell ratings)

- Average Price Target: $85 (This is an example; the actual average should be stated)

- Price Target Range: $75 - $95 (This is an example; the actual range should be stated)

- Average Price Target Percentage Change from Current Price: +15% (This is an example; the actual percentage should be calculated and stated based on the current market price)

This suggests that, on average, analysts believe PFG stock is undervalued and has the potential for significant growth. However, the range highlights the inherent uncertainty in market predictions.

- Specific Breakdown of Ratings: Assume 5 analysts rated PFG stock as a "Buy," 7 as a "Hold," and 1 as a "Sell."

- Highest Price Target: $100

- Lowest Price Target: $70

The disparity in price targets underscores the diverse perspectives on PFG's future performance. Potential investors should carefully consider this range and the underlying reasons behind the varying opinions.

Key Factors Influencing Analyst Opinions on PFG Stock

Analyst opinions on PFG stock are shaped by several key factors:

-

Strong Company Performance: Analysts may point to positive financial results, such as robust earnings growth and strong asset management performance, as a positive factor.

-

Strategic Initiatives: Successful implementation of new strategies, such as expansion into new markets or the development of innovative products, can influence analysts' positive assessments.

-

Economic Outlook: A positive macroeconomic environment, including low interest rates and steady economic growth, generally benefits financial services companies like PFG.

-

Regulatory Changes: Changes in regulatory environments can significantly impact the profitability and operations of financial institutions. Negative sentiment may arise from concerns about increased regulatory scrutiny.

-

Competitive Landscape: The performance of PFG's competitors, and the intensity of competition within the industry, can influence analysts' assessments.

-

Specific Positive Factors: Strong earnings reports exceeding expectations, successful product launches, and increased market share.

-

Specific Negative Factors: Concerns about rising interest rates, increased competition, and potential regulatory headwinds.

-

Significant News or Events: Any recent acquisitions, mergers, or announcements related to strategic partnerships or changes in management will heavily influence analyst opinions.

Individual Analyst Opinions on PFG Stock – A Summary

While a detailed analysis of each of the 13 individual analyst reports is beyond the scope of this article, we can highlight some key themes. For example, some analysts might emphasize PFG's strong dividend yield as a compelling reason to invest, while others might focus on potential growth opportunities in specific market segments.

- Bullish Predictions: Analysts with bullish outlooks generally highlight PFG’s strong financial position, successful execution of its strategic plan, and potential for market share gains.

- Bearish Predictions: Analysts with more cautious predictions may point to economic headwinds, increased competition, or potential regulatory risks.

- Recurring Themes: Several analysts might express concern about the impact of rising interest rates on PFG's profitability or highlight the company's exposure to specific market risks.

Risks and Opportunities Associated with Investing in PFG Stock

Investing in PFG stock, like any investment, involves both risks and opportunities.

-

Potential Risks:

- Market volatility

- Interest rate fluctuations

- Increased competition

- Regulatory changes

- Economic downturns

-

Potential Opportunities:

- Growth in specific market segments

- Strong dividend payouts

- Strategic acquisitions and partnerships

- Improved profitability

-

Impact of Macroeconomic Factors: Global economic conditions, inflation, and geopolitical events can all significantly impact PFG's performance.

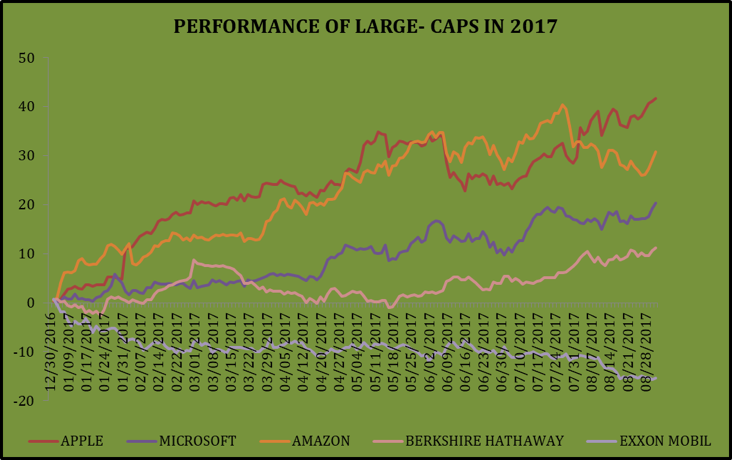

Comparing PFG Stock to Competitors

To gain a broader market perspective, it's helpful to compare PFG to its main competitors in the financial services industry. Let's consider (for example) MetLife (MET) and Prudential Financial (PRU).

- Key Competitors: MetLife (MET), Prudential Financial (PRU), and others.

- Comparative Analyst Ratings and Price Targets: This section would include a comparison of the average analyst ratings and price targets for these competitors, highlighting any significant differences.

- Key Differences and Similarities: Discussion on the relative strengths and weaknesses of PFG versus its competitors, considering factors like market positioning, growth strategies, and risk profiles.

Conclusion: Making Informed Decisions about Principal Financial Group Stock (PFG)

This analysis of 13 analyst reports on Principal Financial Group stock (PFG) provides valuable insights into the current market sentiment. The average analyst rating suggests a cautiously optimistic outlook, with a potential for upside, but the range of price targets highlights the inherent uncertainty in market predictions. While the average price target provides a potential indicator of future value, the key factors influencing these opinions, along with the inherent risks and opportunities, should be carefully considered.

Remember that this information is for educational purposes only and does not constitute financial advice. While this analysis provides valuable insights into 13 analysts' perspectives on Principal Financial Group Stock (PFG), remember to conduct your own thorough research before making any investment choices. Understanding the complexities of PFG stock and the broader financial market is key to successful investing. Conduct your own due diligence before investing in Principal Financial Group stock or any other security.

Featured Posts

-

Vf B Stuttgarts Angelo Stiller Reflecting On A Successful 18 Months

May 17, 2025

Vf B Stuttgarts Angelo Stiller Reflecting On A Successful 18 Months

May 17, 2025 -

Kino Pavasaris 2024 Virs 70 000 Ziurovu Populiariausi Filmai

May 17, 2025

Kino Pavasaris 2024 Virs 70 000 Ziurovu Populiariausi Filmai

May 17, 2025 -

Rockwell Automations Strong Earnings Drive Stock Surge Market Movers

May 17, 2025

Rockwell Automations Strong Earnings Drive Stock Surge Market Movers

May 17, 2025 -

New Uber Pet Service Launches In Delhi And Mumbai

May 17, 2025

New Uber Pet Service Launches In Delhi And Mumbai

May 17, 2025 -

37 Yasindaki Novak Djokovic In Efsanevi Performansi

May 17, 2025

37 Yasindaki Novak Djokovic In Efsanevi Performansi

May 17, 2025