Proposed Legislation: Increased Taxes On Harvard And Yale Endowments

Table of Contents

Arguments in Favor of Increased Taxes on University Endowments

Proponents of increased taxes on university endowments like those held by Harvard and Yale argue that such measures are necessary for addressing critical societal issues.

Addressing Income Inequality

The immense wealth disparity between the ultra-rich and the general population is a significant concern. Harvard and Yale's enormous endowments – totaling billions of dollars – undeniably contribute to this imbalance. Taxing these endowments could help redistribute wealth and alleviate the burden on taxpayers.

- Statistics: Harvard's endowment exceeds $50 billion, while Yale's surpasses $40 billion. These figures dwarf the average student loan debt, which is crippling for many.

- Potential Impact: A portion of the tax revenue generated could significantly fund vital public services, improving infrastructure, healthcare, and social programs.

- Keyword Variations: Taxation of university endowments, wealth redistribution, endowment tax policy, closing the wealth gap.

Funding Public Education

Underfunded public schools and universities struggle to provide adequate resources and opportunities to students. Taxing university endowments could generate substantial revenue to address this critical issue.

- Examples: Numerous public school districts across the nation lack essential resources, including qualified teachers, updated technology, and necessary learning materials.

- Potential Impact: Increased funding could improve teacher salaries, reduce class sizes, and provide students with better access to technology and educational opportunities.

- Keyword Variations: Public education funding, closing the education gap, equitable resource distribution, funding public schools.

Promoting Social Mobility

Redirecting resources from massive university endowments can significantly increase opportunities for students from lower socioeconomic backgrounds.

- Statistics: Access to higher education for low-income students remains severely limited. The cost of tuition, fees, and living expenses often presents insurmountable barriers.

- Potential Impact: Increased financial aid, funded through endowment taxes, could dramatically expand access to higher education for deserving students regardless of their financial background. This would help level the playing field and promote social mobility.

- Keyword Variations: Affordable higher education, social equity, student financial aid, increasing access to higher education.

Arguments Against Increased Taxes on University Endowments

Opponents of increased taxes on university endowments cite several potential negative consequences.

Impact on University Operations & Research

Significantly taxing university endowments could severely impair university operations, research funding, and financial aid programs.

- Examples: Many crucial research projects rely heavily on endowment funding. Cutting this funding could stifle groundbreaking discoveries and advancements in various fields.

- Potential Impact: Reduced financial aid offerings could limit access to higher education for many students, negating the very benefits proponents of endowment taxes seek to achieve. Reduced funding could also affect the overall quality and competitiveness of universities.

- Keyword Variations: University funding, research funding cuts, endowment management, impact on higher education.

Legal and Constitutional Challenges

Imposing taxes on university endowments could face significant legal and constitutional challenges.

- Legal Precedents: The tax-exempt status of non-profit institutions, including universities, raises important legal questions. Existing laws and legal precedents regarding property rights and taxation need careful consideration.

- Potential Court Challenges: Universities could mount legal challenges arguing that such taxes violate their rights and impede their ability to fulfill their educational missions.

- Keyword Variations: Tax law, constitutional rights, legal implications, tax exemption for non-profits.

Economic Implications

The economic consequences of imposing new taxes on university endowments extend beyond the universities themselves.

- Impact on Investment Markets: Large-scale divestment from university endowments could disrupt investment markets and have broader economic repercussions.

- Universities as Employers: Universities are major employers, and significant funding cuts could lead to job losses and affect local economies.

- Unintended Consequences: Imposing new taxes without careful consideration could lead to unintended and negative economic consequences.

- Keyword Variations: Economic impact, fiscal policy, investment strategy, unintended consequences.

Conclusion

The proposed legislation to increase taxes on Harvard and Yale's endowments presents a complex issue with significant implications for higher education, income inequality, and public policy. While proponents advocate for addressing wealth disparities and improving public education funding, opponents highlight the potential negative impacts on university operations, research, and overall economic stability. A comprehensive understanding of both perspectives is crucial for informed policymaking. Further research and public dialogue on the potential ramifications of increased taxes on Harvard and Yale endowments, and similar institutions, are vital to finding a balanced solution that promotes equitable resource allocation while preserving the vital contributions of universities to society.

Featured Posts

-

Foto Ribuan Pekerja Terjebak Jaringan Penipuan Online Myanmar Ada Wni

May 13, 2025

Foto Ribuan Pekerja Terjebak Jaringan Penipuan Online Myanmar Ada Wni

May 13, 2025 -

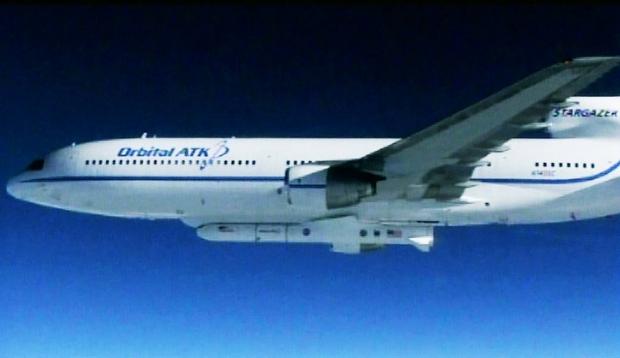

Blue Origin Postpones Launch Details On Subsystem Malfunction

May 13, 2025

Blue Origin Postpones Launch Details On Subsystem Malfunction

May 13, 2025 -

Packhams Scathing Critique Of Trumps Climate Change Approach On The Bbc

May 13, 2025

Packhams Scathing Critique Of Trumps Climate Change Approach On The Bbc

May 13, 2025 -

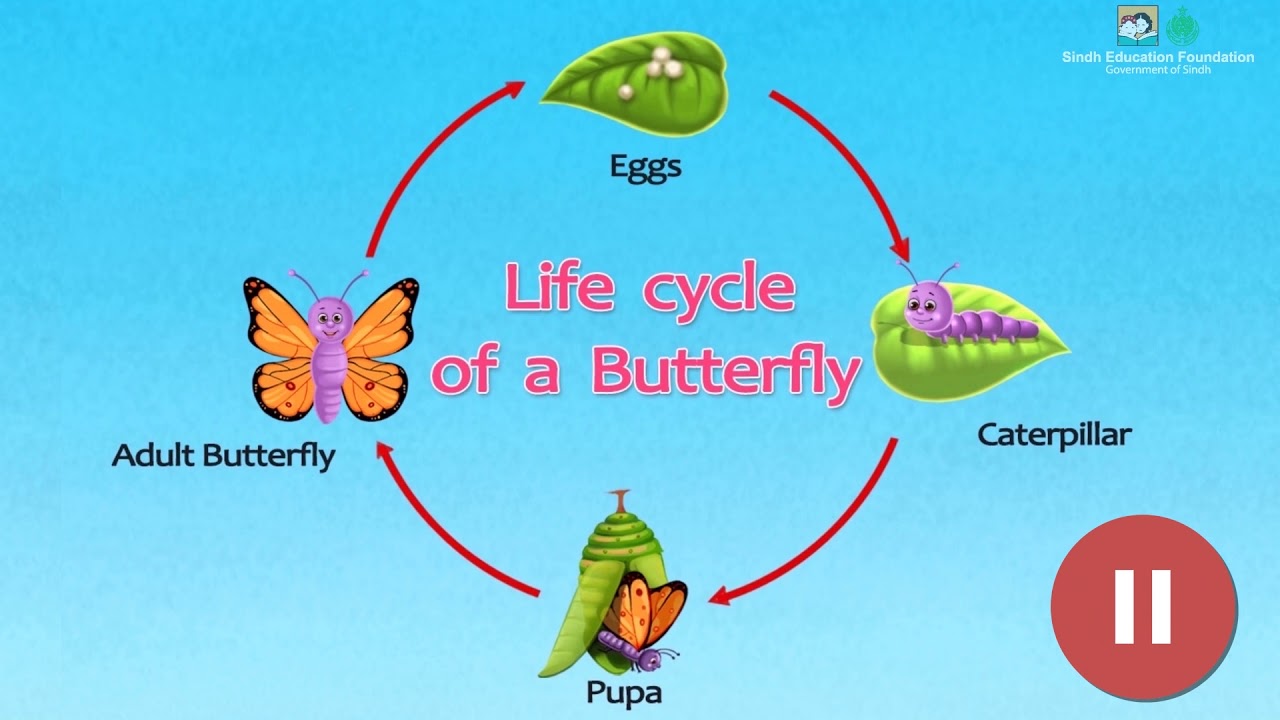

Experiential Learning How Campus Farm Animals Teach Students About Life Cycles

May 13, 2025

Experiential Learning How Campus Farm Animals Teach Students About Life Cycles

May 13, 2025 -

Ereyna Gia Ton Megalo Kataklysmo Anakalypseis Kai Nea Dedomena Gia Ti Mesogeio

May 13, 2025

Ereyna Gia Ton Megalo Kataklysmo Anakalypseis Kai Nea Dedomena Gia Ti Mesogeio

May 13, 2025

Latest Posts

-

Why Jannik Sinners Fox Logo Cant Match Roger Federers Branding Power

May 14, 2025

Why Jannik Sinners Fox Logo Cant Match Roger Federers Branding Power

May 14, 2025 -

Gde Kupiti Novakove Patike Tsena Preko 1 500 Evra

May 14, 2025

Gde Kupiti Novakove Patike Tsena Preko 1 500 Evra

May 14, 2025 -

Luksuzne Patike Inspirisane Novakom Okovi Em Preko 1 500 Evra

May 14, 2025

Luksuzne Patike Inspirisane Novakom Okovi Em Preko 1 500 Evra

May 14, 2025 -

Novakove Patike Pregled Na Skupljikh Modela 1 500 Evra

May 14, 2025

Novakove Patike Pregled Na Skupljikh Modela 1 500 Evra

May 14, 2025 -

Central London Welcomes Lindts Chocolate Paradise Doors Now Open

May 14, 2025

Central London Welcomes Lindts Chocolate Paradise Doors Now Open

May 14, 2025