Protecting Your Credit Score: Managing Your Student Loan Debt

Table of Contents

Understanding the Impact of Student Loans on Your Credit Score

Student loans significantly impact your credit score, both positively and negatively. Responsible management is key to reaping the benefits. Your payment history on these loans is a major factor in determining your creditworthiness.

How do student loan payments affect your credit score? Simple: on-time payments build a positive credit history, while late or missed payments severely damage it. Lenders view consistent, timely payments as a sign of reliability. This is especially important in the early stages of building your credit history. Student loans often represent the first significant credit obligation for many young adults.

- On-time payments boost your credit score: Each on-time payment contributes to a higher credit score, demonstrating your creditworthiness to lenders.

- Late or missed payments severely damage your credit score: Late payments can significantly lower your credit score and make it harder to secure loans or credit cards in the future. A single missed payment can have lasting consequences.

- Your credit utilization ratio is affected by your student loan debt: High levels of student loan debt can increase your credit utilization ratio (the percentage of available credit you're using), which can negatively impact your credit score. Aim to keep this ratio low.

- Student loans are a significant part of your credit report: Your student loan repayment history is a prominent feature of your credit report, influencing your credit score for years to come.

Strategies for Responsible Student Loan Management

Effective student loan management requires a proactive approach. Understanding your repayment options and choosing the right strategy for your circumstances is crucial. Several repayment plans are available to help borrowers manage their debt.

- Standard Repayment Plan: Fixed monthly payments over a 10-year period. This is the most common plan but might result in higher monthly payments.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can be beneficial initially, but payments will become significantly higher in later years.

- Income-Driven Repayment (IDR) Plans: Monthly payments are based on your income and family size. This option is particularly helpful for borrowers with lower incomes.

The Importance of Staying Organized and Monitoring Your Credit Report

Staying organized and regularly monitoring your credit report is paramount to protecting your credit score. This proactive approach allows you to identify and address any issues promptly.

-

Explore income-driven repayment (IDR) plans if struggling: If you're having trouble making payments, IDR plans can significantly reduce your monthly burden.

-

Consider refinancing for a lower interest rate (with caution): Refinancing can potentially lower your interest rate and monthly payments but involves careful consideration of the terms and conditions.

-

Automate payments to avoid late payments: Setting up automatic payments ensures you never miss a payment and helps maintain a positive payment history.

-

Set up a budget to prioritize loan payments: A detailed budget helps allocate funds for loan payments and other essential expenses, preventing financial strain and late payments.

-

Use free credit report services (AnnualCreditReport.com): Check your credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion) to identify any errors.

-

Monitor your credit score regularly: Track your credit score using free or paid services to detect any sudden drops or concerning trends.

-

Understand your credit report thoroughly: Familiarize yourself with the information contained in your credit report to identify potential problems early on.

-

Address any inaccuracies promptly: If you find errors, dispute them immediately with the respective credit bureau to correct your credit report.

Preventing Negative Impacts on Your Credit Score

Defaulting on your student loans has severe consequences, significantly impacting your credit score and financial stability. Understanding the risks and available options is crucial.

- Defaulting can severely damage your credit score: A default can severely lower your credit score, making it difficult to obtain future loans or credit.

- Default can lead to wage garnishment and tax refund offset: The government can garnish your wages or seize your tax refund to recover the defaulted loan amount.

- Explore deferment or forbearance options if facing hardship: These options temporarily postpone your payments but might have implications for the overall loan repayment.

- Communicate with your loan servicer proactively if you anticipate difficulty making payments: Contacting your loan servicer early on can help you find solutions and avoid default.

Conclusion

Successfully managing your student loan debt is key to protecting your credit score and achieving long-term financial stability. By understanding the impact of student loans on your credit, utilizing responsible repayment strategies, and diligently monitoring your credit report, you can safeguard your financial future. Don't let student loan debt derail your credit score; take control today and adopt proactive management techniques. Start protecting your credit score by exploring the various student loan repayment options available to you and making informed choices about your financial well-being.

Featured Posts

-

Angelo Stiller To Liverpool German Media Weighs In

May 17, 2025

Angelo Stiller To Liverpool German Media Weighs In

May 17, 2025 -

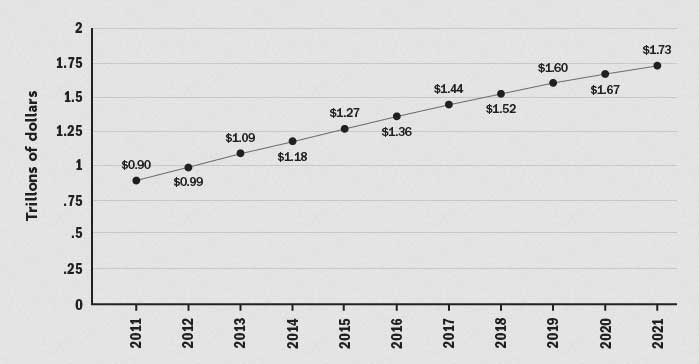

New Business Hot Spots A Nationwide Map And Analysis

May 17, 2025

New Business Hot Spots A Nationwide Map And Analysis

May 17, 2025 -

Page Not Found On Reddit Us Specific Outage Reported By Users

May 17, 2025

Page Not Found On Reddit Us Specific Outage Reported By Users

May 17, 2025 -

Decoding Trumps Bonds With Arab Leaders Handsome Attractive Tough And Strategic

May 17, 2025

Decoding Trumps Bonds With Arab Leaders Handsome Attractive Tough And Strategic

May 17, 2025 -

Reddit Goes Dark Global Service Interruption Affecting Users

May 17, 2025

Reddit Goes Dark Global Service Interruption Affecting Users

May 17, 2025