QBTS Stock: Predicting The Earnings Reaction

Table of Contents

Analyzing Past QBTS Earnings Reports: Identifying Trends and Patterns

Understanding QBTS's historical performance is key to predicting future earnings reactions. By examining past data, we can identify trends and patterns that may offer clues about the upcoming report.

Revenue Growth and its Impact

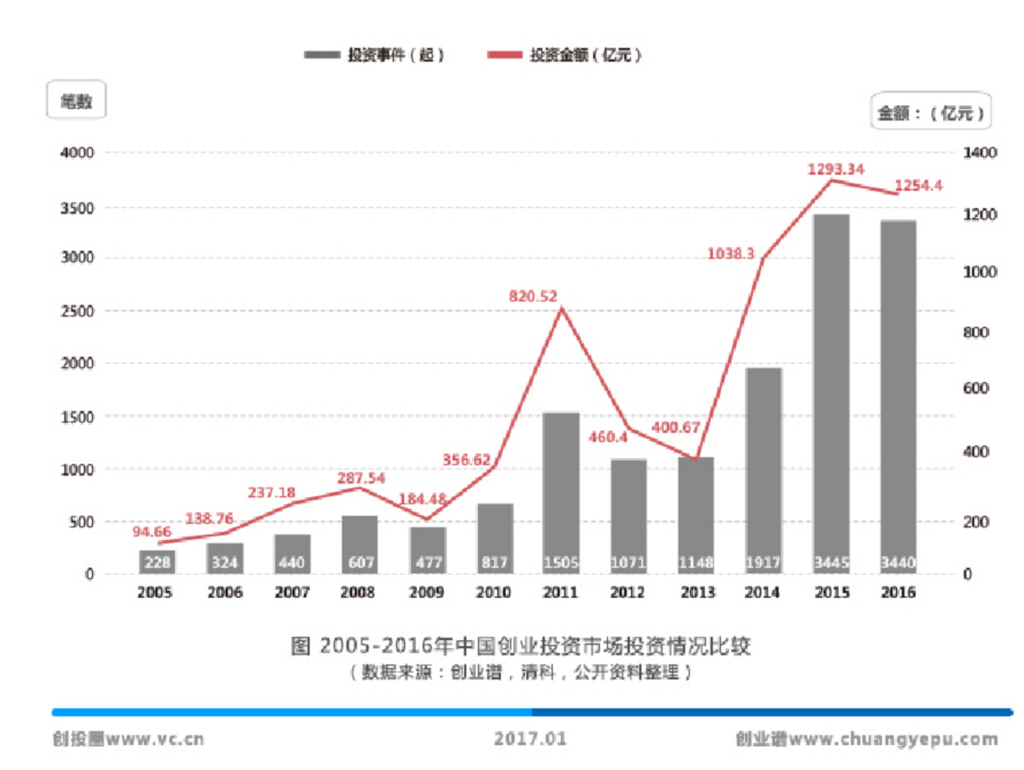

QBTS's revenue growth has been inconsistent over the past few years. Analyzing historical data reveals periods of strong growth followed by periods of slower expansion. (Insert chart/graph of historical revenue data here).

- Key Revenue Drivers: QBTS's revenue is primarily driven by its flagship product, the "Nova" platform, and strong sales in the North American market. Recent expansion into the European market has shown promising early results.

- Consistent Patterns: Historically, QBTS has shown stronger revenue growth during the fourth quarter, likely due to increased holiday spending and year-end purchasing.

Profitability and Margins

Examining QBTS's profitability reveals valuable insights into its operational efficiency. (Insert chart/graph showing gross profit margin, operating profit margin, and net income margin over time).

- Factors Influencing Profitability: The cost of goods sold (COGS) has fluctuated due to changes in raw material prices. Operating expenses have generally remained consistent as a percentage of revenue.

- Trends in Profitability: While gross profit margins have remained relatively stable, operating profit margins have shown some improvement in recent quarters, suggesting operational improvements.

EPS (Earnings Per Share) Performance

Analyzing QBTS's EPS performance reveals its profitability on a per-share basis. (Insert chart/graph comparing actual EPS vs. analyst expectations).

- EPS vs. Analyst Expectations: In the past, QBTS has occasionally surprised analysts with better-than-expected EPS, resulting in positive stock price reactions. Conversely, instances of missing expectations have led to negative market sentiment.

- Earnings Surprises: Significant positive earnings surprises have historically resulted in a stock price increase of X%, while negative surprises have led to a decrease of Y%.

Assessing Current Market Conditions and Their Influence

The upcoming QBTS earnings reaction will not only depend on its internal performance but also on broader market forces.

Macroeconomic Factors

The current macroeconomic environment plays a crucial role. High inflation and rising interest rates could potentially impact consumer spending, which may affect QBTS's sales. Conversely, a positive economic outlook could benefit QBTS's growth prospects.

Competitor Analysis

Analyzing the performance of QBTS's main competitors is crucial. Companies like XYZ Corp and ABC Inc. are key players in the same market segment. (Include details on competitors' recent performance and market share).

- Competitive Threats: The increasing competitiveness in the market presents a potential challenge to QBTS's market share.

- Competitive Advantages: QBTS’s innovative technology and strong brand recognition give it a significant advantage over its competitors.

Analyst Sentiment and Expectations

Analyst sentiment and expectations significantly influence the market's reaction to earnings reports. Currently, analysts hold a generally positive outlook on QBTS, with a consensus price target of Z dollars. (Include details on analyst ratings and earnings estimates).

- Analyst Revisions: Recent upward revisions to earnings estimates suggest increased confidence in QBTS’s future performance.

Forecasting the Upcoming QBTS Earnings Reaction: Potential Scenarios

Based on our analysis, we can outline several potential scenarios for the upcoming QBTS earnings reaction.

Bullish Scenario

A bullish scenario would involve QBTS exceeding analyst expectations on both revenue and EPS. This could be driven by stronger-than-anticipated demand for its "Nova" platform and successful expansion into new markets. This scenario could lead to a significant stock price increase (estimate the percentage).

Bearish Scenario

A bearish scenario would involve QBTS missing expectations due to factors like weaker-than-expected sales, increased competition, or higher-than-anticipated operating costs. This could lead to a substantial decline in the stock price (estimate the percentage).

Neutral Scenario

A neutral scenario would see QBTS meeting analyst expectations, resulting in a relatively muted market response. This could happen if the company performs as anticipated without any major surprises.

Conclusion: Preparing for the QBTS Stock Earnings Reaction

The QBTS stock earnings reaction will depend on a complex interplay of factors, including the company's financial performance, macroeconomic conditions, competitive landscape, and analyst sentiment. While a bullish scenario is possible, a bearish or neutral outcome is equally plausible. Remember, stock market predictions are inherently uncertain.

Before making any investment decisions regarding QBTS stock, conduct your own thorough research and consider consulting a financial advisor. Monitor the QBTS stock earnings reaction closely, and remember to always manage your risk effectively. Share your predictions and analysis in the comments below!

Featured Posts

-

Cadillac Seat F1 World Champions Endorsement For Mick Schumacher

May 20, 2025

Cadillac Seat F1 World Champions Endorsement For Mick Schumacher

May 20, 2025 -

Understanding Ftv Lives Hell Of A Run A Critical Analysis

May 20, 2025

Understanding Ftv Lives Hell Of A Run A Critical Analysis

May 20, 2025 -

Schumacher Vuela De Mallorca A Suiza En Helicoptero Visita A Su Nieta

May 20, 2025

Schumacher Vuela De Mallorca A Suiza En Helicoptero Visita A Su Nieta

May 20, 2025 -

Un Amigo De Schumacher Cuenta La Historia Detras De Su Regreso A La F1 En 2010

May 20, 2025

Un Amigo De Schumacher Cuenta La Historia Detras De Su Regreso A La F1 En 2010

May 20, 2025 -

Jennifer Lawrence Antras Vaikas Naujausia Informacija Apie Aktores Seima

May 20, 2025

Jennifer Lawrence Antras Vaikas Naujausia Informacija Apie Aktores Seima

May 20, 2025

Latest Posts

-

Programma Esperidas Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Programma Esperidas Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025 -

Vc 4

May 20, 2025

Vc 4

May 20, 2025 -

Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025

Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Blog Home Office Alebo Kancelaria Prehlad Vyhod A Nevyhod Pre Manazment

May 20, 2025

Blog Home Office Alebo Kancelaria Prehlad Vyhod A Nevyhod Pre Manazment

May 20, 2025 -

Ap It

May 20, 2025

Ap It

May 20, 2025