QBTS Stock: Predicting The Earnings Report Impact

Table of Contents

Analyzing QBTS's Recent Performance and Trends

Analyzing QBTS's recent performance is critical for predicting the impact of the upcoming earnings report on its stock price. This involves examining several key aspects of the company's financial health and market position.

Revenue Growth and Profitability

Examining QBTS's revenue growth and profitability is paramount. We need to look beyond simple top-line numbers and delve into the underlying drivers of financial performance.

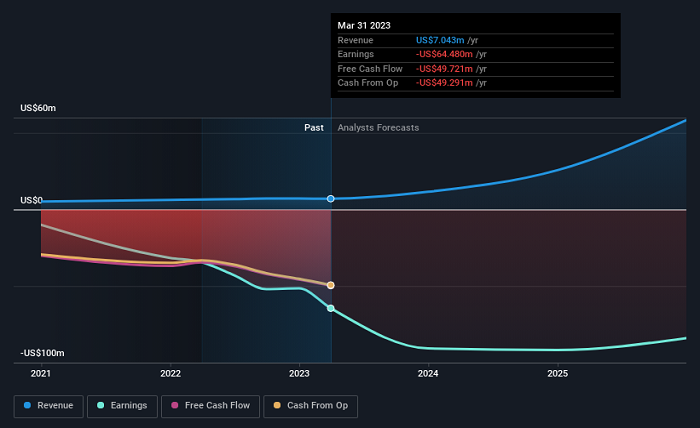

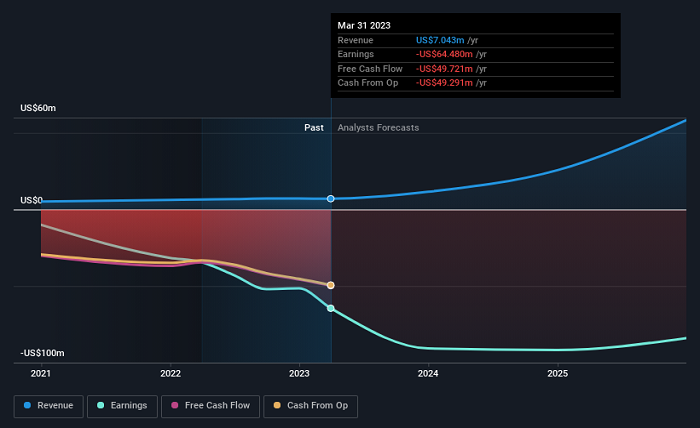

- Year-over-Year Revenue Growth: A consistent upward trend indicates strong performance, while a decline warrants closer examination. Consider the percentage growth rate and compare it to industry benchmarks. [Insert chart showing QBTS year-over-year revenue growth].

- Changes in Operating Income and Net Income: These metrics reveal the company's efficiency and profitability after accounting for operating expenses and taxes. A widening gap between revenue growth and profit margin increase should trigger further investigation. [Insert chart showing QBTS operating income and net income trends].

- Significant One-Time Events: One-off events like acquisitions, divestitures, or legal settlements can significantly skew short-term results. It's important to identify and isolate these events to gain a clearer picture of the underlying business performance.

- Impact of Macroeconomic Factors: Consider the broader economic landscape. Factors like inflation, interest rates, and overall economic growth can significantly impact QBTS's financial performance. For instance, rising interest rates might increase borrowing costs, affecting profitability.

Market Share and Competition

Understanding QBTS's competitive landscape is crucial. Analyzing market share trends and competitive pressures helps gauge the company's long-term prospects.

- Key Competitors: Identify QBTS's primary competitors and analyze their strategies, strengths, and weaknesses. Are they gaining or losing market share? [Insert table comparing QBTS with its main competitors].

- Market Strategies and Threats: Evaluate QBTS's competitive advantages, such as its brand reputation, innovative products, or efficient operations. Analyze any potential threats from new entrants or disruptive technologies.

- Partnerships, Acquisitions, and New Product Launches: Recent strategic moves can significantly impact market share and future growth. New product launches can boost revenue, while acquisitions can expand market reach. Evaluate the success and impact of these initiatives.

- Competitive Landscape Analysis: Overall, assess the overall competitiveness of the market. Is it saturated, or are there opportunities for significant growth? This assessment informs the potential for QBTS’s future earnings.

Factors Influencing QBTS Stock Price Post-Earnings Report

The QBTS stock price reaction following the earnings report will depend on several interconnected factors.

Earnings Expectations and Analyst Forecasts

The gap between actual results and market expectations significantly influences stock price movements.

- Consensus Earnings Estimates: Analyze the average earnings per share (EPS) predictions from various analysts. This provides a benchmark against which to measure the actual results.

- Individual Analyst Predictions: Compare the range of EPS predictions to identify potential outliers and understand the diversity of opinions.

- Earnings Surprises: Positive or negative surprises—when actual results exceed or fall short of expectations—often lead to significant stock price fluctuations. The magnitude of the surprise is key.

- Historical Relationship: Examine how QBTS stock has reacted to past earnings announcements. This historical analysis can provide insights into the market's sensitivity to earnings surprises.

Guidance and Future Outlook

Management commentary on future prospects is crucial. This provides a window into the company's internal expectations and strategic plans.

- Revenue Growth and Profitability Guidance: Pay close attention to the company's projections for future revenue growth and profitability. Realistic and achievable guidance is usually well-received by investors.

- Future Investments and Strategic Direction: Any significant changes in strategic direction or planned investments (e.g., R&D, capital expenditures) can influence investor sentiment.

- Risks and Challenges: Listen for any potential risks or challenges that could impact future performance. Transparency in addressing potential headwinds is crucial.

- Tone and Implications: The overall tone of the management's discussion and their confidence level regarding future prospects will influence investor perceptions.

Overall Market Conditions

The broader economic and market environment significantly influences stock prices.

- Interest Rates and Inflation: Rising interest rates can reduce investor appetite for equities, while high inflation can erode corporate profits.

- Economic Growth: Strong economic growth generally supports higher stock prices, while recessionary fears can lead to market declines.

- Geopolitical Events: Global events can create market uncertainty and affect investor sentiment.

- Investor Sentiment: The overall mood of the market (bullish or bearish) significantly influences how investors react to earnings reports.

Conclusion

This analysis of QBTS stock highlights the importance of considering various factors—financial performance, competitive landscape, market expectations, and the broader economic context—when predicting the impact of the upcoming earnings report. Understanding these aspects is crucial for effective investment strategy. The interplay between QBTS’s internal performance and external market forces determines the likely impact on the QBTS stock price.

Call to Action: While this article provides insights into predicting the impact of the QBTS earnings report on the stock price, remember that investing always involves risk. Conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions regarding QBTS stock or any other security. Stay informed about future QBTS earnings reports and market trends to refine your QBTS stock investment strategy and navigate market volatility effectively.

Featured Posts

-

Where To Invest A Map Of The Countrys New Business Hot Spots

May 21, 2025

Where To Invest A Map Of The Countrys New Business Hot Spots

May 21, 2025 -

The Goldbergs Comparing The Show To Real 80s Family Dynamics

May 21, 2025

The Goldbergs Comparing The Show To Real 80s Family Dynamics

May 21, 2025 -

Debate Over Kartels Trinidad Show Age Limits And Song Bans On The Table

May 21, 2025

Debate Over Kartels Trinidad Show Age Limits And Song Bans On The Table

May 21, 2025 -

Bp Chief Executives Pay Drops By 31 Percent

May 21, 2025

Bp Chief Executives Pay Drops By 31 Percent

May 21, 2025 -

Gangsta Granny Comparisons To Other Childrens Literature

May 21, 2025

Gangsta Granny Comparisons To Other Childrens Literature

May 21, 2025

Latest Posts

-

Abn Amro Analyse Van De Stijgende Occasionverkopen

May 22, 2025

Abn Amro Analyse Van De Stijgende Occasionverkopen

May 22, 2025 -

Toenemend Autobezit Occasionverkoop Abn Amro In De Lift

May 22, 2025

Toenemend Autobezit Occasionverkoop Abn Amro In De Lift

May 22, 2025 -

Occasionmarkt Bloeit Abn Amro Ziet Sterke Toename Verkopen

May 22, 2025

Occasionmarkt Bloeit Abn Amro Ziet Sterke Toename Verkopen

May 22, 2025 -

Abn Amro De Impact Van Amerikaanse Heffingen Op Nederlandse Voedselexport

May 22, 2025

Abn Amro De Impact Van Amerikaanse Heffingen Op Nederlandse Voedselexport

May 22, 2025 -

Abn Amro Ziet Flinke Groei In Occasionverkoop Impact Van Toenemend Autobezit

May 22, 2025

Abn Amro Ziet Flinke Groei In Occasionverkoop Impact Van Toenemend Autobezit

May 22, 2025