Quantum Stocks 2025: Rigetti, IonQ Lead The Charge

Table of Contents

Rigetti Computing: A Deep Dive into its Quantum Stock Potential

Rigetti's Technology and its Competitive Advantages:

Rigetti Computing distinguishes itself through its unique approach to quantum computing. Their technology centers around:

- Superconducting qubits: These qubits are manufactured using advanced fabrication techniques, allowing for scalability and potential for larger, more powerful quantum computers.

- Modular architecture: Rigetti's design allows for the integration of multiple quantum processing units (QPUs), boosting computing power and flexibility.

- Quantum cloud services: Rigetti offers access to its quantum computers through the cloud, enabling broader accessibility for researchers and developers.

Compared to competitors like IBM and Google, Rigetti's focus on modularity and its emphasis on cloud accessibility provide a competitive edge, broadening its potential customer base and revenue streams. They also have established significant partnerships with various research institutions and corporations, further solidifying their position in the market.

Rigetti's Business Model and Financial Projections:

Rigetti's revenue streams stem from several key areas:

- Hardware sales: Direct sales of their QPUs to research institutions and corporations.

- Cloud access fees: Subscription-based access to their quantum computing resources via the cloud.

- Research and development contracts: Collaborations with clients on specific quantum computing projects.

While still in its early stages, Rigetti's financial performance is showing promise. Analyst predictions (note: Always consult your financial advisor before making investment decisions, and this is not financial advice. Specific financial data should be verified through independent sources) vary widely, but generally point towards strong growth potential in the coming years. Careful monitoring of quarterly reports and industry analysis is crucial for assessing the accuracy of these projections.

Investing in Rigetti Stock: Risks and Rewards

Investing in Rigetti, as with any early-stage company in the quantum computing sector, carries substantial risks:

- Technological hurdles: The development of quantum computers faces significant technological challenges. Rigetti’s success is not guaranteed.

- Competition: The quantum computing landscape is highly competitive. Rigetti must continuously innovate to maintain its market position.

- Market volatility: The value of Rigetti stock will likely fluctuate significantly based on market sentiment and company performance.

However, the potential rewards are considerable:

- Significant returns: If Rigetti successfully overcomes technological hurdles and establishes market leadership, investors could see substantial returns.

- First-mover advantage: As a pioneer in the field, Rigetti stands to benefit greatly from early adoption and market penetration.

Rigetti stock is only suitable for investors with a high-risk tolerance and a long-term investment horizon.

IonQ: Another Promising Player in the Quantum Stocks Market

IonQ's Technological Prowess and Market Positioning:

IonQ differentiates itself through its use of trapped ion qubits. This technology offers several advantages:

- High fidelity: Trapped ion qubits boast high levels of accuracy and coherence, crucial for reliable quantum computation.

- Scalability potential: IonQ has demonstrated the ability to scale its technology, paving the way for larger and more powerful quantum computers.

- Industry partnerships: Similar to Rigetti, IonQ has forged strategic alliances to advance its technology and reach a broader market.

Compared to Rigetti's superconducting qubit approach, IonQ's trapped ion technology offers unique strengths in terms of qubit fidelity and scalability, although it presents its own engineering challenges. IonQ's market share is currently growing, indicating positive market acceptance.

IonQ's Business Strategy and Financial Outlook:

IonQ's business model relies heavily on:

- Cloud access: Providing cloud-based access to its quantum computers.

- Hardware sales: Direct sales of quantum computers to select clients.

- Research collaborations: Partnerships with research organizations and corporations.

Like Rigetti, IonQ's financial performance and future projections should be analyzed cautiously, relying on independent financial analysis and their own reports. Analyst predictions again vary but indicate potential for substantial growth.

IonQ Investment Considerations: Risks and Opportunities:

Investing in IonQ also presents risks:

- Technological risks: Unforeseen technical challenges could hamper IonQ's progress.

- Market competition: The quantum computing space remains highly competitive.

- Financial volatility: IonQ's stock price is susceptible to market fluctuations.

Despite these risks, the opportunities are significant:

- High growth potential: Successful execution of IonQ's business strategy could lead to significant stock appreciation.

- First-mover advantage: Early market penetration offers considerable advantages.

IonQ stock is suitable only for investors with a high-risk tolerance and a long-term investment outlook.

Beyond Rigetti and IonQ: Other Quantum Stocks to Watch in 2025

While Rigetti and IonQ represent prominent players, other companies are making significant strides in the quantum computing sector. These include [list other relevant companies and link to their websites]. Further research into these companies is recommended to gain a more comprehensive understanding of the quantum computing investment landscape. The broader quantum computing market is anticipated to experience substantial growth over the next decade, presenting numerous investment opportunities.

Analyzing the Quantum Computing Investment Landscape for 2025

Macroeconomic factors such as government funding, overall investment sentiment in technology stocks, and prevailing interest rates significantly influence quantum stock valuations. The regulatory environment surrounding quantum computing technology also plays a crucial role. It's crucial to understand the impact of both domestic and international regulations on the sector. Diversifying investments across multiple companies within the quantum computing sector is advisable to mitigate risk.

Conclusion: Investing in the Future of Computing with Quantum Stocks

Investing in quantum stocks, particularly in companies like Rigetti and IonQ, presents a unique opportunity to participate in a revolutionary technology with the potential for enormous returns. However, it's critical to recognize the high-risk nature of these investments. Thorough due diligence, including a comprehensive analysis of each company's technology, business model, financial performance, and competitive landscape, is essential before committing funds. While Rigetti and IonQ are leading contenders, remember that success is not guaranteed. Conduct further research on "quantum stocks 2025," "Rigetti stock analysis," and "IonQ investment outlook" to inform your decisions. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

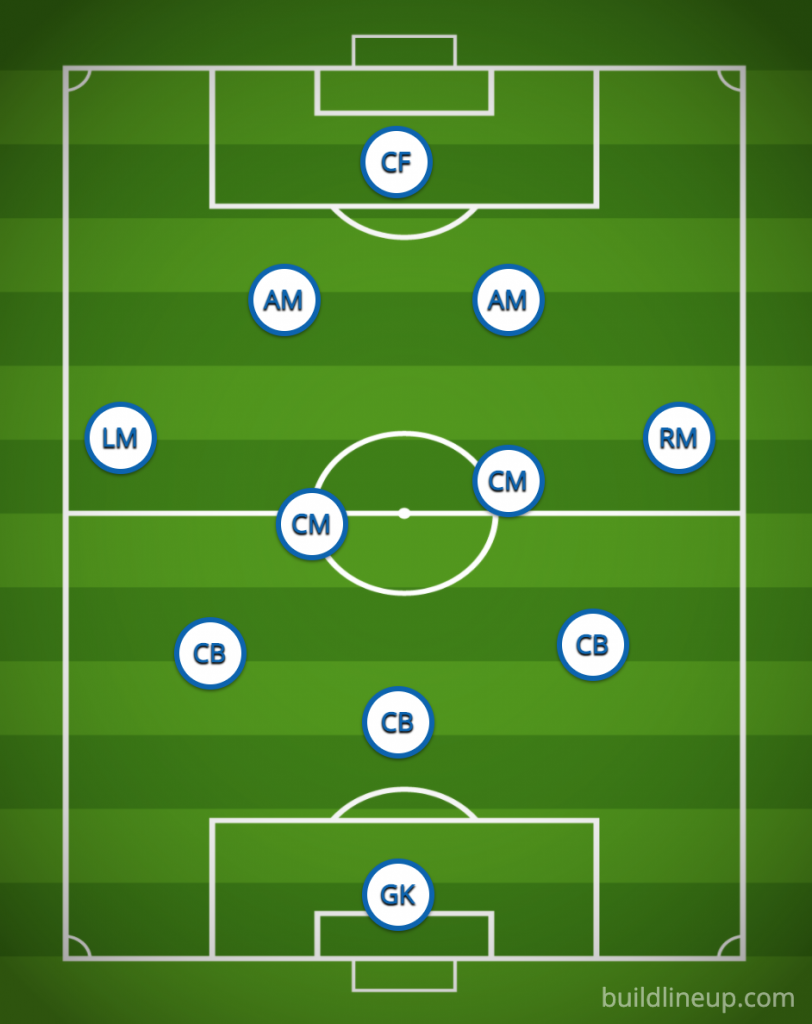

Suomi Ryhmaen Avauskokoonpanossa Muutoksia Kaellmanin Paikka Kyseenalainen

May 21, 2025

Suomi Ryhmaen Avauskokoonpanossa Muutoksia Kaellmanin Paikka Kyseenalainen

May 21, 2025 -

Reddits Viral Fake Disappearance A Sydney Sweeney Movie Plot

May 21, 2025

Reddits Viral Fake Disappearance A Sydney Sweeney Movie Plot

May 21, 2025 -

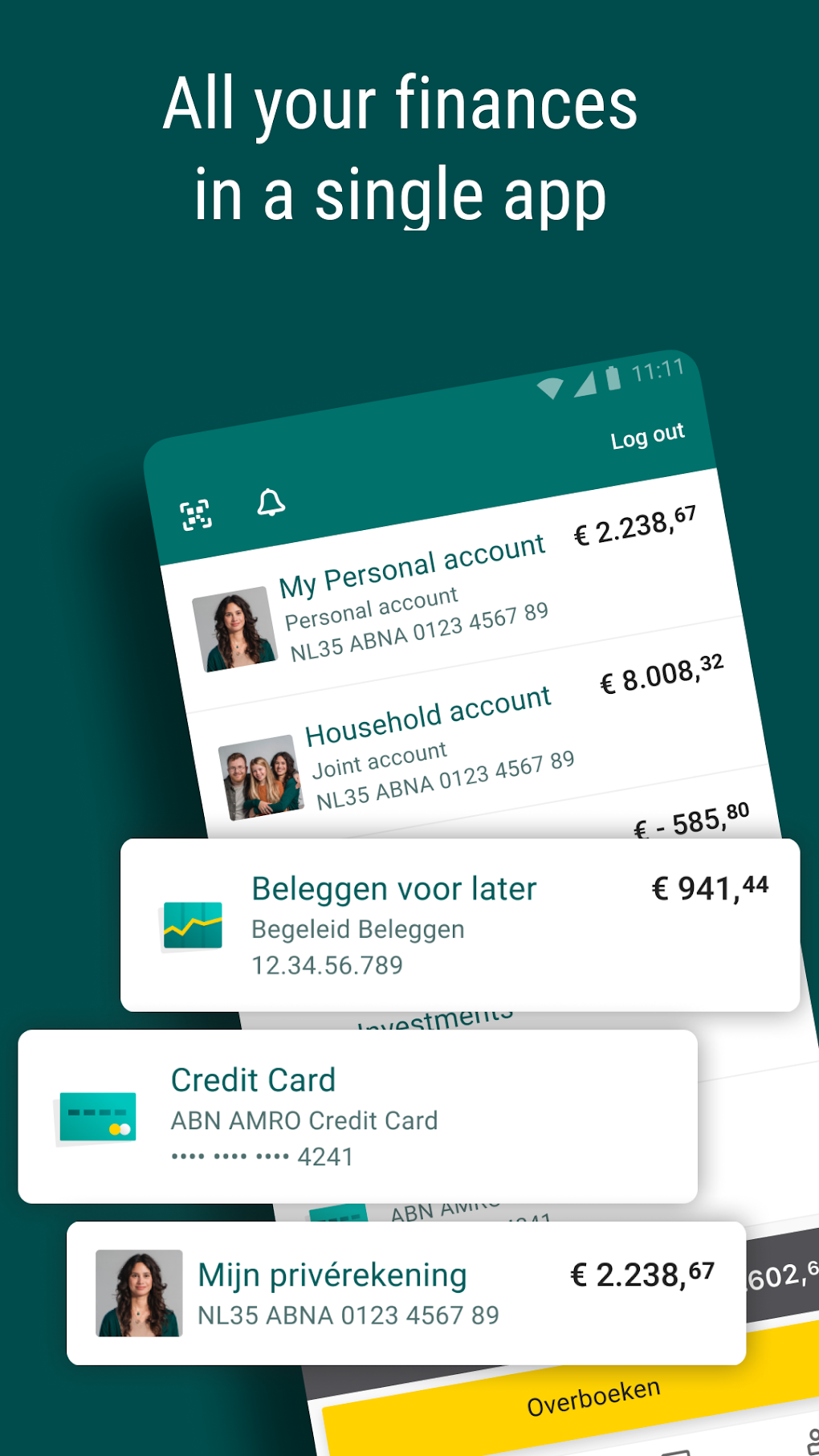

Abn Amro Import Van Voedingsmiddelen Naar Vs Gehalveerd Door Heffingen

May 21, 2025

Abn Amro Import Van Voedingsmiddelen Naar Vs Gehalveerd Door Heffingen

May 21, 2025 -

Podcast Revolution Ai And The Repetitive Scatological Document Challenge

May 21, 2025

Podcast Revolution Ai And The Repetitive Scatological Document Challenge

May 21, 2025 -

Tv Host Lorraine Kelly Squirming After David Walliams Remarks

May 21, 2025

Tv Host Lorraine Kelly Squirming After David Walliams Remarks

May 21, 2025

Latest Posts

-

Couple Arrested Following Antiques Roadshow Appearance National Treasure Case

May 22, 2025

Couple Arrested Following Antiques Roadshow Appearance National Treasure Case

May 22, 2025 -

Antiques Roadshow Appraisal Leads To Arrest For National Treasure Trafficking

May 22, 2025

Antiques Roadshow Appraisal Leads To Arrest For National Treasure Trafficking

May 22, 2025 -

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025