Quantum Stocks Surge In 2025: Rigetti And IonQ Lead The Charge

Table of Contents

The Rise of Quantum Computing and its Market Impact

Understanding the Quantum Computing Market

Quantum computing leverages the principles of quantum mechanics to solve complex problems far beyond the capabilities of classical computers. Its potential applications span numerous industries:

- Medicine: Drug discovery and development, personalized medicine, and genomic analysis are revolutionized by quantum computing's ability to simulate molecular interactions with unprecedented accuracy.

- Finance: Portfolio optimization, risk management, and fraud detection benefit from quantum algorithms' speed and power.

- Materials Science: Designing new materials with specific properties (e.g., superconductors) becomes significantly faster and more efficient.

Market projections for the quantum computing market are incredibly optimistic. According to a report by [Insert Reputable Source and Link Here], the market is expected to reach [Insert Projected Market Size] by [Insert Year], growing at a [Insert Growth Rate]% CAGR. This substantial growth is driven by increased investment from both the public and private sectors, along with significant advancements in quantum technology.

Why Invest in Quantum Stocks Now?

The current investment climate for quantum stocks is characterized by high growth potential and significant risk. Several factors contribute to this surge in interest:

- High Long-Term Returns: The potential for exponential returns is a major draw for investors seeking high-growth opportunities. The early adoption of this transformative technology could lead to significant returns for early investors.

- Technological Breakthroughs: Continuous advancements in qubit technology, error correction, and algorithm development are driving the rapid maturation of the quantum computing industry.

- Government Support: Many governments worldwide recognize the strategic importance of quantum computing and are providing substantial funding for research and development, further stimulating growth in the sector.

Rigetti Computing: A Deep Dive

Company Overview and Technology

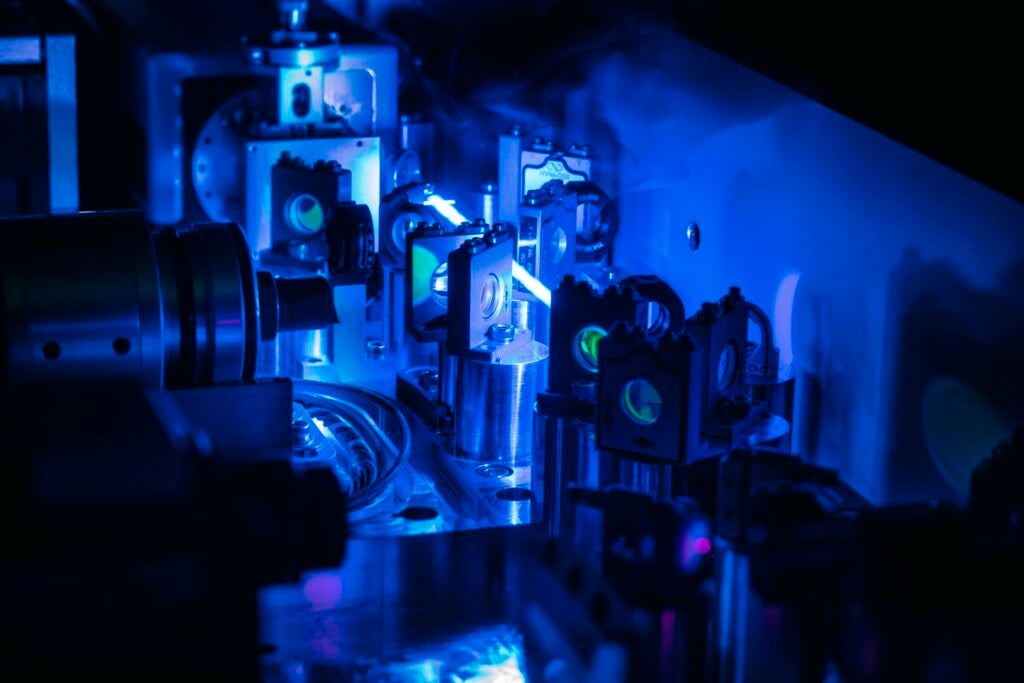

Rigetti Computing is a prominent player in the quantum computing industry, specializing in the development of superconducting quantum computers. Their business model focuses on providing both cloud-based access to their quantum computers and developing quantum-specific hardware and software. Key features include:

- Superconducting Qubits: Rigetti utilizes superconducting qubits, a leading technology in the quantum computing race.

- Modular Architecture: Their approach emphasizes scalability and modularity, aiming to build larger and more powerful quantum computers.

Key Partnerships: [List key partnerships] Recent Funding Rounds: [List recent funding rounds and amounts] Stock Ticker Symbol: [Insert Stock Ticker Symbol, if applicable] Current Stock Price: [Insert Current Stock Price, if applicable – Disclaimer: Stock prices are volatile.]

Investment Outlook for Rigetti

Rigetti's future growth hinges on several factors:

- Competitive Advantage: Their modular architecture offers potential scalability advantages compared to some competitors.

- Scalability Challenges: Scaling up quantum computers while maintaining qubit coherence remains a significant technological challenge for all companies in the field.

- Market Adoption: The successful integration of their technology into various applications will be crucial for their long-term success.

IonQ: A Leading Competitor in the Quantum Race

IonQ's Technological Approach and Market Position

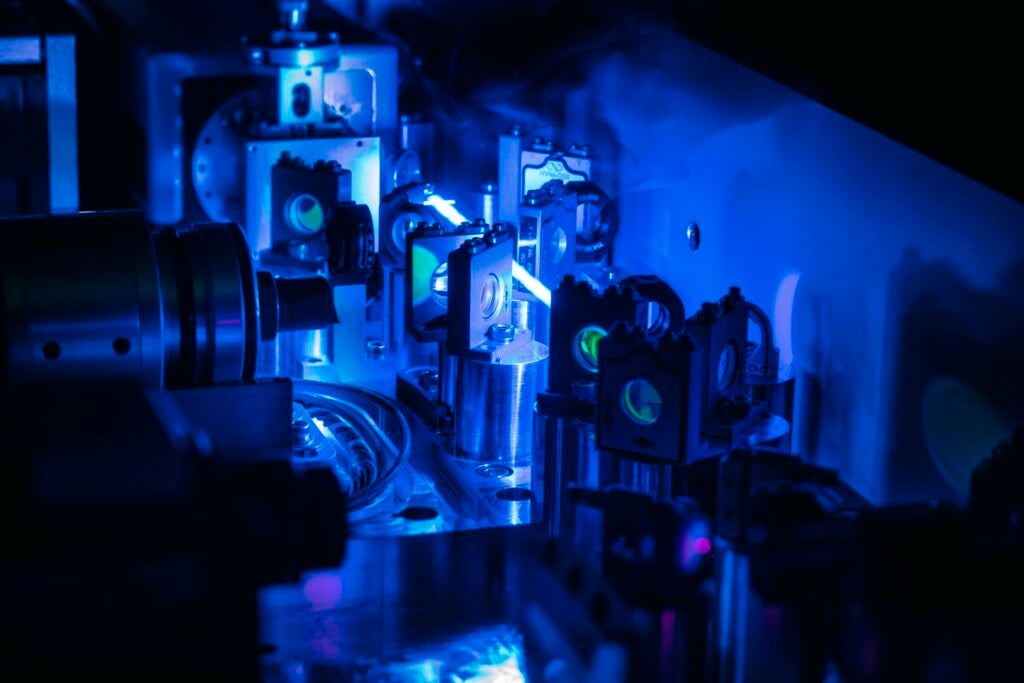

IonQ employs a different approach, utilizing trapped ion quantum computers. This technology offers several advantages, including:

- High Fidelity Qubits: Trapped ion qubits are known for their high fidelity and long coherence times.

- Established Partnerships: IonQ boasts notable partnerships with major companies in various sectors.

Key Partnerships: [List key partnerships] Significant Contracts: [List any significant contracts or agreements] Stock Ticker Symbol: [Insert Stock Ticker Symbol, if applicable] Current Stock Price: [Insert Current Stock Price, if applicable – Disclaimer: Stock prices are volatile.]

Investment Potential and Risks of IonQ

IonQ's continued success depends on several elements:

- Maintaining Technological Leadership: Staying ahead of the competition in terms of qubit performance and scalability is crucial.

- Market Penetration: Securing contracts and partnerships with major clients across various industries will drive growth.

- Regulatory Landscape: Navigating the evolving regulatory landscape for quantum technologies will be an important factor influencing their trajectory.

Other Key Players and Future Trends in the Quantum Stock Market

Beyond Rigetti and IonQ, companies like Google and IBM are also making significant strides in quantum computing, although their stock performance is often tied to broader technology market trends.

Future trends in the quantum stock market include:

- Consolidation: We may see increased mergers and acquisitions as companies seek to expand their capabilities and market share.

- Technological Disruptions: New qubit technologies and breakthroughs in error correction could significantly impact the competitive landscape.

- Government Regulations: Government regulations could play a significant role in shaping the quantum computing market.

Conclusion

The surge in quantum stocks in 2025 reflects the growing recognition of quantum computing's transformative potential. Rigetti and IonQ are leading the charge, but the sector remains highly dynamic and competitive. Investing in quantum stocks offers the potential for substantial returns, but it also comes with significant risk. While the long-term prospects are compelling, investors should conduct thorough due diligence and carefully consider their risk tolerance before investing in this nascent technology. Start your research on quantum stocks today and capitalize on this potentially lucrative opportunity!

Featured Posts

-

Kaksi Tuttua Nimeae Ulos Huuhkajien Avauskokoonpanosta

May 20, 2025

Kaksi Tuttua Nimeae Ulos Huuhkajien Avauskokoonpanosta

May 20, 2025 -

Drier Weather On The Horizon Impacts And Adaptations

May 20, 2025

Drier Weather On The Horizon Impacts And Adaptations

May 20, 2025 -

Burnham And Highbridge Photo Archive A Look Into The Past Opens Today

May 20, 2025

Burnham And Highbridge Photo Archive A Look Into The Past Opens Today

May 20, 2025 -

Sinners Monte Carlo Training Disrupted By Rain

May 20, 2025

Sinners Monte Carlo Training Disrupted By Rain

May 20, 2025 -

Historic Photos Of Burnham And Highbridge Archive Opens Tomorrow

May 20, 2025

Historic Photos Of Burnham And Highbridge Archive Opens Tomorrow

May 20, 2025

Latest Posts

-

Jurgen Klopps Agent Addresses Real Madrid Links

May 20, 2025

Jurgen Klopps Agent Addresses Real Madrid Links

May 20, 2025 -

Matt Lucas Gives Little Britain Revival Update After Fan Questions

May 20, 2025

Matt Lucas Gives Little Britain Revival Update After Fan Questions

May 20, 2025 -

Why Gen Z Loves Little Britain Despite Its Cancellation

May 20, 2025

Why Gen Z Loves Little Britain Despite Its Cancellation

May 20, 2025 -

Little Britains Future Matt Lucas Addresses Revival Speculation

May 20, 2025

Little Britains Future Matt Lucas Addresses Revival Speculation

May 20, 2025 -

Matt Lucas On Little Britain Revival A Future Update

May 20, 2025

Matt Lucas On Little Britain Revival A Future Update

May 20, 2025