Quebec's Lion Electric Faces Revised Acquisition Offer

Table of Contents

Details of the Revised Acquisition Offer

The initial acquisition offer for Lion Electric, while not publicly disclosed in full detail, was understood to be a significant investment aiming to bolster the company's growth and market share in the competitive electric vehicle sector. The revised offer, however, introduces key changes that alter the dynamics of the potential acquisition. While the specific details remain somewhat shrouded in confidentiality due to ongoing negotiations, certain aspects have emerged.

-

Original offer amount and terms: The original offer's specifics remain undisclosed, but industry analysts suggested it valued Lion Electric at a certain figure, likely based on its current market capitalization and future growth potential. Terms likely included payment structures, stipulations for Lion Electric's management, and integration plans.

-

Changes in the revised offer (increased/decreased price, altered conditions): Reports indicate the revised offer includes an adjusted price, although whether this represents an increase or decrease is currently unclear. It’s also speculated that the revised terms may include changes to the timeline or other conditions previously stipulated.

-

Key players involved in the negotiation (e.g., board of directors, investment firms): Lion Electric's board of directors are central to the negotiations, weighing the implications for shareholders and the company's long-term strategy. Specific investment firms involved have not yet been fully revealed, but industry watchers are keen to identify the potential acquiring entity.

-

Expected completion date (if available): No official completion date has been publicly announced. The timeline will likely depend on the acceptance or rejection of the revised offer, further negotiations, and regulatory approvals.

Lion Electric's Response to the Revised Offer

Lion Electric has yet to publicly release a comprehensive statement on the revised acquisition offer. However, industry sources suggest the company is carefully considering the implications of the proposal.

-

Lion Electric's official statement regarding the revised offer: A formal response is anticipated, clarifying the company's stance on the new terms. This statement will likely be crucial in influencing investor sentiment and the stock price.

-

Key considerations influencing their decision (e.g., shareholder value, future growth prospects): The Lion Electric board will need to assess whether the revised offer maximizes shareholder value while aligning with the company's long-term strategic goals for growth and innovation in the EV market.

-

Any counter-offers or negotiations expected: It's plausible that Lion Electric might engage in further negotiations, potentially proposing counter-offers to improve the terms in their favor, or seek additional bids.

-

Impact on Lion Electric's short-term and long-term strategies: The acceptance or rejection of the offer will significantly shape Lion Electric’s future. A successful acquisition could accelerate growth and market penetration, while rejection could necessitate a recalibration of its long-term strategy.

Market Impact and Analysis of the Revised Offer

The revised acquisition offer carries substantial implications for various stakeholders.

-

Predicted effect on Lion Electric's stock price: The stock price is expected to fluctuate significantly depending on the outcome of the negotiations. Acceptance of a favorable offer could lead to a price surge, while rejection or a poor counter-offer might trigger a decline.

-

Potential impact on competition in the electric vehicle sector: The acquisition could reshape the competitive landscape, potentially leading to increased consolidation or prompting rivals to accelerate their own expansion strategies.

-

Implications for investment in Quebec's green technology sector: The outcome will significantly influence future investment in Quebec's burgeoning green technology sector, either attracting more capital or potentially dampening investor enthusiasm depending on the perceived success of the acquisition.

-

Wider implications for the Canadian EV market: The deal's success or failure could have wider repercussions for the overall development of Canada's EV infrastructure and its position within the global EV market.

Alternative Scenarios and Potential Outcomes

Several scenarios could unfold following the revised offer.

-

Scenario 1: Successful acquisition – implications for Lion Electric and the EV market: A successful acquisition could significantly benefit Lion Electric through access to capital, technology, and expanded market reach, boosting innovation and competition within the EV market.

-

Scenario 2: Rejection of the offer – implications for Lion Electric and future strategies: Rejection will necessitate a reassessment of Lion Electric’s strategic direction, potentially leading to alternative funding strategies or a renewed focus on organic growth.

-

Scenario 3: Counter-offer and subsequent negotiations – potential outcomes: Further negotiations could result in a revised agreement more favorable to Lion Electric, potentially leading to a higher acquisition price and improved terms. However, extended negotiations may also increase the risk of the deal collapsing entirely.

Conclusion

The revised acquisition offer for Quebec's Lion Electric presents a pivotal moment for the company and the broader electric vehicle industry. The outcome will significantly influence Lion Electric's future trajectory, impacting its stock price, market position, and contribution to the growth of sustainable transportation. The implications extend beyond Lion Electric, affecting the competitive landscape, investment in green technology within Quebec, and the development of Canada’s EV market.

Call to Action: Stay tuned for further updates on this evolving story regarding Lion Electric's future and the impact of this revised acquisition offer on the electric vehicle market. Keep following our site for the latest news on Lion Electric and other developments in the electric vehicle sector.

Featured Posts

-

Sevilla Miercoles 7 De Mayo 2025 Tu Plan Perfecto

May 14, 2025

Sevilla Miercoles 7 De Mayo 2025 Tu Plan Perfecto

May 14, 2025 -

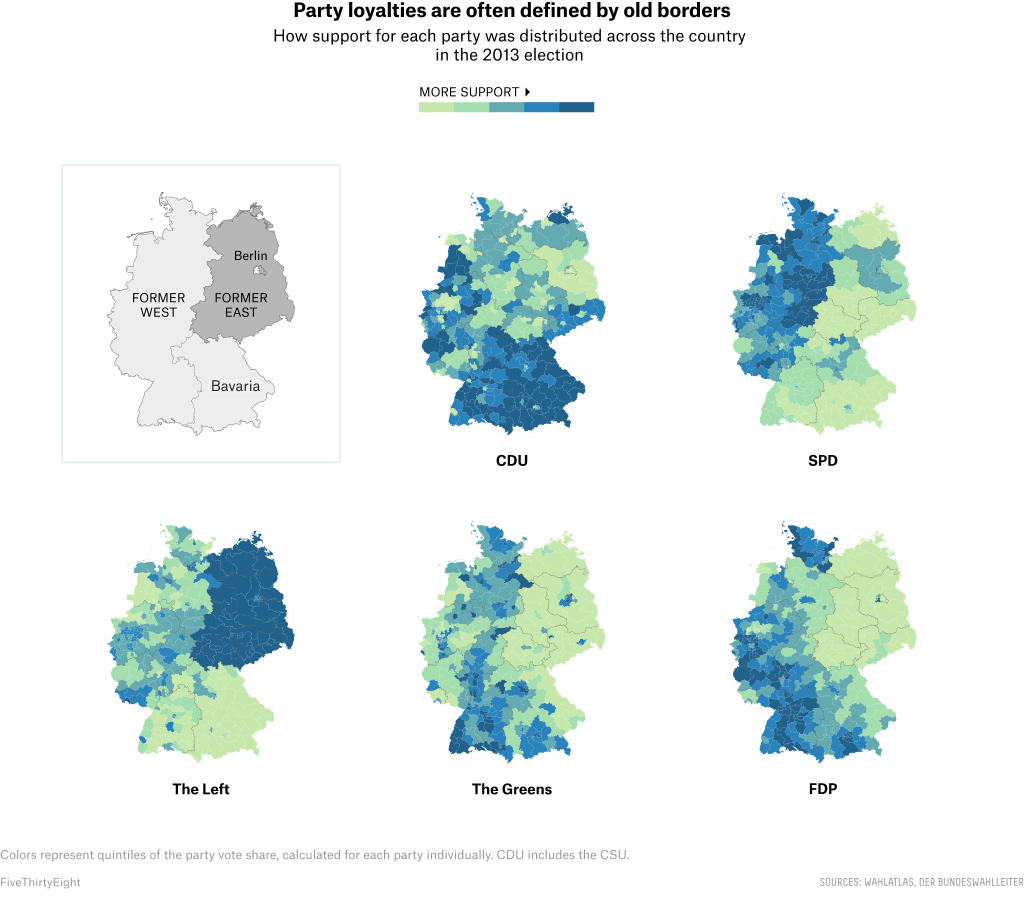

The Upcoming German Election A Defining Moment

May 14, 2025

The Upcoming German Election A Defining Moment

May 14, 2025 -

Rejoindre Societe Generale Les Dernieres Nominations Et Opportunites D Emploi

May 14, 2025

Rejoindre Societe Generale Les Dernieres Nominations Et Opportunites D Emploi

May 14, 2025 -

Casa Sanremo Campus 2024 Corso Performer 4 0 E Il Futuro Dei Talenti

May 14, 2025

Casa Sanremo Campus 2024 Corso Performer 4 0 E Il Futuro Dei Talenti

May 14, 2025 -

How To Watch The Snow White Live Action Movie At Home

May 14, 2025

How To Watch The Snow White Live Action Movie At Home

May 14, 2025