Rate Cut Optimism Among Bond Traders Evaporates After Powell Speech

Table of Contents

Powell's Hawkish Stance and its Impact on Bond Yields

Powell's speech emphasized the Fed's unwavering commitment to lowering inflation, even at the cost of potential economic slowdown. This hawkish stance signaled a lower probability of imminent rate cuts, contradicting earlier market expectations fueled by hopes for rate cut relief. Consequently, bond yields rose sharply across the maturity spectrum, reflecting investors' revised expectations for future interest rates. The increased yields indicate a reduced demand for bonds as investors seek higher returns in other asset classes.

- Powell's decisive language: Powell's use of phrases like "unwavering commitment" and "substantial further progress" signaled a less dovish approach than many traders had anticipated. This stark contrast to previous more lenient statements significantly altered market sentiment.

- Magnitude of yield increase: The 10-year Treasury yield, a key benchmark, experienced a notable increase following the speech, reflecting investors' growing expectation of higher interest rates for an extended period. Shorter-term yields also saw significant jumps, demonstrating a widespread shift in market sentiment. This increase signals a shift away from the expectation of rate cuts.

- Impact on different bond maturities: The impact wasn't uniform across all maturities. Shorter-term bonds, more sensitive to near-term interest rate expectations, experienced a more pronounced yield increase than longer-term bonds. This highlights the market's anticipation of a sustained period of higher interest rates.

Shifting Market Sentiment and Investor Behavior

The unexpected shift in the Fed's stance led to increased market volatility and uncertainty. Investors, previously anticipating rate cuts and lower yields, are now exhibiting risk aversion. This has resulted in a potential "flight to safety," with investors moving towards less risky assets like government bonds, considered a safer haven during periods of uncertainty. Many investors are reevaluating their bond portfolios and adjusting their strategies in response to the altered outlook.

- Increased market volatility: The abrupt change in expectations created significant volatility in the bond market, making it challenging for investors to predict future price movements. The uncertainty also affected other asset classes as investors looked for safer investments.

- Risk aversion and flight to safety: The uncertainty spurred a move away from riskier assets, including corporate bonds and emerging market debt, as investors sought the perceived safety of government bonds. This 'flight to safety' increased the demand for government bonds, further impacting bond yields and rate cut expectations.

- Impact on different investor profiles: Institutional investors, with larger portfolios and more sophisticated risk management strategies, may be better equipped to navigate this period of uncertainty. Retail investors, however, may require more caution and potentially seek professional financial advice.

Implications for the Economic Outlook

The Fed's focus on inflation control could lead to slower economic growth, potentially triggering a recession. Aggressive monetary policy tightening, aimed at curbing inflation, may inadvertently stifle economic activity and negatively impact GDP growth. The effectiveness of the Fed's approach in achieving a "soft landing"—lowering inflation without causing a recession—is now being seriously questioned.

- Recession risk: The combination of higher interest rates and reduced consumer spending due to inflation could significantly impact economic growth. Economists are increasingly discussing the possibility of a recession in the near future, largely fueled by the Fed's hawkish stance and its impact on the rate cut outlook.

- Inflation control vs. economic growth: The Fed faces a difficult balancing act: controlling inflation without triggering a severe economic downturn. The effectiveness of its current policy will significantly shape the economic outlook for the coming months and years. Maintaining rate hikes while monitoring GDP growth will be a crucial challenge.

- Economic data and forecasts: Key economic indicators, such as inflation rates, unemployment figures, and GDP growth, will be crucial in determining the actual impact of the Fed's policy on the economy. These data points will be carefully scrutinized by investors and economists alike to gauge the effectiveness of current measures and predict the need for future adjustments to monetary policy, impacting potential rate cuts.

Looking Ahead: Future Prospects for Bond Markets

The future path of interest rates remains uncertain, dependent on incoming economic data and inflation trends. Bond traders will be closely monitoring upcoming economic indicators for clues about the Fed's next move. Investors should adopt a cautious approach and consider diversifying their portfolios to mitigate risk. Careful risk management strategies are crucial in navigating this period of uncertainty.

- Uncertainty about future interest rates: The trajectory of interest rates will be influenced by several factors, including inflation data, economic growth, and geopolitical events. Predicting future interest rates with certainty is challenging given the current economic climate.

- Importance of economic indicators: Investors need to actively monitor key economic indicators like the Consumer Price Index (CPI), Producer Price Index (PPI), and employment data to anticipate changes in monetary policy and their impact on bond yields. Rate cut predictions will be influenced by this data.

- Investment strategy and risk management: Investors should diversify their portfolios across different asset classes and maturities to reduce overall risk. Adopting a long-term perspective, carefully assessing risk tolerance, and consulting a financial advisor are recommended strategies.

Conclusion

Powell's recent speech significantly altered the market's expectations regarding future rate cuts, causing a reversal of the initial optimism among bond traders. The hawkish stance has led to increased bond yields, heightened market volatility, and a reassessment of the economic outlook. The future direction of interest rates remains uncertain, requiring a cautious approach from investors. Understanding the nuanced implications of Fed rate cut decisions is crucial for navigating the complexities of the bond market.

Call to Action: Stay informed on the latest developments regarding interest rate decisions and their impact on the bond market. Continuously monitor the Fed’s announcements and their influence on bond yields to effectively manage your investment strategy and mitigate risks related to rate cut expectations. Understanding the implications of rate cut decisions and the Fed's overall monetary policy is crucial for successful navigation of the ever-changing bond market.

Featured Posts

-

Bessent Reports On Us China Trade Talks Progress

May 12, 2025

Bessent Reports On Us China Trade Talks Progress

May 12, 2025 -

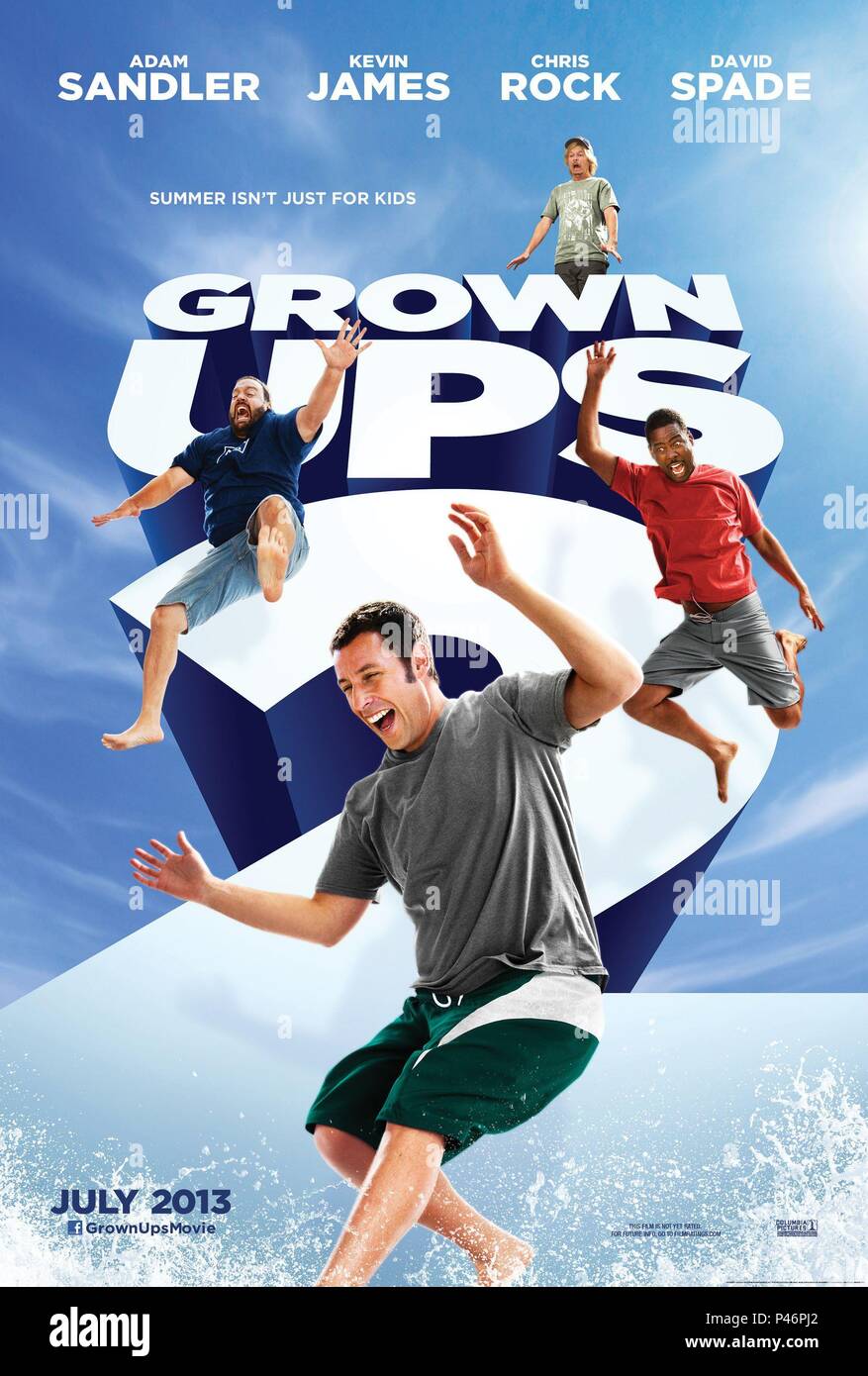

Grown Ups 2 Comparing It To The Original Film

May 12, 2025

Grown Ups 2 Comparing It To The Original Film

May 12, 2025 -

Unveiling The Grandeur Mansions Featured On Mtv Cribs

May 12, 2025

Unveiling The Grandeur Mansions Featured On Mtv Cribs

May 12, 2025 -

Lily Collins Effortless Beauty Bob Brows And Nude Lip Trend

May 12, 2025

Lily Collins Effortless Beauty Bob Brows And Nude Lip Trend

May 12, 2025 -

10 Images Benny Blancos Actions Amid Selena Gomez Relationship Speculation

May 12, 2025

10 Images Benny Blancos Actions Amid Selena Gomez Relationship Speculation

May 12, 2025