Real Estate Market Crash: Home Sales Plummet To Crisis Levels

Table of Contents

Causes of the Real Estate Market Crash

Several interconnected factors have converged to create the current real estate market crash. Understanding these causes is crucial for navigating the market effectively.

Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes have significantly impacted affordability. Higher mortgage rates translate directly into increased monthly payments, reducing the purchasing power of potential homebuyers.

- Increased mortgage payments: Even a small percentage increase in interest rates can dramatically increase monthly mortgage payments, making homeownership unaffordable for many.

- Fewer buyers: The higher cost of borrowing is significantly reducing the number of qualified buyers in the market.

- Decreased demand: Lower demand leads to a slowdown in sales, causing a ripple effect throughout the real estate market.

- Reduced home prices: In a buyer's market, sellers are often forced to lower their prices to attract buyers.

Inflation and Economic Uncertainty

High inflation and fears of a potential recession are creating significant buyer hesitancy. Uncertainty about job security and future income is making people reluctant to commit to large financial obligations like purchasing a home.

- Eroding purchasing power: Inflation reduces the value of savings, making it harder for people to afford a down payment and monthly mortgage payments.

- Recession fears: Concerns about a potential economic downturn make people less likely to invest in real estate.

- Investor pullback: Investors, a significant segment of the market, are pulling back from real estate investments, further reducing demand.

- Market uncertainty: This creates a climate of uncertainty making many potential homebuyers wait and see.

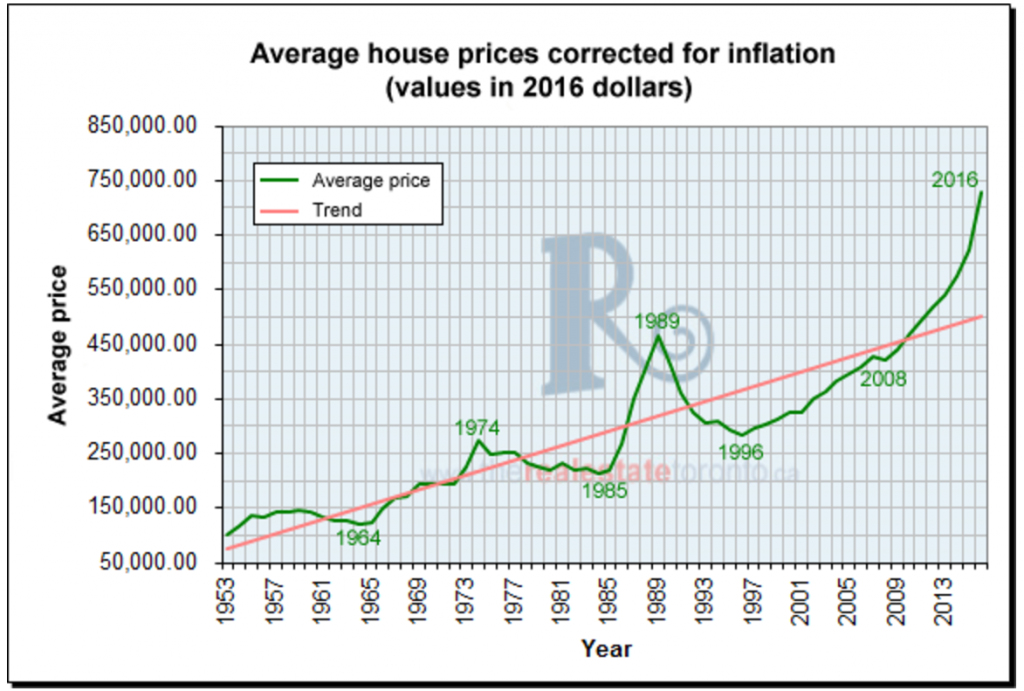

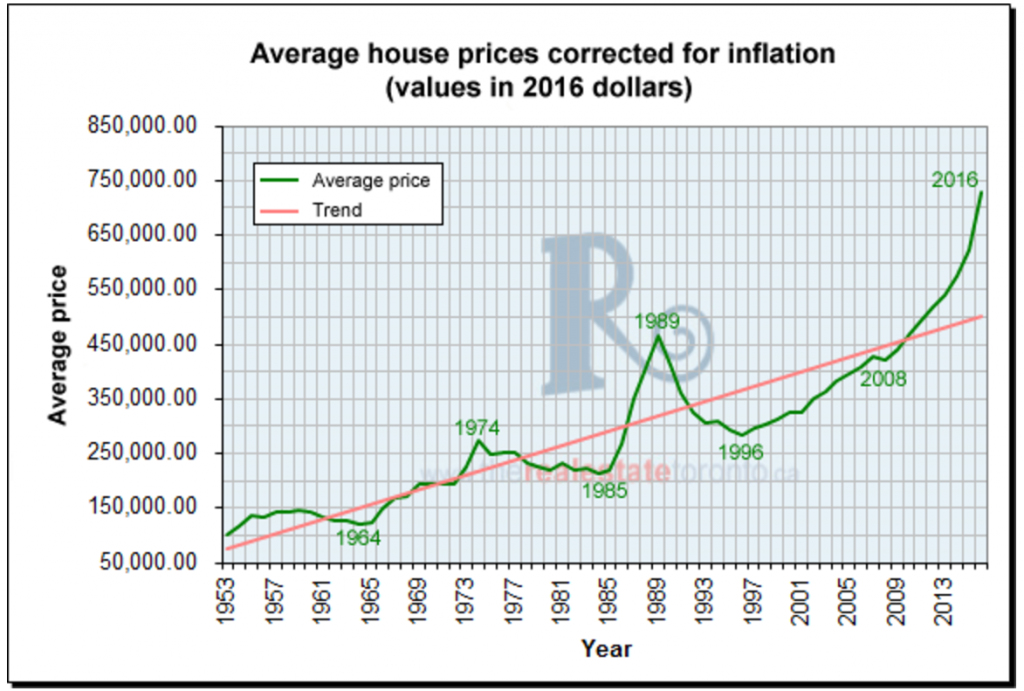

Overvalued Housing Market

In many areas, housing prices had become significantly inflated before the crash, creating an unsustainable market. This overvaluation was fueled by low interest rates and high demand during the pandemic. The current downturn is essentially a correction of this inflated market.

- Market correction: The current decline represents a necessary correction to bring prices back in line with market fundamentals.

- Sharpest declines in overvalued areas: Areas where prices experienced the most significant increases are now seeing the steepest declines.

- Housing bubble burst: Many analysts believe the current situation reflects the bursting of a housing bubble, although the severity varies geographically.

- Return to sustainable levels: The crash is expected to lead to more sustainable and realistic pricing in the long term.

Reduced Housing Inventory (Paradoxical Impact)

While historically low inventory is usually associated with high prices, the current situation presents a paradox. The combination of low inventory and significantly reduced buyer demand creates a frozen market.

- Seller reluctance: Sellers are hesitant to sell at lower prices, hoping for a market rebound.

- Buyer hesitancy: Buyers are reluctant to purchase due to high interest rates and economic uncertainty.

- Market stagnation: This creates a stalemate, exacerbating the overall downturn in the real estate market crash.

- Price adjustments needed: For the market to recover, either prices must adjust to reflect current demand, or inventory levels need to substantially increase.

Impact of the Real Estate Market Crash

The real estate market crash has far-reaching consequences for homeowners and the broader economy.

Impact on Homeowners

Existing homeowners face several challenges as a result of this real estate market crash.

- Decreased equity: Falling home values reduce homeowner equity, impacting their net worth.

- Refinancing difficulties: Higher interest rates make refinancing more expensive and potentially unattainable for some homeowners.

- Negative equity risk: Some homeowners may find themselves in negative equity situations, owing more on their mortgage than their home is worth.

- Financial strain: Many homeowners may face increased financial strain as a result of market conditions.

Impact on the Economy

A significant downturn in the real estate market has considerable ripple effects throughout the economy.

- Reduced construction activity: Lower demand for new homes leads to decreased construction activity and job losses in the construction industry.

- Job losses in related industries: The downturn impacts related industries like real estate services, furniture, and home improvement.

- Decreased consumer spending: Reduced home values and economic uncertainty lead to decreased consumer spending.

- GDP impact: The overall effect on GDP growth can be significant, potentially leading to slower economic expansion.

Navigating the Real Estate Market Crash

Both buyers and sellers need to adapt strategies to navigate this challenging market successfully.

Strategies for Buyers

For buyers, this real estate market crash presents both challenges and opportunities.

- Wait for price stabilization: Consider waiting for prices to stabilize before making a purchase.

- Seek out better deals: A buyer's market offers opportunities to negotiate lower prices.

- Secure pre-approval: Getting pre-approved for a mortgage demonstrates financial readiness to sellers.

- Thorough research: Conduct extensive research on properties and market trends before making an offer.

Strategies for Sellers

For sellers, adapting to the current market is crucial.

- Realistic pricing: Price your property competitively to attract buyers.

- Curb appeal and staging: Make your home visually appealing to potential buyers.

- Knowledgeable real estate agent: Partner with a skilled real estate agent experienced in navigating a downturn market.

- Market analysis: Understand your local market conditions and price your home accordingly.

Conclusion

The real estate market crash is a complex situation with far-reaching consequences. Rising interest rates, inflation, economic uncertainty, and an overvalued market contributed to the current downturn. Buyers and sellers must adapt their strategies to successfully navigate this turbulent period. By understanding the causes and impacts of this real estate market crash, and by implementing the appropriate strategies, both buyers and sellers can increase their likelihood of successful transactions. Staying informed about the latest developments and adjusting your approach accordingly is crucial to effectively manage this real estate market crash.

Featured Posts

-

Pete Muntean On Cnn A Pilots Perspective On Air Traffic Control Blackouts

May 30, 2025

Pete Muntean On Cnn A Pilots Perspective On Air Traffic Control Blackouts

May 30, 2025 -

Perbedaan Harga Kawasaki Z900 Dan Z900 Se Di Indonesia Dan Negara Lain

May 30, 2025

Perbedaan Harga Kawasaki Z900 Dan Z900 Se Di Indonesia Dan Negara Lain

May 30, 2025 -

Confesion Impactante Tenista Argentino Revela La Grandeza De Marcelo Rios

May 30, 2025

Confesion Impactante Tenista Argentino Revela La Grandeza De Marcelo Rios

May 30, 2025 -

Air Jordan May 2025 Release Dates The Ultimate Sneakerheads Guide

May 30, 2025

Air Jordan May 2025 Release Dates The Ultimate Sneakerheads Guide

May 30, 2025 -

Setlist Fm Y Ticketmaster Una Alianza Para La Compra De Boletos

May 30, 2025

Setlist Fm Y Ticketmaster Una Alianza Para La Compra De Boletos

May 30, 2025

Latest Posts

-

The Texas Panhandle Wildfire A Year Of Recovery And Lessons Learned

May 31, 2025

The Texas Panhandle Wildfire A Year Of Recovery And Lessons Learned

May 31, 2025 -

Texas Panhandles Resilience A Year After The States Largest Wildfire

May 31, 2025

Texas Panhandles Resilience A Year After The States Largest Wildfire

May 31, 2025 -

Deadly Wildfires Continue To Threaten Eastern Manitoba Communities

May 31, 2025

Deadly Wildfires Continue To Threaten Eastern Manitoba Communities

May 31, 2025 -

Eastern Manitoba Wildfires Rage A Critical Update On The Emergency

May 31, 2025

Eastern Manitoba Wildfires Rage A Critical Update On The Emergency

May 31, 2025 -

Canadian Wildfires Smoke Impacts Us As Province Experiences Unprecedented Evacuation

May 31, 2025

Canadian Wildfires Smoke Impacts Us As Province Experiences Unprecedented Evacuation

May 31, 2025