Recent $67 Million Ethereum Liquidation: Market Implications And Outlook

Table of Contents

Understanding the $67 Million Ethereum Liquidation Event

Defining Liquidation in the Crypto Market

Cryptocurrency liquidation refers to the forced selling of assets held as collateral in a margin trading position. When a trader borrows funds to amplify their investment (leverage), they must maintain a certain minimum collateral value. If the asset's price falls below a critical threshold, the exchange automatically sells the collateral to cover the loan, resulting in a liquidation. This process often happens rapidly and can exacerbate price drops, leading to a cascading effect on the market. Understanding this mechanism is crucial to navigating the risks of leveraged trading in the crypto market.

Details of the $67 Million Ethereum Liquidation

The $67 million Ethereum liquidation event, occurring on [Insert Date and Time], involved a significant number of ETH positions being liquidated across multiple prominent exchanges.

- Date and time of the liquidation: [Insert precise date and time]

- Estimated value of ETH liquidated: Approximately $67 million (USD equivalent at the time of liquidation). The actual amount might slightly vary depending on the source and the exact timing of individual liquidations.

- Platforms affected: [List the major exchanges involved, if known. If not publicly known, state that the information is currently unavailable but likely involved several major platforms.]

- Potential contributing factors: A sharp and sudden drop in Ethereum's price, potentially exacerbated by [mention any suspected market factors like large sell-offs, rumors, or news events]. High leverage employed by traders significantly amplified losses.

Impact on Ethereum Price and Market Sentiment

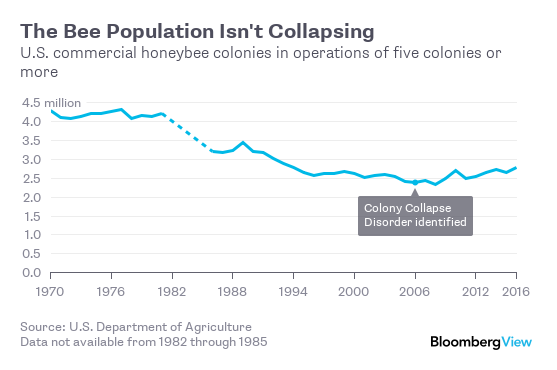

The $67 million Ethereum liquidation immediately impacted Ethereum's price, causing a [percentage]% drop within [timeframe]. Market sentiment turned bearish, with increased volatility and trading volume reflecting investor concern. Charts illustrating the price movement before, during, and after the liquidation would visually demonstrate its immediate impact. (Insert chart here if available. Alternatively, describe the price movement using precise data points). The event served as a stark reminder of the potential for rapid and significant price swings in the cryptocurrency market.

Analyzing the Causes and Contributing Factors

Role of Leverage and Margin Trading

The widespread use of leverage in margin trading is a significant contributing factor to large-scale liquidation events. High leverage amplifies both profits and losses. While allowing traders to potentially gain significant returns with smaller investments, it dramatically increases the risk of liquidation during market downturns. Even small price fluctuations can trigger massive liquidations when high leverage is involved.

Market-Wide Factors

The $67 million Ethereum liquidation wasn't an isolated incident. Broader market factors likely played a role. These could include:

- Regulatory uncertainty: Regulatory announcements or looming changes can cause market uncertainty and volatility.

- Macroeconomic conditions: Global economic events and trends significantly influence investor sentiment towards risk assets, including cryptocurrencies.

- Overall crypto market trends: A general downturn in the broader cryptocurrency market can trigger cascading liquidations across various assets.

Identifying Potential Systemic Risks

This event raises concerns about potential systemic risks within the DeFi ecosystem. The interconnectedness of various DeFi protocols means that a large liquidation in one area can have ripple effects throughout the system. Further research and analysis are needed to identify and mitigate these risks.

Market Implications and Future Outlook

Short-Term Market Predictions

The short-term outlook for Ethereum's price following this liquidation is uncertain. However, considering the volatility witnessed and the market sentiment, a period of consolidation or potentially further price correction is possible in the short term. Technical analysis, along with an assessment of overall market sentiment, will be key in forecasting any short-term price movements.

Long-Term Implications for Ethereum

The long-term implications for Ethereum are less clear-cut. While the $67 million Ethereum liquidation highlights the risks of leveraged trading, it doesn't necessarily undermine Ethereum's underlying technology or its long-term potential. The event serves as a learning opportunity, emphasizing the need for responsible risk management within the ecosystem. The continued development of Ethereum's network and the expanding DeFi ecosystem will play crucial roles in its long-term prospects.

Lessons Learned and Risk Mitigation

This $67 million Ethereum liquidation event underscores the importance of responsible trading practices. Key takeaways include:

- Avoid excessive leverage: Using high leverage significantly magnifies both potential profits and losses.

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across different cryptocurrencies to reduce risk.

- Implement stop-loss orders: These orders automatically sell your assets when the price reaches a predetermined level, limiting potential losses.

- Thoroughly understand risk: Before engaging in margin trading, carefully assess the risks involved and ensure you have a clear understanding of liquidation mechanisms.

Conclusion

The $67 million Ethereum liquidation serves as a potent reminder of the inherent volatility and risks associated with the cryptocurrency market, especially when leveraged trading is involved. The event highlighted the impact of high leverage, market-wide factors, and the potential for systemic risks within the DeFi ecosystem. Understanding these factors, along with implementing risk mitigation strategies, is crucial for navigating the dynamic cryptocurrency market. Stay updated on future Ethereum price movements and major liquidation events, and learn more about mitigating risks in the volatile cryptocurrency market to protect your investments. Responsible trading practices are essential for success in the crypto space.

Featured Posts

-

Scholar Rock Stocks Monday Decline Causes And Implications

May 08, 2025

Scholar Rock Stocks Monday Decline Causes And Implications

May 08, 2025 -

Rezultati Minimal I Psg Analiza E Strategjise Dhe Performances

May 08, 2025

Rezultati Minimal I Psg Analiza E Strategjise Dhe Performances

May 08, 2025 -

Eliminatorias Sudamericanas Neymar Convocado Y Listo Para Jugar Contra Messi

May 08, 2025

Eliminatorias Sudamericanas Neymar Convocado Y Listo Para Jugar Contra Messi

May 08, 2025 -

Uber Ditches Commission Model Subscription Plans For Drivers Explained

May 08, 2025

Uber Ditches Commission Model Subscription Plans For Drivers Explained

May 08, 2025 -

Dl Ka Dwrh Gjranwalh Myn Wlyme Ke Dn Dlha Ky Mwt

May 08, 2025

Dl Ka Dwrh Gjranwalh Myn Wlyme Ke Dn Dlha Ky Mwt

May 08, 2025