Recent Developments In The Oil Market: May 16 Report

Table of Contents

Global Oil Supply and Production

OPEC+ Production Decisions

The OPEC+ alliance, comprising the Organization of the Petroleum Exporting Countries (OPEC) and other major oil-producing nations, plays a crucial role in shaping global crude oil supply. Their latest meeting on [Insert date of meeting, if available] resulted in [Summarize the key decision regarding production quotas – e.g., a decision to maintain current production levels, or a small increase/decrease]. This decision was primarily based on [Explain the rationale behind the OPEC+ decision – e.g., concerns about global economic growth, a desire to maintain price stability, or an assessment of current inventory levels].

- Saudi Arabia: Maintained its production at [Insert production level].

- Russia: Faced challenges due to ongoing sanctions, resulting in a production decrease of [Insert percentage or amount]. The impact of these sanctions on the global oil supply continues to be significant.

- UAE: Increased its production slightly to [Insert production level].

- Internal Tensions: While a consensus was reached, internal disagreements persisted regarding [mention any specific disagreements within OPEC+, if applicable]. The compliance of individual member countries with the agreed-upon quotas remains a key factor affecting actual oil production.

Non-OPEC Production

Major non-OPEC oil producers, including the United States, Canada, and Brazil, also significantly influence the global oil supply. The US, driven by shale oil production, continues to be a major player, but growth rates have slowed recently. Canada faces challenges related to pipeline capacity, limiting its production potential. Brazil, while increasing its production steadily, remains a comparatively smaller player on the global stage.

- US Shale Oil: Production growth in the US shale sector has [increased/decreased/remained stable] in recent months, primarily driven by [mention factors influencing shale oil production – e.g., investment levels, technological advancements, commodity prices].

- Canadian Production: Limited pipeline capacity continues to constrain Canada's ability to fully capitalize on its oil reserves, affecting its export potential and the overall global crude oil supply.

- Supply Disruptions: Unforeseen circumstances, such as extreme weather events or unexpected maintenance issues, can disrupt oil production and significantly impact global supply.

Inventory Levels

Global oil inventory levels provide important insights into the balance between supply and demand. As of May 16th, global crude oil inventories stood at [Insert data on crude oil inventories]. This represents a [increase/decrease] compared to [previous period – e.g., the previous month, the same period last year]. This change is primarily attributed to [Explain the reasons behind the changes in inventory levels – e.g., increased production, decreased demand, seasonal factors].

- Strategic Petroleum Reserves: The utilization of strategic petroleum reserves by various countries has had a noticeable effect on overall supply.

- Refined Product Inventories: Inventories of refined products, such as gasoline and diesel, also play a crucial role in determining the overall health of the oil market and reflecting consumer demand.

- Inventory Levels and Oil Prices: Typically, lower inventory levels tend to push prices upward due to increased scarcity, while higher inventory levels often exert downward pressure on prices.

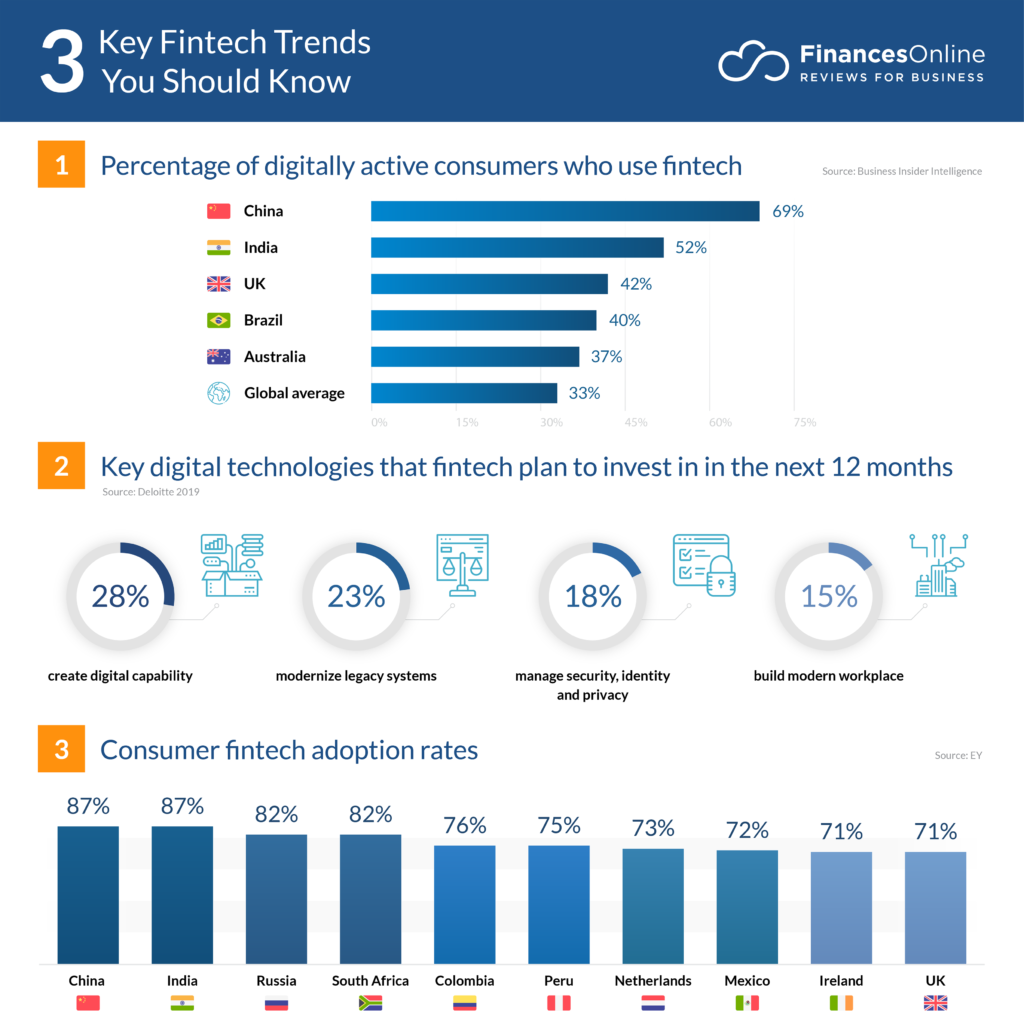

Global Oil Demand and Consumption

Economic Growth and its Impact

Global economic growth is a significant driver of oil demand. Strong economic growth usually translates to higher energy consumption, particularly in industrial sectors and transportation. However, current economic uncertainties, including high inflation and rising interest rates, have cast a shadow on the outlook for oil demand. Recessionary fears in key economies could significantly impact consumption patterns.

- IEA/OPEC Forecasts: Major energy agencies like the International Energy Agency (IEA) and OPEC have recently published forecasts for oil demand, indicating [Summarize the key findings of these forecasts, including projected growth rates and potential scenarios].

- Regional Variations: Oil consumption patterns vary significantly across different regions, with emerging economies typically exhibiting higher growth rates compared to mature economies.

- Government Policies: Government policies aimed at promoting energy efficiency or transitioning to renewable energy sources can impact overall oil demand.

Transportation Sector Trends

The transportation sector remains the largest consumer of oil globally. The growth of air travel, road transportation, and shipping significantly influences oil demand. However, the increasing adoption of electric vehicles (EVs) and other alternative fuel technologies presents a potential challenge to long-term oil demand growth.

- Air Travel: Post-pandemic recovery in air travel has boosted jet fuel demand.

- Road Transportation: The growth of personal vehicles continues to drive gasoline demand, although fuel efficiency improvements are playing a role.

- Electric Vehicles: The rising popularity of electric vehicles is gradually reducing oil dependence in the transportation sector, however, the rate of adoption remains a crucial factor in the trajectory of future oil consumption.

Seasonal Demand Fluctuations

Oil demand exhibits significant seasonal fluctuations. During the winter months in the northern hemisphere, demand for heating fuels increases, while in the summer months, demand for cooling and transportation fuels rises. These seasonal patterns contribute to price volatility throughout the year.

- Heating Oil: Winter months see a significant spike in heating oil demand, particularly in colder regions.

- Gasoline/Diesel: Summer months usually see increased demand for gasoline and diesel due to increased road travel and tourism.

- Seasonal Price Volatility: The seasonal changes in demand contribute significantly to the fluctuations in oil prices throughout the year.

Geopolitical Factors and Market Volatility

Geopolitical Risks and Uncertainty

Geopolitical events and uncertainties are significant drivers of oil price volatility. Conflicts, sanctions, and political instability in major oil-producing regions often lead to supply disruptions and price spikes. The ongoing war in Ukraine serves as a stark example of the impact of geopolitical instability on global energy markets.

- Ukraine War Impact: The ongoing conflict in Ukraine has resulted in significant disruptions to global energy supplies and significantly impacted oil prices.

- Sanctions on Russia: Sanctions imposed on Russia have restricted its oil exports, leading to supply tightness and price increases.

- Political Instability: Political instability in other oil-producing regions could trigger further supply disruptions and price volatility.

Conclusion

The oil market continues to be influenced by a complex interplay of supply and demand factors, as well as significant geopolitical events. The May 16th data shows a tightening supply situation, potentially leading to continued price volatility, despite some concerns about economic slowdown affecting demand. Understanding these recent developments in the oil market is crucial for investors, businesses, and policymakers alike. To stay informed on the latest shifts in this vital commodity market, regularly check for updates and analysis on recent developments in the oil market. Stay tuned for our next report for further insights into this dynamic sector.

Featured Posts

-

40

May 17, 2025

40

May 17, 2025 -

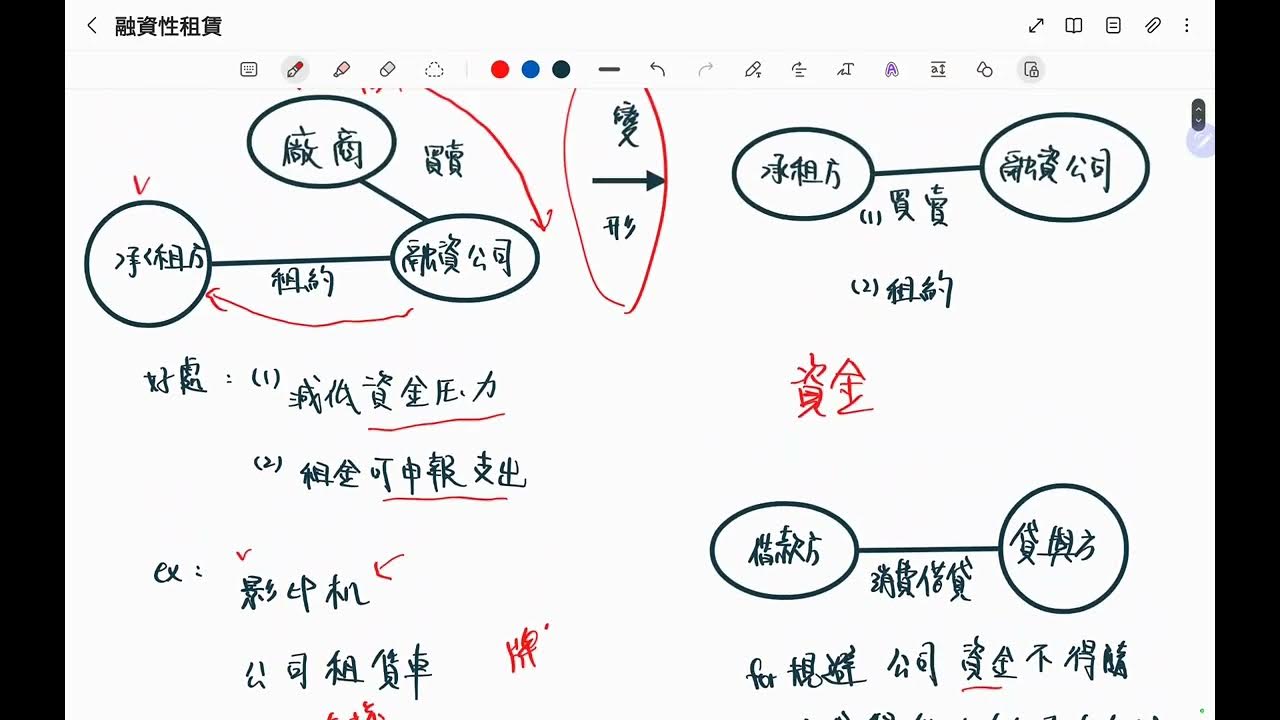

10 Essential Sherlock Holmes Quotes Ranked By Impact

May 17, 2025

10 Essential Sherlock Holmes Quotes Ranked By Impact

May 17, 2025 -

Record High For Canadas S And P Tsx Composite Index

May 17, 2025

Record High For Canadas S And P Tsx Composite Index

May 17, 2025 -

Watch Seattle Mariners Vs Chicago Cubs Spring Training Games Online Free

May 17, 2025

Watch Seattle Mariners Vs Chicago Cubs Spring Training Games Online Free

May 17, 2025 -

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025