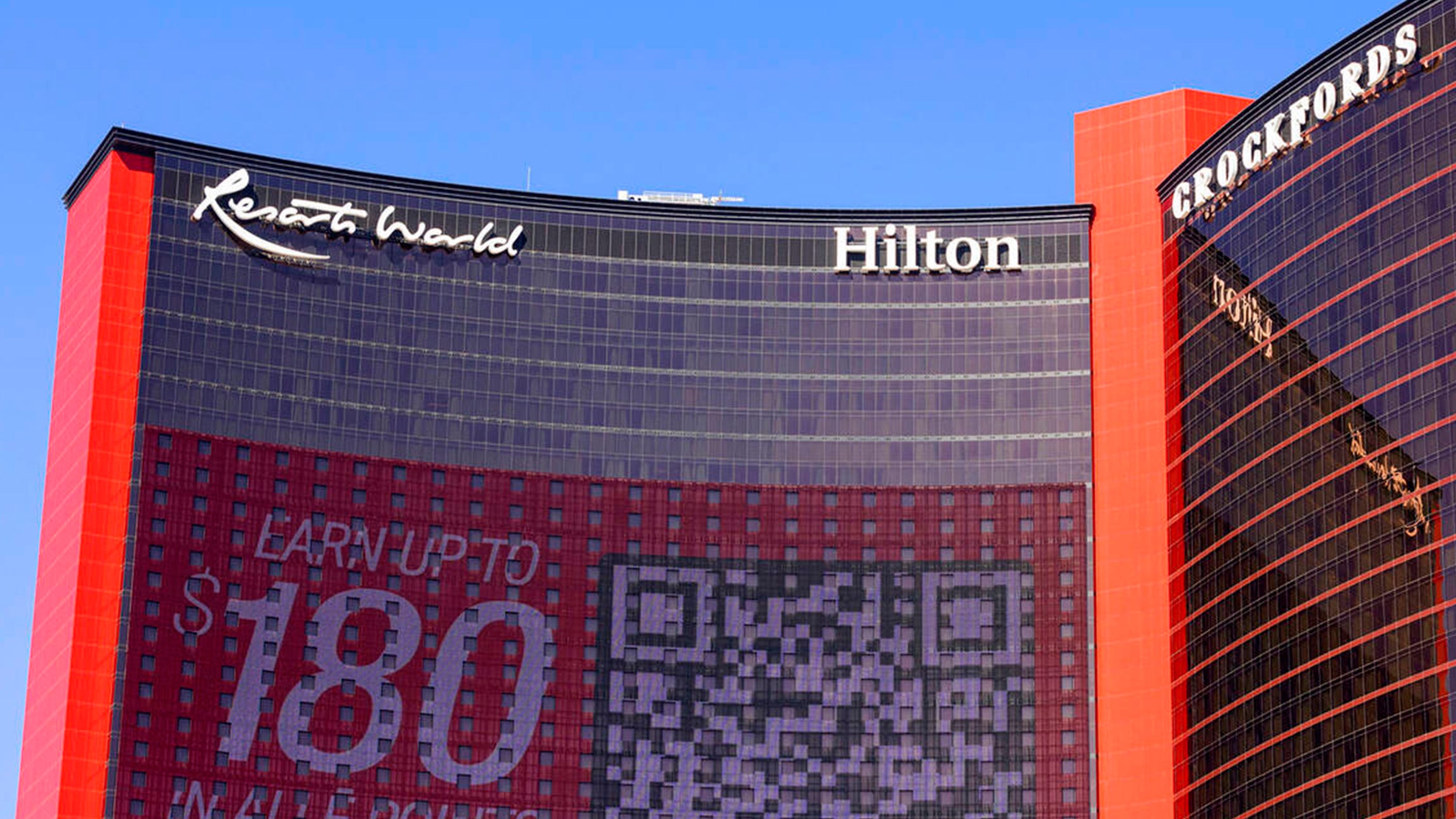

Recent Drop In Caesar's Las Vegas Strip Property Values

Table of Contents

Economic Factors Impacting Caesar's Property Values

Several interconnected economic forces have contributed to the decrease in Caesar's property valuations. These include the uneven post-pandemic recovery, rising interest rates and inflation, and increased competition within the Las Vegas market.

The Post-Pandemic Economic Recovery

The tourism industry, a cornerstone of the Las Vegas economy, experienced a slower-than-expected recovery following the COVID-19 pandemic. This directly impacted hotel occupancy rates and revenue for Caesar's properties.

- Slower-than-expected tourist return: International travel restrictions and lingering concerns about health and safety hampered the return of tourists to pre-pandemic levels.

- Reduced spending per visitor: Even with increased tourist numbers, visitors are spending less per trip due to economic uncertainty and inflation.

- Lingering travel restrictions (if applicable): While many restrictions have eased, some international travel limitations continue to impact visitor numbers.

While precise figures fluctuate, reports suggest that Caesar's hotel occupancy rates have remained below pre-pandemic levels for a considerable period, leading to a decrease in overall revenue and impacting property valuations. For example, [insert a hypothetical statistic, e.g., "Q3 2023 occupancy rates were reported to be 15% below Q3 2019 levels at some Caesar's properties."].

Rising Interest Rates and Inflation

The current inflationary environment and the Federal Reserve's efforts to combat it through interest rate hikes have significantly impacted the real estate market, including Caesar's properties.

- Increased financing costs: Higher interest rates make borrowing more expensive, increasing the cost of financing development projects and impacting the profitability of existing properties.

- Reduced investment appetite: Uncertainty in the economic climate makes investors more hesitant to invest in new projects or acquire existing properties.

- Potential for loan defaults: Increased borrowing costs may lead to difficulties in servicing existing loans, potentially leading to defaults on mortgages and other debts.

Current interest rates stand at [insert current interest rate data] and inflation is at [insert current inflation data], significantly increasing the cost of capital for large-scale developments like those on the Las Vegas Strip. This directly affects the valuation of existing properties.

Competition in the Las Vegas Market

The Las Vegas Strip is a highly competitive market, with new resorts and expansions of existing properties constantly vying for market share. This intensified competition has put downward pressure on Caesar's property values.

- New resort openings: The opening of new luxury resorts offers guests alternative options, fragmenting the market.

- Expansion of existing properties: Existing resorts expanding their amenities and capacity increase competition for customers.

- Changing preferences of tourists: Shifting tourist preferences towards certain types of entertainment and experiences can affect the demand for specific properties.

The recent opening of [insert competitor resort name] and the ongoing expansion of [insert another competitor resort name] exemplify the heightened competition within the Las Vegas market, placing pressure on occupancy rates and revenue across all properties.

Operational Challenges Faced by Caesar's Entertainment

Beyond the broader economic factors, Caesar's Entertainment faces internal operational challenges that further impact property values.

Labor Shortages and Increased Wages

The hospitality industry, including Caesar's, has experienced significant labor shortages in recent years, impacting operational efficiency and increasing costs.

- Difficulty in staffing key positions: Finding and retaining qualified employees for various roles, from housekeeping to management, remains a challenge.

- Increased wages to attract and retain employees: To compete for talent, Caesar's has had to increase wages, adding to operational expenses.

- Potential impact on service quality: Staffing shortages can lead to reduced service quality, affecting customer satisfaction and potentially impacting future bookings.

The Las Vegas hospitality sector’s unemployment rate is currently [insert data on unemployment rates and wage growth], contributing to the increased costs faced by Caesar's Entertainment.

Supply Chain Disruptions

Supply chain disruptions, a global issue, have also impacted Caesar's operational costs and the ability to maintain and renovate its properties efficiently.

- Increased costs of materials: The increased cost of construction materials, furnishings, and other goods necessary for maintaining the properties has added to expenses.

- Delays in renovations and repairs: Supply chain bottlenecks have caused delays in crucial renovations and repairs, impacting the overall quality and appeal of the properties.

- Impact on property upkeep: The inability to readily source necessary materials can affect the consistent upkeep and maintenance of the properties, potentially reducing their value.

Delays in sourcing [insert example of a specific material] have impacted several renovation projects at Caesar's properties, further highlighting the challenges faced by the company.

The Future Outlook for Caesar's Las Vegas Strip Property Values

While the current outlook presents challenges, there are factors that could contribute to a rebound in Caesar's property values.

Potential for Recovery and Growth

Several factors could trigger a recovery and future growth for Caesar's properties.

- Increased tourism: A resurgence in tourism, both domestic and international, could significantly boost occupancy rates and revenue.

- Economic recovery: A broader economic recovery could lead to increased consumer spending and a return of investment appetite.

- Strategic investments by Caesar's: Strategic investments in new amenities, technology, and marketing campaigns could enhance the appeal of the properties.

- Innovative marketing campaigns: Effective marketing strategies could attract new customers and increase brand loyalty.

Industry analysts predict [insert optimistic prediction from an industry analyst report] indicating the potential for a market rebound.

Long-Term Sustainability and Adaptability

Caesar's long-term success depends on its ability to adapt to changing market conditions and prioritize sustainability.

- Investment in new technologies: Investing in technology to improve operational efficiency and enhance the guest experience can provide a competitive edge.

- Diversification of revenue streams: Exploring new revenue streams beyond traditional hotel and casino operations can increase profitability.

- Focus on sustainability initiatives: Embracing sustainable practices to appeal to environmentally conscious tourists can be a major selling point.

- Future developments or renovations: Planned developments or renovations can attract new clientele and improve the overall appeal of the properties.

Caesar's plans to [mention specific plans, e.g., implement energy-efficient technologies or expand their entertainment offerings] demonstrate a commitment to adapting to the changing market demands.

Conclusion

The recent drop in Caesar's Las Vegas Strip property values reflects a confluence of factors, including a slow post-pandemic recovery, rising interest rates, increased competition, and operational challenges. However, the potential for future recovery and growth remains, contingent on successful adaptation to changing market conditions and strategic investments in innovation and sustainability. To stay informed about the future of Caesar's Las Vegas Strip property values and the dynamic Las Vegas real estate market, subscribe to our updates, follow reputable news sources, and continue to research the impact of economic shifts on Caesar's Entertainment holdings. [Include links to relevant resources here]. Understanding these shifts will be crucial for navigating the complexities of the Las Vegas real estate market and making informed investment decisions regarding Caesar's Las Vegas Strip property values.

Featured Posts

-

Ufc Vegas 106 Burns Vs Morales Expert Predictions And Best Odds

May 18, 2025

Ufc Vegas 106 Burns Vs Morales Expert Predictions And Best Odds

May 18, 2025 -

Novak Djokovic Miami Acik Finalde

May 18, 2025

Novak Djokovic Miami Acik Finalde

May 18, 2025 -

Vip Stake Discover Exclusive Uk Vip Casino Experiences

May 18, 2025

Vip Stake Discover Exclusive Uk Vip Casino Experiences

May 18, 2025 -

Mike Myers On Shrek A Three Word Summary

May 18, 2025

Mike Myers On Shrek A Three Word Summary

May 18, 2025 -

Best Online Casinos In Canada For 2025 A 7 Bit Casino Focus

May 18, 2025

Best Online Casinos In Canada For 2025 A 7 Bit Casino Focus

May 18, 2025

Latest Posts

-

Metatrepontas Tin Ellada Se Pagkosmio Naytiliako Komvo

May 18, 2025

Metatrepontas Tin Ellada Se Pagkosmio Naytiliako Komvo

May 18, 2025 -

Pakstan Se Ealmy Shpng Kntynr Fryt Ryts Myn Adafe Ka Jayzh

May 18, 2025

Pakstan Se Ealmy Shpng Kntynr Fryt Ryts Myn Adafe Ka Jayzh

May 18, 2025 -

I Naytilia Stin Ellada Apospasmata Apo Tin Omilia Toy Kasselaki

May 18, 2025

I Naytilia Stin Ellada Apospasmata Apo Tin Omilia Toy Kasselaki

May 18, 2025 -

Naytiliaki Igemonia Mia Biosimi Stratigiki Gia Tin Ellada

May 18, 2025

Naytiliaki Igemonia Mia Biosimi Stratigiki Gia Tin Ellada

May 18, 2025 -

Ywrp Mshrq Wsty Awr Afryqa Ke Lye Kntynr Shpng Pakstan Se Brhte Akhrajat

May 18, 2025

Ywrp Mshrq Wsty Awr Afryqa Ke Lye Kntynr Shpng Pakstan Se Brhte Akhrajat

May 18, 2025