Recession Looms: TD Bank Forecasts 100,000 Job Cuts

Table of Contents

TD Bank's Recession Prediction and its Implications

TD Bank's prediction of 100,000 job cuts isn't made lightly. Their forecast is based on a careful analysis of several key economic indicators. These include:

- Soaring Inflation: Persistent high inflation erodes purchasing power, dampening consumer spending and impacting business profitability.

- Rising Interest Rates: Increased interest rates, implemented by central banks to combat inflation, can stifle economic growth and lead to decreased investment.

- Weakening Consumer Spending: As inflation rises and interest rates increase, consumers are likely to reduce their spending, impacting businesses reliant on consumer demand.

These factors, combined with geopolitical instability and supply chain disruptions, contribute to TD Bank's pessimistic outlook. The predicted job cuts are expected to disproportionately affect specific sectors:

- Technology: The tech sector, after a period of rapid expansion, may experience significant layoffs due to reduced investment and decreased demand.

- Manufacturing: Global supply chain issues and decreased consumer demand could lead to production cuts and layoffs in the manufacturing sector.

- Retail: With consumers tightening their belts, retail businesses may be forced to reduce staff to maintain profitability.

The ripple effect of these job cuts could be devastating. Reduced consumer spending will further impact businesses, potentially leading to a vicious cycle of layoffs and economic contraction. This sectoral impact underscores the gravity of the economic forecast and the potential for a significant financial crisis.

The Impact of 100,000 Job Cuts on the Workforce

The human cost of 100,000 job cuts is immense. These are not just numbers; they represent families facing financial hardship, individuals struggling to find new employment, and a potential surge in social and economic anxieties. The impact on the workforce is multifaceted:

- Increased Unemployment Rate: A significant increase in unemployment is expected, placing a strain on social welfare systems and increasing competition for available jobs.

- Heightened Job Insecurity: Even those who retain their jobs may experience increased anxiety and job insecurity as companies implement cost-cutting measures.

- Increased Competition for Jobs: The influx of job seekers will make finding new employment significantly more challenging.

To mitigate the risk of job loss, individuals should consider the following strategies:

- Upskilling and Reskilling: Invest in acquiring new skills to remain competitive in the job market.

- Networking: Actively cultivate professional relationships to expand your job search network.

- Diversifying Skills: Developing a broad range of skills can increase your employability across multiple sectors.

These proactive steps are crucial for maintaining job security in this challenging economic downturn.

Government and Corporate Responses to the Looming Recession

Governments and corporations will need to respond decisively to mitigate the impact of this potential recession. Government interventions might include:

- Stimulus Packages: Government spending aimed at boosting economic activity.

- Increased Unemployment Benefits: Providing financial support to those who lose their jobs.

- Tax Cuts: Reducing the tax burden on businesses and individuals to encourage spending and investment.

Corporations, on the other hand, may employ strategies such as:

- Hiring Freezes: Halting new hiring to conserve resources.

- Cost-Cutting Measures: Reducing operational expenses to maintain profitability.

- Salary Reductions: Lowering salaries to avoid layoffs.

The effectiveness of these responses will depend on their timely implementation and coordination. Past responses to similar economic crises offer valuable lessons, highlighting the importance of proactive and well-coordinated strategies to minimize the severity of the downturn. Analyzing past government policy and corporate strategy is crucial to inform current decision-making and improve the efficacy of economic stimulus and fiscal policy.

Preparing for a Potential Recession: Practical Advice for Individuals and Businesses

Preparing for a potential recession requires proactive measures from both individuals and businesses. Individuals should focus on:

- Budgeting: Create a detailed budget and track your expenses meticulously.

- Saving: Build an emergency fund to cover unexpected expenses.

- Debt Management: Reduce high-interest debt to improve your financial stability.

Businesses should prioritize:

- Cost Optimization: Identify areas where expenses can be reduced without compromising quality.

- Diversification: Explore new markets and revenue streams to reduce reliance on a single source of income.

- Risk Management: Develop contingency plans to mitigate potential disruptions.

By taking these actionable steps, individuals and businesses can enhance their resilience and navigate the economic uncertainty more effectively. Remember, effective financial planning and proactive risk management are vital for ensuring business continuity and improving personal finance during times of economic instability.

Key Takeaways:

- TD Bank's prediction of 100,000 job cuts highlights the seriousness of the potential recession.

- Several key economic indicators point towards a significant economic downturn.

- Individuals and businesses must take proactive steps to prepare for potential job losses and economic hardship.

Conclusion: Recession Looms: Understanding and Navigating the TD Bank Forecast

TD Bank's forecast underscores the potential for a severe economic downturn, with significant implications for the global workforce and economy. The predicted 100,000 job cuts represent a considerable threat, demanding immediate attention and proactive responses from individuals, businesses, and governments. The potential increase in the unemployment rate and the resulting economic downturn necessitate a comprehensive approach to recession preparedness.

Don't wait for the recession to hit; proactively prepare for the potential job cuts and economic downturn by reviewing your financial plan, updating your skills, and exploring additional resources on recession preparedness. Understanding the implications of the TD Bank forecast is crucial in navigating these uncertain times. Strengthen your job security through diligent financial planning, and ensure your business's business continuity through robust risk management. Proactive measures now can significantly mitigate the impact of this looming economic downturn.

Featured Posts

-

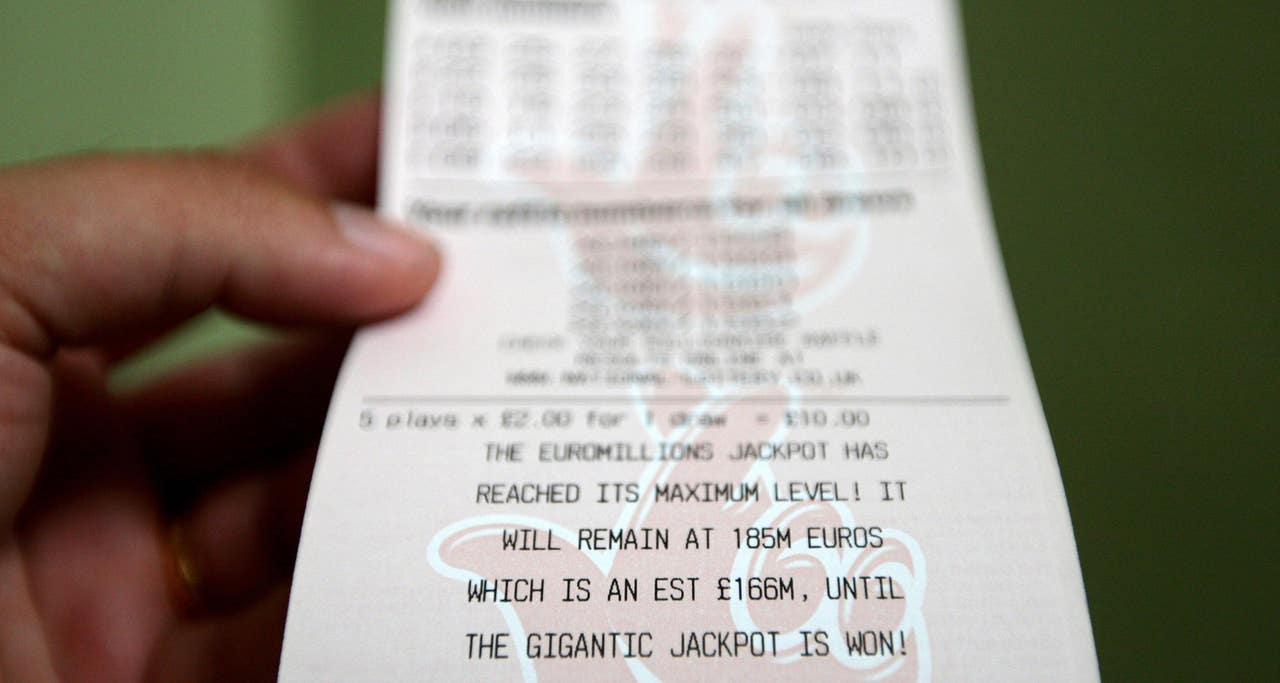

Unclaimed 300k Euro Millions Prize National Lottery Issues Five Day Deadline

May 28, 2025

Unclaimed 300k Euro Millions Prize National Lottery Issues Five Day Deadline

May 28, 2025 -

Peningkatan Kesadaran Masyarakat Dalam Persemian Gerakan Bali Bersih Sampah

May 28, 2025

Peningkatan Kesadaran Masyarakat Dalam Persemian Gerakan Bali Bersih Sampah

May 28, 2025 -

Indiana Pacers Mathurin Downgraded Kings Game In Jeopardy

May 28, 2025

Indiana Pacers Mathurin Downgraded Kings Game In Jeopardy

May 28, 2025 -

Comparatif Prix Samsung Galaxy S25 256 Go Le Meilleur Bon Plan A 699 90 E

May 28, 2025

Comparatif Prix Samsung Galaxy S25 256 Go Le Meilleur Bon Plan A 699 90 E

May 28, 2025 -

Rayan Cherki What A German Source Says

May 28, 2025

Rayan Cherki What A German Source Says

May 28, 2025

Latest Posts

-

Exploring The Differences Between Rosemary And Thyme Flavor Profiles And Uses

May 31, 2025

Exploring The Differences Between Rosemary And Thyme Flavor Profiles And Uses

May 31, 2025 -

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025 -

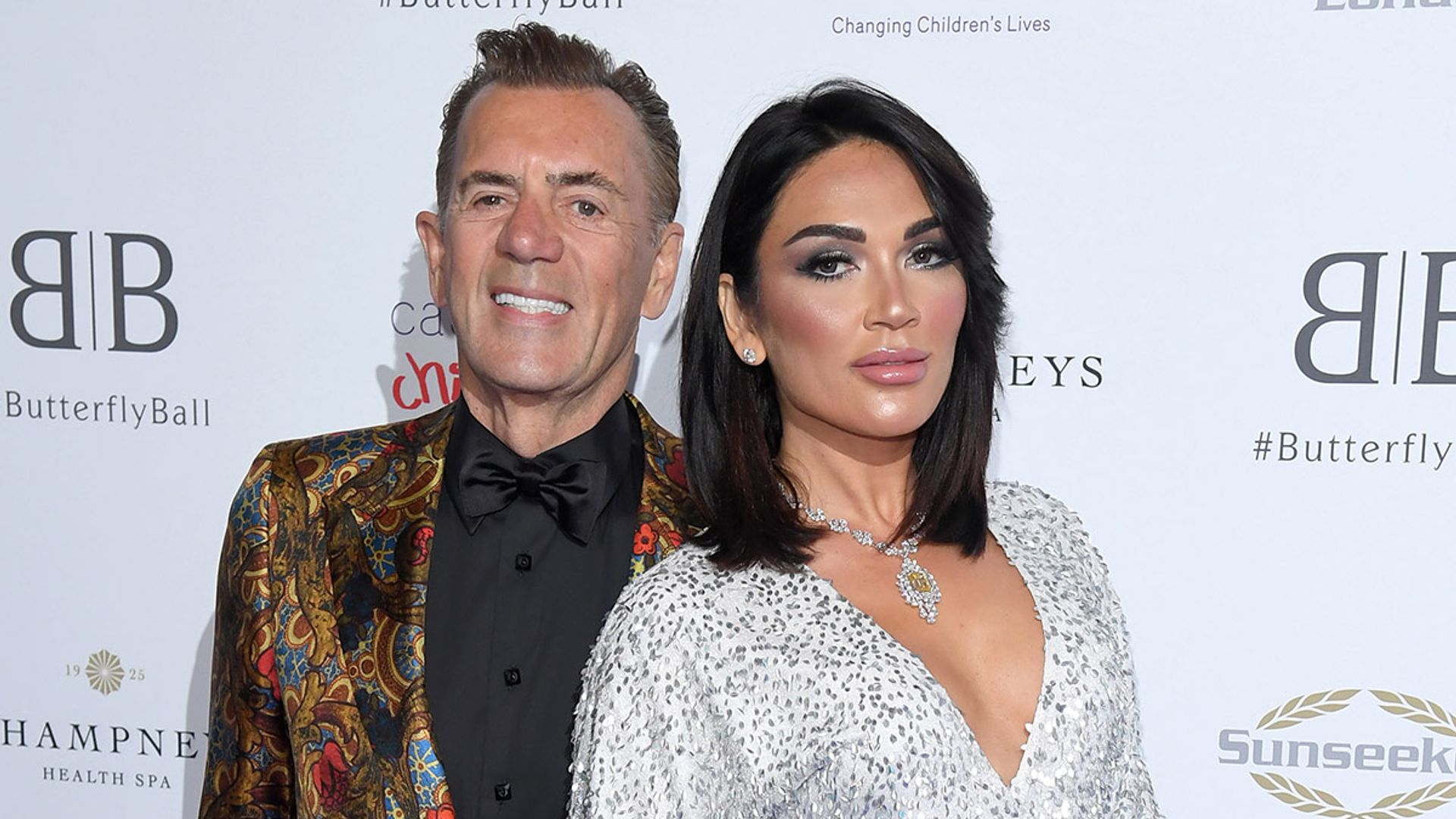

Duncan Bannatynes Support For Life Changing Childrens Charity In Morocco

May 31, 2025

Duncan Bannatynes Support For Life Changing Childrens Charity In Morocco

May 31, 2025 -

Dragon Dens Duncan Bannatyne Supports Moroccan Childrens Charity

May 31, 2025

Dragon Dens Duncan Bannatyne Supports Moroccan Childrens Charity

May 31, 2025 -

Achieving The Good Life A Step By Step Guide For Lasting Fulfillment

May 31, 2025

Achieving The Good Life A Step By Step Guide For Lasting Fulfillment

May 31, 2025