Retirement Portfolio Diversification: Should You Include This New Investment?

Table of Contents

Understanding Retirement Portfolio Diversification

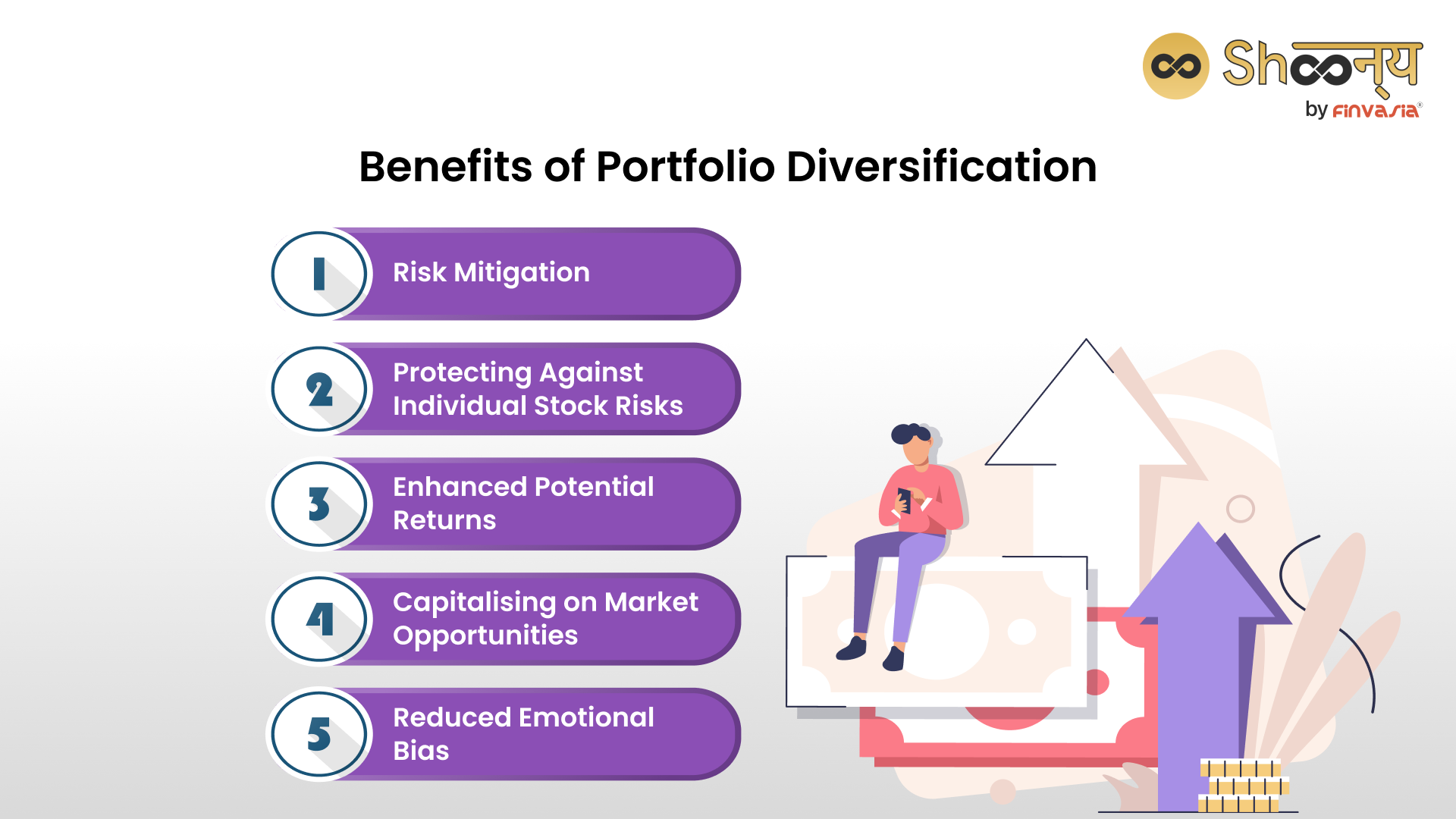

The Importance of Diversification

Diversification is a cornerstone of sound investment strategy. It involves spreading your investments across different asset classes to reduce risk and potentially enhance returns. The core principle is simple: don't put all your eggs in one basket.

- Reduce Volatility: By diversifying, you lessen the impact of market fluctuations on your overall portfolio. If one investment underperforms, others may offset those losses.

- Protect Against Market Downturns: Diversification helps cushion against significant losses during economic downturns or market corrections.

- Improve Long-Term Returns: While short-term performance may vary, a well-diversified portfolio tends to deliver better returns over the long term.

- Different Asset Classes: Diversification includes investing in various asset classes such as stocks (equities), bonds (fixed income), real estate, commodities, and alternative investments.

Traditional Diversification Strategies

Traditional approaches to diversification focus on spreading investments across different areas:

- Asset Allocation: This involves determining the optimal mix of stocks, bonds, and other assets based on your risk tolerance and time horizon.

- Geographic Diversification: Investing in companies and assets located in different countries reduces exposure to risks specific to a single region.

- Sector Diversification: Investing in companies across various sectors (e.g., technology, healthcare, energy) reduces the impact of industry-specific downturns.

Risks of Insufficient Diversification

Concentrating your investments in a few assets or sectors exposes you to significant risks:

- Higher Risk of Significant Losses: If your concentrated investments underperform, the impact on your overall portfolio will be magnified.

- Lower Potential Returns Over the Long Term: A lack of diversification can limit your potential for long-term growth.

- Difficulty Achieving Retirement Goals: Insufficient diversification can hinder your ability to accumulate the necessary funds for a comfortable retirement.

Introducing the New Investment: Green Bonds

What is a Green Bond?

Green bonds are debt securities issued specifically to finance projects with environmental benefits. These projects can include renewable energy, energy efficiency, sustainable transportation, and pollution prevention.

- Definition: A fixed-income instrument used to raise capital for environmentally friendly initiatives.

- Characteristics: Similar to traditional bonds in terms of interest payments and maturity dates, but with a specific environmental focus.

- How it Works: Investors lend money to the issuer (typically a government, corporation, or municipality) in exchange for periodic interest payments and the return of principal at maturity.

Potential Benefits of Green Bonds for Retirement

Green bonds offer several potential advantages for retirement investors:

- Higher Potential Returns: While not guaranteed, some studies suggest green bonds may offer competitive returns compared to traditional bonds.

- Lower Correlation with Traditional Assets: Green bonds may exhibit lower correlation with traditional assets like stocks and corporate bonds, potentially reducing overall portfolio volatility.

- Inflation Hedging: Investments in sustainable infrastructure (often funded by green bonds) can act as an inflation hedge, potentially preserving purchasing power over time.

- Positive Social and Environmental Impact: Investing in green bonds aligns your retirement savings with your values, supporting environmentally responsible projects.

Risks Associated with Green Bonds

It's crucial to acknowledge the potential drawbacks:

- Volatility: Green bond prices can fluctuate based on market conditions and investor sentiment.

- Liquidity Issues: Compared to some traditional bonds, liquidity (the ability to easily buy or sell) may be more limited for certain green bonds.

- Regulatory Risks: Changes in environmental regulations or government policies could affect the performance of green bonds.

- Potential for Loss of Principal: As with any investment, there's always a risk of losing some or all of your invested capital.

Assessing the Suitability for Your Retirement Portfolio

Your Risk Tolerance

Before considering any new investment, assess your risk tolerance:

- Conservative vs. Aggressive Investment Strategies: A conservative approach prioritizes capital preservation over high growth, while an aggressive strategy accepts higher risk for potentially greater returns.

- Time Horizon Until Retirement: Those closer to retirement generally prefer lower-risk investments, while those with longer time horizons can tolerate more risk.

- Financial Goals: Your specific retirement goals (e.g., travel, healthcare expenses) will influence your investment strategy.

Diversification within Your Existing Portfolio

Green bonds can complement existing strategies:

- Illustrative Examples: A portfolio might allocate 5-10% to green bonds, diversifying away from traditional fixed income and potentially enhancing returns.

Seeking Professional Advice

Consulting a financial advisor is crucial:

- Personalized Guidance: A professional can help you assess your risk tolerance, financial goals, and existing portfolio to determine the suitability of green bonds.

- Tailored Investment Strategies: They can create a personalized investment plan that incorporates green bonds while maintaining appropriate diversification.

- Risk Management: They can help you understand and manage the risks associated with green bonds and other investments.

Conclusion

Including green bonds in your retirement portfolio diversification strategy can offer potential benefits, including diversification, competitive returns, and a positive social impact. However, it's essential to understand the associated risks and assess their suitability within your overall investment plan. Remember that diversifying your retirement savings is crucial for mitigating risk and achieving your retirement goals. To optimize your retirement portfolio diversification, research green bonds further and consult a qualified financial advisor to determine if this investment aligns with your individual circumstances and risk profile. Explore this new investment opportunity and take control of your financial future. [Link to relevant resources]

Featured Posts

-

Trumps Measured Response To Indias Us Tariff Reduction Proposal

May 18, 2025

Trumps Measured Response To Indias Us Tariff Reduction Proposal

May 18, 2025 -

Is The Osama Bin Laden Documentary Streaming On Netflix

May 18, 2025

Is The Osama Bin Laden Documentary Streaming On Netflix

May 18, 2025 -

Government Defends Early Release Plan To Alleviate Prison Overcrowding

May 18, 2025

Government Defends Early Release Plan To Alleviate Prison Overcrowding

May 18, 2025 -

Kanye Wests Super Bowl Snub Taylor Swifts Alleged Involvement

May 18, 2025

Kanye Wests Super Bowl Snub Taylor Swifts Alleged Involvement

May 18, 2025 -

Treasury Futures Trading Landscape Transformed Fmxs Impact And The Cmes Response

May 18, 2025

Treasury Futures Trading Landscape Transformed Fmxs Impact And The Cmes Response

May 18, 2025

Latest Posts

-

Taran Killam Discusses His Friendship With Amanda Bynes

May 18, 2025

Taran Killam Discusses His Friendship With Amanda Bynes

May 18, 2025 -

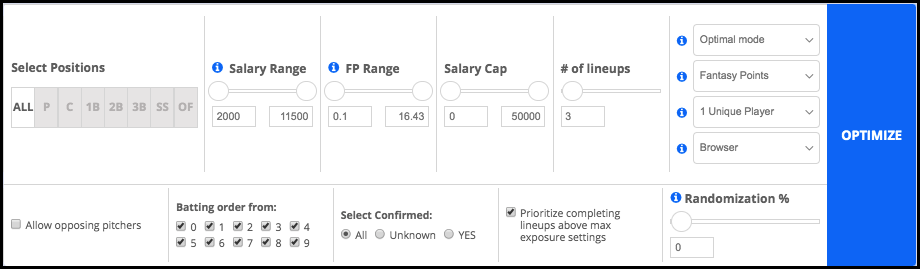

May 8th Mlb Dfs Lineup Optimizer Sleeper Picks And Value Plays

May 18, 2025

May 8th Mlb Dfs Lineup Optimizer Sleeper Picks And Value Plays

May 18, 2025 -

Mlb Dfs May 8th Sleeper Picks And Hitter To Target

May 18, 2025

Mlb Dfs May 8th Sleeper Picks And Hitter To Target

May 18, 2025 -

Amanda Bynes And Rachel Green The Unexpected Comparison Made By Drake Bell

May 18, 2025

Amanda Bynes And Rachel Green The Unexpected Comparison Made By Drake Bell

May 18, 2025 -

Best Mlb Dfs Picks For May 8th Sleeper Plays And One To Avoid

May 18, 2025

Best Mlb Dfs Picks For May 8th Sleeper Plays And One To Avoid

May 18, 2025