Revised Palantir Predictions: Analyzing The Factors Behind The Stock's Rally

Table of Contents

Palantir Technologies (PLTR) has recently experienced a significant stock rally, surprising many who previously held bearish predictions. This unexpected surge in investor sentiment presents a compelling case study in market dynamics. This article will delve into the key factors driving this upward trend, analyzing the revised predictions for Palantir stock and offering insights into its potential future trajectory. We'll examine the company's improved financial performance, shifts in market perception, strategic initiatives, and macroeconomic influences to paint a comprehensive picture of this remarkable turnaround.

Improved Financial Performance and Revenue Growth

Increased Government Contracts and Expansion into Commercial Markets

Palantir's recent success is significantly fueled by its expanding portfolio of government and commercial contracts. The company's data analytics platform is proving increasingly valuable across diverse sectors.

- Government Contracts: Palantir has secured several substantial contracts with US government agencies, including significant deals with the Department of Defense and intelligence communities. These contracts represent multi-year commitments, ensuring a stable revenue stream and bolstering investor confidence. The exact figures are often confidential for security reasons, but reports indicate substantial increases in government revenue year-over-year.

- Commercial Expansion: Beyond government contracts, Palantir is making significant inroads into commercial markets. The healthcare and finance sectors are showing particular promise, with several large corporations adopting Palantir's platform for advanced data analysis and operational optimization. This diversification reduces reliance on any single client sector and contributes to consistent revenue growth. Quantifiable examples of commercial contract wins, showcasing revenue figures and projected growth, further solidify this positive trend. This diversification strengthens Palantir’s overall financial health and increases investor confidence in its long-term viability.

Stronger-than-Expected Earnings Reports and Guidance

Recent earnings reports have consistently surpassed analysts' expectations, significantly contributing to the Palantir stock rally.

- Positive Earnings Metrics: Key performance indicators, including revenue, earnings per share (EPS), and operating margin, have shown robust growth. This outperformance, coupled with the company's positive outlook for future quarters, has fueled a renewed sense of optimism among investors.

- Upward Revisions: Analysts have responded by revising their price targets and ratings for PLTR stock upward, further reinforcing the positive market sentiment. This upward revision reflects a growing belief in Palantir's ability to deliver sustained growth and profitability.

- Impact on Investor Sentiment: The combination of exceeding expectations and providing positive guidance has led to a significant increase in investor confidence, directly translating into a higher stock price.

Positive Market Sentiment and Shifting Investor Perception

Increased Investor Confidence in Palantir's Long-Term Growth Potential

A significant shift in investor perception is a crucial driver of the Palantir stock rally.

- Shifting Analyst Sentiment: Initially met with skepticism, Palantir is now receiving increasingly positive analyst coverage, recognizing the company's growing market share and technological advancements. The narrative around Palantir has shifted from a speculative technology stock to a company with a sustainable business model delivering on its promises.

- Positive News Coverage and Industry Reports: Favorable press coverage and industry reports highlighting Palantir's successful deployments and strategic partnerships have also contributed to the improved market perception. These positive narratives reinforce the credibility of Palantir’s solutions and their applicability across various sectors.

- Adoption of Data Analytics Platform: The growing adoption of Palantir's data analytics platform, particularly within large enterprises, demonstrates the market's recognition of its value proposition. This growing client base speaks to the long-term viability and resilience of Palantir’s business model.

The Impact of Broader Market Trends and Macroeconomic Factors

While Palantir's internal performance is crucial, broader market trends also play a role.

- Demand for Data Analytics: The increasing demand for advanced data analytics solutions across various industries is a tailwind for Palantir. As businesses increasingly rely on data-driven decision-making, Palantir is well-positioned to capitalize on this trend.

- Technology Stock Sentiment: Shifts in overall investor appetite for technology stocks also influence Palantir's valuation. Periods of greater investor risk tolerance often lead to increased valuations for technology companies like Palantir.

- Macroeconomic Influence: Macroeconomic factors, such as inflation and interest rates, impact investor sentiment and overall market conditions. While macroeconomic conditions can influence investor decisions, Palantir’s solid performance has largely insulated it from negative macroeconomic impacts.

Strategic Initiatives and Technological Advancements

Product Innovation and Expansion of Palantir's Platform

Continuous innovation is key to Palantir's success.

- Platform Enhancements: Palantir is consistently enhancing its platform with new features and capabilities, improving its usability and expanding its functionality. These upgrades maintain its competitive edge in the rapidly evolving data analytics market.

- AI and Machine Learning Integration: The increasing integration of AI and machine learning into Palantir's platform is crucial for its future growth. These capabilities provide users with more sophisticated analytical tools and insights, further strengthening the platform's value proposition.

- Competitive Advantage: These advancements in product capabilities solidify Palantir’s position as a market leader, reinforcing its competitive advantage in a field experiencing ever-increasing demand.

Focus on Operational Efficiency and Cost Management

Palantir is also actively focusing on improving its operational efficiency and cost management.

- Optimizing Business Operations: The company is implementing various initiatives to streamline its operations and reduce expenses, improving its profitability and strengthening its financial position.

- Enhanced Profitability: These efforts contribute directly to enhanced profitability and underscore Palantir's commitment to delivering sustainable growth.

Conclusion

The recent surge in Palantir stock price is a result of several converging factors: impressive financial performance exceeding expectations, positive shifts in investor sentiment, strategic initiatives including product innovation and platform expansion, and favorable market trends. While uncertainties always exist in the stock market, the current outlook for Palantir appears significantly improved.

Call to Action: Staying informed about Palantir's ongoing performance and future developments is critical for investors seeking to understand the continued evolution of this technology leader. Continue researching Palantir predictions and carefully analyzing PLTR stock to make well-informed investment decisions. Monitor key financial reports, industry news, and analyst commentary to track the company's progress and adjust your investment strategy accordingly. Understanding the intricacies of Palantir's market position and its evolving product offerings is essential for navigating the complexities of this dynamic sector.

Featured Posts

-

The Elizabeth Line A Review Of Wheelchair User Experience

May 10, 2025

The Elizabeth Line A Review Of Wheelchair User Experience

May 10, 2025 -

Potential Tariffs On Commercial Aircraft Examining Trumps Trade Policy

May 10, 2025

Potential Tariffs On Commercial Aircraft Examining Trumps Trade Policy

May 10, 2025 -

Ma Hw Tathyr Antqal Fyraty Ela Adae Alerby Alqtry

May 10, 2025

Ma Hw Tathyr Antqal Fyraty Ela Adae Alerby Alqtry

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community Personal Accounts

May 10, 2025 -

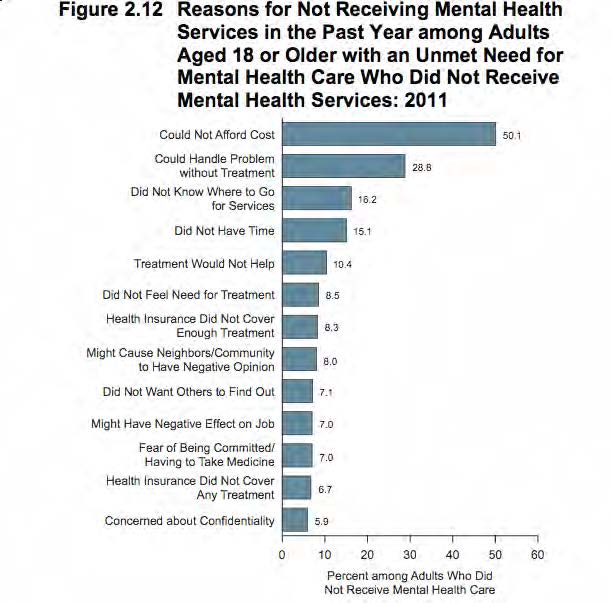

The Stigma Of Mental Illness And Violent Crime A Critical Analysis

May 10, 2025

The Stigma Of Mental Illness And Violent Crime A Critical Analysis

May 10, 2025