Revised Trump Tax Bill Receives House Approval

Table of Contents

Key Changes in the Revised Trump Tax Bill

The revised Trump tax bill features significant amendments compared to its initial iteration. These substantial alterations aim to address some of the criticisms levied against the original proposal, while also reflecting shifts in economic priorities and political landscapes. Key modifications are evident across various sections of the tax code.

-

Individual Tax Rates: The revised bill reportedly adjusts individual tax rates, with some brackets experiencing percentage increases while others see slight decreases. Specific details on these changes, including the precise percentage adjustments for each income bracket, are crucial for taxpayers to understand their potential impact. This information will be available from the official government sources once the bill's final text is released.

-

Corporate Tax Rates and Deductions: The corporate tax rate remains a focal point. The revised bill includes alterations to the corporate tax rate and allowable deductions, potentially affecting corporate profitability and investment strategies. The details of these changes will require close examination by financial analysts and businesses to gauge their full impact.

-

Tax Credits for Families and Businesses: Modifications to tax credits for families and businesses are also included in this revised legislation. This aspect of the bill requires careful scrutiny to determine whether the changes ultimately benefit or hinder these groups. Specific credits and their adjusted values need to be analyzed to ascertain the net effect.

-

Impact on Specific Industries or Demographics: The revised bill's impact varies across different sectors and demographics. Some industries may benefit from specific provisions, while others might face increased tax burdens. A detailed analysis of the bill's sectoral impact is necessary to understand the potential winners and losers.

-

Changes to the Standard Deduction: The standard deduction, a crucial element for many taxpayers, may also have undergone adjustments in this revised bill. These changes could significantly affect the tax liability for a large number of individuals, requiring careful review and understanding.

House Approval Process and Voting Breakdown

The House of Representatives' approval of the revised Trump tax bill followed a rigorous process characterized by intense debate and political maneuvering. The final vote revealed a largely party-line outcome, with [Insert Number] representatives voting in favor and [Insert Number] voting against the legislation.

-

Political Maneuvering: [Describe any significant political negotiations, compromises, or amendments that shaped the bill before the vote.] This section should highlight any last-minute deals or concessions that influenced the final outcome.

-

Party-Line Voting: The vote largely fell along party lines, with [Insert Percentage]% of [Party Name] representatives voting for the bill and [Insert Percentage]% of [Party Name] representatives voting against it. This underscores the deep partisan divisions surrounding tax policy.

-

Bipartisan Support/Opposition: While largely a partisan vote, [mention any significant bipartisan support or opposition and their justifications]. This aspect should highlight any cross-party alliances or disagreements within the voting pattern.

Potential Economic Impacts of the Revised Trump Tax Bill

The revised Trump tax bill carries significant implications for the US economy, both in the short-term and long-term. Economists and financial analysts offer diverse perspectives on its potential effects, with predictions ranging from increased economic growth to escalating national debt.

-

Job Creation/Loss: The bill's effect on job creation or job losses is a crucial area of consideration. Estimates vary widely, depending on which economic models are used and the assumptions made.

-

Income Inequality: The potential impact on income inequality is another highly debated area. Critics argue the bill could exacerbate existing inequalities, while supporters claim it will stimulate economic activity that benefits all segments of society.

-

National Budget Deficit: The bill's impact on the national budget deficit is a primary concern. Some analyses suggest that the tax cuts could significantly increase the deficit, while others predict a smaller or even positive impact on the fiscal outlook.

-

Expert Analysis: Include analyses from prominent economists and financial experts on the bill's potential economic effects. Quoting these experts lends credibility and diverse perspectives to the discussion.

Impact on Small Businesses

The revised Trump tax bill's effects on small businesses are particularly noteworthy. The legislation includes provisions designed to provide small business tax relief, but the actual benefits remain a subject of debate.

-

Deductions and Credits: [Describe specific changes to deductions or credits directly affecting small businesses.] This requires detailed examination of the bill's text to understand the specific implications.

-

Impact on Investment and Growth: The overall impact on small business investment and growth remains uncertain. Some argue the bill will stimulate investment, while others express concerns about its potential to negatively affect small businesses in certain sectors.

The Bill's Future: Senate Approval and Presidential Action

The revised Trump tax bill now faces its next hurdle: Senate approval. The Senate's legislative process could involve further amendments and debates before a final vote is taken. The potential for presidential action, including a potential veto, also remains a key factor.

-

Senate Approval Predictions: [Offer reasoned predictions on the likelihood of Senate approval, considering the Senate's composition and potential political dynamics.]

-

Potential Senate Amendments: [Discuss the possibility of further amendments in the Senate and their potential impact on the bill’s final form.]

-

Timeline: [Provide a realistic timeline for the bill's passage or potential failure, considering the Senate's schedule and presidential timelines.]

Conclusion

The House's approval of the revised Trump tax bill represents a significant step in the ongoing tax reform debate. This revised legislation introduces key changes to individual and corporate tax rates, tax credits, and the standard deduction, with potentially profound economic implications. The bill's future trajectory depends on the Senate's deliberations and potential presidential action. Understanding the revised tax bill is crucial for both businesses and individuals to adapt and plan accordingly.

Call to Action: Stay informed about the progress of the Revised Trump Tax Bill as it moves through the Senate. Follow reputable news sources for updates on this significant legislation and its potential consequences for you and the economy. Understanding the revised tax bill is crucial for making informed financial decisions. Learn more about the Trump tax bill's revisions and their implications.

Featured Posts

-

Guevenilir Mi Calkantili Mi Babalikta Erkek Burclarinin Rolue

May 23, 2025

Guevenilir Mi Calkantili Mi Babalikta Erkek Burclarinin Rolue

May 23, 2025 -

First Test Victory For Zimbabwe Muzarabanis Dominant Bowling Performance

May 23, 2025

First Test Victory For Zimbabwe Muzarabanis Dominant Bowling Performance

May 23, 2025 -

Zimbabwe Triumphant Muzarabani Stars In First Test Win Against Bangladesh

May 23, 2025

Zimbabwe Triumphant Muzarabani Stars In First Test Win Against Bangladesh

May 23, 2025 -

Kazakhstans Billie Jean King Cup Victory Over Australia

May 23, 2025

Kazakhstans Billie Jean King Cup Victory Over Australia

May 23, 2025 -

Aldhhb Fy Qtr Alywm Alithnyn 24 Mars Asear Wmwshrat

May 23, 2025

Aldhhb Fy Qtr Alywm Alithnyn 24 Mars Asear Wmwshrat

May 23, 2025

Latest Posts

-

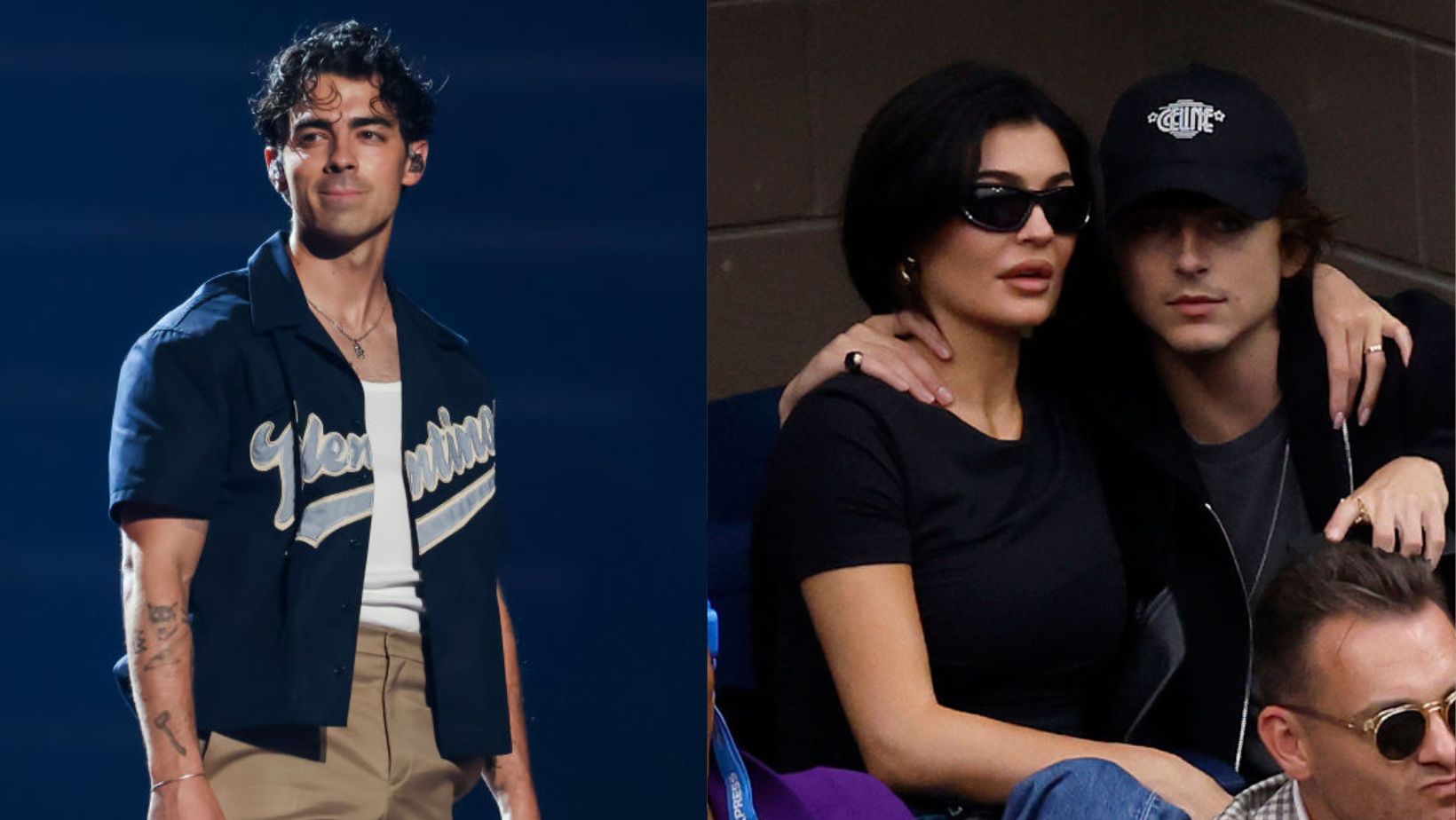

How Joe Jonas Handled A Couple Fighting Over Him

May 23, 2025

How Joe Jonas Handled A Couple Fighting Over Him

May 23, 2025 -

How Joe Jonas Dealt With A Couple Fighting Over Him

May 23, 2025

How Joe Jonas Dealt With A Couple Fighting Over Him

May 23, 2025 -

How Joe Jonas Handled A Couple Arguing Over Him

May 23, 2025

How Joe Jonas Handled A Couple Arguing Over Him

May 23, 2025 -

The Jonas Brothers Joe And The Unexpected Marital Dispute

May 23, 2025

The Jonas Brothers Joe And The Unexpected Marital Dispute

May 23, 2025 -

A Couples Fight Joe Jonass Response And The Internets Reaction

May 23, 2025

A Couples Fight Joe Jonass Response And The Internets Reaction

May 23, 2025