Ride-Sharing Revolution: Investing In Uber's Driverless Technology Via ETFs

Table of Contents

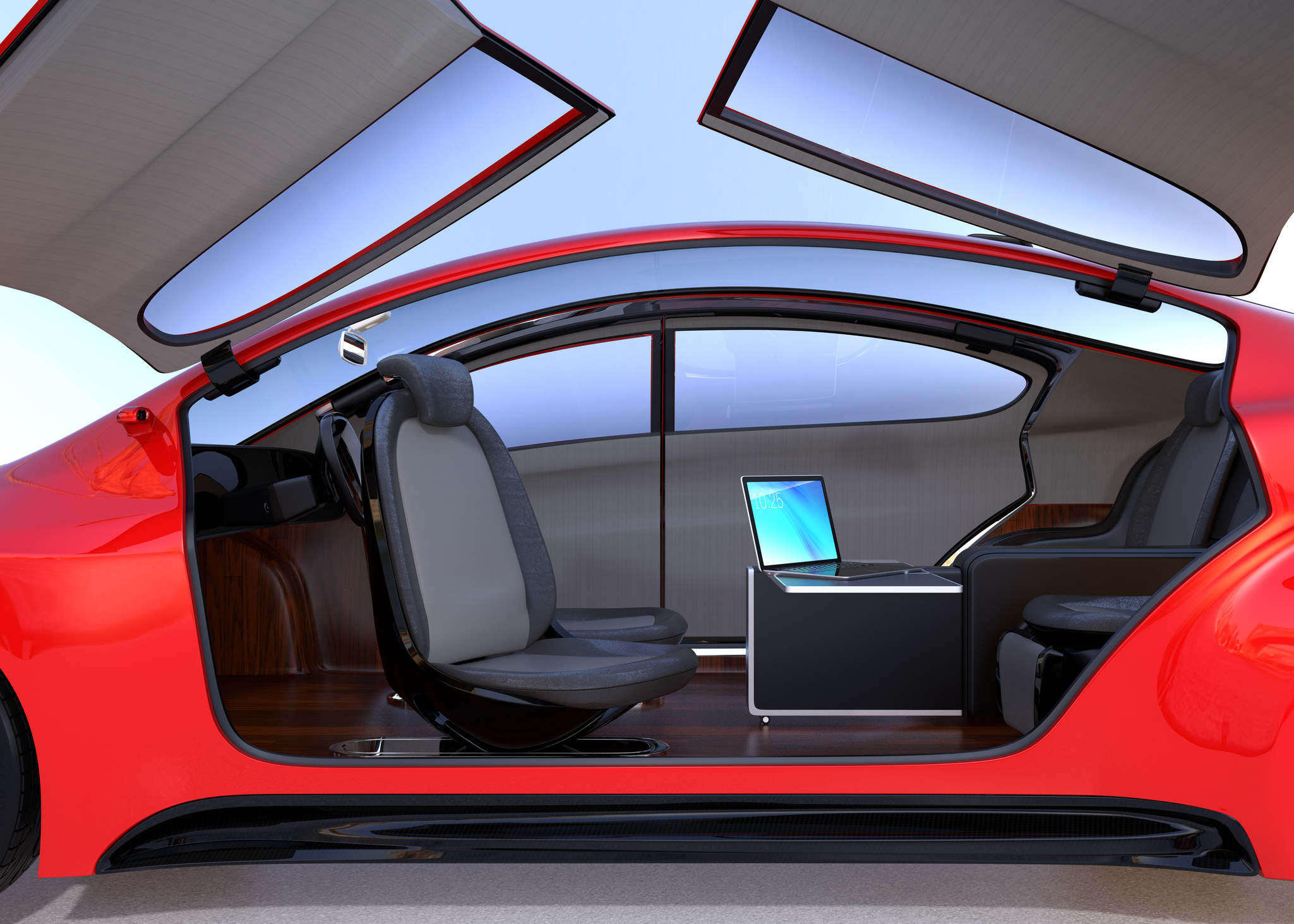

Understanding the Potential of Autonomous Vehicles in the Ride-Sharing Market

Autonomous vehicles stand to disrupt the ride-sharing market profoundly. The potential benefits are far-reaching, impacting both profitability and the overall user experience. Driverless cars promise significant cost reductions for ride-sharing companies. Eliminating the need for human drivers translates directly into lower labor costs, a major expense for services like Uber. Furthermore, optimized routes and reduced idling time contribute to significant fuel savings.

These efficiency improvements lead to several key advantages:

- Reduced operational costs for ride-sharing companies: Lower labor and fuel expenses boost profitability.

- Increased driver availability (24/7 operation): Autonomous vehicles can operate around the clock, maximizing vehicle utilization and revenue potential.

- Potential for lower fares and increased ridership: Reduced operational costs could translate to lower fares for consumers, stimulating demand and increasing ridership.

- Improved safety through reduced human error: Driverless technology has the potential to significantly reduce accidents caused by human error, making ride-sharing safer.

- Expansion into new markets and underserved areas: Autonomous vehicles can access areas with limited public transportation or where driver recruitment is challenging.

Identifying ETFs with Exposure to Uber and Autonomous Vehicle Technology

Investing directly in individual companies like Uber carries significant risk. A more diversified approach involves investing in ETFs that track the broader autonomous vehicle sector. Several ETFs offer exposure to companies involved in autonomous vehicle development, including those with ties to Uber’s technological advancements.

To find suitable ETFs, consider the following strategies:

- Research ETFs with significant holdings in technology sector giants: Look for ETFs that hold shares of companies like Google (Alphabet Inc.), NVIDIA, and other technology leaders involved in AI and autonomous driving technology. These companies often supply critical components or technology to companies like Uber.

- Look for ETFs focused on disruptive technology and innovation: These ETFs actively seek out and invest in companies at the cutting edge of technological advancements, including autonomous vehicles.

- Consider ETFs that track indices with exposure to the automotive technology sector: Indices like the Nasdaq Transportation Index may include companies heavily involved in autonomous driving technologies.

- Analyze ETF expense ratios and historical performance: Compare the fees charged by different ETFs and their past performance to choose the best fit for your investment goals.

Remember to carefully examine the ETF's holdings to ensure significant exposure to the autonomous vehicle sector and companies associated with Uber's driverless car initiatives. Examples of potential ETFs (Note: Specific ETF holdings change; always verify current holdings before investing): [Insert examples of relevant ETFs here with tickers, e.g., "Technology Select Sector SPDR Fund (XLK)," but verify accuracy and add more].

Assessing the Risks and Rewards of Investing in Driverless Technology ETFs

While the potential rewards of investing in autonomous vehicle technology are significant, it's crucial to acknowledge the inherent risks:

- Regulatory uncertainty surrounding autonomous vehicles: Government regulations regarding the deployment and operation of self-driving cars are still evolving, creating uncertainty.

- Technological risks and potential delays in development: The development of fully autonomous vehicles is complex, and unforeseen technological challenges may lead to delays.

- Market volatility and potential for short-term losses: Investing in emerging technologies always involves a degree of risk, and short-term market fluctuations are possible.

- Long-term growth potential of the autonomous vehicle market: Despite the risks, the long-term potential for growth in this sector remains substantial.

- Dependence on the success of specific companies (like Uber): The performance of your investment can be affected by the success or failure of specific companies within the ETF.

Diversification Strategies for Minimizing Risk

To mitigate the risks, diversify your portfolio beyond ETFs focused solely on Uber or autonomous vehicles. Consider investing in other sectors, such as established technology companies, renewable energy, or traditional equities, to create a more balanced and less volatile investment strategy.

Conclusion: Capitalizing on the Ride-Sharing Revolution with Smart ETF Investments

Investing in ETFs that offer exposure to Uber's driverless technology and the broader autonomous vehicle market presents a compelling opportunity to participate in a transformative sector. While significant long-term growth potential exists, it's essential to understand and manage the associated risks. By carefully researching ETFs, diversifying your portfolio, and maintaining a long-term perspective, you can potentially capitalize on the ride-sharing revolution. Start your journey toward capitalizing on the ride-sharing revolution by researching and carefully selecting relevant ETFs focused on autonomous vehicle technology. Don't miss the opportunity to invest in this transformative sector. Remember to conduct your own thorough research and consider consulting a financial advisor before making any investment decisions related to Uber's driverless technology or any ETFs.

Featured Posts

-

Fortnites Backwards Music Players React To Controversial Audio Update

May 17, 2025

Fortnites Backwards Music Players React To Controversial Audio Update

May 17, 2025 -

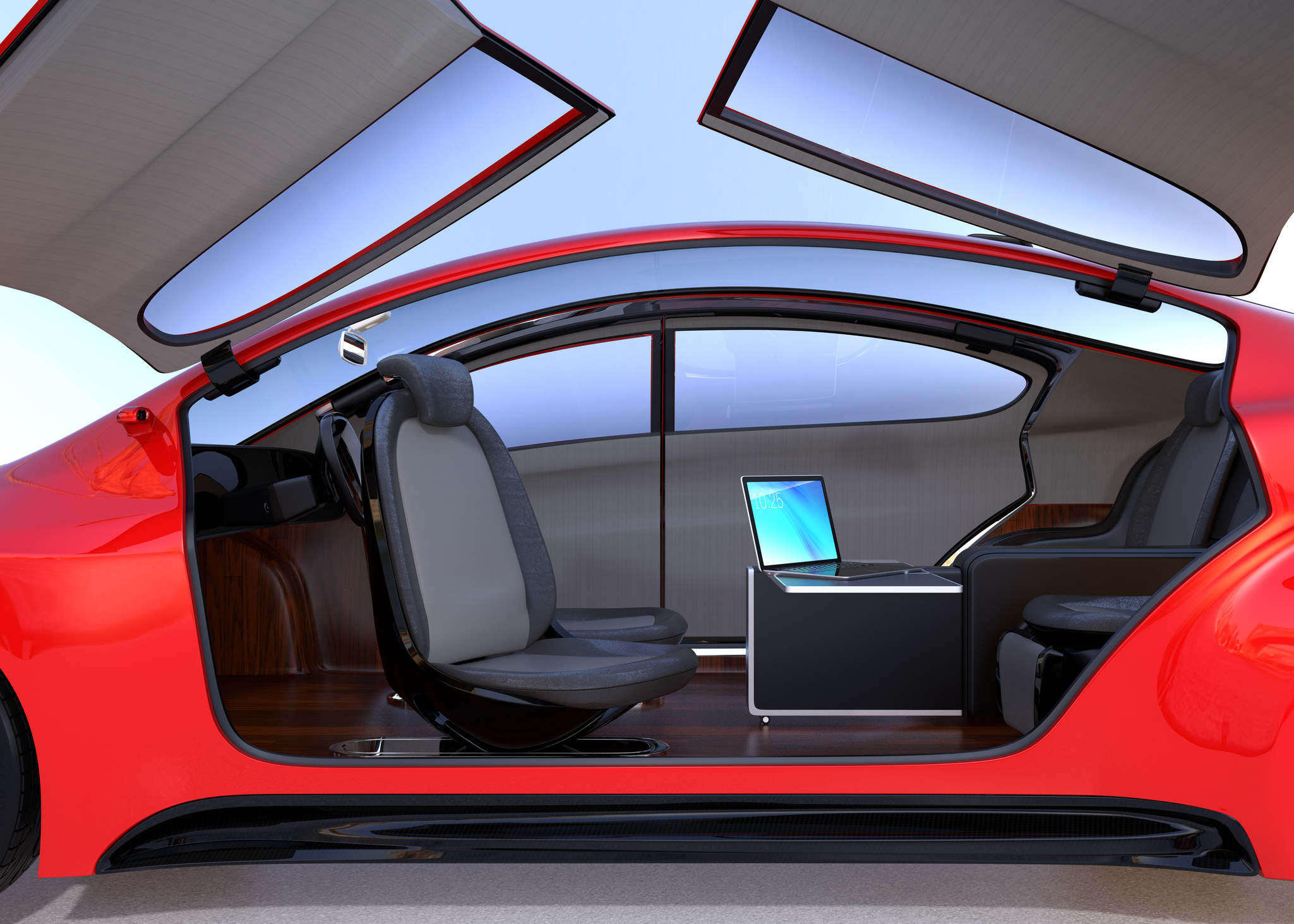

Backlash Against Fortnites Latest Item Shop Refresh

May 17, 2025

Backlash Against Fortnites Latest Item Shop Refresh

May 17, 2025 -

Palmeiras Derrota A Bolivar 2 0 Resumen Y Goles Del Encuentro

May 17, 2025

Palmeiras Derrota A Bolivar 2 0 Resumen Y Goles Del Encuentro

May 17, 2025 -

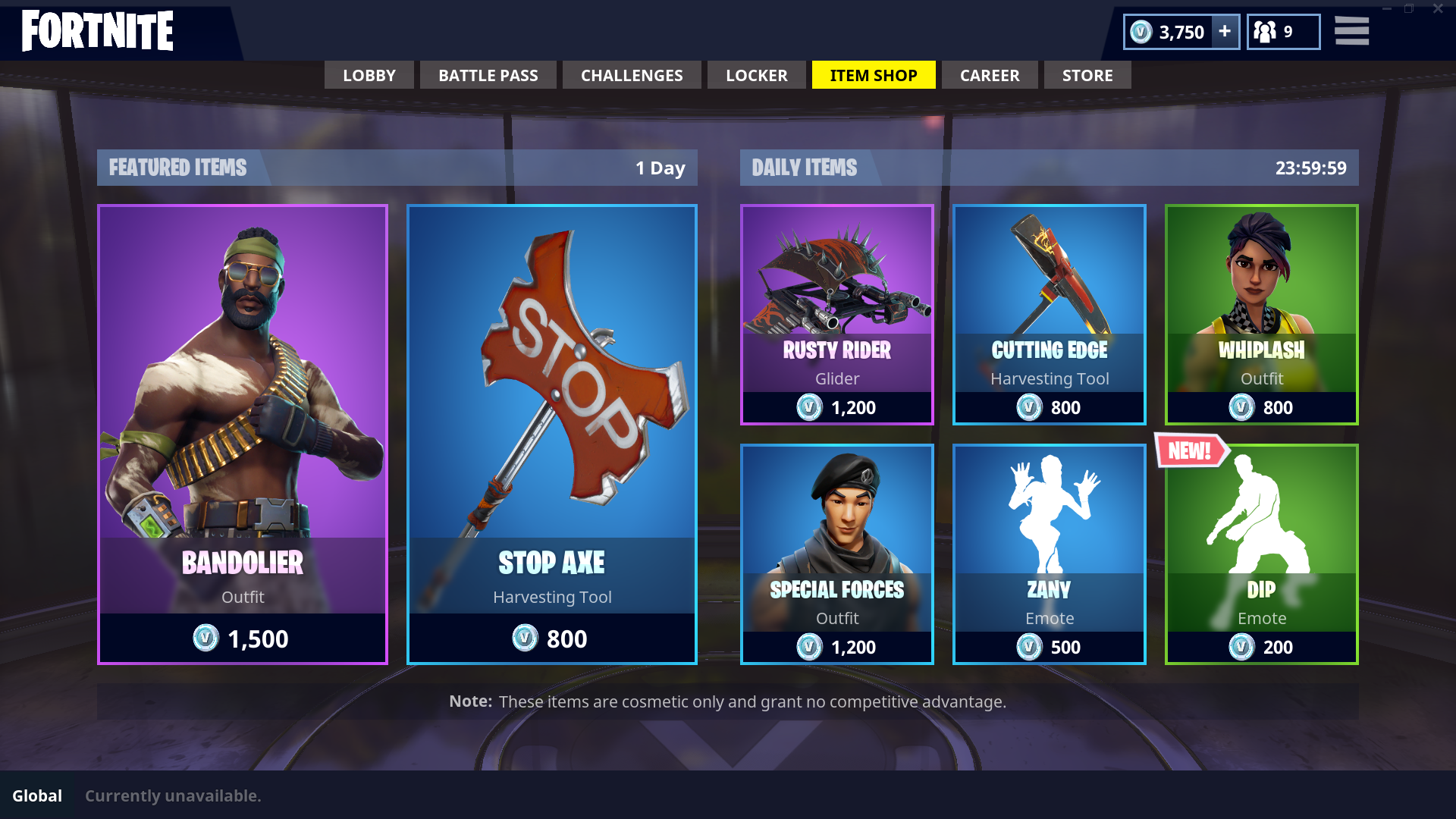

Finding The Best Bitcoin And Crypto Casinos A 2025 Selection

May 17, 2025

Finding The Best Bitcoin And Crypto Casinos A 2025 Selection

May 17, 2025 -

Top Rated Online Casinos In Canada For 2025 7 Bit Casino Leads The Pack

May 17, 2025

Top Rated Online Casinos In Canada For 2025 7 Bit Casino Leads The Pack

May 17, 2025