Ripple (XRP) On The Rise: Exploring The Potential Impact Of Recent Political Events

Table of Contents

H2: The SEC Lawsuit's Lingering Shadow and its Recent Developments

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has cast a long shadow over XRP's price and investor confidence. Understanding the nuances of this case is crucial to assessing XRP's future potential.

H3: The ongoing legal battle and its impact on investor sentiment

The SEC's lawsuit alleges that Ripple sold XRP as an unregistered security, creating uncertainty in the market. This uncertainty directly impacts investor sentiment, leading to price volatility.

- Summary of the SEC's claims: The SEC argues that Ripple's distribution of XRP constituted an unregistered securities offering, violating federal laws.

- Ripple's defense strategy: Ripple maintains that XRP is a currency and not a security, emphasizing its decentralized nature and widespread use.

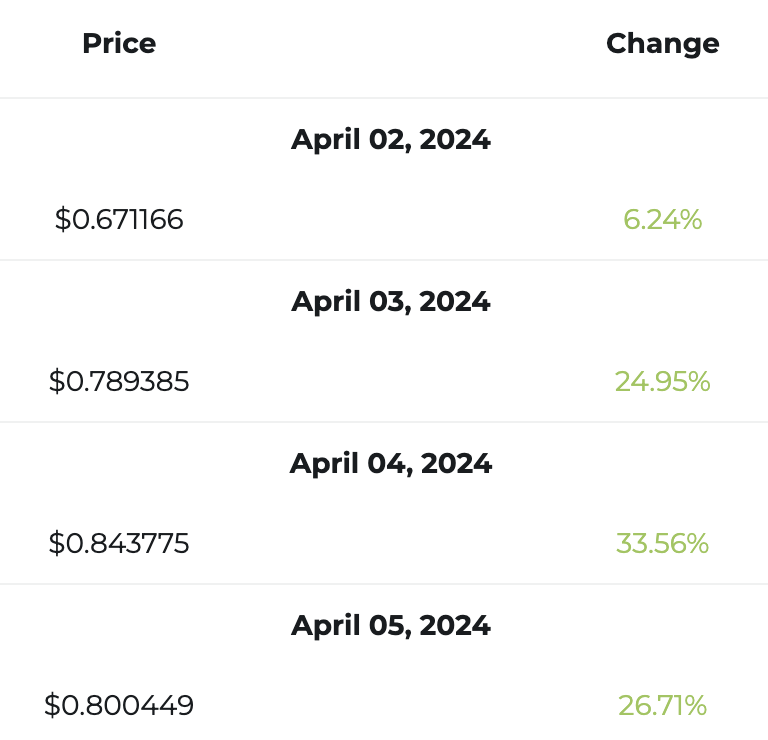

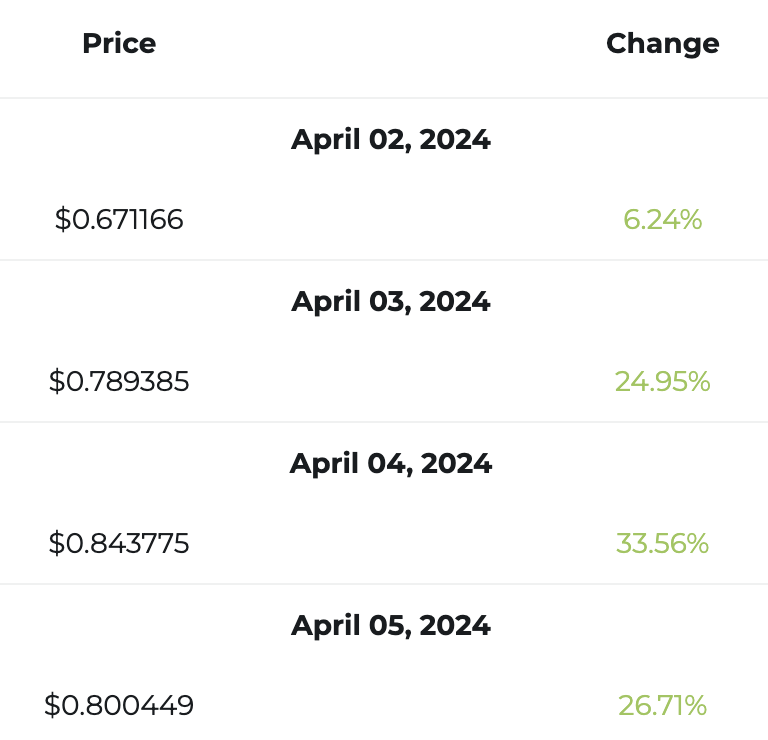

- Impact of positive court rulings (if any) on XRP price: Positive developments in the case, such as favorable court rulings, have historically led to significant surges in XRP's price, demonstrating the market's sensitivity to the lawsuit's outcome.

- Analysis of expert opinions on the lawsuit's likely outcome: Legal experts offer varied opinions, highlighting the complexity of the case and the potential for either a Ripple victory or a settlement that could partially vindicate Ripple's position.

H3: The potential for regulatory clarity and its effect on future growth

A favorable ruling for Ripple could dramatically alter the landscape. The potential for regulatory clarity is a significant catalyst for future growth.

- Potential scenarios following a Ripple victory: A Ripple win could lead to increased institutional investment, wider adoption, and a significant price increase for XRP.

- Increased institutional investment possibilities: Regulatory clarity would likely attract significant institutional investment, as institutional investors often hesitate to invest in assets with uncertain regulatory status.

- Expansion into new markets: A positive outcome could open doors to new markets, allowing Ripple and XRP to expand their reach globally.

- Improved regulatory landscape for cryptocurrencies: A favorable ruling could set a precedent, potentially influencing future regulatory decisions concerning other cryptocurrencies.

H2: Global Regulatory Shifts and Their Influence on XRP's Market Position

The evolving regulatory landscape globally significantly impacts XRP's market position. Different jurisdictions are adopting varying approaches to cryptocurrency regulation, creating a dynamic environment.

H3: Changes in cryptocurrency regulations worldwide

The regulatory environment for cryptocurrencies varies significantly across countries. Some nations are adopting a more progressive stance, while others maintain stricter regulations.

- Examples of countries adopting more favorable crypto regulations: Certain countries are actively exploring the potential of cryptocurrencies and implementing more favorable regulatory frameworks, potentially boosting XRP adoption in those regions.

- Impact of stricter regulations in other jurisdictions: Conversely, stricter regulations in other regions limit XRP's reach and adoption.

- The role of Ripple's lobbying efforts in shaping regulations: Ripple actively engages in lobbying efforts to shape a favorable regulatory environment for XRP and the broader cryptocurrency industry.

H3: The rise of CBDCs and their potential impact on XRP's technology

The emergence of Central Bank Digital Currencies (CBDCs) presents both challenges and opportunities for XRP. Ripple's technology, particularly its RippleNet, has the potential to be integrated into CBDC infrastructure.

- Ripple's role in CBDC development projects: Ripple has been actively involved in several CBDC pilot projects, demonstrating the potential for its technology to be integrated into these systems.

- Comparative analysis of XRP and CBDCs: While CBDCs are centralized, XRP offers a decentralized alternative, and both could potentially coexist.

- Potential for collaboration rather than competition: Instead of direct competition, there's a possibility for collaboration between XRP and CBDCs, with RippleNet facilitating cross-border transactions between both.

H2: Increased Institutional Adoption and Ripple's Strategic Partnerships

The growing interest from institutional investors and strategic partnerships are key factors driving XRP's growth.

H3: Growing interest from institutional investors

Institutional investors are increasingly showing interest in XRP, drawn by factors like its relatively low transaction fees and fast transaction speeds.

- Examples of significant institutional investments: While specifics are often kept confidential, several reports indicate increasing institutional interest and investment in XRP.

- Factors driving institutional interest (e.g., lower transaction fees, speed): The efficiency and cost-effectiveness of XRP's transaction system are attractive to institutional players.

- Analysis of institutional investor sentiment towards Ripple and XRP: Sentiment appears to be shifting positively as regulatory clarity becomes more likely and the utility of XRP increases.

H3: Strategic partnerships and their role in expanding XRP's utility

Ripple's strategic partnerships are significantly expanding the utility and reach of XRP.

- Examples of notable partnerships: Ripple has collaborated with several financial institutions globally, integrating XRP into their payment systems.

- How these partnerships enhance XRP's functionality and adoption: These partnerships expand XRP's reach and demonstrate its real-world applications, increasing adoption.

- Long-term implications of these partnerships for XRP's value: These partnerships represent a significant boost to XRP's long-term value and potential for growth.

3. Conclusion

Recent political events, including the ongoing SEC lawsuit and global regulatory shifts, significantly impact Ripple (XRP)'s trajectory. The potential for regulatory clarity and increased institutional adoption are key drivers of its growth. The lawsuit's outcome remains a crucial factor, but positive developments, coupled with strategic partnerships, suggest a promising future for XRP. The increasing utility of XRP in cross-border payments and potential integration into CBDC infrastructure further enhance its long-term prospects.

With the ongoing evolution of the regulatory landscape and Ripple's strategic advancements, now is a crucial time to understand the potential of Ripple (XRP). Stay informed and explore the opportunities this dynamic cryptocurrency presents. [Link to relevant resources, if applicable]

Featured Posts

-

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025

Dwp To Axe Two Benefits Final Payments Incoming

May 08, 2025 -

March 29th Nba Thunder Vs Pacers Injury Report And Analysis

May 08, 2025

March 29th Nba Thunder Vs Pacers Injury Report And Analysis

May 08, 2025 -

Identifying Emerging Business Hubs A Nationwide Overview

May 08, 2025

Identifying Emerging Business Hubs A Nationwide Overview

May 08, 2025 -

Nuggets Starting Five Including Jokic Sit Out After Grueling Game

May 08, 2025

Nuggets Starting Five Including Jokic Sit Out After Grueling Game

May 08, 2025 -

Lotto 6aus49 Mittwoch 9 4 2025 Gewinnzahlen And Ergebnisse

May 08, 2025

Lotto 6aus49 Mittwoch 9 4 2025 Gewinnzahlen And Ergebnisse

May 08, 2025