Rising Seas, Falling Scores? The Link Between Climate Risk And Your Credit

Table of Contents

Property Value Depreciation Due to Climate Risk

Properties located in high-risk climate zones—coastal areas prone to flooding, wildfire-prone regions, or areas susceptible to extreme heat—are experiencing declining property values. This devaluation directly impacts your equity and can negatively affect your credit if you need to refinance or sell. A climate risk assessment of your property is increasingly important for understanding potential future devaluation.

- Increased insurance premiums due to higher risk: Insurance companies are pricing risk based on location and climate vulnerability. Higher premiums directly impact your monthly budget and could lead to financial strain.

- Difficulty securing a mortgage or loan with a depreciated property: Lenders consider property value as a key factor in loan approval. A declining property value due to climate risk can make it harder to secure a mortgage or refinance at favorable terms.

- Reduced buyer interest in high-risk properties, leading to longer sale times: Potential buyers are increasingly wary of purchasing properties in areas with high climate risk, leading to a slower and potentially less profitable sale.

- Potential for forced sales at below-market value: In extreme cases, facing escalating costs and declining value, homeowners might be forced to sell their property at a loss, negatively impacting their financial health and credit score. This is a significant concern for those with mortgages in high-risk zones.

Rising Insurance Premiums and Credit Scores

Insurance companies are factoring climate risk into their assessments. Properties in high-risk areas face significantly higher premiums for homeowners, flood, and other types of insurance. Inability to afford these premiums can lead to policy cancellations, which can be reported to credit bureaus and negatively affect your credit score. Your insurance score, a factor in determining your premiums, can also be impacted by climate-related claims.

- Higher insurance costs can strain your finances, leading to missed payments: The escalating cost of insurance in high-risk areas can put a strain on household budgets, potentially leading to missed payments and impacting your credit report.

- Cancelled insurance policies due to non-payment impact credit ratings: Failing to maintain adequate insurance coverage, due to unaffordable premiums, can lead to policy cancellation and negatively affect your credit score.

- Increased scrutiny from lenders due to higher risk profiles: Lenders take insurance coverage into account when assessing risk. Higher premiums or cancelled policies can raise red flags and lead to stricter lending criteria.

Mortgage Lending and Climate Risk Disclosure

Mortgage lenders are becoming increasingly aware of climate risks and are incorporating climate risk assessments into their mortgage lending processes. Properties in high-risk zones may face stricter lending criteria, higher interest rates, or even loan denials, impacting your ability to secure financing. Transparency and disclosure of climate risk are becoming crucial parts of the mortgage application process.

- Increased due diligence on properties located in high-risk areas: Lenders are conducting more thorough appraisals and risk assessments for properties situated in areas vulnerable to climate-related events.

- Higher interest rates charged to compensate for increased risk: To offset the higher risk associated with lending in climate-vulnerable areas, lenders may charge higher interest rates.

- Potential loan denials for properties deemed too risky: In cases where the climate risk is deemed too high, lenders may outright deny mortgage applications for properties in those zones.

- Growing availability of green mortgages for energy-efficient properties: Conversely, there's a growing trend towards "green mortgages" which offer more favorable terms for energy-efficient homes, incentivizing climate-conscious renovations and construction.

Proactive Steps to Protect Your Credit Score

While the impact of climate change on your credit is a growing concern, there are proactive steps you can take to protect your financial well-being. Proactive risk mitigation is key to safeguarding your credit score in the face of climate change.

- Conduct a climate risk assessment of your property: Understanding your property's vulnerability to specific climate hazards is the first step in developing a mitigation strategy.

- Invest in home improvements to increase resilience to extreme weather events: Upgrades such as flood-proofing, fire-resistant roofing, and improved insulation can reduce your risk and potentially lower insurance premiums.

- Secure adequate insurance coverage, including flood insurance: Ensure you have sufficient insurance coverage to protect yourself from potential losses due to climate-related events.

- Diversify your investments and build a strong emergency fund: Diversification and emergency savings can help cushion financial impacts from unexpected events related to climate change.

- Stay informed about changing regulations and lending practices related to climate risk: Keeping up-to-date with the latest information helps you adapt and make informed financial decisions.

Conclusion

The link between climate risk and your credit score is undeniable and growing stronger. Rising sea levels, increased extreme weather events, and evolving insurance and lending practices all contribute to this complex relationship. By understanding these risks and taking proactive steps to mitigate them, you can protect your creditworthiness and financial future. Don't underestimate the impact of climate change on your finances – take control and start planning for a more financially secure and climate-resilient future. Learn more about how climate risk may affect your credit score and take steps to mitigate potential negative impacts. Understanding your climate risk is key to protecting your credit.

Featured Posts

-

Nova Filmska Adaptacija Sydney Sweeney U Filmu Inspiriranom Reddit Pricom

May 21, 2025

Nova Filmska Adaptacija Sydney Sweeney U Filmu Inspiriranom Reddit Pricom

May 21, 2025 -

Peppa Pigs New Baby Sister A Girl Arrives

May 21, 2025

Peppa Pigs New Baby Sister A Girl Arrives

May 21, 2025 -

Sterke Kwartaalcijfers Tillen Abn Amro In Aex

May 21, 2025

Sterke Kwartaalcijfers Tillen Abn Amro In Aex

May 21, 2025 -

Halvering Voedselexport Vs Abn Amro Rapport Over Gevolgen Heffingen

May 21, 2025

Halvering Voedselexport Vs Abn Amro Rapport Over Gevolgen Heffingen

May 21, 2025 -

Little Britain Cancelled Yet Still Popular With Gen Z Why

May 21, 2025

Little Britain Cancelled Yet Still Popular With Gen Z Why

May 21, 2025

Latest Posts

-

Mainzs Impressive Win At Gladbach Strengthens Top Four Bid

May 21, 2025

Mainzs Impressive Win At Gladbach Strengthens Top Four Bid

May 21, 2025 -

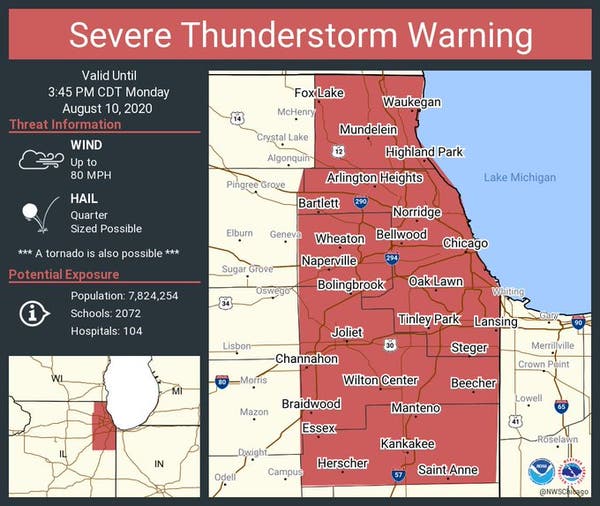

Damaging Winds And Fast Moving Storms What To Watch For

May 21, 2025

Damaging Winds And Fast Moving Storms What To Watch For

May 21, 2025 -

Ftv Lives A Hell Of A Run Facts Figures And Fallout

May 21, 2025

Ftv Lives A Hell Of A Run Facts Figures And Fallout

May 21, 2025 -

Mainz Secure Top Four Spot With Dominant Gladbach Victory

May 21, 2025

Mainz Secure Top Four Spot With Dominant Gladbach Victory

May 21, 2025 -

Watch Out For Damaging Winds Fast Moving Storms

May 21, 2025

Watch Out For Damaging Winds Fast Moving Storms

May 21, 2025