Rockwell Automation Beats Earnings Expectations: A Detailed Analysis

Table of Contents

Exceeding Expectations: Revenue and Earnings Growth

Rockwell Automation's latest earnings report revealed substantial growth across key metrics. The company reported a revenue of [Insert Actual Revenue Figure] exceeding analyst estimates of [Insert Analyst Estimate Figure] by [Insert Percentage Difference]%. This represents a [Insert Percentage] increase compared to the same quarter last year. Similarly, EPS came in at [Insert Actual EPS Figure], significantly surpassing the projected [Insert Analyst Estimate Figure] by [Insert Percentage Difference]%. This impressive performance can be attributed to several factors:

- Strong Demand Across Key Sectors: Robust demand from the automotive, food and beverage, and life sciences sectors fueled significant revenue growth. These industries are increasingly adopting automation technologies to enhance efficiency and productivity.

- Successful Product Launches and Innovation: Rockwell Automation's continued investment in research and development has resulted in the launch of several innovative products and solutions, strengthening its market position and attracting new customers. The success of [mention specific product launch if available] significantly contributed to the positive results.

- Improved Operational Efficiency: Streamlined operational processes and cost optimization initiatives contributed to enhanced profitability and improved margins. This reflects Rockwell Automation's commitment to optimizing its internal processes for maximum efficiency.

- Positive Future Guidance: The company issued positive guidance for the coming quarters, indicating continued confidence in its growth trajectory. This positive outlook further strengthens investor sentiment.

Segment Performance Analysis: Identifying Key Growth Drivers

While specific segment breakdowns may vary depending on Rockwell Automation's reporting structure, a general analysis would involve examining the performance of different business units. For example, [mention segment 1, e.g., Industrial Automation] demonstrated robust growth driven by strong demand for [mention specific product category, e.g., robotics and control systems]. Conversely, [mention segment 2 if applicable, e.g., Software and Services] may have experienced slightly slower growth due to [mention potential reason, e.g., increased competition]. Key performance indicators (KPIs) for each segment should be examined to understand the overall health of the company:

- Revenue Growth: Comparing year-over-year revenue growth across segments highlights which areas are driving overall expansion.

- Profit Margins: Analyzing profit margins for each segment reveals the profitability of different business units.

- Order Backlog: A strong order backlog indicates sustained demand and future revenue potential.

Impact on Stock Price and Investor Sentiment: Market Reaction

The market reacted positively to Rockwell Automation's better-than-expected earnings announcement. The company's stock price experienced a [Insert Percentage] increase following the news release, accompanied by a significant surge in trading volume. Several analysts upgraded their ratings on Rockwell Automation stock, reflecting a more optimistic outlook for the company's future performance. Overall investor sentiment was overwhelmingly positive:

- Positive Media Coverage: Major financial news outlets reported favorably on Rockwell Automation's results, highlighting the strong financial performance and positive future outlook.

- Upgraded Ratings: Several investment firms raised their buy/sell ratings for Rockwell Automation stock, reflecting confidence in the company's growth potential.

- Increased Market Capitalization: The stock price surge resulted in a significant increase in Rockwell Automation's overall market capitalization.

Future Outlook and Challenges for Rockwell Automation: Long-Term Prospects

Rockwell Automation's strategic plan emphasizes continued innovation and expansion within the industrial automation sector. The company plans to leverage technological advancements such as artificial intelligence (AI), machine learning (ML), and the Industrial Internet of Things (IIoT) to enhance its product offerings and expand into new markets. However, several challenges lie ahead:

- Technological Advancements: Staying ahead of the curve in the rapidly evolving industrial automation landscape requires ongoing investment in R&D.

- Global Economic Conditions: Macroeconomic factors such as inflation and recessionary risks could impact demand for industrial automation solutions.

- Competitive Landscape: Intense competition from established players and emerging technology companies poses a significant challenge.

These factors need to be considered for a holistic understanding of Rockwell Automation's long-term prospects.

Conclusion: Rockwell Automation's Earnings Beat: Key Takeaways and Investment Implications

Rockwell Automation's recent earnings announcement demonstrates a significant outperformance, exceeding expectations across key financial metrics. Strong demand across key industrial sectors, successful product launches, and improved operational efficiency were major contributors to this success. The positive market reaction, including stock price increases and analyst upgrades, reflects investor confidence in the company's future growth potential. While challenges exist, Rockwell Automation's strategic focus on innovation and technological advancement positions it well for long-term success in the dynamic industrial automation sector. Stay updated on Rockwell Automation's continued performance and learn more about investment opportunities in the industrial automation sector by following our blog and further researching Rockwell Automation's financial reports and industry analysis. Understanding the nuances of this Rockwell Automation earnings beat is a crucial aspect of any investment strategy focused on industrial automation stocks.

Featured Posts

-

Tokyos Growing Trend Soundproof Apartments For A Serene Urban Lifestyle

May 17, 2025

Tokyos Growing Trend Soundproof Apartments For A Serene Urban Lifestyle

May 17, 2025 -

New York Knicks Facing Extended Absence Jalen Brunsons Injury And Recovery

May 17, 2025

New York Knicks Facing Extended Absence Jalen Brunsons Injury And Recovery

May 17, 2025 -

Crystal Palace Vs Nottingham Forest Minuto A Minuto Y Resumen Del Partido

May 17, 2025

Crystal Palace Vs Nottingham Forest Minuto A Minuto Y Resumen Del Partido

May 17, 2025 -

Compare The Best Australian Crypto Casino Sites For 2025

May 17, 2025

Compare The Best Australian Crypto Casino Sites For 2025

May 17, 2025 -

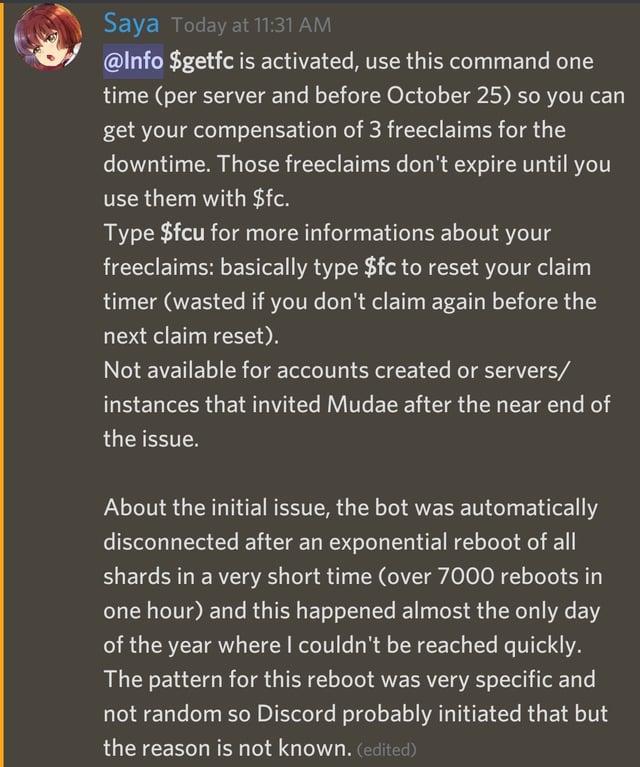

Reddit Outage Confirmed By Psa

May 17, 2025

Reddit Outage Confirmed By Psa

May 17, 2025