RTL Group: On Track For Streaming Profitability?

Table of Contents

RTL Group's Streaming Strategy

RTL Group's streaming strategy centers around a multi-platform approach, combining localized content with broader international offerings. Understanding this strategy is key to assessing its path to profitability.

Key Streaming Platforms and Content

RTL Group operates several key streaming platforms, each tailored to specific geographic markets and audiences. RTL+ is a major player in Germany, offering a wide range of content. Videoland serves the Dutch market with a similar diverse programming strategy.

- RTL+: Features a blend of German-produced originals, international acquisitions, and live sports events. Successful shows include [Insert Example Show 1] and [Insert Example Show 2], driving subscriber growth. They've secured exclusive streaming rights for [mention a specific show or event].

- Videoland: Focuses on Dutch-language programming, including popular local series and international hits. Their strategy includes a strong emphasis on [mention a specific genre or type of content popular on Videoland]. Exclusive content deals with [mention production companies or studios] have been instrumental in attracting and retaining subscribers.

- Other Platforms: Mention any other relevant streaming platforms and their content offerings within RTL Group's portfolio.

Keywords: RTL+, Videoland, streaming content, local programming, international content, exclusive content, German streaming, Dutch streaming

Subscription Model and Pricing

RTL Group employs a subscription model for its core streaming services. The pricing strategy aims to balance affordability with value, competing effectively within their respective markets.

- RTL+ Pricing: [Insert Pricing Details, including any subscription tiers]. Compared to competitors like Netflix and Disney+ in Germany, RTL+ offers [comparison of pricing and value proposition]. Promotional offers like free trial periods are frequently utilized to attract new subscribers.

- Videoland Pricing: [Insert Pricing Details, including any subscription tiers]. Similar to RTL+, Videoland offers competitive pricing with regular promotional bundles and offers.

- Competitive Analysis: Direct comparisons to other streaming services in their respective regions are crucial to understanding RTL Group's market positioning and potential for success.

Keywords: subscription model, pricing strategy, subscription tiers, competitive pricing, promotional offers, RTL+ pricing, Videoland pricing

Investment in Original Content

RTL Group recognizes the importance of original programming to differentiate its services and attract subscribers. Significant investments have been made to develop exclusive content for its platforms.

- Successful Originals: Examples include [List successful original productions on RTL+ and Videoland, quantifying their success if possible – e.g., viewership numbers, awards]. Highlighting specific successes will showcase the effectiveness of their investment strategy.

- Production Budget: While exact figures may not be publicly available, a general indication of investment in original content production would be beneficial. Analyzing the return on investment (ROI) for original productions is a key performance indicator (KPI).

Keywords: original content, investment in streaming, original programming, successful shows, production budget, ROI, streaming investment

Financial Performance and Growth

Analyzing RTL Group's financial performance provides a clearer picture of its progress towards streaming profitability.

Subscriber Growth and Acquisition Costs

Tracking subscriber growth across its platforms is vital. However, it’s equally important to assess the cost of acquiring these subscribers.

- Subscriber Numbers: [Insert publicly available subscriber numbers for RTL+ and Videoland, if accessible]. Show year-over-year growth (or decline) to illustrate trends.

- Customer Acquisition Cost (CAC): [Discuss the cost of acquiring a new subscriber. If data isn't publicly available, discuss strategies to reduce CAC]. Lowering CAC is essential for long-term profitability.

- Churn Rate: [Mention churn rate data, if available, to show subscriber retention]. High churn indicates potential problems with content or service.

Keywords: subscriber growth, subscriber acquisition cost, CAC, churn rate, user acquisition, RTL+ subscribers, Videoland subscribers

Revenue Generation and Advertising

RTL Group's streaming revenue is generated through subscriptions and advertising. A balanced approach is crucial.

- Revenue Figures: [Insert publicly available revenue figures related to the streaming division, broken down by subscription and advertising revenue. If not available, discuss the revenue model in detail].

- Advertising Strategy: [Discuss the effectiveness of the advertising strategy employed by RTL Group on its streaming platforms. This could include targeted advertising, ad-supported tiers, etc.].

Keywords: revenue generation, streaming revenue, subscription revenue, advertising revenue, monetization strategy, RTL+ revenue, Videoland revenue

Profitability Metrics

Key profitability metrics offer a direct assessment of RTL Group’s progress.

- EBITDA and Net Income: [Insert available data on EBITDA and net income related to the streaming division]. Analyze trends to show progress toward profitability. Highlight any positive or negative developments.

Keywords: EBITDA, net income, profitability, streaming profitability, financial performance

Challenges and Future Outlook

Despite progress, RTL Group faces significant challenges in the competitive streaming market.

Competition in the Streaming Market

The streaming market is fiercely competitive. RTL Group must contend with established giants and agile newcomers.

- Major Competitors: [List major competitors in the relevant markets and discuss their strategies]. This competitive landscape requires continuous innovation and adaptation.

Keywords: competition, streaming competition, market share, competitive landscape, streaming wars

Content Acquisition Costs and Rights

Securing high-quality content is expensive and becoming increasingly challenging.

- Licensing Fees: [Discuss the costs associated with acquiring streaming rights and securing content]. Negotiating favorable licensing agreements is vital for profitability.

- Content Rights: [Mention any potential risks related to content rights and licensing agreements. The landscape of rights is constantly evolving].

Keywords: content acquisition, licensing fees, content rights, content strategy

Technological Advancements and Innovation

Staying competitive requires ongoing technological innovation to enhance user experience.

- Technology Investments: [Mention investments in technology, platform upgrades, and new features being developed]. Continuous improvement of technology is essential to providing a superior user experience and maintaining a competitive edge.

Keywords: technological innovation, user experience, technology investments, streaming technology

Conclusion: Is RTL Group's Streaming Future Bright?

RTL Group has made strides in its pursuit of streaming profitability. Its multi-platform strategy, investment in original content, and competitive pricing demonstrate a commitment to success. However, the intense competition, high content acquisition costs, and the ever-evolving technological landscape present significant challenges. The future of RTL Group's streaming success will depend on its ability to adapt to market changes, control costs, and continue to deliver high-quality, engaging content. To stay informed about RTL Group's progress and the latest developments in the streaming industry, follow their investor relations page: [Insert Link to RTL Group Investor Relations]. The future of streaming is dynamic; keeping a close eye on RTL Group's strategies will be crucial in understanding the evolving landscape of streaming profitability.

Keywords: RTL Group, streaming profitability, future of streaming, streaming outlook, media industry, investment opportunity

Featured Posts

-

Adressage Abidjan 14 279 Voies Identifiees A Ce Jour

May 20, 2025

Adressage Abidjan 14 279 Voies Identifiees A Ce Jour

May 20, 2025 -

Why Gen Z Loves Little Britain Despite Its Cancellation

May 20, 2025

Why Gen Z Loves Little Britain Despite Its Cancellation

May 20, 2025 -

Rashfords Double Aston Villas Fa Cup Victory Over Preston

May 20, 2025

Rashfords Double Aston Villas Fa Cup Victory Over Preston

May 20, 2025 -

Cobollis First Atp Title Bucharest Open Victory

May 20, 2025

Cobollis First Atp Title Bucharest Open Victory

May 20, 2025 -

Apples Efforts To Improve Siris Ai Capabilities

May 20, 2025

Apples Efforts To Improve Siris Ai Capabilities

May 20, 2025

Latest Posts

-

Whats Sydney Sweeney Doing After Echo Valley And The Housemaid New Film Role Revealed

May 21, 2025

Whats Sydney Sweeney Doing After Echo Valley And The Housemaid New Film Role Revealed

May 21, 2025 -

Sydney Sweeneys Next Role After Echo Valley And The Housemaid

May 21, 2025

Sydney Sweeneys Next Role After Echo Valley And The Housemaid

May 21, 2025 -

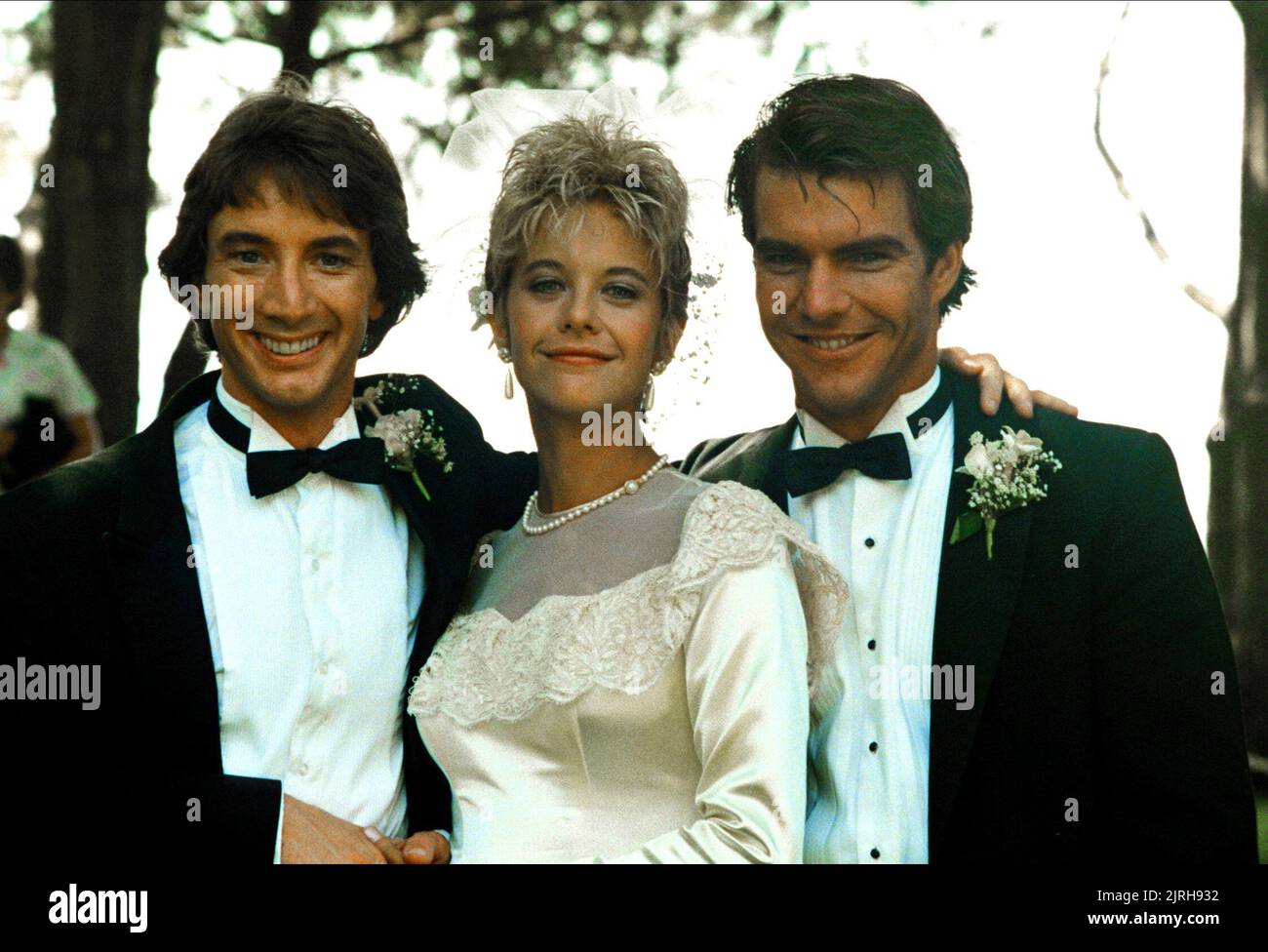

A Hidden Gem The Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025

A Hidden Gem The Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025 -

Dennis Quaid Meg Ryan And James Caans Forgotten Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caans Forgotten Western Neo Noir

May 21, 2025 -

Liverpool Dan Liga Inggris 2024 2025 Siapa Pelatih Yang Tepat

May 21, 2025

Liverpool Dan Liga Inggris 2024 2025 Siapa Pelatih Yang Tepat

May 21, 2025