RTL Group's Streaming Business: A Profitability Forecast

Table of Contents

Current State of RTL Group's Streaming Landscape

RTL Group operates several streaming platforms across Europe, including RTL+ (formerly TV Now) in Germany and other localized services. These platforms offer a diverse range of content, encompassing local productions, international acquisitions, and live television streams. The geographic reach is primarily concentrated in German-speaking countries and other key European markets, though expansion plans are constantly evolving. The size and diversity of the content library are key factors in attracting and retaining subscribers, impacting RTL Group streaming profitability directly.

Subscriber Growth and Acquisition Strategies

RTL Group's subscriber numbers have shown growth, although the exact figures are not always publicly available. The company employs a mixed strategy for subscriber acquisition, relying on both organic growth through marketing and promotional campaigns and strategic acquisitions to expand its content library and geographic reach.

- Specific subscriber numbers: While precise figures remain undisclosed, reports suggest a steady increase in subscribers across its various streaming platforms in recent years.

- Successful acquisitions: While large-scale acquisitions haven't been widely publicized recently, smaller acquisitions of production companies or niche streaming services could be contributing to content library expansion and increased RTL Group streaming profitability.

- Marketing and promotional strategies: RTL Group utilizes various marketing strategies, including targeted advertising campaigns, partnerships with telecom providers, and bundled offers with other services, to drive subscriber growth.

Content Strategy and Investment

RTL Group's content strategy is a blend of original programming, licensed content, and live television. Investment in original productions is crucial for attracting and retaining subscribers, differentiating its services from competitors, and boosting RTL Group streaming profitability.

- Successful original shows: [Insert examples of successful RTL+ original shows here, linking to their pages if possible]. The success of these shows directly impacts subscriber acquisition and retention.

- Budget allocation for content creation: While precise budget allocations are confidential, it's evident that RTL Group is committing substantial resources to original content creation, suggesting a long-term commitment to its streaming strategy.

- Analysis of content licensing costs: Licensing costs for international content form a significant part of the operating expenses. Negotiating favorable licensing deals is crucial for maximizing RTL Group streaming profitability.

Factors Affecting Profitability

Several factors significantly influence the profitability of RTL Group's streaming business. Understanding these factors is crucial for predicting the trajectory of RTL Group streaming profitability.

Competition in the Streaming Market

The European streaming market is highly competitive, with established players like Netflix, Disney+, and Amazon Prime Video, along with local competitors. RTL Group faces challenges in standing out amongst these giants.

- Key competitors and their market share: Netflix and Disney+ command significant market share in Europe, creating stiff competition for RTL Group. Amazon Prime Video also poses a formidable challenge with its bundled offering.

- RTL Group's unique selling propositions: RTL Group leverages its established brand recognition and its focus on local content to differentiate its services. Strong local content is often a key differentiator in competitive markets.

- Analysis of pricing strategies: RTL Group's pricing strategy needs to balance affordability with the value proposition of its content library to compete effectively with the pricing models of global streaming giants.

Advertising Revenue and Subscription Models

RTL Group's streaming services utilize a dual revenue model, combining advertising revenue with subscription fees. The balance between these two streams plays a crucial role in overall profitability.

- Breakdown of revenue sources: The exact revenue split between advertising and subscriptions varies but it's likely a significant portion of revenue comes from advertising, at least in the near term.

- Comparison of subscription pricing models to competitors: RTL Group needs to carefully consider its subscription pricing compared to major competitors to maintain a competitive edge.

- Effectiveness of advertising integration: Effective ad integration without impacting user experience is vital to maximizing advertising revenue without alienating subscribers.

Technological Infrastructure and Costs

The technological infrastructure required to deliver streaming services incurs significant costs, including server maintenance, bandwidth, and cybersecurity. Technological efficiency plays a key role in minimizing these costs and enhancing user experience.

- Estimates of infrastructure costs: The costs associated with maintaining and upgrading the necessary infrastructure represent a significant portion of the overall operational expenses.

- Technological advancements implemented: Investments in technologies that enhance compression, improve streaming quality, and personalize content delivery can contribute to cost optimization and improved user experience.

- Impact of technological efficiency on profitability: Efficient technology directly impacts profitability by reducing operational costs and improving the user experience, leading to better subscriber acquisition and retention.

Profitability Forecast and Timeline

Predicting the exact timeline for RTL Group's streaming profitability is challenging due to the dynamic nature of the market. However, a reasonable forecast can be constructed based on the analysis above.

- Projected subscriber numbers for the next 3-5 years: [Insert projected subscriber numbers here, with justification based on previous analysis and market trends. Consider a range of scenarios: best-case, worst-case, and most likely].

- Estimated revenue and expense figures: [Provide estimated revenue and expense figures for the same period, justifying the projections based on previous sections.]

- Projected profitability timeline: Based on the projected revenue and expenses, it is possible to forecast a profitability timeline. [Provide a timeline, including ranges for different scenarios.]

Conclusion

This analysis of RTL Group's streaming profitability reveals a complex picture influenced by fierce competition, content investment, and technological advancements. While the path to profitability is not without challenges, strategic content acquisition, effective monetization strategies, and technological efficiencies could significantly accelerate the timeline. Continued monitoring of RTL Group's strategic moves and market performance is crucial for accurate forecasting of their future success in the streaming landscape. Stay informed on the latest developments regarding RTL Group streaming profitability and its impact on the broader media landscape.

Featured Posts

-

Mission Patrimoine 2025 Plouzane Et Clisson Des Projets De Restauration En Bretagne

May 21, 2025

Mission Patrimoine 2025 Plouzane Et Clisson Des Projets De Restauration En Bretagne

May 21, 2025 -

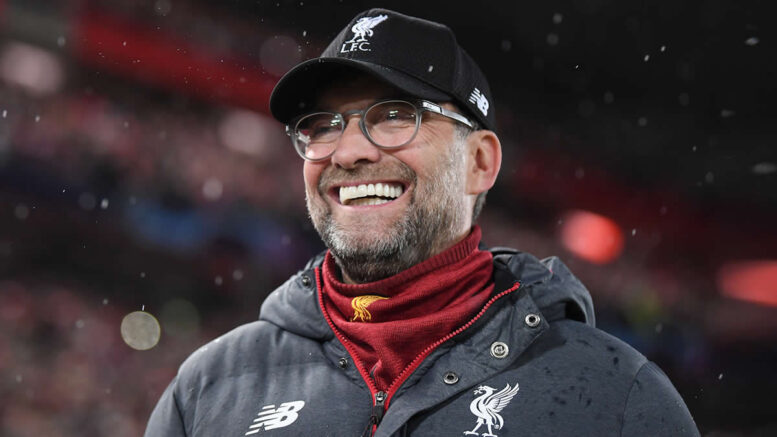

Klopps Liverpool Transforming Doubters Into Believers A Journey

May 21, 2025

Klopps Liverpool Transforming Doubters Into Believers A Journey

May 21, 2025 -

Patra Efimeries Giatron Savvatokyriako 12 13 Aprilioy

May 21, 2025

Patra Efimeries Giatron Savvatokyriako 12 13 Aprilioy

May 21, 2025 -

Barclay Center Concert Vybz Kartels April Nyc Show Confirmed

May 21, 2025

Barclay Center Concert Vybz Kartels April Nyc Show Confirmed

May 21, 2025 -

Antiques Roadshow Stolen Treasures Result In Criminal Charges

May 21, 2025

Antiques Roadshow Stolen Treasures Result In Criminal Charges

May 21, 2025

Latest Posts

-

Couple Arrested Following Antiques Roadshow Appearance National Treasure Case

May 22, 2025

Couple Arrested Following Antiques Roadshow Appearance National Treasure Case

May 22, 2025 -

Antiques Roadshow Appraisal Leads To Arrest For National Treasure Trafficking

May 22, 2025

Antiques Roadshow Appraisal Leads To Arrest For National Treasure Trafficking

May 22, 2025 -

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025

Couple Arrested Following Antiques Roadshow Stolen Goods Discovery

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025