Ryan Reynolds' MNTN: Imminent IPO Launch

Table of Contents

MNTN: A Deep Dive into the Brand and its Potential

MNTN isn't your average sports drink. Its unique selling proposition (USP) lies in its commitment to premium ingredients, a direct-to-consumer (DTC) sales model, and, of course, the undeniable star power of its founder. Unlike mass-produced competitors loaded with artificial sweeteners and colors, MNTN focuses on a cleaner, more natural formula appealing to health-conscious consumers. The DTC model allows for tighter control over branding, customer relationships, and ultimately, profitability.

The target market is discerning consumers seeking a higher-quality alternative to mainstream sports drinks. This demographic is actively engaged online, making MNTN’s digital marketing strategies highly effective. The brand has skillfully leveraged influencer marketing, particularly through Reynolds' own vast social media reach, to create a significant buzz and brand loyalty.

MNTN's key strengths contribute significantly to the anticipation surrounding the Ryan Reynolds' MNTN IPO:

- High-quality ingredients: A focus on natural ingredients sets it apart from competitors.

- Strong brand identity: The association with Ryan Reynolds instantly lends credibility and appeal.

- Effective digital marketing: Clever campaigns have generated considerable brand awareness and engagement.

- Direct-to-consumer sales model: Provides control over pricing, distribution, and customer relationships.

The Anticipated MNTN IPO: What Investors Should Know

An IPO, or Initial Public Offering, is the process of a private company offering shares of its stock to the public for the first time. This allows the company to raise capital for growth and expansion while providing investors with an opportunity to own a piece of the company. The MNTN IPO valuation is eagerly awaited, with projections suggesting substantial growth potential based on the brand's performance to date.

Investor interest is driven by several factors:

- Strong brand growth: MNTN has already demonstrated impressive sales and market penetration.

- Celebrity appeal: Ryan Reynolds’ involvement adds a significant layer of appeal and market recognition.

- Unique product offering: The premium, natural formula differentiates MNTN in a crowded market.

However, potential investors should also consider potential risks:

- Market competition: The sports drink market is highly competitive, with established players holding significant market share.

- Financial performance: While growth is promising, future financial performance is not guaranteed.

- Regulatory considerations: Compliance with regulations concerning food and beverage products is crucial.

- Overall market conditions: Economic downturns can significantly impact consumer spending and IPO performance.

Key factors to consider before investing in the Ryan Reynolds' MNTN IPO include carefully analyzing market competition, reviewing MNTN's financial performance and projections, understanding regulatory considerations, and assessing the overall market conditions.

Ryan Reynolds' Role and Influence on MNTN's Success

Ryan Reynolds' involvement extends far beyond a mere celebrity endorsement. He's deeply ingrained in MNTN's development, acting as a strategic investor, advisor, and brand ambassador. His marketing strategies, utilizing his massive social media following and sharp wit, have played a pivotal role in building brand awareness and generating excitement. His entrepreneurial reputation and network have also likely been instrumental in securing investors and partnerships.

Reynolds' contributions can be summarized as follows:

- Brand ambassador and spokesperson: His image and personality are integral to MNTN's marketing.

- Strategic investor and advisor: He provides invaluable guidance and support to the company's leadership.

- Leveraging personal brand and network: His extensive network opens doors to opportunities and partnerships.

The Future of MNTN Post-IPO

The Ryan Reynolds' MNTN IPO marks a significant milestone, but it's also a springboard for future growth. Post-IPO, we can anticipate MNTN to aggressively pursue expansion plans, potentially including:

- Product diversification: Introducing new flavors, formats, or complementary products.

- International expansion: Bringing MNTN to new markets worldwide.

- Strategic partnerships and acquisitions: Collaborating with other brands or acquiring complementary businesses.

These strategic moves will further solidify MNTN’s position in the market and create significant long-term value for investors.

Conclusion: Is Investing in Ryan Reynolds' MNTN IPO Right for You?

The upcoming Ryan Reynolds' MNTN IPO presents a compelling investment opportunity, fueled by a strong brand, a unique product, and the celebrity appeal of its founder. However, as with any investment, potential rewards come with inherent risks. Thorough due diligence is crucial before making any investment decision. Carefully weigh the potential benefits against the risks outlined above. Consider your personal risk tolerance and investment goals before committing to the Ryan Reynolds' MNTN IPO. Stay updated on the latest developments and conduct your own comprehensive research to make an informed investment choice. [Link to relevant financial news sources or MNTN investor relations (if available)].

Featured Posts

-

Ufc 315 Muhammad Vs Della Maddalena Odds Predictions And Betting Analysis

May 11, 2025

Ufc 315 Muhammad Vs Della Maddalena Odds Predictions And Betting Analysis

May 11, 2025 -

The Most Profitable Dividend Investing Strategy Simplicity Wins

May 11, 2025

The Most Profitable Dividend Investing Strategy Simplicity Wins

May 11, 2025 -

Potential Tariffs On Aircraft And Engines Examining Trumps Trade Policy

May 11, 2025

Potential Tariffs On Aircraft And Engines Examining Trumps Trade Policy

May 11, 2025 -

Ditinstvo Printsa Endryu Fotografiyi Do 65 Richchya

May 11, 2025

Ditinstvo Printsa Endryu Fotografiyi Do 65 Richchya

May 11, 2025 -

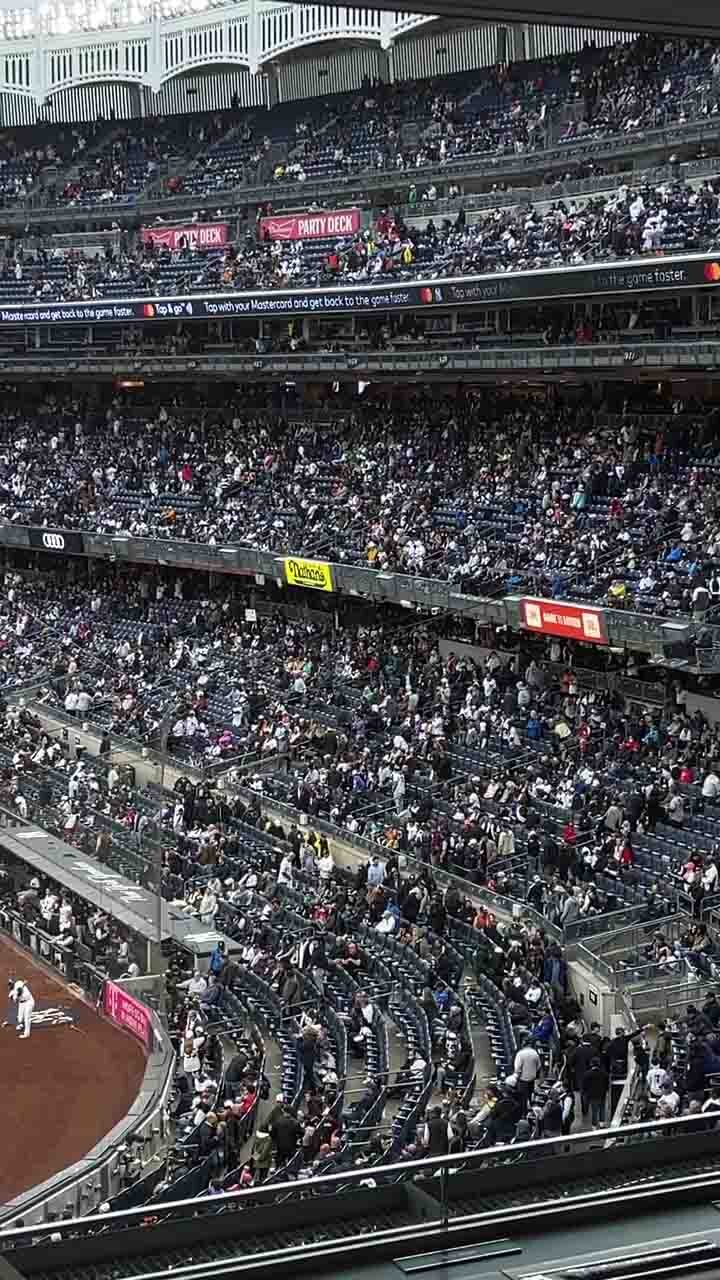

Yankees Sure Aaron Judge Is A Hall Of Famer After 1 000 Games

May 11, 2025

Yankees Sure Aaron Judge Is A Hall Of Famer After 1 000 Games

May 11, 2025