S&P 500 Reacts To US-China Trade Truce With 3%+ Increase

Table of Contents

Understanding the US-China Trade Truce and its Implications

The US-China trade truce, while not a complete resolution of the long-standing trade dispute, marked a significant de-escalation. Key aspects of the agreement included a temporary pause in the imposition of new tariffs, a commitment to further negotiations, and reciprocal concessions on various trade issues. This followed years of escalating tensions, marked by significant tariff increases on billions of dollars worth of goods, creating considerable economic uncertainty and market volatility.

- Historical Context: The trade war stemmed from concerns over trade imbalances, intellectual property theft, and unfair trade practices. Both nations imposed tariffs, disrupting global supply chains and impacting businesses worldwide.

- Key Concessions: While specifics remained somewhat opaque, the truce involved both sides making concessions, likely including reduced tariffs on certain goods and commitments to address specific trade concerns.

- Uncertainty Alleviation: The agreement, however temporary, removed the immediate threat of further tariff escalations, substantially reducing the uncertainty that had plagued markets for months and significantly improved investor sentiment. This led to a considerable increase in market confidence and subsequently the S&P 500’s positive reaction.

The S&P 500's Immediate Response to the News

Following the announcement of the trade truce, the S&P 500 experienced a sharp and swift increase. The index jumped by over 3%, representing a massive gain in market capitalization. Trading volume soared, indicating heightened investor activity and a strong positive market sentiment.

- Percentage Increase: The specific percentage increase varied depending on the timing of the announcement and the specific index calculation, but a 3%+ gain was widely reported.

- Market Sentiment: Investor sentiment shifted dramatically from fear and uncertainty to optimism and relief. This is evident in the significant increase in trading volume and the widespread positive price movement across various sectors.

- Sector Performance: Technology and industrial stocks, particularly vulnerable to the trade war's disruptions, saw particularly strong gains. This suggests investors viewed the truce as particularly beneficial to these sectors.

Analyzing the Long-Term Effects on the S&P 500

The long-term effects of the US-China trade truce on the S&P 500 and the US economy remain to be seen. However, several potential scenarios exist:

- Increased Consumer Confidence: Reduced trade uncertainty could lead to increased consumer spending and business investment, boosting economic growth.

- Global Trade Growth: The truce could contribute to greater stability and predictability in global trade, fostering economic expansion worldwide.

- Potential Risks: The truce is temporary, and further negotiations could still falter. Geopolitical risks and other economic factors could still negatively impact the market. Furthermore, the initial positive market reaction may not be fully sustained in the long run.

- Expert Opinions: Many financial analysts remain cautiously optimistic, highlighting the need for continued progress in trade negotiations. They caution against viewing the truce as a complete solution to the underlying trade issues.

Investor Strategies Following the S&P 500 Increase

The S&P 500's rally presents both opportunities and challenges for investors. A thoughtful approach is vital:

- Diversification: Diversifying investments across different asset classes and sectors is crucial to mitigate risks. Over-reliance on any single sector or investment strategy can be detrimental.

- Long-Term Perspective: Short-term market fluctuations should not overshadow long-term investment goals. A well-defined investment plan that considers your risk tolerance and financial objectives is key.

- Professional Advice: Seeking advice from a qualified financial advisor is recommended before making any significant investment decisions. This will help you assess your personal risk tolerance and tailor your approach.

Disclaimer: This article provides general information and should not be considered as financial advice. Consult a professional financial advisor before making any investment decisions.

Conclusion: The S&P 500's Future in Light of the US-China Trade Truce

The US-China trade truce has had a significant and immediate positive impact on the S&P 500, but the long-term consequences remain uncertain. While the short-term market surge offers potential opportunities, investors should maintain a balanced and diversified portfolio, carefully considering both the positive and negative factors. The future trajectory of the S&P 500 will depend heavily on the progress of ongoing trade negotiations and the broader global economic environment. To stay informed about the evolving situation and its effects on the market, follow further S&P 500 market analysis, track the S&P 500 trade impact, and consider subscribing to reputable financial news sources to stay abreast of developments that may affect your investments. Continue following the S&P 500 for critical updates on this dynamic situation.

Featured Posts

-

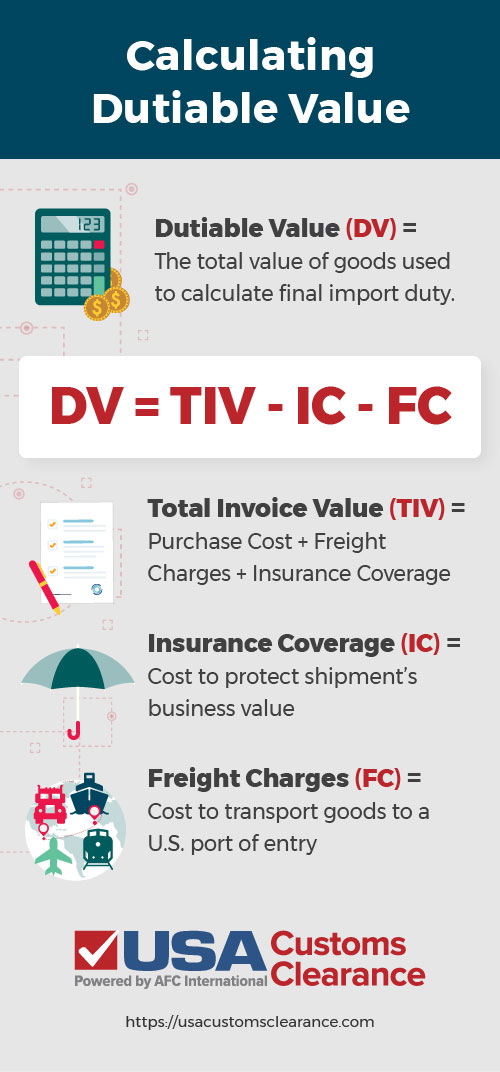

U S Customs Duty Revenue Reaches Record High Of 16 3 Billion In April

May 13, 2025

U S Customs Duty Revenue Reaches Record High Of 16 3 Billion In April

May 13, 2025 -

Trump Era Refugee Status Grants Bring White South Africans To The Us

May 13, 2025

Trump Era Refugee Status Grants Bring White South Africans To The Us

May 13, 2025 -

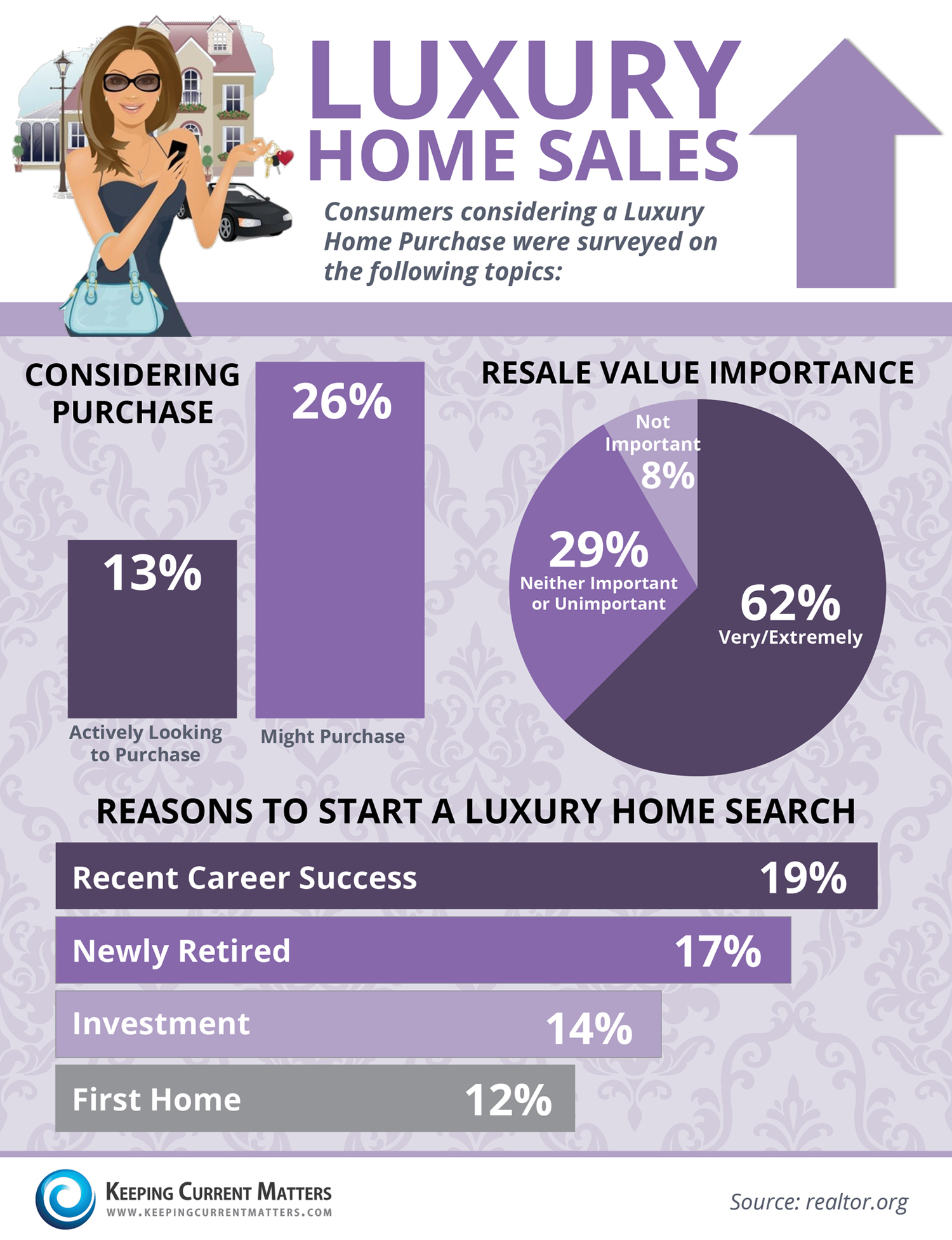

Luxury Presence Launches Hub For Off Market Home Sales

May 13, 2025

Luxury Presence Launches Hub For Off Market Home Sales

May 13, 2025 -

Arestovan Stalker Ugrozhavshiy Teraktom Seme Skarlett Yokhansson

May 13, 2025

Arestovan Stalker Ugrozhavshiy Teraktom Seme Skarlett Yokhansson

May 13, 2025 -

Schoduvel In Braunschweig Wo Sie Den Karneval 2025 Live Sehen Koennen

May 13, 2025

Schoduvel In Braunschweig Wo Sie Den Karneval 2025 Live Sehen Koennen

May 13, 2025

Latest Posts

-

Yuval Raphael Everything You Need To Know About Israels Eurovision 2025 Act

May 14, 2025

Yuval Raphael Everything You Need To Know About Israels Eurovision 2025 Act

May 14, 2025 -

Israels Eurovision 2025 Song Contestant Yuval Raphael

May 14, 2025

Israels Eurovision 2025 Song Contestant Yuval Raphael

May 14, 2025 -

Yuval Raphael Israels Eurovision 2025 Hopeful

May 14, 2025

Yuval Raphael Israels Eurovision 2025 Hopeful

May 14, 2025 -

Eurovision Chief Defends Israel Ignores Boycott Pleas

May 14, 2025

Eurovision Chief Defends Israel Ignores Boycott Pleas

May 14, 2025 -

Israel Eurovision Boycott Directors Dismissal

May 14, 2025

Israel Eurovision Boycott Directors Dismissal

May 14, 2025