S&P 500 Surge: 3%+ Gain On Trade War Tariff Relief

Table of Contents

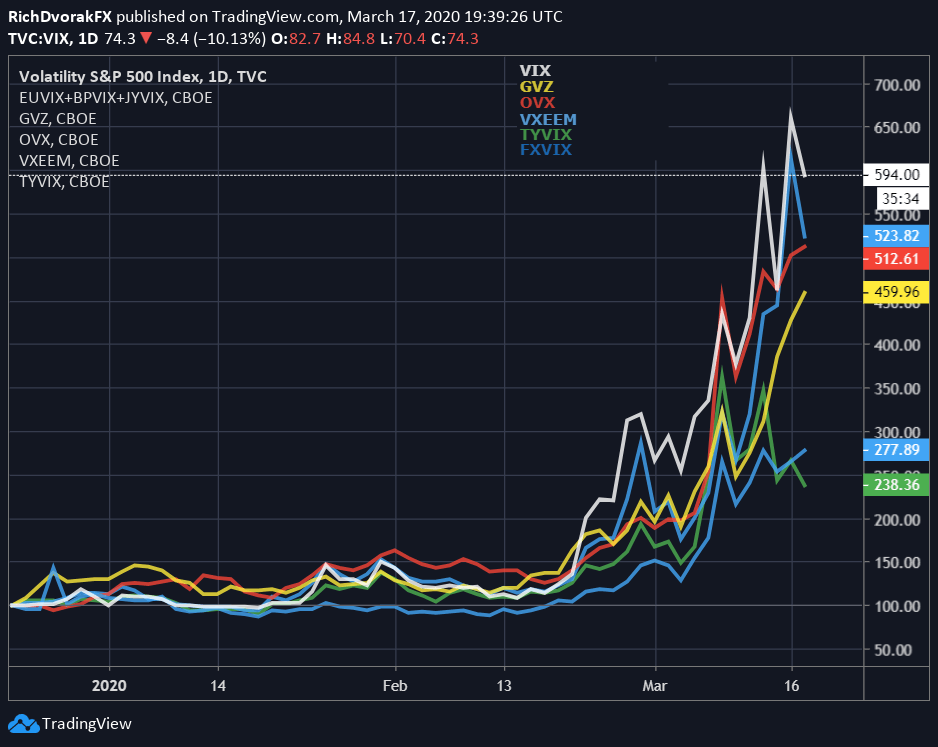

The Impact of Tariff Relief on the S&P 500

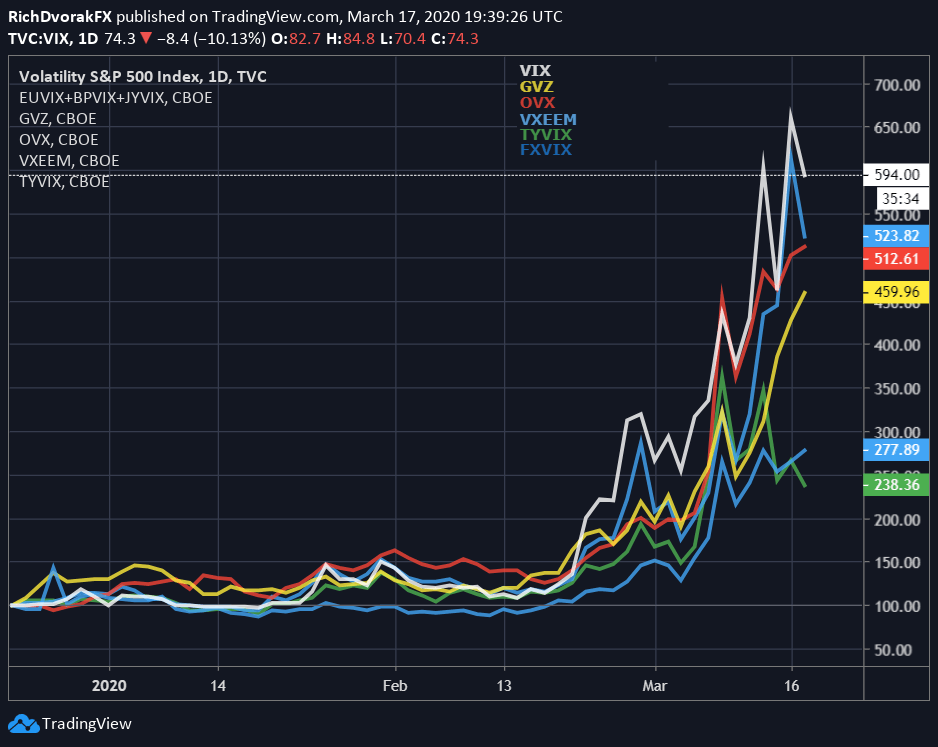

The recent surge in the S&P 500 can be largely attributed to significant progress in trade negotiations, specifically the easing of trade tensions between major global economies. The "Phase One" trade deal, for example, resulted in the reduction or removal of tariffs on various goods, significantly impacting multiple sectors. This reduction in trade barriers fostered a sense of relief and reduced uncertainty within the business community.

The economic rationale behind the market's positive reaction is multifaceted. Reduced uncertainty allows businesses to confidently plan for the future, leading to increased investment in capital projects, expansion, and hiring. Lower import costs translate to higher profit margins, boosting corporate earnings. Simultaneously, consumers benefit from lower prices on goods, increasing consumer spending and driving further economic growth. This positive feedback loop fuels a stock market rally, as investors react favorably to improved economic prospects.

- Reduced costs for businesses importing goods: Lower tariffs mean cheaper raw materials and components, improving profitability.

- Increased consumer spending due to lower prices: Reduced tariffs translate to lower prices for consumers, boosting spending and demand.

- Improved corporate profitability forecasts: Reduced uncertainty and lower costs lead to more optimistic earnings projections.

- Increased investor confidence leading to higher stock valuations: Positive economic news and improved corporate outlook drive increased investment and higher stock prices.

Sector-Specific Performance Following the S&P 500 Surge

The impact of tariff relief wasn't uniform across all sectors of the S&P 500. Certain sectors were disproportionately affected, experiencing significant gains compared to others.

The Technology sector, for instance, saw exceptional outperformance. Reduced import costs for components used in electronics manufacturing directly boosted the profitability of major tech companies. Similarly, the Retail sector experienced a surge as consumers responded to lower prices on imported goods. The Manufacturing sector also witnessed a recovery, as improved business conditions and reduced uncertainty spurred increased production and investment.

- Technology sector outperformance: Reduced import costs for components like semiconductors and displays boosted margins. Examples include companies heavily reliant on global supply chains.

- Retail sector surge: Increased consumer spending on goods with lowered tariffs drove sales and profits for major retailers.

- Manufacturing sector recovery: Improved business confidence and lower input costs spurred increased production and investment in new capacity.

Investor Sentiment and Market Outlook Post-S&P 500 Rally

The S&P 500 surge marked a significant shift in investor sentiment. A wave of optimism replaced previous concerns about protracted trade wars and their economic consequences. Risk appetite increased, leading to higher investment in equities. Many analysts now hold a more bullish outlook for the S&P 500, predicting continued growth based on the positive economic effects of tariff relief.

However, it's crucial to acknowledge potential risks. Geopolitical uncertainty, economic slowdowns in other regions, and unforeseen domestic challenges could still impact future growth. While the immediate outlook is positive, caution remains warranted.

- Increased optimism regarding future economic growth: The tariff relief is seen as a catalyst for stronger economic performance.

- Potential for further market gains: Continued progress in trade negotiations could further fuel market growth.

- Risks associated with geopolitical uncertainty and other economic factors: Unforeseen events could still negatively impact market performance.

Conclusion: Understanding the S&P 500 Surge and its Implications

The 3%+ gain in the S&P 500 was primarily driven by significant tariff relief, significantly impacting various sectors and boosting investor confidence. The reduction in trade barriers fueled increased business investment, consumer spending, and improved corporate profitability, creating a positive feedback loop that propelled the market higher.

While the current outlook is positive, it is essential to monitor ongoing trade negotiations and other economic factors that could influence future market performance. The S&P 500's response to future trade developments will be crucial to its long-term trajectory.

Call to action: Stay informed about the S&P 500's response to future trade developments. Monitor the S&P 500 for further market insights and learn more about how trade policies affect the S&P 500 to make informed investment decisions.

Featured Posts

-

Tuckers Home Run And More Mlb Prop Bets For April 26th

May 13, 2025

Tuckers Home Run And More Mlb Prop Bets For April 26th

May 13, 2025 -

Nba Draft Lottery 2024 Toronto Raptors Odds And Cooper Flagg Projection

May 13, 2025

Nba Draft Lottery 2024 Toronto Raptors Odds And Cooper Flagg Projection

May 13, 2025 -

Sicherheitsalarm An Braunschweiger Schule Kinder In Sicherheit

May 13, 2025

Sicherheitsalarm An Braunschweiger Schule Kinder In Sicherheit

May 13, 2025 -

The Implications Of A U S China Tariff Rollback For American Businesses And Consumers

May 13, 2025

The Implications Of A U S China Tariff Rollback For American Businesses And Consumers

May 13, 2025 -

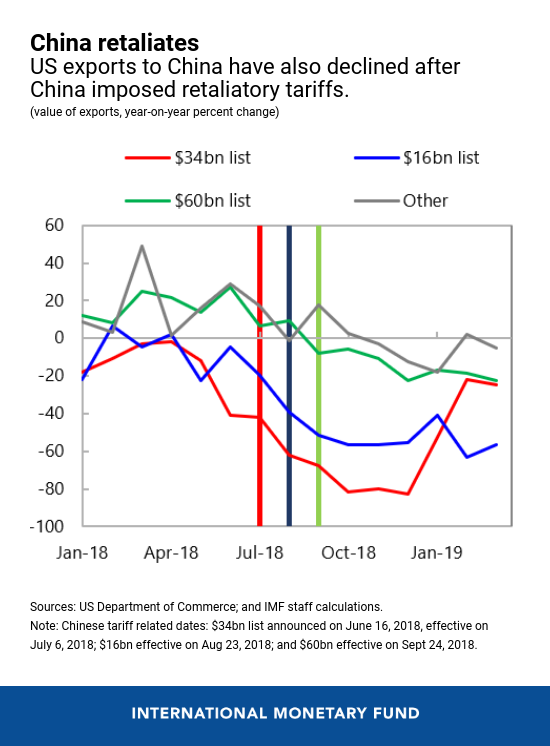

Sabalenkas Miami Open Victory A Dominant Performance Against Pegula

May 13, 2025

Sabalenkas Miami Open Victory A Dominant Performance Against Pegula

May 13, 2025

Latest Posts

-

Swedens Eurovision 2024 Chances A Strong Contender

May 14, 2025

Swedens Eurovision 2024 Chances A Strong Contender

May 14, 2025 -

Boycott Eurovision Protests Target Rte And Bbc Broadcasting

May 14, 2025

Boycott Eurovision Protests Target Rte And Bbc Broadcasting

May 14, 2025 -

Boycott Eurovision In Israel Director Responds To Criticism

May 14, 2025

Boycott Eurovision In Israel Director Responds To Criticism

May 14, 2025 -

Tommy Fury Rejects Jake Pauls 3 Million Offer Feud Reignited

May 14, 2025

Tommy Fury Rejects Jake Pauls 3 Million Offer Feud Reignited

May 14, 2025 -

Eurovision 2025 Dates Participants And The United Kingdoms Entry

May 14, 2025

Eurovision 2025 Dates Participants And The United Kingdoms Entry

May 14, 2025