Sabic Explores IPO For Its Gas Business: A Potential Saudi Arabian Market Game Changer

Table of Contents

Sabic's Gas Business: A Deep Dive

Sabic's gas business is a significant component of its overall portfolio, playing a crucial role in Saudi Arabia's energy landscape. It boasts substantial production capacity, a wide geographical reach, and produces a range of key petrochemical products vital to various industries.

- Production Capacity: The scale of its gas processing and petrochemical production is substantial, contributing significantly to Saudi Arabia's national output. Specific figures on production capacity would need to be sourced from reliable financial reports and industry publications for inclusion here.

- Geographical Reach: The business operates both domestically and internationally, leveraging its strategic location and access to Saudi Arabia's vast gas reserves. Details on export markets and international partnerships are needed for a more complete picture.

- Key Products: The gas business produces a variety of essential petrochemicals used in diverse applications such as plastics, fertilizers, and other industrial products. Listing these key products with their applications will enhance the article's relevance and SEO.

- Strategic Importance: The gas business is not only economically significant but also strategically important for Sabic's overall operations and for Saudi Arabia's energy security. Further elaboration on its contribution to downstream operations and the national economy is required.

- Partnerships and Joint Ventures: Any major collaborative efforts with other companies (perhaps including Saudi Aramco) should be highlighted, emphasizing the synergistic benefits and network effects. Keywords: Sabic gas production, petrochemical production, gas processing, Saudi gas reserves, downstream operations.

The Potential Benefits of an IPO

An IPO of Sabic's gas business offers several potential benefits for both the company and the Saudi Arabian economy.

- Financial Benefits for Sabic: The IPO could generate significant capital for expansion projects, enabling further growth and technological advancements. It also presents an opportunity to reduce debt and enhance shareholder value by increasing liquidity and market valuation.

- Benefits for the Saudi Arabian Market: Increased foreign investment is a key anticipated outcome, attracting international investors interested in the lucrative Saudi Arabian energy sector. This inflow of capital could stimulate job creation, contribute to economic diversification, and drive further development. Keywords: IPO benefits, capital raising, foreign investment in Saudi Arabia, economic diversification, Saudi investment opportunities, shareholder value.

- Attracting International Investors: The IPO is likely to attract significant interest from international investors seeking exposure to the growing Saudi Arabian energy market and its substantial gas reserves. High market interest could translate to a highly successful IPO and boost the Saudi economy.

Challenges and Risks Associated with the IPO

Despite the potential benefits, several challenges and risks are associated with a Sabic gas business IPO.

- Global Market Volatility: Fluctuations in oil and gas prices represent a significant risk, potentially impacting the valuation and attractiveness of the IPO.

- Geopolitical Risks: Regional instability and geopolitical events could negatively affect investor sentiment and market confidence.

- Regulatory Hurdles: Navigating the regulatory landscape and complying with all necessary requirements represents a significant challenge.

- Competition: The competitive landscape within the Saudi and global petrochemical markets needs careful consideration, including potential challenges from established players and new entrants. Keywords: IPO risks, market volatility, geopolitical risks, regulatory compliance, oil price fluctuations, competition in petrochemicals.

Impact on the Saudi Arabian Economy and Vision 2030

The potential IPO aligns directly with Saudi Vision 2030's ambitious goals for economic diversification and private sector growth.

- Economic Diversification: The IPO contributes to reducing Saudi Arabia's reliance on oil revenues by fostering growth in the private sector and related industries.

- Private Sector Growth: The IPO supports the Vision 2030 initiative of boosting the private sector's contribution to the Saudi economy.

- Employment: The expansion and growth stimulated by the IPO are likely to create significant employment opportunities within the energy sector and related industries.

- Long-Term Implications: The long-term impact on the Saudi Arabian energy sector and its global competitiveness will be significant, shaping the nation's role within the international energy market. Keywords: Saudi Vision 2030, economic diversification, private sector growth, Saudi energy sector, national development plans.

Conclusion: The Future of Sabic and the Saudi Arabian Market

The proposed Sabic gas business IPO presents a complex scenario with substantial potential benefits and risks. While it offers opportunities for significant capital raising, economic diversification, and alignment with Vision 2030, it also faces challenges posed by global market volatility, geopolitical risks, and intense competition. The success of the IPO hinges on effective management of these risks and strategic leveraging of the considerable opportunities. The outcome will significantly shape the future of Sabic, the Saudi Arabian market, and the global petrochemical industry. Stay tuned for updates on the Sabic gas business IPO and its potential to reshape the Saudi Arabian market. Follow us for more insights into this game-changing development in the Saudi petrochemical industry. Keywords: Sabic IPO outlook, Saudi Arabian economic future, petrochemical market trends, investment prospects.

Featured Posts

-

Todays Nyt Connections Hints And Answers May 8 Puzzle 697

May 19, 2025

Todays Nyt Connections Hints And Answers May 8 Puzzle 697

May 19, 2025 -

Red Carpet Rules Guest Violations And Their Consequences Cnn

May 19, 2025

Red Carpet Rules Guest Violations And Their Consequences Cnn

May 19, 2025 -

Eurovision Song Contest 2025 Location Dates And Everything You Need To Know

May 19, 2025

Eurovision Song Contest 2025 Location Dates And Everything You Need To Know

May 19, 2025 -

The Importance Of Middle Managers Fostering Collaboration And Achieving Business Goals

May 19, 2025

The Importance Of Middle Managers Fostering Collaboration And Achieving Business Goals

May 19, 2025 -

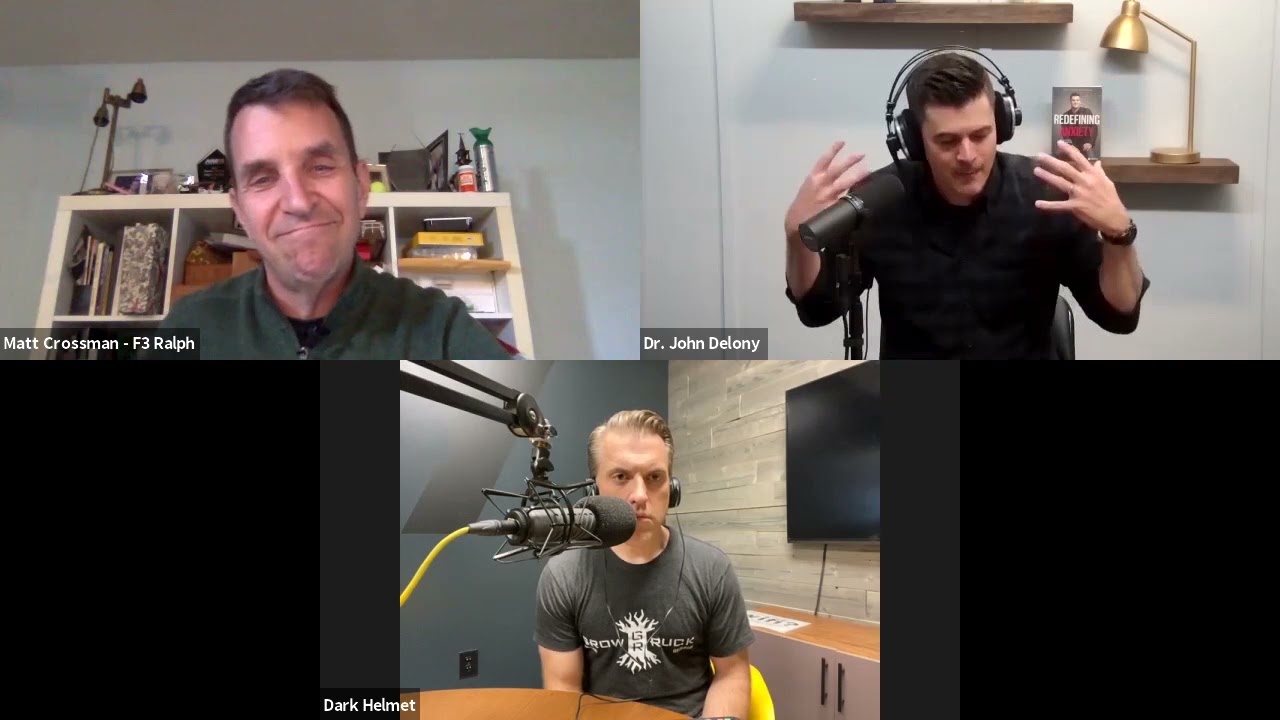

Millions Listen Unpacking Dr John Delonys Unique Podcast Style

May 19, 2025

Millions Listen Unpacking Dr John Delonys Unique Podcast Style

May 19, 2025

Latest Posts

-

A List Husband Starving Wife Income Disparity In Celebrity Marriages

May 19, 2025

A List Husband Starving Wife Income Disparity In Celebrity Marriages

May 19, 2025 -

Are We Saying Goodbye To A Saturday Night Live Star

May 19, 2025

Are We Saying Goodbye To A Saturday Night Live Star

May 19, 2025 -

Starving Artist Wife The Financial Realities Of An A List Marriage

May 19, 2025

Starving Artist Wife The Financial Realities Of An A List Marriage

May 19, 2025 -

Saturday Night Live Quitting Rumors Swirl Around Popular Cast Member

May 19, 2025

Saturday Night Live Quitting Rumors Swirl Around Popular Cast Member

May 19, 2025 -

Is A Beloved Saturday Night Live Cast Member Departing

May 19, 2025

Is A Beloved Saturday Night Live Cast Member Departing

May 19, 2025