Safe-Haven Demand Pushes Gold Higher After Trump's Actions Against The EU

Table of Contents

Trump's Actions and Market Volatility

Trump's aggressive trade policies targeting the EU, including increased trade tariffs and threats of further sanctions, have created significant market instability. This escalation of the trade war has fueled considerable uncertainty, impacting investor confidence and creating a climate of risk aversion.

- Increased trade tariffs and their impact on global trade: The imposition of hefty tariffs on various goods has disrupted established supply chains, increasing costs for businesses and consumers alike. This has led to a slowdown in global trade growth and dampened economic outlook.

- Uncertainty surrounding future trade agreements: The unpredictable nature of Trump's trade policies leaves businesses uncertain about future trade relations, hindering investment and long-term planning. This uncertainty is a major driver of market volatility.

- Negative impact on investor confidence: The ongoing trade disputes have eroded investor confidence, leading to a sell-off in stocks and other riskier assets. This "risk-off" sentiment further exacerbates market corrections.

- Increased market volatility and uncertainty: The combination of these factors has resulted in significantly increased market volatility, making it challenging for investors to predict market movements and manage their portfolios effectively.

This volatility fuels a flight to safety, as investors seek refuge in assets perceived as less susceptible to market fluctuations. Gold, with its long history as a safe-haven asset, has become a primary beneficiary of this trend. Related keywords: trade war, economic sanctions, market correction, risk aversion.

Gold as a Safe-Haven Asset

Gold has historically served as a reliable safe haven during times of economic and geopolitical turmoil. Its inherent properties make it an attractive investment during periods of uncertainty.

- Gold's non-correlation with traditional assets (stocks and bonds): Unlike stocks and bonds, gold often moves independently of traditional markets. This lack of correlation makes it a valuable tool for portfolio diversification, reducing overall portfolio risk.

- Tangible asset providing protection against inflation: Gold is a tangible asset, meaning it holds intrinsic value and is not subject to the same risks as fiat currencies. It has historically served as an effective inflation hedge, protecting purchasing power during periods of rising prices.

- Its historically proven resilience during economic downturns: Throughout history, gold has demonstrated remarkable resilience during economic downturns, often appreciating in value while other assets decline. This makes it an attractive investment during times of crisis.

- Use of gold as a diversification strategy: Adding gold to a diversified investment portfolio can help mitigate risk and potentially improve overall returns. It acts as a buffer against market downturns, offering stability and security.

Related keywords: portfolio diversification, inflation protection, hedge against risk, precious metal investment.

Increased Investor Demand for Gold

The recent market instability has spurred a significant increase in investor demand for gold across various segments.

- Increased demand from central banks: Central banks worldwide have been steadily increasing their gold reserves, recognizing gold's importance as a safe-haven asset and a store of value.

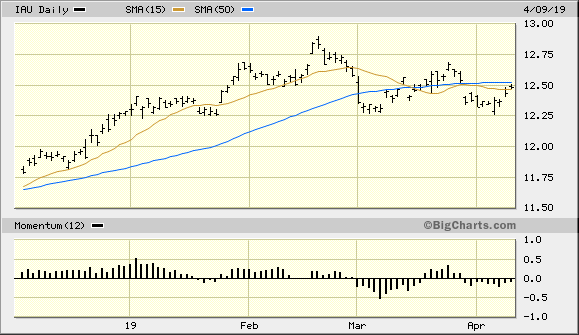

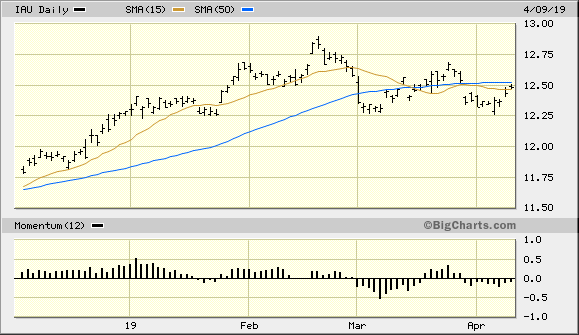

- Rise in gold ETF holdings: Gold exchange-traded funds (gold ETFs) have experienced a surge in inflows, reflecting growing investor interest in accessing the gold market through easily tradable instruments.

- Growing interest in physical gold purchases: Individual investors are also increasingly purchasing physical gold in the form of gold bullion, coins, and bars, seeking direct ownership of this precious metal.

- Impact of this increased demand on gold prices: The combined effect of increased demand from central banks, ETFs, and individual investors has driven gold prices significantly higher.

Related keywords: gold ETFs, physical gold, gold bullion, central bank gold reserves, investment demand.

Impact on Other Precious Metals

The increased safe-haven demand for gold has also had a positive spillover effect on other precious metals, although the extent varies.

- Correlation between gold and other precious metals: While gold is the most prominent safe-haven asset, other precious metals like silver, platinum, and palladium often exhibit some correlation with gold prices.

- Relative price movements: The price movements of these metals are not always perfectly aligned with gold, but they often follow a similar trend, particularly during periods of heightened market uncertainty.

- Investment opportunities in related precious metals: Investors seeking exposure to the precious metals market may find investment opportunities in silver, platinum, and palladium, depending on their individual risk tolerance and investment goals.

Related keywords: silver price, platinum price, palladium price, precious metals investment.

Conclusion

Trump's actions against the EU have undeniably fueled a surge in safe-haven demand, pushing gold prices to new heights. This highlights the enduring value of gold as a hedge against market volatility and geopolitical uncertainty. The increased demand from central banks, ETFs, and individual investors underscores gold's critical role in diversifying investment portfolios and protecting wealth during times of economic and political instability.

Given the current geopolitical climate and market instability, now is a crucial time to consider adding gold to your investment portfolio as a safe-haven asset. Learn more about diversifying your investments with gold and explore the various ways to invest in this precious metal to protect your wealth from future market uncertainties. Consider exploring safe-haven demand strategies to safeguard your finances.

Featured Posts

-

Jenson Fw 22 Extended Details And New Arrivals

May 26, 2025

Jenson Fw 22 Extended Details And New Arrivals

May 26, 2025 -

Ahtjajat Mtwaslt Fy Tl Abyb Litlaq Srah Alasra

May 26, 2025

Ahtjajat Mtwaslt Fy Tl Abyb Litlaq Srah Alasra

May 26, 2025 -

Desinformation La Rtbf Et La Journee Mondiale Du Fact Checking

May 26, 2025

Desinformation La Rtbf Et La Journee Mondiale Du Fact Checking

May 26, 2025 -

Fascisms Resurgence Delaware Governors Perspective In The Post Biden Trump Era

May 26, 2025

Fascisms Resurgence Delaware Governors Perspective In The Post Biden Trump Era

May 26, 2025 -

Sg Wireless Expanded Manufacturing Partnerships A Solution For Oems

May 26, 2025

Sg Wireless Expanded Manufacturing Partnerships A Solution For Oems

May 26, 2025

Latest Posts

-

Meilleur Prix Samsung Galaxy S25 512 Go 985 56 E

May 28, 2025

Meilleur Prix Samsung Galaxy S25 512 Go 985 56 E

May 28, 2025 -

Understanding Personal Loan Interest Rates Today

May 28, 2025

Understanding Personal Loan Interest Rates Today

May 28, 2025 -

Ou Acheter Le Samsung Galaxy S25 256 Go Au Meilleur Prix

May 28, 2025

Ou Acheter Le Samsung Galaxy S25 256 Go Au Meilleur Prix

May 28, 2025 -

Test Et Avis Samsung Galaxy S25 256 Go Un Bon Plan A Saisir

May 28, 2025

Test Et Avis Samsung Galaxy S25 256 Go Un Bon Plan A Saisir

May 28, 2025 -

Check Todays Personal Loan Interest Rates Quick And Easy

May 28, 2025

Check Todays Personal Loan Interest Rates Quick And Easy

May 28, 2025