Sasol (SOL) 2023 Strategy Update: What Investors Need To Know

Table of Contents

Operational Efficiency and Cost Optimization

Sasol's 2023 strategy heavily emphasizes boosting operational efficiency and slashing costs. This is a vital aspect of their plan to enhance profitability and shareholder value. The company is pursuing this goal through several key initiatives.

Production Enhancements

Sasol is implementing several projects aimed at improving production processes and leveraging technological upgrades to reduce operational costs. These efforts are designed to increase output while simultaneously lowering the cost per unit.

- Lake Charles Chemicals Project Optimization: Sasol is focusing on optimizing the Lake Charles Chemicals Project to maximize its efficiency and reduce operational costs. This includes improvements to process control and waste reduction strategies. They aim for a 15% reduction in operational expenses by Q4 2024.

- Digitalization Initiatives: The implementation of advanced digital technologies across their operations is improving real-time monitoring, predictive maintenance, and overall process optimization. This is leading to significant reductions in downtime and maintenance costs.

- Target Production Increase: Sasol aims to increase production across its various segments by at least 10% by the end of 2024, driven by these efficiency improvements. This increase is expected to positively impact profit margins.

These improvements in Sasol production and the related cost reduction strategies are central to the overall Sasol (SOL) strategy.

Supply Chain Optimization

Streamlining the supply chain is another crucial element of Sasol's cost-optimization strategy. By improving logistics and mitigating supply chain risks, Sasol aims to minimize disruptions and reduce costs.

- Strategic Partnerships: Sasol is forging strategic partnerships with key suppliers to ensure reliable access to raw materials and reduce transportation costs. These partnerships aim to provide price stability and reduce potential supply chain disruptions.

- Inventory Management: Improved inventory management systems are helping to reduce warehousing costs and minimize waste. This is part of a broader effort to optimize the entire Sasol supply chain.

- Enhanced Logistics: Investments in advanced logistics technologies are aimed at optimizing transportation routes, reducing transit times, and minimizing logistical bottlenecks.

These supply chain optimization efforts are vital for the long-term success of the Sasol (SOL) strategy.

Growth and Expansion Strategies

Sasol's 2023 strategy also focuses on strategic growth and expansion, both organically and through acquisitions. These initiatives aim to diversify revenue streams and create new avenues for growth.

New Projects and Investments

Sasol is actively pursuing several new projects and investments to drive future growth. These projects are carefully selected based on their potential for high returns on investment (ROI).

- Renewable Energy Investments: Sasol is investing in renewable energy projects, aligning with the global shift towards cleaner energy sources. This diversification strategy reduces reliance on traditional fossil fuels.

- Expansion in Key Markets: Sasol is targeting expansion into high-growth markets, leveraging its expertise in chemicals and energy to capitalize on emerging opportunities. This market expansion strategy is key to long-term growth.

- Expected ROI: The company projects an aggregate ROI of over 15% across all new projects and investments within the next five years. This target represents a key performance indicator for the success of their expansion.

These Sasol investments are vital for ensuring sustainable growth and are a cornerstone of the overall Sasol (SOL) strategy.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions are playing a key role in Sasol's growth strategy. These collaborations and acquisitions expand Sasol's market reach and technological capabilities.

- Technology Licensing Agreements: Sasol is actively pursuing technology licensing agreements to access cutting-edge technologies and accelerate innovation. This strategy helps to maintain a competitive edge.

- Joint Ventures: Sasol is exploring joint ventures with other companies to leverage their expertise and resources in specific areas. These joint ventures aim to reduce individual risk and generate significant synergy benefits.

- Potential Acquisitions: Sasol is actively evaluating potential acquisition targets that align with their growth strategy and provide strategic benefits. These acquisitions aim to strengthen their competitive position and open new avenues for growth.

Financial Performance and Outlook

Sasol's updated 2023 strategy aims to significantly improve financial performance. The company is focusing on debt management, capital allocation, and improving key financial metrics.

Financial Projections and Guidance

Sasol's financial projections point towards a significant improvement in revenue and profit margins in the coming years. The company's guidance indicates strong revenue growth and improved operational efficiency.

- Revenue Growth Targets: Sasol projects double-digit revenue growth over the next three years, driven by increased production and market expansion.

- Improved Profit Margins: The company anticipates a substantial improvement in profit margins, fueled by cost reductions and higher production volumes.

- Stock Performance: The implementation of the new strategy is expected to positively impact Sasol's stock performance, making it an attractive investment opportunity for investors.

This Sasol financials outlook shows a clear commitment to financial success.

Debt Management and Capital Allocation

Sasol is committed to sound debt management and efficient capital allocation to maximize shareholder returns. Their strategy focuses on debt reduction and strategic investments.

- Debt Reduction Plan: Sasol is actively implementing a debt reduction plan to strengthen its balance sheet and improve its financial flexibility. This strategy is crucial for long-term stability.

- Capital Allocation Priorities: The company prioritizes investments in high-return projects and organic growth opportunities. This focused approach is key to maximizing shareholder value.

- Dividend Policy: Sasol maintains a commitment to a sustainable dividend policy, returning value to shareholders while maintaining financial health. This policy reflects a commitment to shareholder returns.

Conclusion

This article provided a comprehensive overview of Sasol's (SOL) updated 2023 strategy. We explored key areas such as operational efficiency improvements, growth initiatives, and financial projections. Understanding these elements is crucial for investors to make informed decisions regarding their Sasol (SOL) investments.

Call to Action: Stay informed about the evolving Sasol (SOL) strategy by regularly reviewing company announcements and market analysis. Understanding the Sasol (SOL) strategy is essential for successful investment. Continue researching the Sasol (SOL) strategy to make informed investment choices.

Featured Posts

-

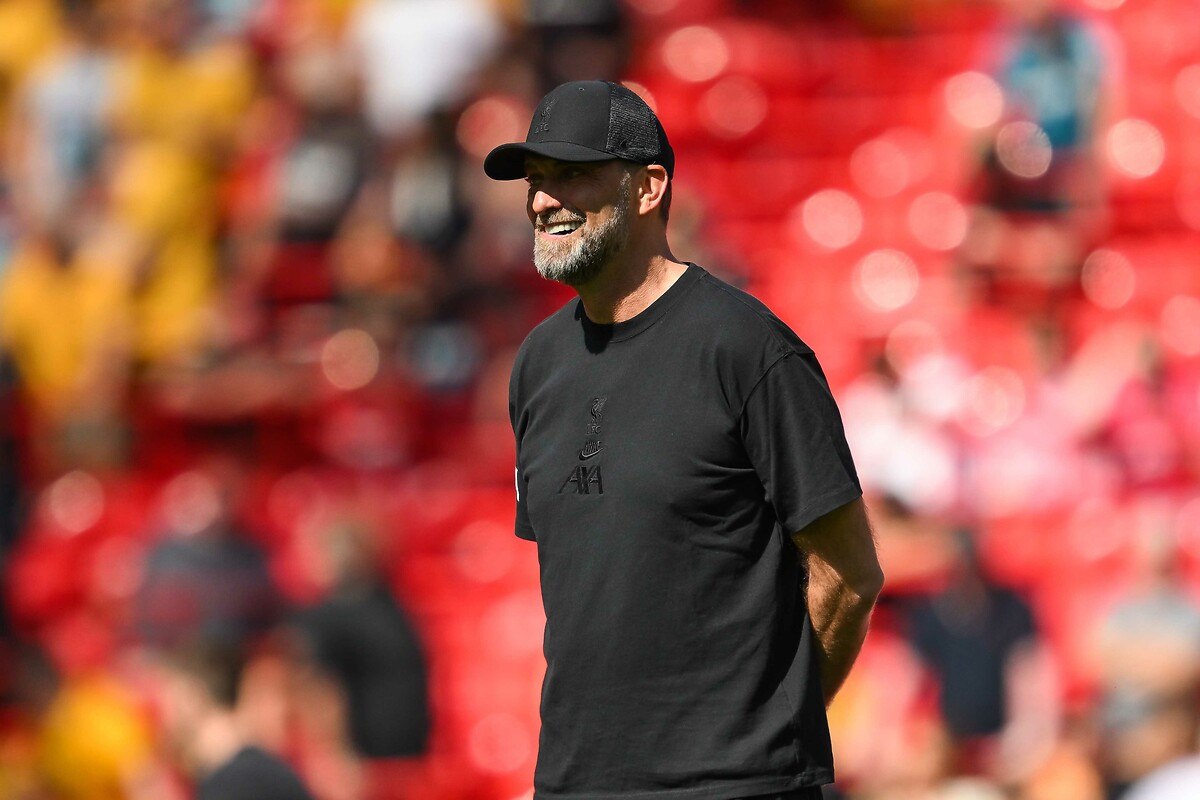

Carlo Ancelotti Den Juergen Klopp A Bir Teknik Direktoer Degisimi Analizi

May 21, 2025

Carlo Ancelotti Den Juergen Klopp A Bir Teknik Direktoer Degisimi Analizi

May 21, 2025 -

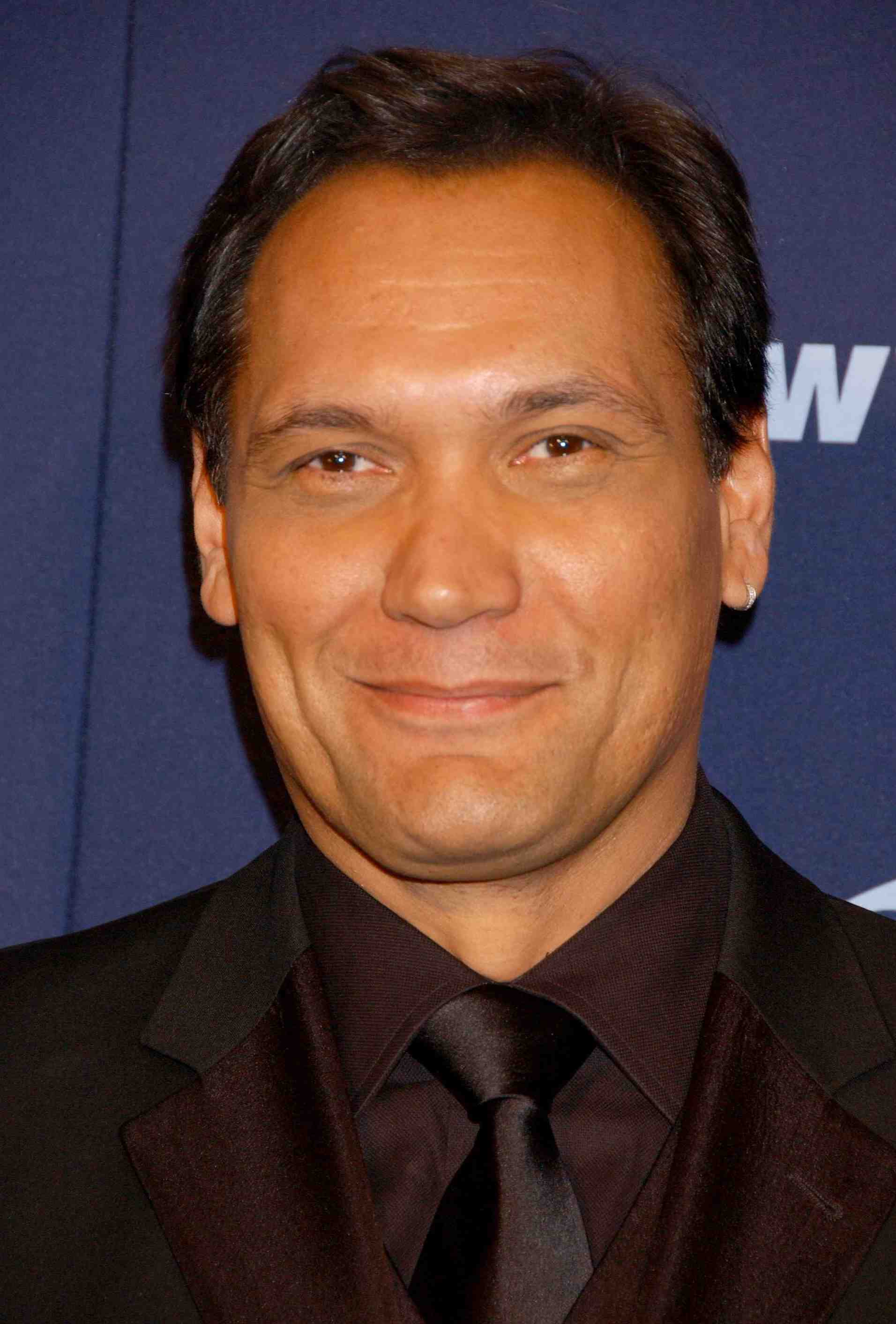

Confirmation John Lithgow And Jimmy Smits In Dexter Resurrection

May 21, 2025

Confirmation John Lithgow And Jimmy Smits In Dexter Resurrection

May 21, 2025 -

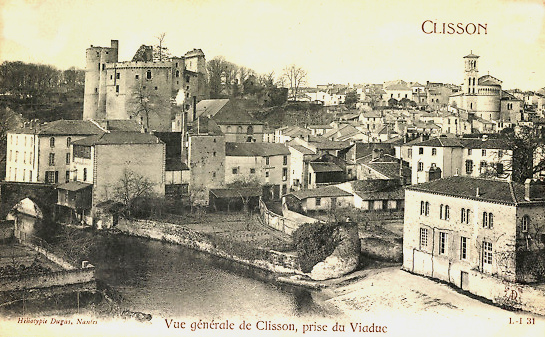

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficiaires De La Mission Patrimoine 2025

May 21, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficiaires De La Mission Patrimoine 2025

May 21, 2025 -

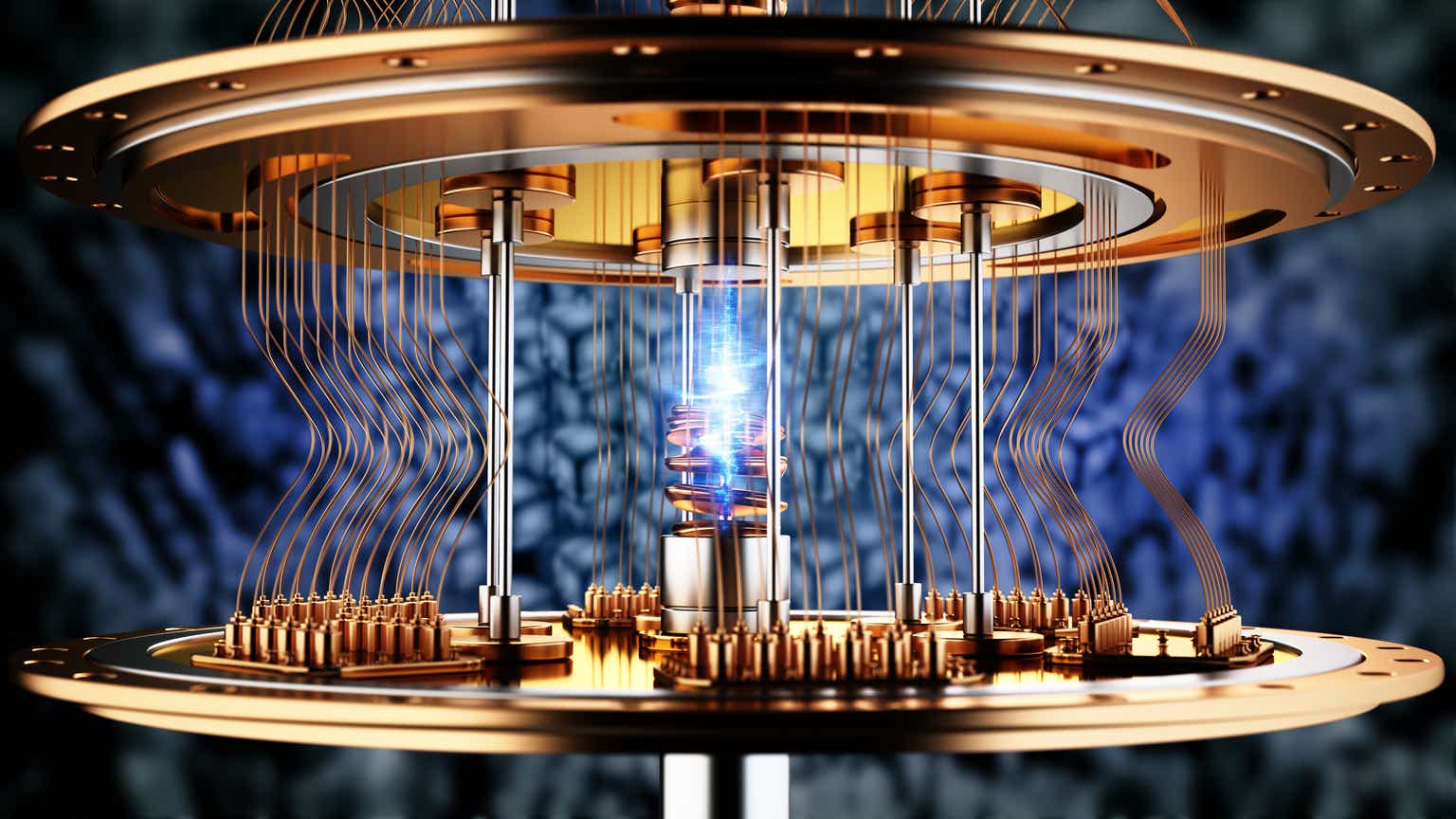

D Wave Quantum Qbts Explaining Todays Significant Stock Price Movement

May 21, 2025

D Wave Quantum Qbts Explaining Todays Significant Stock Price Movement

May 21, 2025 -

3 Laebyn Yndmwn Lawl Mrt Lmntkhb Alwlayat Almthdt Alamrykyt Bqyadt Almdrb Bwtshytynw

May 21, 2025

3 Laebyn Yndmwn Lawl Mrt Lmntkhb Alwlayat Almthdt Alamrykyt Bqyadt Almdrb Bwtshytynw

May 21, 2025

Latest Posts

-

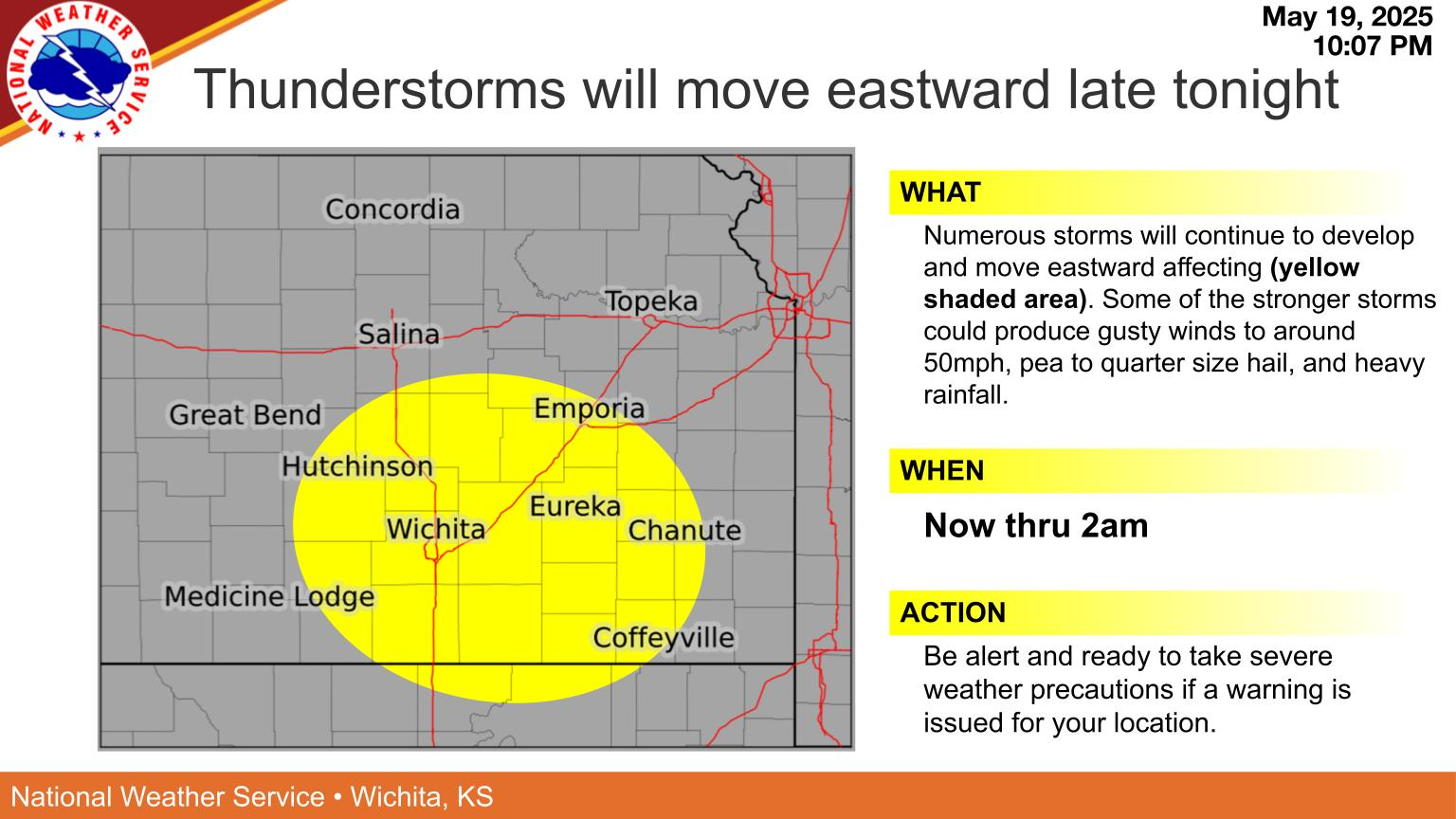

Storm Chance Overnight Severe Weather Potential Monday

May 21, 2025

Storm Chance Overnight Severe Weather Potential Monday

May 21, 2025 -

Driving In A Wintry Mix Of Rain And Snow A Guide

May 21, 2025

Driving In A Wintry Mix Of Rain And Snow A Guide

May 21, 2025 -

Understanding The Shift To Drier Weather Conditions

May 21, 2025

Understanding The Shift To Drier Weather Conditions

May 21, 2025 -

Understanding And Coping With A Wintry Mix Of Rain And Snow

May 21, 2025

Understanding And Coping With A Wintry Mix Of Rain And Snow

May 21, 2025 -

Drier Weather Ahead Tips For Home And Garden

May 21, 2025

Drier Weather Ahead Tips For Home And Garden

May 21, 2025