Sasol's 2023 Strategy Update: What Investors Need To Know

Table of Contents

Financial Performance and Outlook

Sasol's 2023 financial results offer a mixed bag, reflecting the volatile nature of the energy and chemical markets. Analyzing Sasol's reported financial results requires careful consideration of fluctuating commodity prices. Key metrics such as revenue, profit margins, and debt levels need thorough examination to assess the overall health of the company.

-

Impact of Fluctuating Commodity Prices: The price volatility of oil, gas, and various chemicals significantly impacts Sasol's profitability. High prices can boost revenue, but they also increase input costs. Conversely, low prices can squeeze margins. Sasol's ability to manage this volatility effectively is a key factor influencing its financial performance and investor confidence. Understanding the hedging strategies employed by Sasol to mitigate price risks is crucial for assessing the Sasol investment outlook.

-

Capital Expenditure and ROI: Sasol's capital expenditure plans are vital for future growth. Investors need to analyze the planned investments, their anticipated return on investment (ROI), and the alignment of these investments with Sasol's long-term strategic goals. A detailed examination of the allocated funds for different projects, including expansion, upgrades, and research & development, is necessary for a comprehensive understanding of the Sasol financial results.

-

Sustainability of the Financial Trajectory: Analyzing Sasol's debt levels, cash flow generation, and overall financial strength is crucial for determining the sustainability of its current financial trajectory. A thorough assessment of its long-term viability requires considering factors such as its competitive positioning, market share, and ability to adapt to changing market conditions. A healthy balance sheet is essential for long-term success and investor confidence in Sasol's profitability.

Strategic Priorities and Initiatives

Sasol's 2023 strategy update outlines several key strategic priorities. These priorities reveal the company's direction and its commitment to long-term growth and shareholder value. Understanding these priorities is vital for investors seeking to assess the potential of a Sasol investment.

-

Decarbonization and Sustainability: Sasol's commitment to decarbonization and sustainability is a crucial aspect of its strategy. Investors need to evaluate the company's initiatives in this area, including investments in renewable energy sources, carbon capture technologies, and emissions reduction targets. The success of these initiatives will directly impact Sasol's long-term sustainability and its ability to meet growing regulatory pressures. The Sasol decarbonization strategy is a vital component of its overall growth strategy.

-

Mergers, Acquisitions, and Joint Ventures: Sasol's strategy might include plans for mergers, acquisitions, or joint ventures. These activities can significantly alter the company's size, scope, and market position. Investors should analyze the potential benefits and risks associated with such transactions, considering their impact on Sasol's financial performance and strategic objectives. The success of these actions significantly contributes to the Sasol growth strategy.

-

Geographical Expansion and Product Diversification: Sasol's plans for geographical expansion and product diversification are also important considerations. Analyzing its strategies for growth in specific markets or product lines helps investors understand its diversification strategy and its potential for future revenue streams. This aspect of the Sasol strategic priorities directly influences the company's resilience to market fluctuations and its overall growth potential.

Operational Efficiency and Cost Reduction Measures

Sasol's commitment to operational efficiency and cost reduction is essential for maintaining profitability and competitiveness. The 2023 strategy update highlights various initiatives aimed at streamlining operations and improving efficiency.

-

Technological Advancements: Sasol's investment in technological advancements plays a significant role in reducing production costs and improving overall efficiency. Analyzing the impact of these technological improvements on production processes, output, and cost savings is vital for investors. This contributes directly to the improvement of Sasol's operational efficiency.

-

Supply Chain Optimization: Streamlining supply chain management is crucial for reducing costs and enhancing operational efficiency. Investors should assess Sasol's strategies for improving its supply chain, including its logistics, procurement, and inventory management processes. A more efficient supply chain directly contributes to the Sasol cost reduction efforts.

-

Restructuring Initiatives: Restructuring initiatives, such as workforce optimization or asset disposals, can contribute to cost reduction. However, investors need to evaluate the potential impact of these measures on employee morale, operational effectiveness, and long-term competitiveness. Understanding the details of any Sasol restructuring plans is essential for assessing their potential benefits and risks.

Risk Assessment and Mitigation Strategies

Sasol operates in a complex and dynamic environment, facing various risks that could affect its performance. Understanding these risks and the company's mitigation strategies is vital for informed investment decisions.

-

Geopolitical Risks: Geopolitical events and their impact on Sasol's operations need thorough analysis. This includes considering factors such as political instability in key operating regions, trade disputes, and sanctions. Sasol's ability to manage these geopolitical risks is crucial for its long-term success.

-

ESG Factors: Environmental, Social, and Governance (ESG) factors are increasingly important for investors. Analyzing Sasol's approach to managing ESG risks, including its environmental footprint, social responsibility initiatives, and corporate governance practices, is crucial. A strong Sasol ESG profile is becoming increasingly important for attracting investment.

-

Economic Downturns and Market Volatility: Sasol's preparedness for potential economic downturns or market volatility is a significant concern for investors. Analyzing the company's financial resilience, its contingency plans, and its ability to adapt to changing market conditions is vital for understanding its risk management capabilities.

Conclusion

Sasol's 2023 strategy update provides investors with valuable insights into the company's future direction. Understanding its financial performance, strategic priorities, operational efficiency measures, and risk mitigation strategies is crucial for making informed investment decisions. By analyzing these key elements, investors can gain a clearer perspective on Sasol's potential for growth and long-term value creation. For a comprehensive understanding of the implications of the Sasol 2023 strategy, further research is recommended. Stay informed on future developments and updates regarding the Sasol 2023 strategy for continued success in your investment portfolio.

Featured Posts

-

Key Takeaways From The Old North State Report May 9 2025

May 20, 2025

Key Takeaways From The Old North State Report May 9 2025

May 20, 2025 -

Ryanair Faces Tariff War Headwinds Initiates Share Buyback Program

May 20, 2025

Ryanair Faces Tariff War Headwinds Initiates Share Buyback Program

May 20, 2025 -

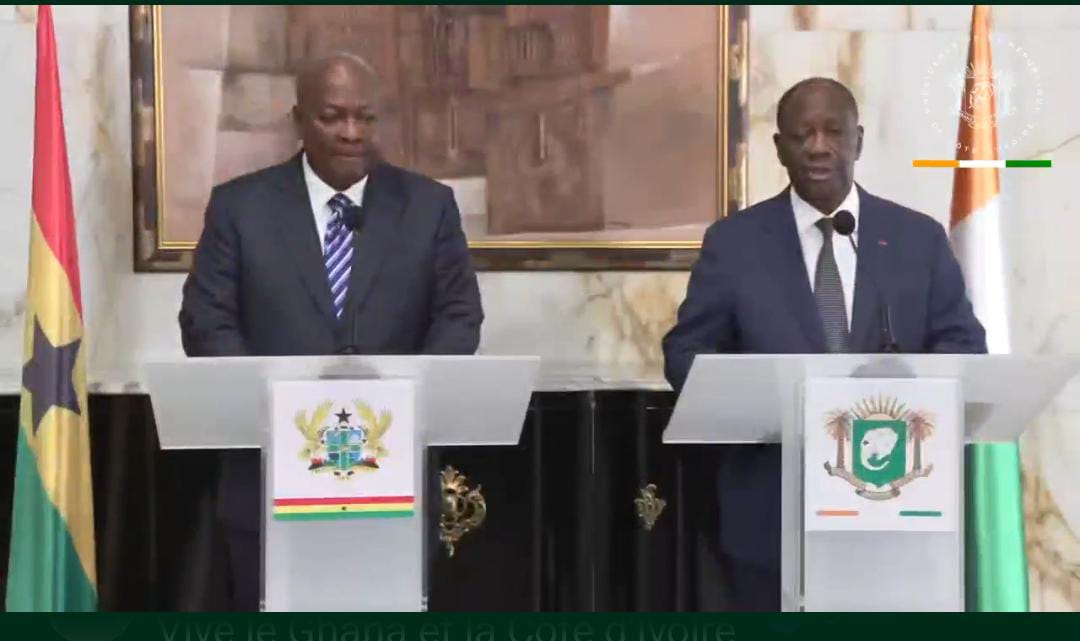

Abidjan Accueille Le President Mahama Une Visite Pour Consolider La Diplomatie Et Le Partenariat

May 20, 2025

Abidjan Accueille Le President Mahama Une Visite Pour Consolider La Diplomatie Et Le Partenariat

May 20, 2025 -

How Middle Management Drives Employee Engagement And Business Performance

May 20, 2025

How Middle Management Drives Employee Engagement And Business Performance

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025

Latest Posts

-

Barry Ward Discusses His Career From Police Officer Roles To Diverse Characters

May 21, 2025

Barry Ward Discusses His Career From Police Officer Roles To Diverse Characters

May 21, 2025 -

Barry Ward Interview I Look Like A Cop Says Irish Actor

May 21, 2025

Barry Ward Interview I Look Like A Cop Says Irish Actor

May 21, 2025 -

Echo Valley Images Reveal Details Of The Upcoming Sweeney Moore Thriller

May 21, 2025

Echo Valley Images Reveal Details Of The Upcoming Sweeney Moore Thriller

May 21, 2025 -

Irish Actor Barry Ward A Candid Interview On Roles And Type Casting

May 21, 2025

Irish Actor Barry Ward A Candid Interview On Roles And Type Casting

May 21, 2025 -

Interview Barry Ward On Playing Cops And Casting

May 21, 2025

Interview Barry Ward On Playing Cops And Casting

May 21, 2025