SEC Crypto Broker Rules Face Overhaul: Chairman Atkins' Announcement

Table of Contents

Key Changes Proposed in the SEC Crypto Broker Rules Overhaul

The proposed changes to the SEC's regulatory framework for crypto brokers are wide-ranging and aim to address several key areas of concern.

Increased Scrutiny of Crypto Exchanges

The SEC plans to significantly enhance its oversight of crypto exchanges, focusing on critical aspects of market integrity and investor protection. This increased scrutiny aims to curb illicit activities and ensure a fairer playing field for all participants.

- Increased reporting requirements for trading activity: Exchanges will likely face more stringent reporting obligations, providing the SEC with greater transparency into trading volumes, order flow, and other crucial market data. This will improve the SEC's ability to detect and prevent market manipulation.

- Stricter KYC/AML compliance measures: Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations will be strengthened, requiring exchanges to implement more robust identity verification and transaction monitoring procedures. This aims to combat financial crime and protect the integrity of the financial system.

- Enhanced cybersecurity audits and standards: Exchanges will be subject to more rigorous cybersecurity audits to ensure they maintain adequate protection against hacking and data breaches. Higher security standards will be enforced to protect investor assets.

- Potential limitations on leveraged trading and derivatives: The SEC may introduce limitations on leveraged trading and the offering of complex crypto derivatives to mitigate the risks associated with highly speculative activities.

Registration and Licensing Requirements

The overhaul aims to clarify and significantly tighten the registration and licensing process for crypto brokers and exchanges, creating a higher barrier to entry and ensuring only qualified entities operate within the regulated space.

- Increased capital requirements for registered brokers: Higher capital requirements will ensure financial stability and resilience, protecting investors against potential bankruptcies or insolvency of the exchange.

- Enhanced background checks for key personnel: More thorough background checks will help prevent individuals with a history of fraud or other misconduct from holding key positions in crypto exchanges.

- Clearer definitions of what constitutes a "crypto broker" under SEC jurisdiction: The SEC aims to eliminate ambiguity by providing clearer definitions, leaving less room for interpretation and ensuring consistent enforcement.

- Potential for a tiered licensing system based on risk and asset class: A tiered system could differentiate licensing requirements based on the risk profile of the exchange and the types of crypto assets it offers, leading to a more tailored and nuanced regulatory approach.

Investor Protection Measures

Bolstering investor protection is a central theme of the proposed overhaul. The SEC aims to create a safer environment for investors by improving transparency, strengthening safeguards against fraud, and enhancing dispute resolution mechanisms.

- Mandated disclosure of risks associated with crypto investments: Investors will be provided with clearer and more comprehensive disclosures regarding the inherent risks of investing in cryptocurrencies.

- Enhanced investor education programs: The SEC may promote investor education initiatives to increase awareness of crypto investment risks and best practices.

- Improved mechanisms for handling customer complaints and disputes: More robust mechanisms for handling complaints and resolving disputes between investors and exchanges will be implemented.

- Greater transparency in pricing and trading practices: Increased transparency in pricing and trading practices will ensure fairer and more efficient markets.

Stablecoin Regulation

Stablecoin regulation is a significant aspect of the proposed overhaul. The SEC aims to address concerns about the stability and systemic risk associated with stablecoins, ensuring they operate within a robust regulatory framework.

- Potential requirements for backing stablecoins with sufficient reserves: Stablecoin issuers may be required to maintain sufficient reserves to ensure they can always redeem their stablecoins at a 1:1 ratio with the underlying asset.

- Enhanced oversight of stablecoin issuers: The SEC will increase its oversight of stablecoin issuers to ensure compliance with regulations and to identify and mitigate potential risks.

- Clearer definitions and regulatory frameworks for different types of stablecoins: Clearer regulatory frameworks will be established to address the unique characteristics of different types of stablecoins, such as fiat-collateralized, crypto-collateralized, and algorithmic stablecoins.

- Increased scrutiny of algorithmic stablecoins: Algorithmic stablecoins, which rely on complex algorithms to maintain their peg, will likely face increased scrutiny due to the inherent risks and volatility associated with them.

Impact on the Cryptocurrency Market and Industry Players

The proposed SEC crypto broker rules overhaul will have far-reaching consequences for the cryptocurrency market and its participants.

- Potential decrease in trading volume on less compliant exchanges: Smaller, less compliant exchanges may struggle to meet the new regulatory requirements, potentially leading to a decrease in trading volume.

- Increased compliance costs for crypto businesses: Meeting the increased regulatory demands will significantly increase compliance costs for crypto businesses, potentially impacting profitability and competitiveness.

- Potential for market consolidation among exchanges: The higher barrier to entry and increased compliance costs may lead to market consolidation, with larger, well-capitalized exchanges dominating the landscape.

- Shift in investor preference towards regulated exchanges: Investors may increasingly favor regulated exchanges, potentially leading to a shift in trading volume towards these platforms.

Potential Challenges and Future Outlook for SEC Crypto Broker Rules

Implementing and enforcing the new regulations will present significant challenges.

- Challenges in defining a universal definition of a "crypto broker": Defining what constitutes a "crypto broker" and applying the rules consistently across different platforms will be a complex undertaking.

- Potential legal challenges from affected industry players: The new regulations may face legal challenges from industry players who disagree with specific provisions or believe they are unfairly burdened.

- Need for ongoing adaptation to the evolving crypto landscape: The cryptocurrency market is constantly evolving, requiring ongoing adaptation and refinement of the regulatory framework.

- Importance of international coordination in crypto regulation: Effective regulation requires international coordination to ensure consistent standards and prevent regulatory arbitrage.

Conclusion

Chairman Atkins' announcement signifies a pivotal moment for the cryptocurrency industry. The proposed overhaul of SEC crypto broker rules represents a significant effort to create a more transparent, secure, and regulated environment for crypto trading. While implementing these changes will present challenges, the long-term goal is to protect investors and promote the responsible growth of the crypto market. Staying abreast of developments concerning the SEC crypto broker rules overhaul is crucial for both investors and businesses operating in the crypto space. Regularly consult the SEC's website for updates and official announcements to remain informed about these important regulatory changes.

Featured Posts

-

Lucids Acquisition Of Airfocus Implications For The Future Of Work Management

May 13, 2025

Lucids Acquisition Of Airfocus Implications For The Future Of Work Management

May 13, 2025 -

Culinary Diplomacy India And Myanmar Connect Through Food

May 13, 2025

Culinary Diplomacy India And Myanmar Connect Through Food

May 13, 2025 -

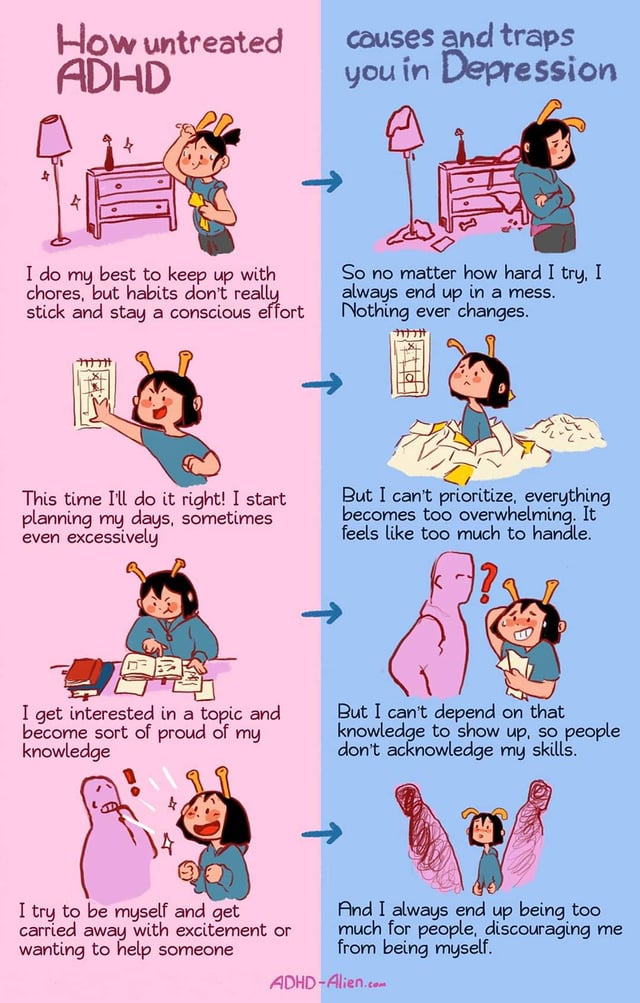

Understanding Adhd A Journey Inside Our Minds

May 13, 2025

Understanding Adhd A Journey Inside Our Minds

May 13, 2025 -

Truckies Realistic Plea To Keep Key Road Open In Tasman

May 13, 2025

Truckies Realistic Plea To Keep Key Road Open In Tasman

May 13, 2025 -

Salman Khans Biggest Flops More Than Just Radhe And Antim

May 13, 2025

Salman Khans Biggest Flops More Than Just Radhe And Antim

May 13, 2025

Latest Posts

-

Scotty Mc Creerys Sons Sweet George Strait Tribute Goes Viral

May 14, 2025

Scotty Mc Creerys Sons Sweet George Strait Tribute Goes Viral

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Honors George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Honors George Strait

May 14, 2025 -

Watch Scotty Mc Creerys Son Pay Heartfelt Tribute To George Strait

May 14, 2025

Watch Scotty Mc Creerys Son Pay Heartfelt Tribute To George Strait

May 14, 2025 -

Country Music Scotty Mc Creerys Sons Adorable George Strait Tribute

May 14, 2025

Country Music Scotty Mc Creerys Sons Adorable George Strait Tribute

May 14, 2025 -

Cute Video Scotty Mc Creerys Sons George Strait Tribute

May 14, 2025

Cute Video Scotty Mc Creerys Sons George Strait Tribute

May 14, 2025