Secure Personal Loans For Bad Credit: Direct Lender Options & Up To $5000

Table of Contents

Understanding Personal Loans for Bad Credit

What are Personal Loans for Bad Credit?

Personal loans are unsecured loans that provide a lump sum of money for various personal expenses. Unlike secured loans (which require collateral), personal loans don't require you to put up an asset like a car or home. They differ from payday loans, which typically have extremely high interest rates and short repayment periods, and credit cards, which often carry high ongoing interest charges and can be difficult to manage. While personal loans for bad credit can help in emergencies, it's crucial to understand the risks. High interest rates are common, and missing payments can severely damage your credit score further. Responsible borrowing involves careful budgeting and a realistic assessment of your ability to repay the loan.

- Purpose: Debt consolidation, home repairs, medical expenses, unexpected bills.

- Risks: High interest rates, potential damage to credit score if not repaid on time, difficulty securing future loans.

- Responsible Borrowing: Create a detailed budget, compare loan offers, only borrow what you can afford to repay.

Direct Lenders vs. Brokers: Which is Better for Bad Credit?

When seeking a personal loan, you’ll encounter two main routes: direct lenders and brokers. Direct lenders are financial institutions that provide loans directly to borrowers. Brokers act as intermediaries, connecting borrowers with multiple lenders. For bad credit borrowers, direct lenders often provide a more transparent and streamlined process. Brokers might charge hidden fees, and the application process can be more complex. Direct lenders, on the other hand, often have clearer terms and conditions, minimizing the risk of unexpected costs.

- Direct Lenders: Simpler application, transparent fees, quicker approval (potentially).

- Brokers: May offer a wider range of lenders, but potentially higher fees and less transparency.

- Examples of Reputable Direct Lenders: (Note: This section should not endorse specific lenders; instead, it can encourage readers to research well-known banks, credit unions, and online lenders that specifically cater to borrowers with less-than-perfect credit.)

Factors Affecting Approval for a Bad Credit Personal Loan

Several factors influence your approval chances for a bad credit personal loan. Your credit score plays a significant role, but lenders also consider other aspects:

- Credit Score: A higher credit score significantly improves your odds of approval and securing a lower interest rate.

- Debt-to-Income Ratio (DTI): A lower DTI (the percentage of your income that goes towards debt repayment) shows lenders you can manage your finances effectively.

- Employment History and Income Stability: A stable job with a consistent income demonstrates your ability to repay the loan.

- Length of Residency: Lenders often check how long you've lived at your current address.

- Accurate Application Information: Providing false or misleading information will negatively impact your application.

Finding Secure Personal Loans for Bad Credit Up to $5000

How to Find Reputable Direct Lenders

Finding a trustworthy direct lender requires thorough research:

- Online Research and Comparison Websites: Use comparison websites to compare offers from different lenders.

- Checking Lender Reviews and Testimonials: Read online reviews to gauge the experiences of other borrowers.

- Verifying Licensing and Registration: Ensure the lender is properly licensed and registered in your state.

- Looking for Transparent Fee Structures: Avoid lenders with hidden fees or unclear terms.

- Avoiding Predatory Lenders: Be wary of lenders offering loans with excessively high interest rates or unreasonable terms.

Tips for Improving Your Chances of Approval

You can increase your chances of approval by taking proactive steps:

- Improve Your Credit Score: Pay off existing debts, correct errors on your credit report, and use credit responsibly.

- Shop Around for the Best Interest Rates: Compare offers from multiple lenders to secure the most favorable terms.

- Provide Accurate and Complete Application Information: Accuracy is crucial for a smooth application process.

- Consider a Co-signer: If your credit is poor, a co-signer with good credit can significantly improve your chances of approval.

- Understand the Loan Terms and Conditions Carefully: Read the fine print thoroughly before signing any agreement.

Securing Your Loan and Managing Repayment

Understanding Loan Terms and Conditions

Before accepting a loan, fully grasp the terms:

- APR (Annual Percentage Rate): The total cost of borrowing, including interest and fees.

- Loan Repayment Schedule: The timeframe for repaying the loan, including monthly payments.

- Penalties for Late Payments: Understand the consequences of missed or late payments.

- Prepayment Options: Check if there are any penalties for paying off the loan early.

- Total Cost of the Loan: Calculate the total amount you’ll repay, including interest and fees.

Managing Your Repayments Effectively

Successful repayment requires careful planning:

- Budgeting and Financial Planning: Create a budget to ensure you can afford the monthly payments.

- Setting Up Automatic Payments: Automating payments helps avoid missed payments and late fees.

- Contacting the Lender if Facing Difficulties: If you anticipate difficulties, contact your lender immediately to discuss potential solutions.

Conclusion: Secure Your Future with the Right Personal Loan

Securing a secure personal loan for bad credit requires careful research and responsible decision-making. Choosing a reputable direct lender with transparent terms and conditions is essential. By understanding the factors influencing approval, improving your creditworthiness, and managing your repayments effectively, you can increase your chances of securing the funds you need. Remember to start your search for secure personal loans for bad credit today. Carefully research direct lenders, compare loan offers, and select the best option for your needs, keeping in mind the available loan amounts, such as those up to $5000. Don't let bad credit hold you back from achieving your financial goals.

Featured Posts

-

Angels Defeat Dodgers In Thrilling Freeway Series Matchup

May 28, 2025

Angels Defeat Dodgers In Thrilling Freeway Series Matchup

May 28, 2025 -

Leeds United Closing In On 31 Cap England International

May 28, 2025

Leeds United Closing In On 31 Cap England International

May 28, 2025 -

Alcarazs Soaring Confidence Vs Swiateks Challenges At Roland Garros

May 28, 2025

Alcarazs Soaring Confidence Vs Swiateks Challenges At Roland Garros

May 28, 2025 -

Sinners Rise How Alcaraz And Zverev Faltered During His Absence

May 28, 2025

Sinners Rise How Alcaraz And Zverev Faltered During His Absence

May 28, 2025 -

Real Madrid 3 2 Celta Vigo Tres Preguntas Y Tres Respuestas Clave

May 28, 2025

Real Madrid 3 2 Celta Vigo Tres Preguntas Y Tres Respuestas Clave

May 28, 2025

Latest Posts

-

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025 -

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025 -

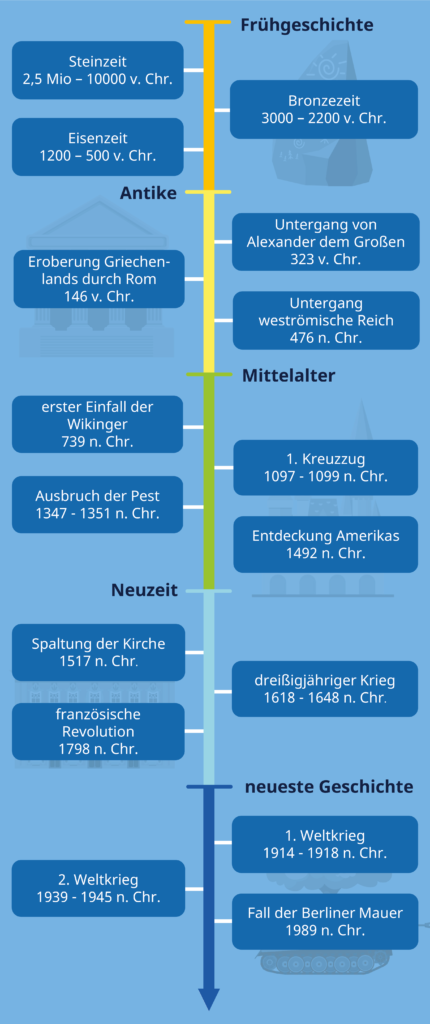

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025 -

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025 -

Andre Agassi Revine In Competitie Debutul In Pickleball

May 30, 2025

Andre Agassi Revine In Competitie Debutul In Pickleball

May 30, 2025