Self-Defense And The Law: The Importance Of Insurance Coverage

Table of Contents

The Legal Complexities of Self-Defense

Understanding the legal aspects of self-defense is critical. Successfully invoking self-defense requires proving you acted within the bounds of the law. This means demonstrating that you faced an imminent threat, used only reasonable force proportionate to the threat, and had no other reasonable option to escape the danger.

Understanding Legal Justification:

Legal standards for self-defense vary significantly across jurisdictions. What might be deemed justifiable force in one state could be considered excessive in another. This complexity underscores the importance of understanding the specific self-defense laws in your area.

- Differences in self-defense laws across jurisdictions: Stand Your Ground laws, for instance, vary widely in their application and interpretation. Some states require a duty to retreat, while others do not.

- The burden of proof in self-defense cases: The burden of proving self-defense often rests on the individual who used force, even if the incident was captured on video. This can necessitate extensive legal representation and the presentation of compelling evidence.

- Potential for civil lawsuits even if criminal charges are dropped: Even if criminal charges are dropped or dismissed, the victim or their family may still pursue a civil lawsuit against you, leading to significant financial liabilities.

Financial Implications of Self-Defense Cases

The financial burden of defending yourself in court can be staggering, even if you were acting in self-defense. Legal battles can be protracted and expensive, with costs quickly accumulating.

Legal Fees and Costs:

Legal representation in self-defense cases is rarely cheap. Expect substantial fees for attorneys, expert witnesses (such as forensic specialists or self-defense experts), court costs, and other related expenses.

- Examples of actual legal costs in self-defense cases: Costs can easily reach tens of thousands, or even hundreds of thousands, of dollars depending on the complexity of the case and its duration.

- The potential for protracted legal battles: Self-defense cases often involve lengthy investigations, depositions, and court proceedings, stretching over months or even years.

- The impact of lengthy court processes on employment and personal life: The stress and time commitment involved can significantly impact your employment, relationships, and overall well-being.

The Protective Role of Insurance Coverage

This is where insurance coverage becomes invaluable. Several types of insurance can help mitigate the financial risks associated with self-defense situations.

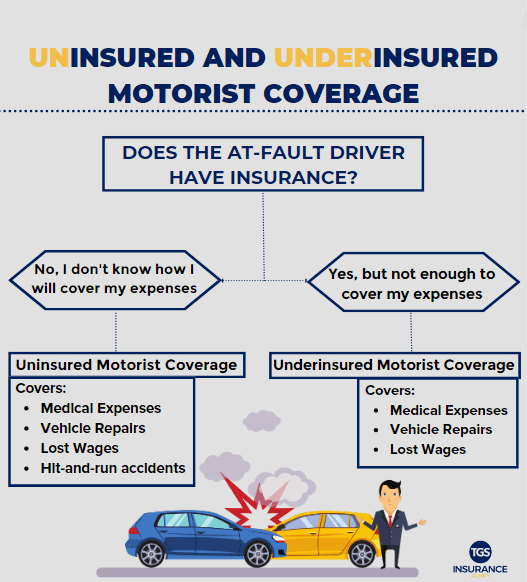

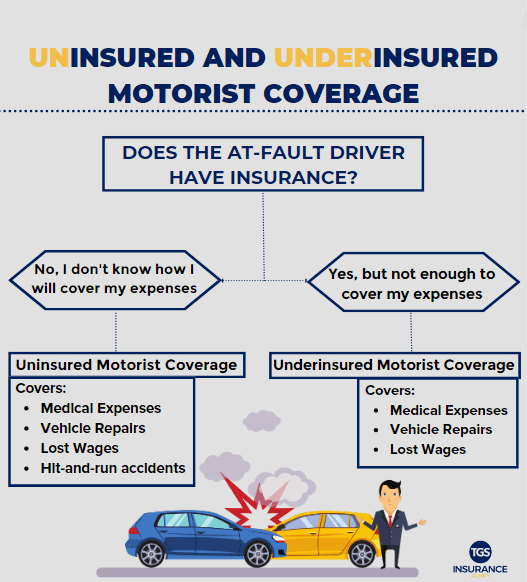

Types of Insurance That Can Help:

Appropriate insurance policies can cover legal defense costs, settlements, and other related expenses arising from self-defense incidents.

- How different policies cover legal defense costs and settlements: Homeowner's insurance, umbrella liability insurance, and personal liability insurance all offer varying degrees of coverage for legal defense and settlements related to incidents on your property or involving your actions.

- The importance of reviewing policy details and coverage limits: Carefully review the specific details of your policies, paying close attention to coverage limits and exclusions. Understanding your policy's limitations is crucial.

- The benefits of consulting with an insurance professional: An insurance professional can help you assess your specific needs and recommend the most appropriate coverage to protect yourself.

Choosing the Right Insurance Coverage for Self-Defense

Selecting the right insurance coverage involves assessing your individual risk profile and potential liabilities.

Assessing Your Risk Profile:

Several factors can influence the level of insurance you need.

- Tips for finding affordable and comprehensive insurance: Shop around, compare quotes from multiple insurers, and don't hesitate to negotiate for better rates.

- The importance of comparing quotes from multiple insurers: Don't settle for the first quote you receive. Comparing offers from different insurance companies can lead to significant savings.

- The need for regular review and updates to your insurance policies: Your needs and circumstances can change over time. Regularly review your policies to ensure they still adequately meet your protection requirements.

Conclusion

The legal complexities of self-defense and the potential for substantial financial burdens, even in justified scenarios, cannot be overstated. Protecting yourself and your family requires proactive planning, including securing adequate insurance coverage. Review your current homeowner's, umbrella liability, and personal liability insurance policies. Consider increasing your liability limits or adding coverage if needed. Don't wait until a crisis arises – take control of your risk profile today. Contact an insurance agent for a consultation to ensure you have the right self-defense and the law insurance to protect yourself and your family from unforeseen financial consequences.

Featured Posts

-

Razvitie Gazosnabzheniya V Eao Plany Gazproma

May 13, 2025

Razvitie Gazosnabzheniya V Eao Plany Gazproma

May 13, 2025 -

Kyle Tuckers Comments On Chicago Cubs Fans Spark Debate

May 13, 2025

Kyle Tuckers Comments On Chicago Cubs Fans Spark Debate

May 13, 2025 -

Nba Draft Lottery Betting Odds On The Toronto Raptors And Cooper Flagg

May 13, 2025

Nba Draft Lottery Betting Odds On The Toronto Raptors And Cooper Flagg

May 13, 2025 -

Bombendrohung An Braunschweiger Grundschule Polizei Gibt Entwarnung

May 13, 2025

Bombendrohung An Braunschweiger Grundschule Polizei Gibt Entwarnung

May 13, 2025 -

The Meg Thee Stallion Shooting Examining Sentencing Differences Across States

May 13, 2025

The Meg Thee Stallion Shooting Examining Sentencing Differences Across States

May 13, 2025

Latest Posts

-

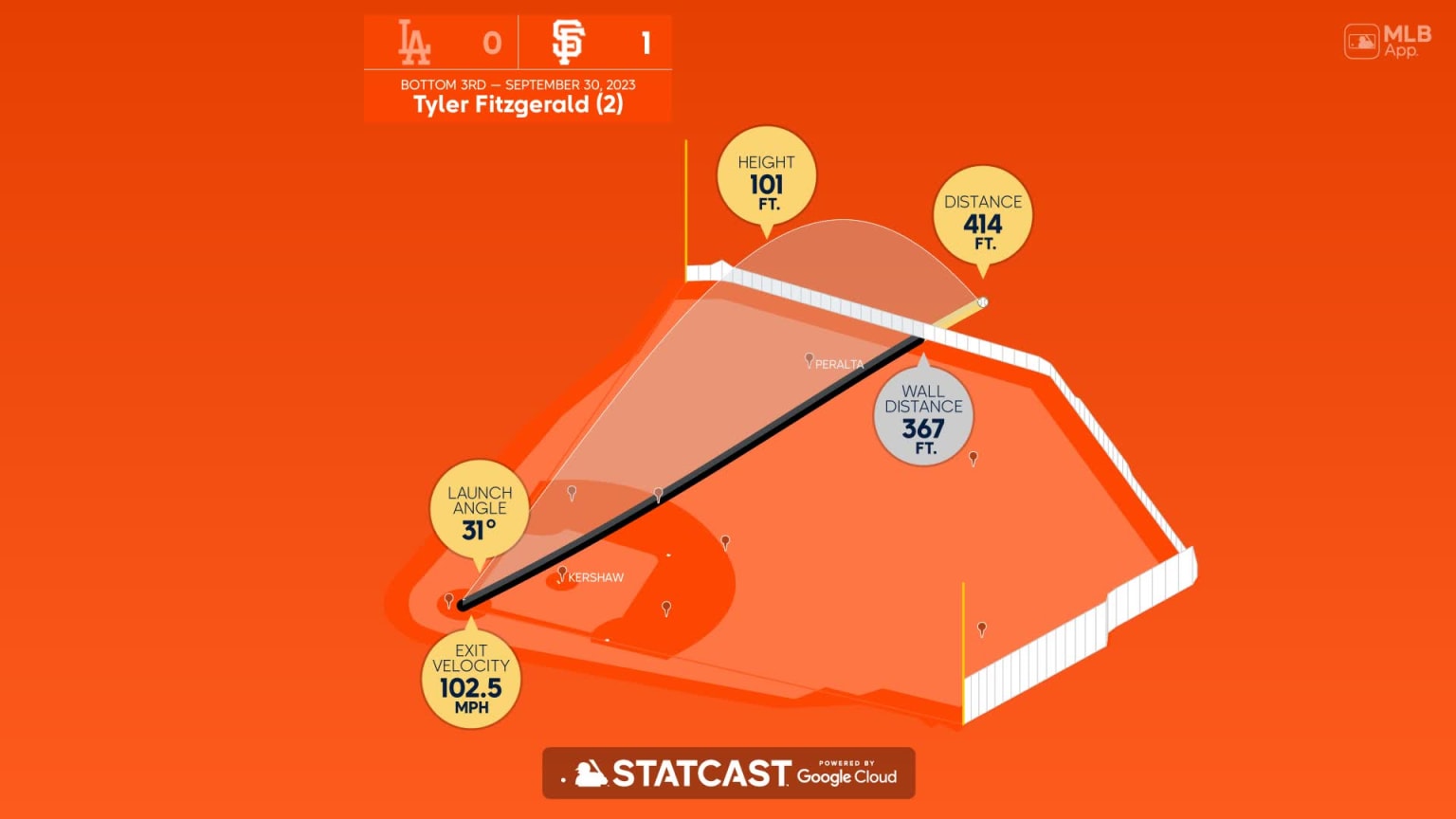

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025 -

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025 -

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025 -

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025 -

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025