Self-Defense Shooting: Do You Need Insurance Coverage?

Table of Contents

The High Cost of Legal Defense After a Self-Defense Shooting

Even if you are entirely justified in using your firearm in self-defense, the legal and financial ramifications can be staggering. The process can be emotionally and financially draining, leaving you vulnerable to significant costs regardless of the outcome.

H3: Criminal Charges and Legal Fees:

Facing criminal charges, even if ultimately acquitted, is a very real possibility. The legal process alone can be incredibly expensive.

- Attorney Fees: Experienced criminal defense attorneys specializing in self-defense cases charge substantial hourly rates. A lengthy trial can easily cost tens of thousands of dollars.

- Court Costs: Filing fees, expert witness fees, and other court-related expenses quickly add up.

- Expert Witness Fees: Ballistics experts, forensic specialists, and other experts are often necessary to build a strong defense, adding significantly to the overall cost.

- Potential Fines: Even if found not guilty, you may still face substantial fines.

Consider this hypothetical: John, a homeowner, shoots an intruder during a home invasion. Even though the intruder was armed and posed a clear and present danger, John is arrested and charged with aggravated assault. His legal fees, including attorney fees, expert witness fees, and court costs, could easily exceed $50,000 before the case is resolved, even with a favorable outcome.

H3: Civil Lawsuits and Liability:

Beyond criminal charges, you might also face a civil lawsuit from the injured party or their family, regardless of the criminal court’s decision.

- Medical Expenses: The injured party's medical bills can reach hundreds of thousands of dollars, all potentially directed at you.

- Lost Wages: Claims for lost income due to injury are common in civil lawsuits.

- Pain and Suffering: Significant damages can be awarded for emotional distress and pain caused by the shooting.

- Wrongful Death Claims: In cases resulting in death, the potential financial burden is exponentially higher, including funeral expenses and loss of support claims by surviving family members.

A real-life example illustrates this: In a recent case, a homeowner successfully defended himself against a burglar but was subsequently sued by the burglar's family for millions of dollars in damages. While acquitted of criminal charges, the homeowner faced years of litigation and substantial legal costs before reaching a settlement.

What Self-Defense Shooting Insurance Covers

Self-defense shooting insurance is designed to mitigate the financial risks associated with these events. It’s a specialized type of liability insurance for gun owners.

H3: Legal Defense Costs:

A comprehensive policy typically covers a significant portion, if not all, of your legal defense costs.

- Attorney fees for criminal and civil cases.

- Expert witness fees for various legal experts.

- Court costs and filing fees.

However, it's vital to understand coverage limitations. There might be a cap on the total amount of legal expenses covered.

H3: Civil Liability Protection:

Crucially, many policies offer civil liability protection, covering potential financial compensation to victims or their families.

- Settlement amounts agreed upon to resolve the lawsuit.

- Judgments awarded against you in court.

- Costs associated with appeals.

Again, be aware of potential exclusions and limitations on the amount of coverage.

H3: Bail Bonds and Other Expenses:

Some policies extend coverage beyond legal fees and civil liabilities. These can include:

- Bail bonds required for release from custody.

- Incarceration costs, including expenses related to jail or prison time (if applicable).

- Other related expenses incurred during the legal process.

Finding the Right Self-Defense Shooting Insurance Policy

Choosing the right policy requires careful consideration of several factors.

H3: Factors to Consider:

- Coverage Limits: Ensure the policy offers sufficient coverage to handle significant legal fees and potential judgments.

- Exclusions: Carefully review the policy to understand what is not covered.

- Premiums: Compare premiums from different insurers to find a policy that fits your budget.

- Insurer Reputation: Research the insurer's financial stability and reputation.

H3: Comparing Policies and Prices:

Get quotes from multiple insurers to compare coverage options and premiums. Don't solely focus on price; prioritize adequate coverage.

- Use online comparison tools.

- Contact insurers directly to ask specific questions.

- Read policy details carefully before signing anything.

H3: Understanding Policy Exclusions:

Most policies have exclusions, so understanding these is critical.

- Intentional acts (shooting someone without justification).

- Illegal activities (using a firearm illegally).

- Pre-existing conditions.

Conclusion:

The legal and financial risks associated with a self-defense shooting, even a justified one, are substantial. The costs of legal representation, potential civil lawsuits, and other related expenses can be crippling. Self-defense shooting insurance, also sometimes referred to as self-defense firearm insurance or shooting incident insurance, offers crucial liability protection for gun owners. It provides a vital safety net, helping mitigate these significant risks. Don't wait until it’s too late; proactively protect yourself and your future by exploring self-defense shooting insurance options and contacting an insurance professional for personalized advice. Responsible gun ownership includes planning for the unexpected; secure your peace of mind today with the right liability protection for gun owners.

Featured Posts

-

The Historic Kanika House Birthplace Of The Indian Constitution Partial

May 13, 2025

The Historic Kanika House Birthplace Of The Indian Constitution Partial

May 13, 2025 -

Vybor Luchshikh Filmov Dzherarda Batlera Personalniy Vzglyad

May 13, 2025

Vybor Luchshikh Filmov Dzherarda Batlera Personalniy Vzglyad

May 13, 2025 -

Legal Battle Intensifies Allegations Of Deposition Tampering In The Tory Lanez Case

May 13, 2025

Legal Battle Intensifies Allegations Of Deposition Tampering In The Tory Lanez Case

May 13, 2025 -

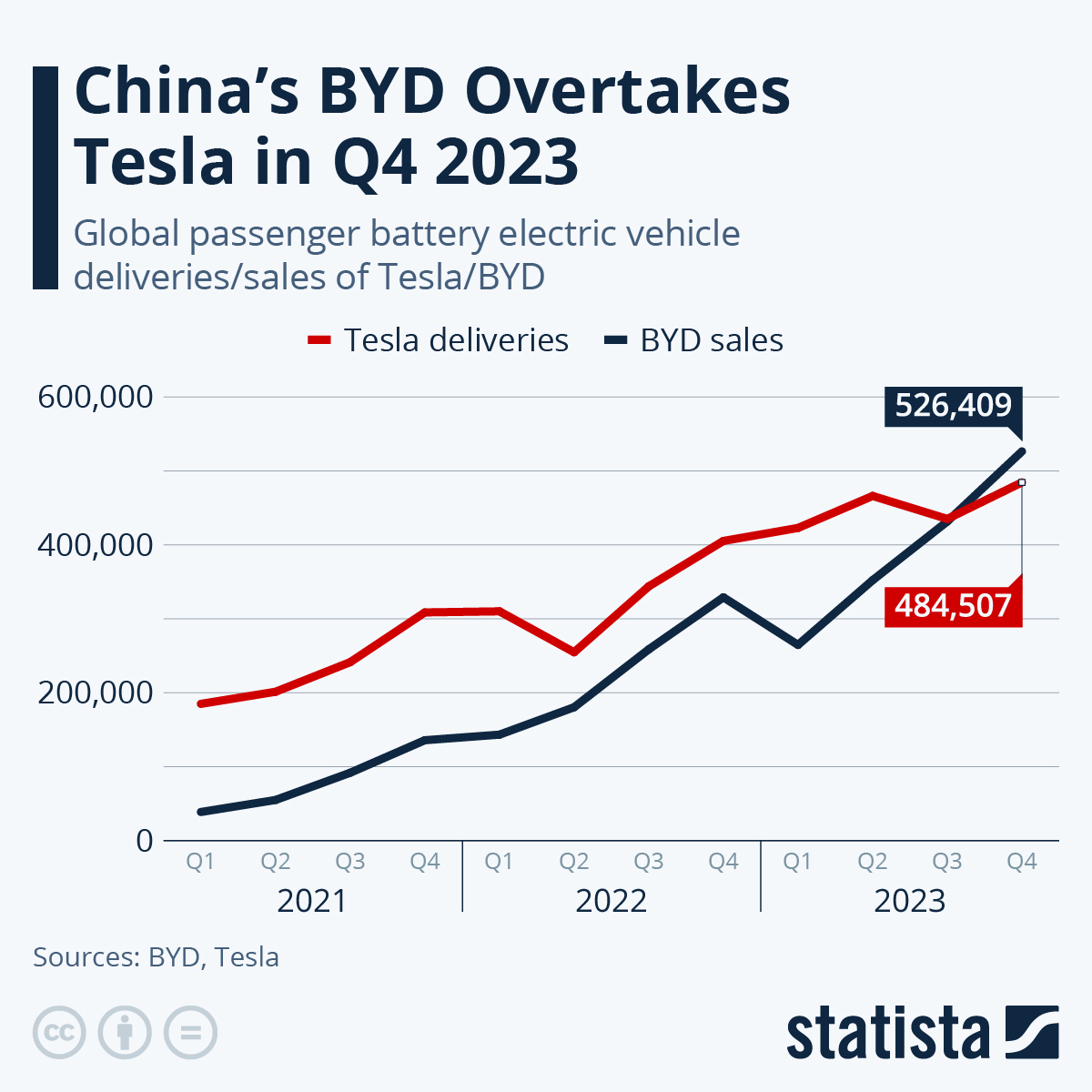

Electric Vehicle Market Shift Byds Global Expansion And Fords Brazilian Legacy

May 13, 2025

Electric Vehicle Market Shift Byds Global Expansion And Fords Brazilian Legacy

May 13, 2025 -

Den Of Thieves 2 Netflix Release Date And Streaming Details

May 13, 2025

Den Of Thieves 2 Netflix Release Date And Streaming Details

May 13, 2025

Latest Posts

-

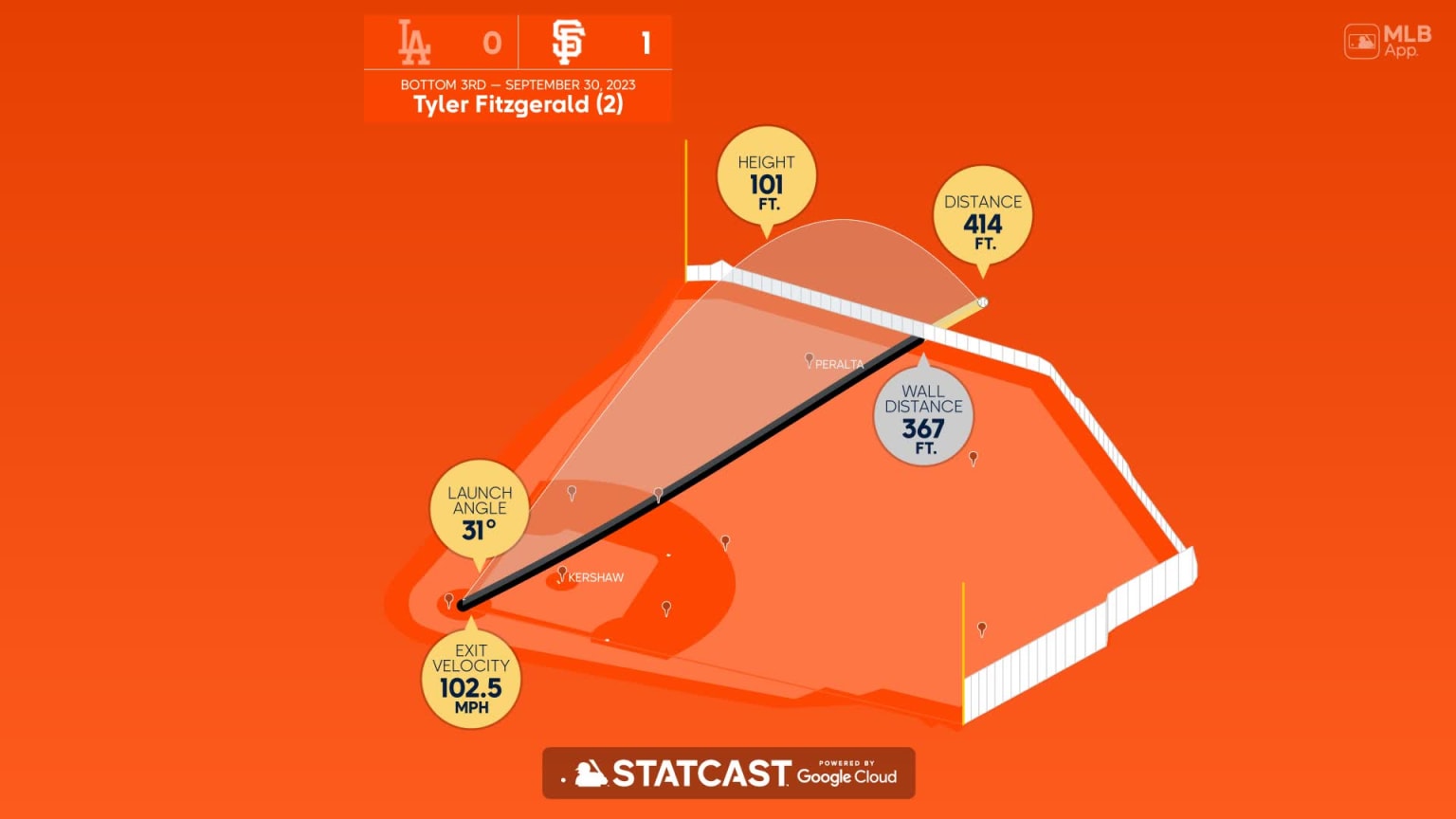

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025

Fitzgeralds Dominant Performance Fuels Giants Victory

May 14, 2025 -

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025

Tyler Fitzgeralds Strong Stretch Continues In Giants Win

May 14, 2025 -

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025

Dodgers Vs Angels Ohtanis Epic 6 Run 9th Inning

May 14, 2025 -

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025

6 Run 9th Ohtanis Power Drives Dodgers Comeback Win

May 14, 2025 -

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Late Homer Secures Dodgers Victory Over Diamondbacks

May 14, 2025