Semiconductor ETF Sell-Off Precedes Sharp Price Increase

Table of Contents

Factors Contributing to Semiconductor ETF Sell-Offs

Several factors can trigger a semiconductor ETF sell-off, creating opportunities for savvy investors. Understanding these drivers is crucial for navigating the market effectively.

Market Corrections and Investor Sentiment

Broader market corrections often trigger panic selling, impacting even fundamentally strong sectors like semiconductors. Investor fear and uncertainty can lead to a cascade effect, with investors rushing to liquidate their holdings regardless of underlying value.

- Examples: The dot-com bubble burst in 2000 and the 2008 financial crisis both saw significant sell-offs in semiconductor ETFs.

- News and Analyst Downgrades: Negative news headlines, analyst downgrades, and concerns about economic slowdown can exacerbate investor anxieties, driving further selling pressure. Fear often outweighs fundamentals in these situations.

Geopolitical Risks and Supply Chain Disruptions

Global events and supply chain vulnerabilities significantly impact semiconductor ETF prices. Geopolitical instability, trade wars, and sanctions can disrupt production, leading to shortages and price volatility.

- Examples: The US-China trade war, sanctions on specific companies or countries, and regional conflicts can all create uncertainty and trigger sell-offs.

- Manufacturing Bottlenecks: Manufacturing bottlenecks, shortages of raw materials, and logistical challenges can impact semiconductor production, leading to price increases and subsequently, corrections as investors react to supply concerns.

Profit-Taking and Technical Analysis

Profit-taking by investors and technical indicators can also trigger sell-offs, even in the absence of significant fundamental issues. Short-term traders often utilize technical analysis to identify opportune moments to exit positions.

- Resistance Levels and Chart Patterns: Reaching resistance levels on charts can prompt profit-taking, leading to temporary price declines. Specific chart patterns also signal potential reversals for traders.

- Short-Term Trading Strategies: Short-term trading strategies focusing on quick profits contribute to the volatility observed in semiconductor ETFs. These strategies often exploit short-term price fluctuations, leading to increased selling pressure at times.

Why Sell-Offs Often Precede Sharp Price Increases in Semiconductor ETFs

While seemingly counterintuitive, semiconductor ETF sell-offs often pave the way for sharp price increases. This is due to several interacting factors.

Oversold Conditions and Buying Opportunities

Sell-offs can create oversold conditions, presenting attractive entry points for long-term investors. Technical indicators can help identify these opportunities.

- RSI (Relative Strength Index): An RSI below 30 often signals an oversold market, suggesting a potential rebound.

- Buy the Dip Strategy: Experienced investors often employ a "buy the dip" strategy, capitalizing on temporary price declines to acquire assets at discounted prices.

Fundamental Strength of the Semiconductor Industry

The semiconductor industry boasts strong long-term growth potential, driven by its critical role in various technological advancements. This fundamental strength often underpins price recoveries after sell-offs.

- Key Growth Sectors: Artificial intelligence (AI), 5G technology, and the automotive industry are significant drivers of semiconductor demand.

- Technological Innovation: Continuous technological innovation ensures sustained demand for advanced semiconductors, supporting long-term growth prospects.

Increased Institutional Investment

Institutional investors often capitalize on sell-offs, increasing their positions and triggering price recoveries. Their involvement provides stability and support.

- Large-Scale Investments: Large-scale investments by institutional investors can significantly impact price movements, driving recovery after a sell-off.

- Long-Term Investment Strategies: Institutional investors typically adopt long-term investment strategies, less susceptible to short-term market fluctuations, promoting stability.

Strategies for Navigating Semiconductor ETF Volatility

Navigating the volatility of semiconductor ETFs requires a well-defined investment strategy, balancing risk and reward.

Diversification and Risk Management

Diversification is key to mitigating risk. Spreading investments across multiple semiconductor ETFs or broader technology ETFs reduces exposure to any single company or sector.

- Diversification Across ETFs: Investing in several ETFs reduces dependency on the performance of a single ETF.

- Stop-Loss Orders: Utilizing stop-loss orders helps limit potential losses by automatically selling shares if the price falls below a predetermined level.

Long-Term Investing vs. Short-Term Trading

Long-term investing offers a more stable approach, while short-term trading entails higher risk and volatility.

- Buy-and-Hold Strategy: A buy-and-hold strategy focuses on long-term growth, minimizing the impact of short-term price fluctuations.

- Short-Term Trading Risks: Short-term trading strategies expose investors to increased risk due to market volatility.

Fundamental Analysis vs. Technical Analysis

A combined approach using both fundamental and technical analysis provides a comprehensive view of the market.

- Combining Approaches: Using both fundamental (company performance, industry trends) and technical analysis (chart patterns, indicators) allows for a more informed decision-making process.

- Informed Decision Making: Integrating these approaches aids in identifying potential entry and exit points, maximizing potential gains while mitigating risks.

Conclusion: Capitalizing on Semiconductor ETF Sell-Offs

Semiconductor ETF sell-offs, while initially unsettling, often present compelling investment opportunities. By understanding the underlying factors contributing to these price dips—market corrections, geopolitical risks, profit-taking, and technical adjustments—and by employing effective diversification and risk management strategies, investors can potentially profit from these market fluctuations. The fundamental strength of the semiconductor industry, coupled with the potential for increased institutional investment, often fuels significant price rebounds following these sell-offs. Start your research on semiconductor ETFs today! Remember, thorough research and responsible risk management are crucial before making any investment decisions.

Featured Posts

-

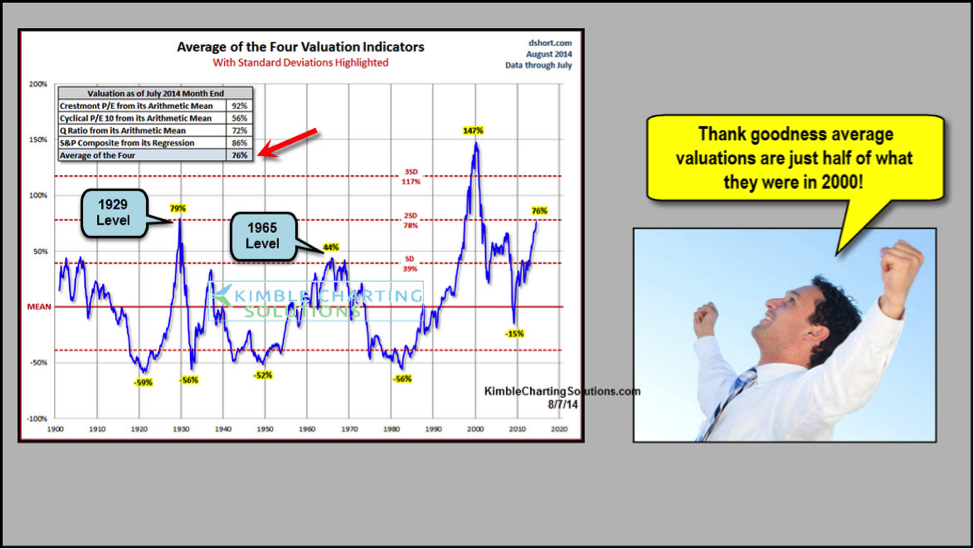

Bof As Take Why Current Stock Market Valuations Shouldnt Worry Investors

May 13, 2025

Bof As Take Why Current Stock Market Valuations Shouldnt Worry Investors

May 13, 2025 -

Niedersachsen And Bremen Entwarnung Nach Bombendrohung An Braunschweiger Grundschule

May 13, 2025

Niedersachsen And Bremen Entwarnung Nach Bombendrohung An Braunschweiger Grundschule

May 13, 2025 -

Millions Gained From Executive Office365 Infiltration Fbi Investigation

May 13, 2025

Millions Gained From Executive Office365 Infiltration Fbi Investigation

May 13, 2025 -

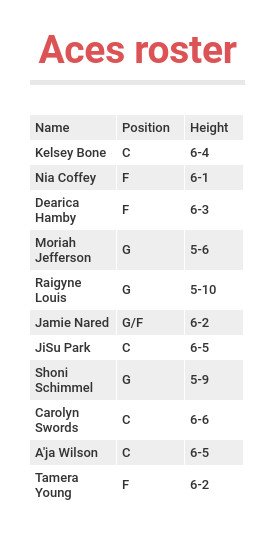

Aces Cut Forward Training Camp Roster Move Announced

May 13, 2025

Aces Cut Forward Training Camp Roster Move Announced

May 13, 2025 -

Peregovory O Bezopasnosti Mezhdu Britaniey I Es Perspektivy I Riski

May 13, 2025

Peregovory O Bezopasnosti Mezhdu Britaniey I Es Perspektivy I Riski

May 13, 2025

Latest Posts

-

Captain America Brave New World How The Mcu Escaped Its Darkest Era

May 14, 2025

Captain America Brave New World How The Mcu Escaped Its Darkest Era

May 14, 2025 -

Captain America Brave New World Available Now For Home Entertainment

May 14, 2025

Captain America Brave New World Available Now For Home Entertainment

May 14, 2025 -

Captain America Brave New World Disney Premiere Date Updates

May 14, 2025

Captain America Brave New World Disney Premiere Date Updates

May 14, 2025 -

Stream Captain America Brave New World Where To Watch

May 14, 2025

Stream Captain America Brave New World Where To Watch

May 14, 2025 -

Disney Streaming Captain America Brave New World Release Date News

May 14, 2025

Disney Streaming Captain America Brave New World Release Date News

May 14, 2025