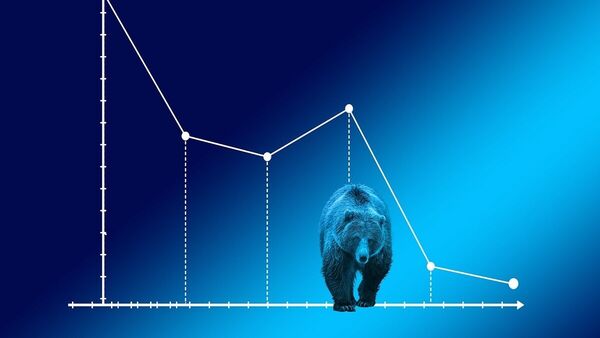

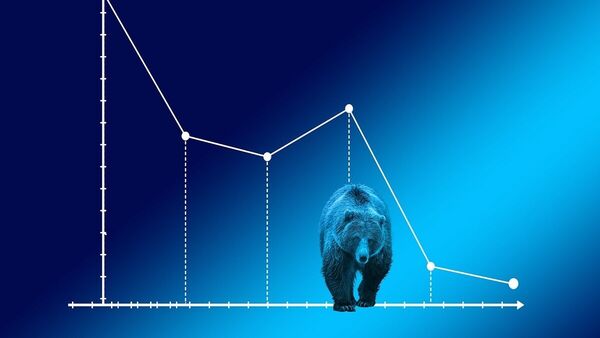

Sensex Gains 200 Points, Nifty Surges Past 22,600: Market Update

Table of Contents

Sensex's 200-Point Gain: Driving Factors

Positive Global Cues

Positive global market trends played a crucial role in boosting the Sensex. Easing inflation concerns in major economies and positive economic data contributed to a generally optimistic global outlook. This positive sentiment spilled over into the Indian market, encouraging investors to take a bullish stance.

- Stronger-than-expected GDP growth in the US.

- Easing inflation rates in Europe and the US.

- Positive signals from major international indices like the Dow Jones and Nasdaq. Keywords: Global markets, international indices, economic indicators, inflation.

Sector-Specific Performances

The Sensex's gain wasn't uniform across all sectors. Several sectors experienced particularly strong performance, driving the overall index higher.

- IT Sector: The IT sector saw significant gains, fueled by positive global tech earnings and increased outsourcing demands. Percentage gains ranged from 2-4% for major IT players.

- Banking Sector: Stronger-than-expected credit growth and positive regulatory announcements contributed to a robust performance by banking stocks. Percentage gains varied but averaged around 1.5-3%.

- FMCG Sector: Positive consumer sentiment and robust sales figures boosted performance in the FMCG sector, with some companies seeing gains exceeding 2%. Keywords: Sectoral performance, IT sector, banking sector, FMCG sector, stock market sectors.

Key Stocks Driving the Rally

Several individual stocks significantly contributed to the Sensex's rise. These top performers often reflect specific industry trends or positive company-specific news.

- Reliance Industries: Strong quarterly earnings and positive investor outlook drove significant gains.

- HDFC Bank: Continued growth in lending and a positive outlook for the banking sector contributed to its strong performance.

- Infosys: Strong quarterly results and robust order book fueled gains in this major IT player. Keywords: Top gainers, stock market leaders, individual stock performance.

Nifty Surges Past 22,600: Implications and Analysis

Breaking the 22,600 Barrier

The Nifty index crossing the 22,600 mark holds significant psychological importance. This level had previously acted as a resistance point, and breaking through it suggests a potential continuation of the upward trend. Overcoming this resistance could signal further gains in the short term.

- Previous resistance levels at 22,500 and 22,400 were overcome relatively easily, indicating strong buying pressure.

- The psychological impact of breaking through key resistance levels often attracts further investment. Keywords: Nifty index, market resistance, psychological levels, stock market trends.

Future Outlook and Predictions

While the current market sentiment is positive, maintaining a cautious outlook is crucial. Several factors could influence the market's future direction.

- Global economic uncertainty remains a key factor. Geopolitical events and potential economic slowdowns could impact investor sentiment.

- Domestic policy changes and regulatory announcements could also affect market performance.

- Inflationary pressures, although easing, remain a concern that could impact future market trends. Keywords: Market outlook, future predictions, market analysis, stock market forecast.

Expert Opinions and Analyst Views

Market analysts offer diverse perspectives on the market's future trajectory. While many express optimism about the short-term outlook, they caution against overconfidence.

- Several analysts predict continued growth in the near term, driven by strong corporate earnings and positive global cues.

- Others emphasize the need to monitor global economic developments closely and to maintain a diversified portfolio. Keywords: Market analysts, expert opinions, stock market predictions.

Conclusion: Navigating the Sensex and Nifty's Ascent

The significant gains in both the Sensex and Nifty indices today represent a positive development for the Indian stock market. Positive global cues, strong sectoral performances, and the breaking of key resistance levels have contributed to this rally. However, investors should maintain a balanced perspective, acknowledging the inherent uncertainties in the market. Staying informed about the latest market news and economic indicators is crucial for making well-informed investment decisions.

Stay informed about the latest Sensex and Nifty movements by subscribing to our daily market updates! [Link to subscription/resource]

Featured Posts

-

Edmonton Oilers Favoured Betting Odds For Kings Series End

May 10, 2025

Edmonton Oilers Favoured Betting Odds For Kings Series End

May 10, 2025 -

Joanna Page Calls Out Wynne Evans Performance On Bbc Show

May 10, 2025

Joanna Page Calls Out Wynne Evans Performance On Bbc Show

May 10, 2025 -

150 Million The Price Of Silence Broken At Credit Suisse

May 10, 2025

150 Million The Price Of Silence Broken At Credit Suisse

May 10, 2025 -

Proposed Uk Visa Changes Impact On Certain Nationalities

May 10, 2025

Proposed Uk Visa Changes Impact On Certain Nationalities

May 10, 2025 -

New York Times Spelling Bee April 12 2025 Solutions And Analysis

May 10, 2025

New York Times Spelling Bee April 12 2025 Solutions And Analysis

May 10, 2025