Sensex Soars 1400 Points, Nifty Above 23800: Top 5 Reasons For Today's Market Surge

Table of Contents

Positive Global Cues: Riding the Wave of International Market Optimism

Positive global economic indicators played a crucial role in today's market surge. Easing geopolitical tensions and encouraging US inflation data contributed significantly to the overall positive sentiment. This global market optimism spilled over into the Indian market, boosting investor confidence.

- Easing Geopolitical Tensions: Reduced concerns about international conflicts created a more stable global economic environment, encouraging investment across markets, including India.

- Positive US Inflation Data: Better-than-expected US inflation figures eased concerns about aggressive interest rate hikes by the Federal Reserve, positively impacting global market sentiment. This stability influenced foreign investment flows into emerging markets like India.

- Strong International Indices: The positive performance of major global indices, such as the Dow Jones and Nasdaq, further fueled the positive sentiment and encouraged investors to participate in the Indian stock market rally. This global market momentum was a significant factor in today's gains.

These positive global cues, coupled with the overall improvement in the international market, created a favorable environment for the Indian stock market to experience significant growth.

Robust Foreign Institutional Investor (FII) Inflow: Driving the Market Upward

Significant inflows from Foreign Institutional Investors (FIIs) directly propelled today's market surge. FIIs, who play a crucial role in driving the Indian stock market, demonstrated increased confidence in the Indian economy, leading to substantial capital inflow.

- Increased FII Investment: A large influx of funds from FIIs significantly boosted buying pressure, pushing the Sensex and Nifty to record highs. This investment reflects a growing confidence in the long-term prospects of the Indian economy.

- Positive Economic Outlook: The positive economic outlook for India, fueled by strong GDP growth projections and ongoing reforms, attracted significant FII interest. This positive narrative is a major reason for their investment.

- Government Reforms: Positive government policies and reforms continue to attract foreign investment, demonstrating confidence in the regulatory environment and potential for higher returns. This has helped strengthen the Indian stock market.

The robust FII inflow is a clear indicator of growing global confidence in the Indian economy and its potential for future growth.

Strong Corporate Earnings: Positive Business Sentiment Boosts Confidence

Strong corporate earnings from several listed companies contributed to the positive market sentiment. Better-than-expected quarterly results across various sectors boosted investor confidence and triggered increased buying activity.

- Positive Quarterly Results: Several companies reported outstanding quarterly results, exceeding market expectations and showcasing strong business performance. This improved sentiment was key to driving the Indian stock market surge.

- Sector-Specific Growth: Strong performance across various sectors, indicating broader economic strength, further fueled the market's upward momentum. This broad-based strength supports the significant stock market gains.

- Improved Business Sentiment: Positive corporate earnings significantly improved business sentiment, which was reflected in increased investor confidence and higher trading volumes. This demonstrates the market's positive reaction to successful corporate performance.

This positive trend in corporate earnings signifies a healthy economic outlook and fuels further optimism about the Indian stock market's future.

Government Policies and Initiatives: Positive Regulatory Environment

Recent government policies and initiatives aimed at boosting economic growth contributed significantly to the positive market sentiment. These policies created a favorable regulatory environment and enhanced investor confidence.

- Supportive Government Measures: Recent policy announcements aimed at stimulating economic growth and attracting investment have further boosted investor confidence. These are critical for the long-term stability and growth of the Indian stock market.

- Improved Regulatory Environment: A stable and transparent regulatory environment has enhanced investor confidence, encouraging both domestic and foreign investment. The clarity in regulations is extremely beneficial for the market.

- Focus on Infrastructure Development: Continued government focus on infrastructure development, which is key for economic growth, further supports the positive market outlook. Infrastructure projects help improve overall business confidence and investor sentiment.

The government's commitment to economic reforms and a favorable regulatory environment has reinforced investor confidence and contributed to the significant market rally.

Technical Factors: Chart Patterns and Trading Activity

Technical factors, including chart patterns and increased trading volumes, also played a significant role in today's market surge. These technical indicators pointed towards a bullish trend, further driving the market's upward momentum.

- Bullish Chart Patterns: Certain technical indicators and chart patterns suggested a strong bullish trend, encouraging investors to take long positions. This technical confirmation reinforced the positive sentiment.

- Increased Trading Volume: High trading volumes, exceeding recent averages, indicated strong investor participation and contributed to the market's rapid ascent. This shows a robust engagement in the market with strong investment activity.

- Market Momentum: The positive market momentum, driven by the combined effect of the factors mentioned above, created a self-reinforcing upward trend. This snowball effect fueled the surge.

Technical analysis suggests a strong bullish trend, reinforcing the positive market sentiment and contributing to the impressive gains in the Sensex and Nifty.

Conclusion: Understanding the Sensex and Nifty Surge – What's Next?

Today's remarkable 1400-point Sensex surge and Nifty crossing 23800 can be attributed to a confluence of factors: positive global cues, robust FII inflow, strong corporate earnings, supportive government policies, and favorable technical indicators. This stock market rally demonstrates the strength of the Indian economy and the growing confidence of both domestic and international investors. While predicting future market trends is inherently challenging, the current positive momentum suggests continued growth in the short-term. However, it's crucial to stay informed and monitor the evolving global and domestic landscape. To stay updated on the latest Sensex and Nifty movements and gain deeper insights into market analysis, subscribe to our newsletter for regular updates and in-depth analysis of stock market trends. Understanding the forces shaping the Sensex and Nifty is crucial for navigating the Indian stock market effectively.

Featured Posts

-

Exploring Bert Kreischers Comedy His Wifes Perspective On His Netflix Sex Jokes

May 10, 2025

Exploring Bert Kreischers Comedy His Wifes Perspective On His Netflix Sex Jokes

May 10, 2025 -

The Future Of Ryujinx Impact Of Nintendos Intervention

May 10, 2025

The Future Of Ryujinx Impact Of Nintendos Intervention

May 10, 2025 -

Paris Saint Germains Victory The Luis Enrique Effect

May 10, 2025

Paris Saint Germains Victory The Luis Enrique Effect

May 10, 2025 -

Living Legends Of Aviation A Tribute To Firefighters And First Responders

May 10, 2025

Living Legends Of Aviation A Tribute To Firefighters And First Responders

May 10, 2025 -

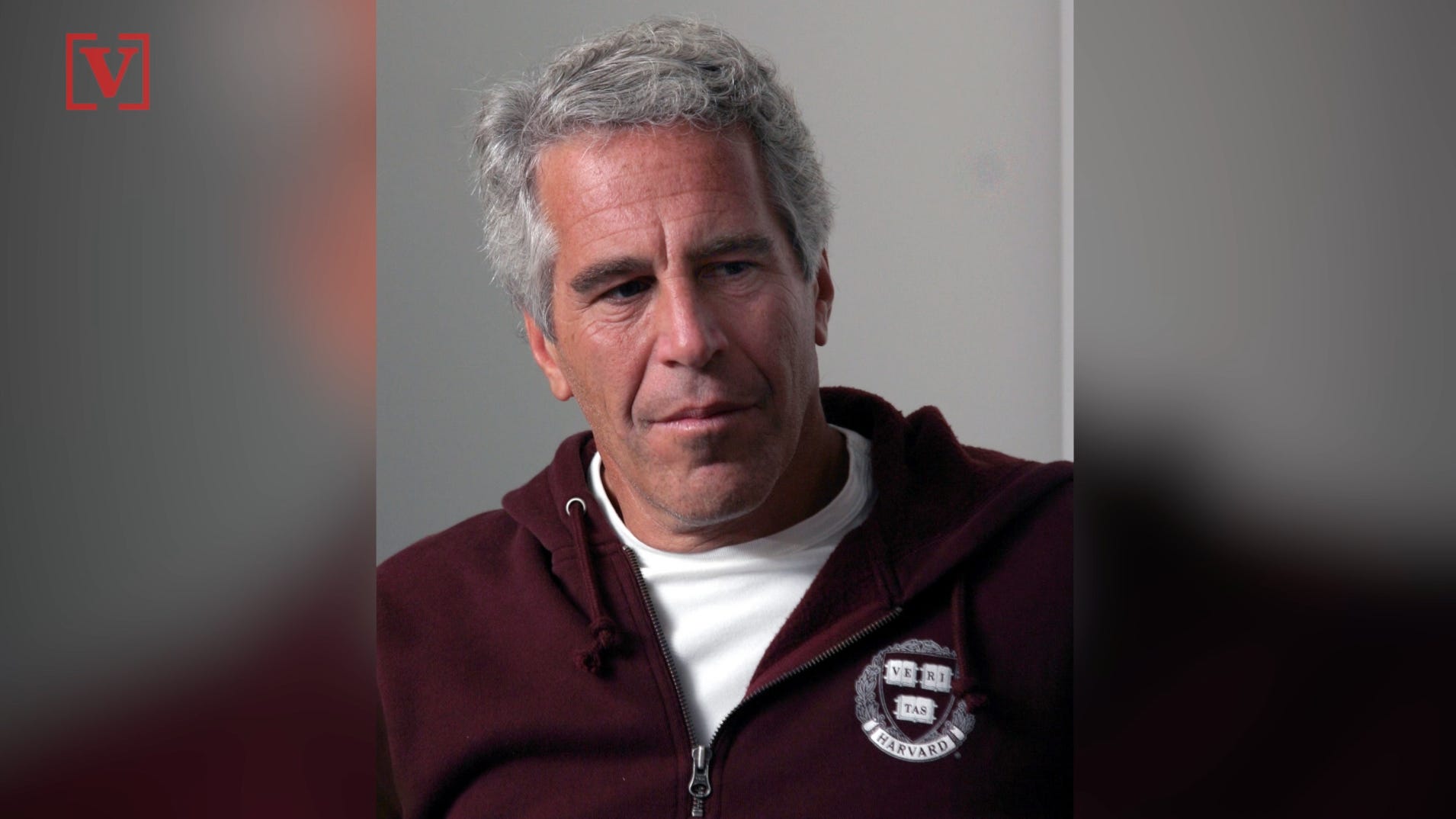

Bondi Under Fire Senate Democrats Claim Hidden Epstein Files

May 10, 2025

Bondi Under Fire Senate Democrats Claim Hidden Epstein Files

May 10, 2025