Shareholder Lawsuit Expedited After Judge Denies Paramount-Skydance Merger Block

Table of Contents

The Paramount-Skydance Merger and the Initial Lawsuit

The proposed merger between Paramount Global and Skydance Media promised significant expansion for both entities. However, a shareholder lawsuit was filed alleging several critical issues surrounding the merger agreement. The plaintiffs argued that the deal undervalued Paramount's stake, ultimately shortchanging shareholders.

- Alleged Violations: The lawsuit alleges breaches of fiduciary duty by Paramount's board of directors, citing inadequate consideration for the company's assets and a lack of transparency in the negotiation process. The plaintiffs also claim insufficient due diligence was conducted before the agreement was finalized.

- Plaintiffs' Arguments: The core argument rests on the assertion that the proposed merger price significantly underrepresents the true value of Paramount, leaving shareholders with less than they're entitled to. This undervaluation, they contend, stems from flawed due diligence and a lack of proper evaluation of Paramount's long-term prospects.

- Defendants' Arguments: Paramount and Skydance have likely countered these claims, arguing the merger price reflects a fair market valuation supported by thorough analysis and independent expert opinions. Their defense would likely focus on demonstrating due diligence and the sound strategic rationale behind the merger. They may argue the lawsuit is without merit and is designed to disrupt a mutually beneficial agreement.

The Judge's Decision and its Impact

The judge's decision to deny the motion to block the merger effectively cleared the path for the deal to proceed, significantly impacting the shareholder lawsuit's trajectory. The court's reasoning likely centered on the insufficient evidence presented to demonstrate irreparable harm to shareholders if the merger were allowed to proceed.

- Key Arguments Considered: The judge likely weighed the arguments regarding the adequacy of the merger price, the fairness of the process, and the potential harm to both parties involved if the merger were halted.

- Implications for the Lawsuit: This decision doesn't dismiss the lawsuit; instead, it shifts the focus to the merits of the claims regarding breach of fiduciary duty and inadequate consideration. The expedited nature of the proceedings now accelerates the discovery and pretrial phases, potentially leading to a faster resolution.

- Legal Ramifications: This case sets a significant legal precedent for future merger litigation. The judge's reasoning and the final outcome will undoubtedly be scrutinized and cited in similar cases, influencing legal strategy and judicial review in corporate mergers and acquisitions.

Expedited Litigation and its Implications for Shareholders

The judge's decision to proceed without blocking the merger has resulted in an expedited litigation process. This fast-track approach significantly shortens the legal timeline, accelerating discovery, motion practice, and ultimately, the path to a potential trial or settlement.

- Advantages and Disadvantages: Expedited litigation offers a quicker resolution, beneficial for both parties wanting to move past the legal battle. However, it also limits the time for extensive discovery and thorough investigation, potentially impacting the depth of evidence presented. This can be a disadvantage for plaintiffs who might not have the time to uncover all pertinent information.

- Potential Outcomes: Several outcomes are possible, including a settlement reached between the parties, a trial, or an appeal following an unfavorable verdict. The expedited process pressures both sides to reach a quicker resolution, making a settlement more likely.

- Impact on Shareholder Investments: The uncertainty surrounding the lawsuit, even in an expedited setting, could create volatility in the stock market. Shareholder investments may be impacted depending on the outcome of the litigation. The speed of the process can be both beneficial and detrimental depending on individual investor risk tolerance and investment strategies.

Protecting Shareholder Rights in Merger Disputes

Shareholders facing similar situations need to be proactive in protecting their rights. Understanding your legal options is crucial.

- Seek Legal Counsel: Consulting with a qualified attorney specializing in shareholder rights and corporate litigation is paramount. They can assess the situation, advise on the merits of your case, and guide you through the legal process.

- Available Resources: Several shareholder advocacy groups and legal aid organizations can provide valuable information and support. Researching these resources can empower shareholders to navigate the complexities of such disputes more effectively.

Conclusion

The Paramount-Skydance merger, the subsequent shareholder lawsuit, and the judge's decision to expedite the proceedings mark a significant event in corporate litigation. The case highlights the importance of strong corporate governance, thorough due diligence in merger negotiations, and the robust protection of shareholder rights. The speed at which this shareholder lawsuit is progressing serves as a stark reminder of the potential impact of legal challenges on mergers and acquisitions. The outcome will undoubtedly influence future merger disputes and investor behavior.

Call to Action: Stay informed about the ongoing lawsuit and understand your rights as a shareholder. If you find yourself in a similar situation involving potential shareholder lawsuits or concerning aspects of merger agreements, seek legal counsel immediately to protect your interests. Proactive engagement is key to safeguarding your investments and ensuring corporate accountability in matters involving shareholder lawsuits.

Featured Posts

-

Kai Cenat And Ninja Clash Asmongold Offers His Perspective

May 27, 2025

Kai Cenat And Ninja Clash Asmongold Offers His Perspective

May 27, 2025 -

Four Books Exposing The Power Of Private Equity

May 27, 2025

Four Books Exposing The Power Of Private Equity

May 27, 2025 -

How To Watch Survivor Season 48 Episode 13 For Free A Complete Guide

May 27, 2025

How To Watch Survivor Season 48 Episode 13 For Free A Complete Guide

May 27, 2025 -

Gucci Re Motion Bag Blue Gg Canvas Product Code 832461 Aaew 34245 May 2025

May 27, 2025

Gucci Re Motion Bag Blue Gg Canvas Product Code 832461 Aaew 34245 May 2025

May 27, 2025 -

Atentatot Na Robert Kenedi Raz Asnuvanje Preku 10 000 Ob Aveni Dokumenti

May 27, 2025

Atentatot Na Robert Kenedi Raz Asnuvanje Preku 10 000 Ob Aveni Dokumenti

May 27, 2025

Latest Posts

-

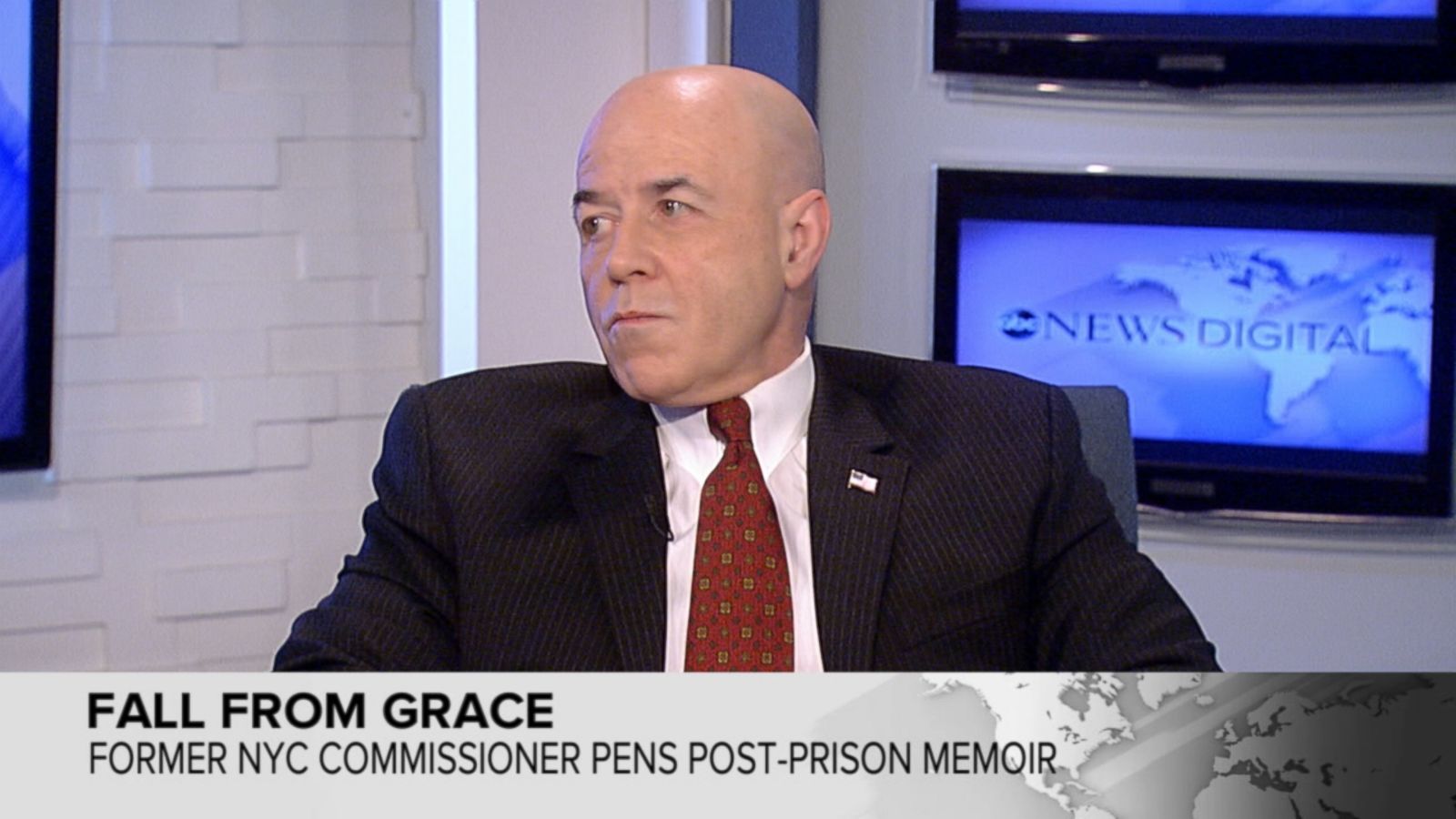

Exploring Bernard Keriks Family Wife Hala Matli And Children

May 31, 2025

Exploring Bernard Keriks Family Wife Hala Matli And Children

May 31, 2025 -

Bernard Keriks Wife Hala Matli And Their Children A Family Portrait

May 31, 2025

Bernard Keriks Wife Hala Matli And Their Children A Family Portrait

May 31, 2025 -

9 11 And Beyond Reflecting On Bernard Keriks Nypd Leadership

May 31, 2025

9 11 And Beyond Reflecting On Bernard Keriks Nypd Leadership

May 31, 2025 -

Assessing Bernard Keriks Leadership During The 9 11 Crisis And Aftermath

May 31, 2025

Assessing Bernard Keriks Leadership During The 9 11 Crisis And Aftermath

May 31, 2025 -

Bernard Kerik And The Nypds Response To 9 11

May 31, 2025

Bernard Kerik And The Nypds Response To 9 11

May 31, 2025