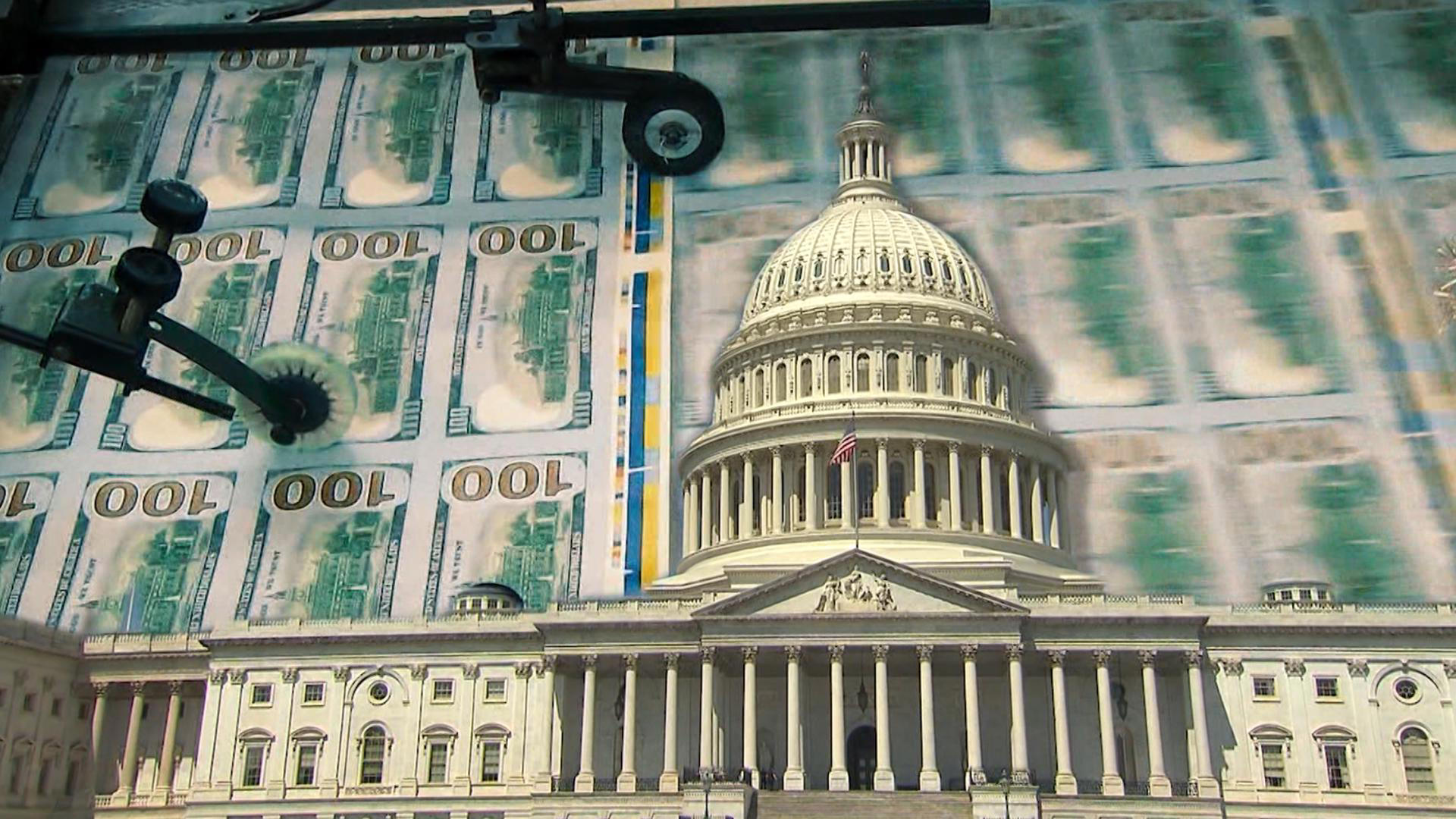

Shareholder Lawsuits Against Tesla: The Fallout From Elon Musk's Pay Package

Table of Contents

The Controversial 2018 Compensation Package

In 2018, Tesla's board approved a massive compensation package for Elon Musk, structured around stock options contingent upon achieving ambitious performance goals. This package, unprecedented in scale, tied the CEO's compensation directly to Tesla's market capitalization and the achievement of specific operational milestones. While proponents argued that it incentivized Musk to drive exceptional growth and innovation, critics immediately questioned its excessive nature compared to industry standards for similar roles. The initial shareholder votes approving the package were themselves contested, raising questions about the fairness and transparency of the process.

- Unprecedented scale of stock options: The sheer number of stock options granted to Musk far exceeded those given to CEOs of comparable companies, raising concerns about potential for excessive enrichment.

- Ambiguous performance metrics: Some of the performance metrics used to unlock the stock options were considered vague and open to interpretation, allowing for potential manipulation and subjectivity.

- Potential for excessive CEO enrichment: Critics argued the structure was designed to guarantee Musk an enormous payout regardless of actual company performance, potentially at the expense of shareholder returns.

- Lack of independent board oversight (alleged): Several lawsuits alleged that the board lacked sufficient independence and objectivity when approving the package, potentially leading to a conflict of interest.

Key Arguments in Shareholder Lawsuits

Numerous shareholder lawsuits have been filed against Tesla and its board of directors, primarily alleging breaches of fiduciary duty and corporate waste. The core arguments center around the claim that the compensation package was not designed in the best interests of shareholders and unfairly enriched Elon Musk at their expense. Plaintiffs argue the board failed to adequately protect shareholder value by approving such an extravagant and potentially risky compensation plan.

- Inadequate due diligence in setting performance goals: Lawsuits allege that the board did not conduct sufficient due diligence when establishing the performance targets for unlocking the stock options.

- Conflicts of interest within the board: Concerns were raised about potential conflicts of interest among board members due to their personal relationships with Elon Musk or financial ties to the company.

- Misrepresentation of the package's value and risks: Lawsuits claim that the board misrepresented the true value and inherent risks associated with the compensation package to shareholders.

- Unfair enrichment of Elon Musk at shareholder expense: This is the central claim of the lawsuits – that Musk's compensation was excessive and prioritized his personal gain over the interests of the company and its shareholders.

The Legal Battles and Their Outcomes (or ongoing status)

The legal battles surrounding these shareholder lawsuits against Tesla are complex and ongoing. Several lawsuits have been consolidated, and the plaintiffs are pursuing various legal strategies. The defendants have filed motions to dismiss, arguing that the shareholders failed to demonstrate harm or that the board acted within its legal authority. Key legal arguments focus on Delaware corporate law, which governs Tesla's corporate structure. Specific details on settlements, dismissals, or court rulings are subject to change as the legal process continues.

- Timeline of legal proceedings: The lawsuits have been unfolding for several years, with various stages of discovery, motions, and potential trials ahead.

- Key legal precedents cited: Both sides cite relevant case law related to executive compensation, fiduciary duties, and corporate governance.

- Outcomes of motions to dismiss: The court's decisions on motions to dismiss will be critical in determining the future trajectory of the lawsuits.

- Potential financial implications for Tesla: A negative outcome could lead to significant financial liabilities for Tesla, including substantial payouts to shareholders.

Impact on Tesla's Stock Price

The shareholder lawsuits against Tesla, and the negative publicity surrounding Elon Musk's compensation, have had a complex relationship with the company's stock performance. While some negative publicity might be expected to negatively impact stock price, analyzing the correlation requires accounting for other significant market factors impacting Tesla's stock.

- Stock price fluctuations before, during, and after the lawsuits: Analyzing these fluctuations requires careful consideration of numerous factors influencing Tesla's market valuation.

- Investor sentiment analysis: Investor sentiment has likely been influenced by the lawsuits, though disentangling this from other market factors requires advanced modeling.

- Market reaction to court decisions: Future court rulings will undoubtedly impact investor confidence and, consequently, the stock price.

Implications for Corporate Governance and Executive Compensation

The Tesla case has far-reaching implications for corporate governance practices and the future design of executive compensation packages across all publicly traded companies. It highlights the need for increased scrutiny of executive pay, improved board independence, and more transparent processes for approving compensation plans.

- Increased scrutiny of executive pay: The lawsuits have amplified public and regulatory attention on the fairness and reasonableness of executive compensation.

- Potential for regulatory changes: This case may lead to legislative or regulatory changes to strengthen shareholder rights and oversight of executive compensation.

- Enhanced shareholder activism: Shareholder activism is likely to increase, with shareholders demanding greater transparency and accountability in executive pay decisions.

- Best practices for designing equitable compensation plans: Companies may revisit their compensation structures, aiming for plans that better align executive incentives with long-term shareholder value.

Conclusion

The shareholder lawsuits against Tesla stemming from Elon Musk's compensation package represent a significant challenge to traditional corporate governance models. The controversies surrounding this deal, the ongoing legal battles, and the potential financial and reputational consequences for Tesla have highlighted the crucial need for greater transparency, accountability, and fairness in executive compensation. The impact extends beyond Tesla, influencing how boards structure executive pay and how shareholders engage in corporate governance. Stay informed about the ongoing developments in these crucial shareholder lawsuits against Tesla. Understanding the legal battles surrounding executive compensation is vital for all investors interested in corporate governance and responsible investing. Further research into the specifics of these shareholder lawsuits against Tesla can provide valuable insights into corporate accountability and the fight for shareholder rights.

Featured Posts

-

The Gops Medicaid Battle Divisions And Consequences

May 18, 2025

The Gops Medicaid Battle Divisions And Consequences

May 18, 2025 -

Maneskins Damiano David Releases Contemplative Solo Single Next Summer

May 18, 2025

Maneskins Damiano David Releases Contemplative Solo Single Next Summer

May 18, 2025 -

Is Your Home Renovation Stressing You Out Consider A House Therapist

May 18, 2025

Is Your Home Renovation Stressing You Out Consider A House Therapist

May 18, 2025 -

Amsterdam Hotel Attack Police Investigation Following Knife Incident

May 18, 2025

Amsterdam Hotel Attack Police Investigation Following Knife Incident

May 18, 2025 -

Eurovision 2025 Uk Entry Announced Amidst Controversys Shadow

May 18, 2025

Eurovision 2025 Uk Entry Announced Amidst Controversys Shadow

May 18, 2025

Latest Posts

-

Kanye West Bianca Censori A Spanish Reunion

May 18, 2025

Kanye West Bianca Censori A Spanish Reunion

May 18, 2025 -

Instruktsiya K Pokhoronam Po Versii Kane Uesta Istoriya Vdokhnoveniya

May 18, 2025

Instruktsiya K Pokhoronam Po Versii Kane Uesta Istoriya Vdokhnoveniya

May 18, 2025 -

Kanye West And Bianca Censori Spotted Together In Spain

May 18, 2025

Kanye West And Bianca Censori Spotted Together In Spain

May 18, 2025 -

Did Kanye West And Bianca Censori Reconcile Spain Dinner Date Sparks Speculation

May 18, 2025

Did Kanye West And Bianca Censori Reconcile Spain Dinner Date Sparks Speculation

May 18, 2025 -

Kane Uest I Pasha Tekhnik Neobychnaya Instruktsiya K Pokhoronam

May 18, 2025

Kane Uest I Pasha Tekhnik Neobychnaya Instruktsiya K Pokhoronam

May 18, 2025