Sharp Decline In Toronto Home Sales: 23% Year-Over-Year Decrease, 4% Price Drop

Table of Contents

Significant Drop in Toronto Home Sales: A 23% Year-Over-Year Decrease

The dramatic 23% year-over-year decrease in Toronto home sales paints a clear picture of a cooling market. Several key factors contribute to this significant downturn.

Impact of Rising Interest Rates

Rising interest rates have directly impacted affordability for potential homebuyers in Toronto. The Bank of Canada's aggressive interest rate hikes throughout 2022 and into 2023 have significantly increased mortgage payments.

- Increased Mortgage Payments: Even a small increase in interest rates translates to a substantial jump in monthly mortgage payments, reducing the purchasing power of many potential buyers. For example, a 1% increase on a $1 million mortgage could add hundreds of dollars to monthly payments.

- Rate Hikes and Timing: The Bank of Canada's key interest rate increased from 0.25% in early 2022 to 5% by the end of 2023, impacting the market significantly. These increases were implemented gradually, but the cumulative effect has been substantial.

- Illustrative Chart: [Insert a chart or graph here clearly showing the correlation between interest rate hikes and the subsequent decline in Toronto home sales. Label axes clearly and provide a concise title].

Reduced Buyer Demand in the Toronto Market

Higher borrowing costs aren't the only factor. Economic uncertainty and inflation have also dampened buyer confidence, leading to a decrease in the number of active buyers in the Toronto market.

- Economic Uncertainty: Concerns about a potential recession, high inflation, and job security have made many potential homebuyers hesitant to enter the market.

- Decreased Buyer Activity: Statistics from the Toronto Real Estate Board (TREB) show a significant drop in the number of transactions across various Toronto neighborhoods, particularly in the traditionally high-demand areas. [Cite specific TREB statistics here].

Inventory Levels in the Toronto Real Estate Market

Increased inventory levels have also played a role in the reduced sales volume. The market is gradually shifting from a seller's market to a buyer's market.

- Increased Inventory: Compared to previous years, the number of properties listed for sale in Toronto has increased. This increased supply gives buyers more options and negotiating power.

- Inventory by Property Type: The increase in inventory is particularly noticeable in certain property types, such as condos and townhouses in specific neighborhoods. [Provide data comparing inventory levels across property types and neighborhoods].

- Shifting Market Dynamics: The increased inventory signifies a move away from the seller's market dominance seen in previous years, giving buyers a more advantageous position in negotiations.

4% Price Drop in Toronto: A Sign of Market Correction?

The 4% average price drop in Toronto represents a significant market correction, signifying a shift in the market dynamics.

Average Price Decreases Across Toronto Neighborhoods

Price decreases are evident across different Toronto neighborhoods, although the magnitude of the drop varies.

- Neighborhood-Specific Data: [Include a table or map visualizing price changes across different Toronto neighborhoods, e.g., Downtown Core, Midtown, North York, Scarborough. Highlight areas with more significant drops and explain potential reasons].

- Contributing Factors: Factors such as the concentration of specific property types, proximity to amenities, and local economic conditions contribute to the variation in price drops across neighborhoods.

Impact on Different Property Types

The price correction is impacting different property types in Toronto to varying degrees.

- Price Changes by Property Type: Detached homes typically experience price changes more slowly than condos or townhouses, which are often more sensitive to market shifts. [Provide data showing price changes for condos, townhouses, and detached homes].

Potential for Further Price Adjustments

Experts predict that further price adjustments are possible depending on several factors.

- Expert Opinions: Market analysts suggest that continued interest rate hikes and persistent economic uncertainty could lead to further price decreases in the Toronto real estate market.

- Influencing Factors: Future price adjustments will depend on economic indicators such as inflation, employment rates, and future interest rate decisions from the Bank of Canada.

Future Outlook for the Toronto Real Estate Market

Predicting the future of the Toronto real estate market requires careful consideration of several interconnected factors.

Predictions for Home Sales in Toronto

Experts anticipate a continued slowdown in home sales in the near term, although the pace of decline may moderate. [Cite relevant predictions from reputable sources].

Potential for Market Stabilization

Market stabilization is possible once interest rates stabilize and economic uncertainty decreases. However, the timing remains uncertain.

Advice for Buyers and Sellers

This shifting market presents both opportunities and challenges for buyers and sellers:

- Buyers: Buyers now have more negotiating power and a wider selection of properties. However, they need to carefully assess their financial situation given the higher interest rates.

- Sellers: Sellers should realistically price their properties to attract buyers in a more competitive market.

Conclusion

The Toronto real estate market has experienced a significant cooling, with a 23% year-over-year decrease in home sales and a 4% average price drop. Rising interest rates, reduced buyer demand, and increased inventory are the primary drivers of this correction. The market is shifting from a seller's market to a more balanced one. While the future remains uncertain, understanding these current trends in the Toronto housing market is crucial for making informed decisions whether you are a buyer or seller. For up-to-date insights and expert analysis on Toronto home sales and prices, continue to follow [your website/publication name].

Featured Posts

-

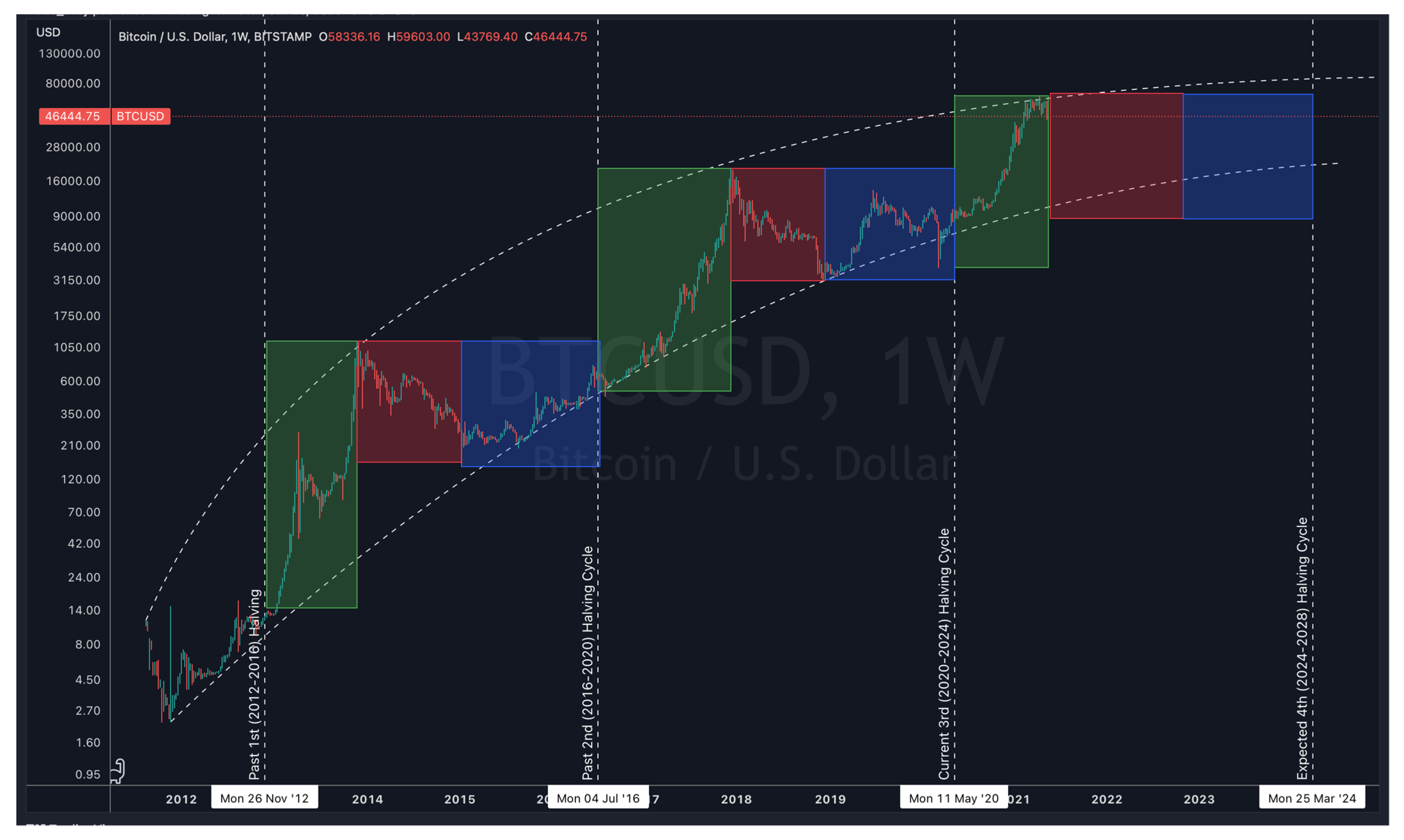

Analyzing Xrp Ripple A Prudent Approach To Investment Decisions

May 08, 2025

Analyzing Xrp Ripple A Prudent Approach To Investment Decisions

May 08, 2025 -

Analyzing The Bitcoin Market Predicting Future Price Based On Trumps Actions

May 08, 2025

Analyzing The Bitcoin Market Predicting Future Price Based On Trumps Actions

May 08, 2025 -

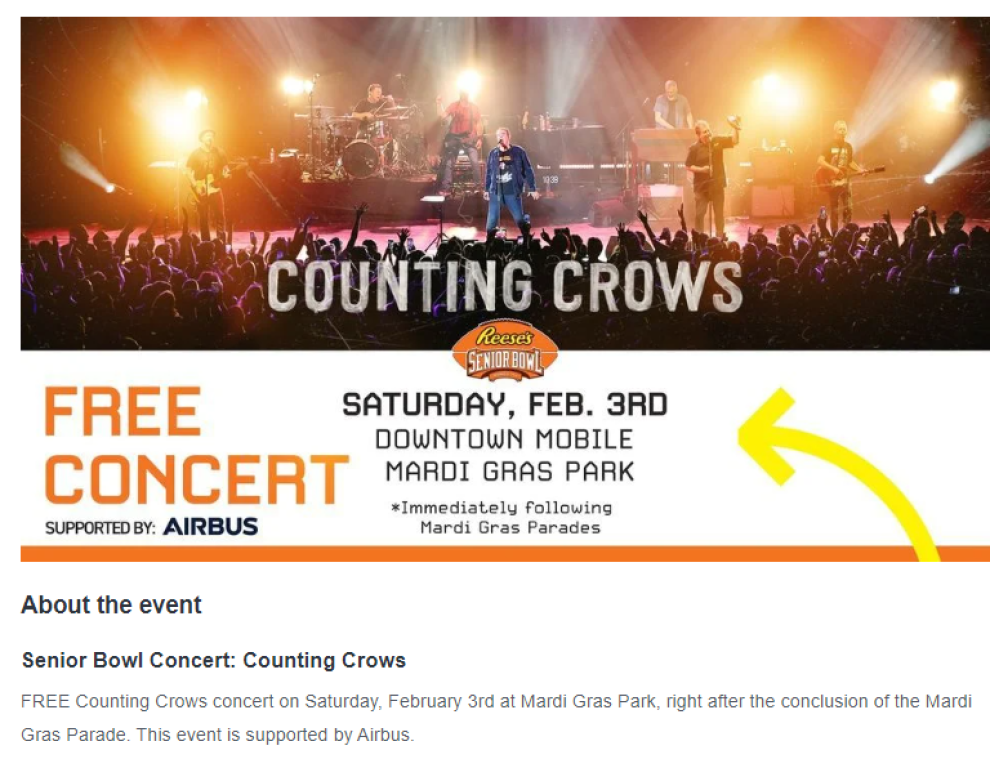

Las Vegas Concert Counting Crows Announce Strip Performance

May 08, 2025

Las Vegas Concert Counting Crows Announce Strip Performance

May 08, 2025 -

Glen Powell Building Bulletproof Fitness For The Running Man Role

May 08, 2025

Glen Powell Building Bulletproof Fitness For The Running Man Role

May 08, 2025 -

Ripple And Xrp Three Factors Pointing To Significant Price Growth Plus Remittix Ico Update

May 08, 2025

Ripple And Xrp Three Factors Pointing To Significant Price Growth Plus Remittix Ico Update

May 08, 2025