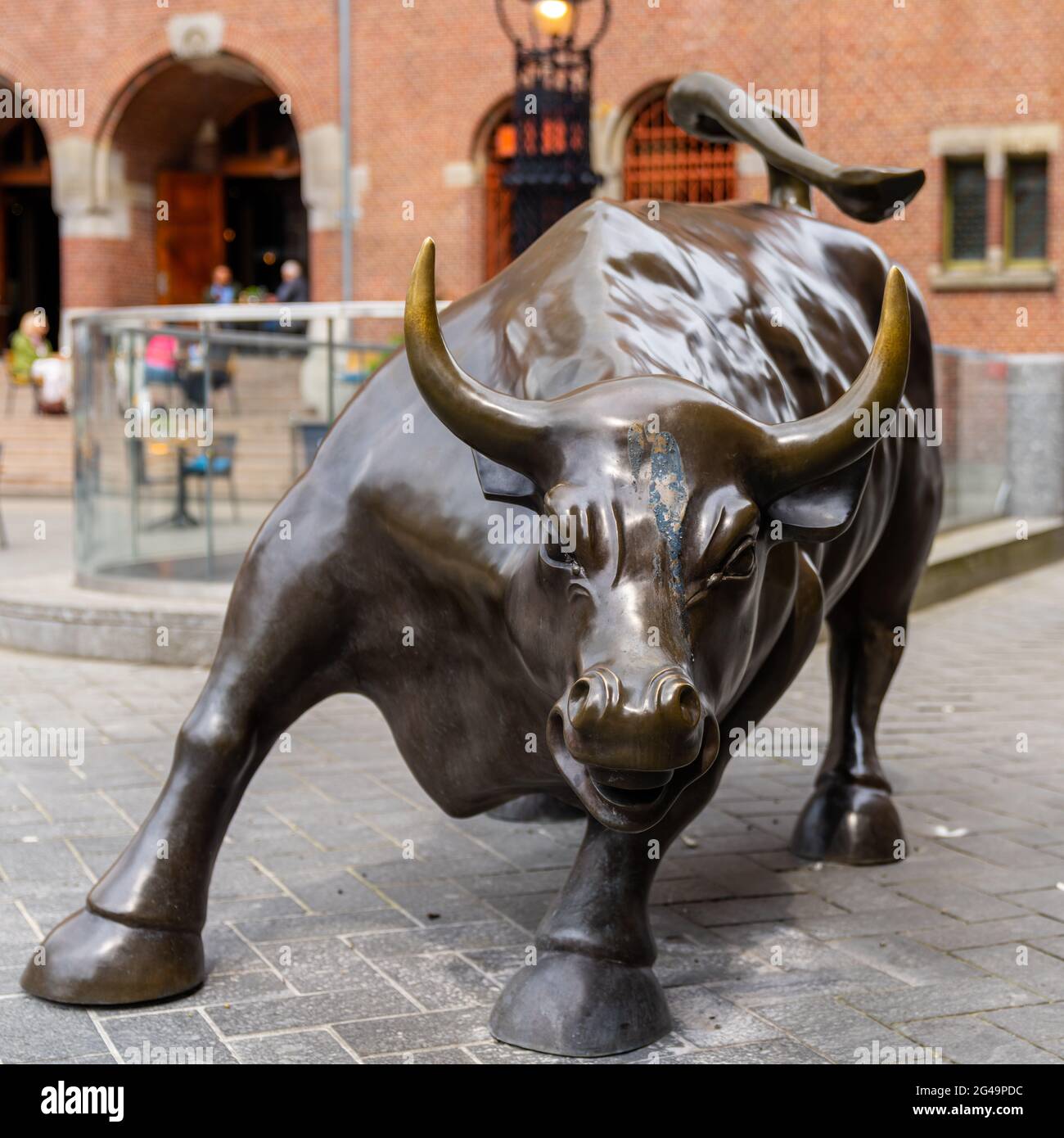

Sharp Decline On Amsterdam Stock Exchange: 11% Down In Three Days

Table of Contents

Understanding the Scale of the Decline

The severity of the AEX's decline cannot be overstated. This 11% drop represents a significant loss of value for investors and highlights the fragility of the current market conditions.

AEX Index Performance:

Over the three-day period, the AEX index plummeted from [Insert starting index value] to [Insert ending index value], representing a dramatic [Insert precise percentage] fall. [Insert chart or graph visualizing the AEX index performance over the three days]. This rapid descent marks one of the sharpest declines in the AEX's recent history.

Impact on Individual Stocks:

The decline wasn't evenly distributed across the board. Several prominent companies listed on the AEX experienced significant losses. For example, Shell, a major component of the index, saw its share price fall by approximately [Insert percentage]%, while ASML, a leading semiconductor equipment manufacturer, experienced a [Insert percentage]% drop. Unilever, a consumer goods giant, also suffered a considerable decline of [Insert percentage]%.

- The highest point reached during this period was [Insert value], while the lowest point reached was [Insert value].

- The approximate financial losses for investors are estimated to be in the range of [Insert monetary value] based on current market capitalization.

- This three-day decline surpasses the severity of [mention previous significant AEX drops and their percentage declines], highlighting the exceptional nature of this recent event.

Potential Causes for the Sharp Drop

The sudden and sharp decline on the Amsterdam Stock Exchange is likely a complex interplay of various factors, both global and domestic.

Global Economic Factors:

Global economic headwinds played a significant role in this downturn. Rising inflation, persistent fears of a global recession, and ongoing geopolitical instability – particularly the [mention specific geopolitical event] – created a climate of uncertainty that triggered significant risk aversion among investors.

Specific Sectoral Impacts:

Certain sectors were disproportionately affected. The technology sector, particularly sensitive to interest rate hikes, experienced a steeper decline than others. Similarly, the energy sector, grappling with fluctuating oil prices and energy security concerns, also saw considerable losses.

Investor Sentiment and Market Psychology:

Fear and panic selling played a crucial role in exacerbating the downturn. As the market began to fall, many investors reacted by selling their holdings, creating a self-reinforcing downward spiral driven by herd behavior. This negative market psychology amplified the initial decline.

- The escalation of the [mention specific global event] significantly contributed to investor anxiety and triggered widespread selling.

- Recent interest rate hikes by the European Central Bank [or relevant monetary authority] also increased concerns about slowing economic growth, contributing to the market's decline.

- Several disappointing financial reports from major companies listed on the AEX further fueled negative investor sentiment.

Consequences and Future Outlook

The consequences of this market crash extend far beyond the Amsterdam Stock Exchange itself.

Impact on the Dutch Economy:

This sharp decline has significant implications for the Dutch economy. Reduced investor confidence can lead to decreased investment in businesses, impacting GDP growth and potentially increasing unemployment. Consumer confidence could also suffer, leading to reduced spending.

Government Response and Regulatory Measures:

The Dutch government is likely to monitor the situation closely and may consider implementing measures to stabilize the market. These could include fiscal stimulus or measures to support affected businesses. However, the scope and effectiveness of such interventions remain to be seen.

Implications for Investors:

This volatility underscores the importance of risk management. Investors need to carefully assess their portfolios, diversify holdings, and consider strategies to mitigate potential losses. This includes considering a more conservative investment approach, hedging strategies, and potentially repositioning assets.

- Long-term effects on investments and retirement savings could be substantial for those heavily invested in the AEX.

- The potential for recovery depends on factors such as resolving geopolitical tensions, controlling inflation, and the overall health of the global economy.

- Investors should focus on long-term investment strategies and avoid panic selling, instead opting for a measured and informed approach.

Conclusion

The sharp 11% decline on the Amsterdam Stock Exchange in just three days represents a significant event with far-reaching implications. The confluence of global economic uncertainties, sectoral weaknesses, and negative investor sentiment contributed to this dramatic downturn. The consequences for the Dutch economy and individual investors are considerable, emphasizing the need for careful monitoring and proactive risk management.

Call to Action: Stay informed about the ongoing situation on the Amsterdam Stock Exchange and its implications for your investments. Follow reputable financial news sources for updates on AEX market performance and analysis to make informed decisions regarding your investment portfolio in light of this significant decline. Monitor the Amsterdam Stock Exchange closely for signs of recovery or further volatility. Understanding the dynamics of the Amsterdam Stock Exchange is crucial for navigating the current market instability.

Featured Posts

-

Ferrari Challenge A High Octane Weekend In South Florida

May 24, 2025

Ferrari Challenge A High Octane Weekend In South Florida

May 24, 2025 -

Experience The Ferrari Challenge Racing Days In South Florida

May 24, 2025

Experience The Ferrari Challenge Racing Days In South Florida

May 24, 2025 -

Woody Allen Sexual Abuse Allegations A Re Examination Following Sean Penns Comments

May 24, 2025

Woody Allen Sexual Abuse Allegations A Re Examination Following Sean Penns Comments

May 24, 2025 -

Avrupa Hisse Senetleri Duesueste Stoxx Europe 600 Ve Dax 40 Endeksleri Geriledi 16 Nisan 2025

May 24, 2025

Avrupa Hisse Senetleri Duesueste Stoxx Europe 600 Ve Dax 40 Endeksleri Geriledi 16 Nisan 2025

May 24, 2025 -

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025 -

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025