Shopify Stock Soars: Nasdaq 100 Inclusion Fuels 14%+ Jump

Table of Contents

Nasdaq 100 Inclusion: A Catalyst for Growth

Being added to the Nasdaq 100 is a monumental event for any company, and for Shopify, it acted as a significant catalyst for growth. The impact is multifaceted, affecting various aspects of the company's market position and investor perception.

Increased Market Exposure and Visibility

Being included in the Nasdaq 100 significantly increases Shopify's visibility to a much broader range of investors. This increased exposure translates into several key benefits:

- Increased trading volume: More investors now have access to SHOP stock, leading to higher trading activity.

- Attraction of institutional investors: Large institutional investors, who often track the Nasdaq 100, are now more likely to include Shopify in their portfolios.

- Enhanced market liquidity: Increased trading volume translates to improved liquidity, making it easier to buy and sell Shopify stock.

- Positive media coverage: Inclusion in the Nasdaq 100 generates positive media attention, further boosting the company's profile.

Index Fund Inflows

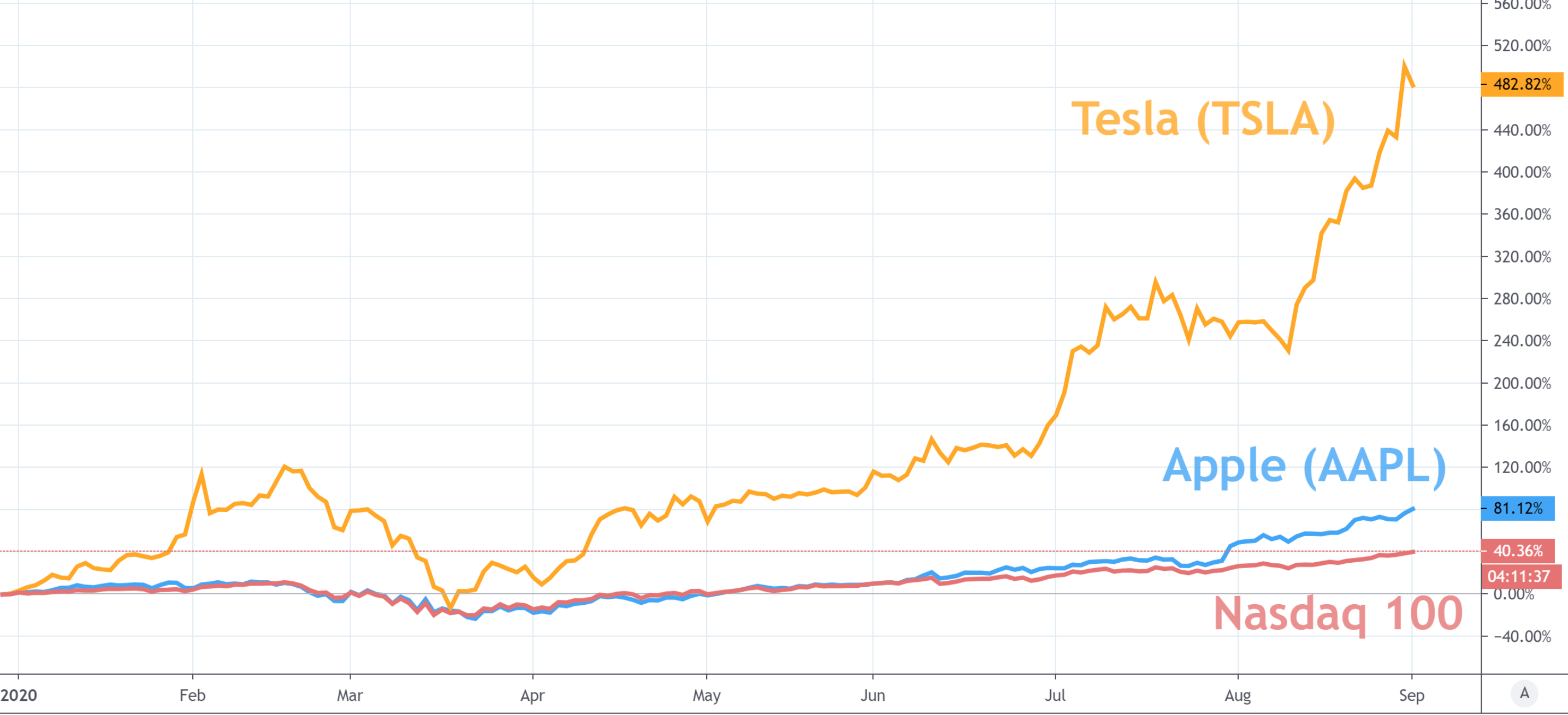

Numerous index funds and exchange-traded funds (ETFs) track the Nasdaq 100. Their inclusion of Shopify necessitates the purchase of SHOP stock, creating significant demand.

- Passive investing driving demand: Passive investment strategies, which involve tracking specific indices, directly contribute to the increased demand for Shopify stock.

- Increased demand pushes up the price: This surge in demand from index funds directly impacts the price, driving it upwards.

- Impact of ETF rebalancing: Periodic rebalancing of ETFs further contributes to the buying pressure on Shopify stock.

Enhanced Credibility and Reputation

Inclusion in the Nasdaq 100 reinforces Shopify's status as a leading and stable technology company, significantly boosting investor confidence in Shopify stock.

- Signal of strong financial performance: Inclusion signifies that Shopify meets the rigorous listing requirements of the Nasdaq 100, indicating strong financial health.

- Improved investor perception: The prestige associated with the Nasdaq 100 enhances the perception of Shopify as a reliable and successful investment.

- Reduced investment risk perception: Many investors view inclusion in the Nasdaq 100 as a reduction in perceived investment risk.

Shopify's Strong Fundamentals and Future Growth Prospects

The recent stock price surge isn't solely due to the Nasdaq 100 inclusion. Shopify's strong fundamentals and positive future growth prospects play a crucial role.

Robust E-commerce Market

Shopify is a major beneficiary of the booming global e-commerce market. Its consistent growth and innovation solidify its position as a leader in the industry.

- Growing number of merchants on the platform: Shopify continues to attract new merchants, expanding its user base and revenue streams.

- Expansion into new markets and verticals: Shopify is actively expanding its reach into new geographical markets and e-commerce verticals.

- Development of new features and services: Continuous innovation and the development of new features enhance the platform's appeal to merchants.

Strategic Acquisitions and Partnerships

Shopify's strategic acquisitions and partnerships contribute to its expansion and competitiveness.

- Examples of successful acquisitions: Strategic acquisitions enhance Shopify's product offerings and capabilities. (Specific examples could be mentioned here).

- Benefits of key strategic partnerships: Partnerships with other technology companies broaden Shopify's reach and enhance its platform's functionality.

- Enhanced product offerings and market reach: These strategic moves significantly expand Shopify's market reach and competitive advantage.

Analyzing the Stock Price Jump and Potential Future Performance of SHOP Stock

While the recent 14%+ jump in Shopify stock price is impressive, investors need to consider both short-term volatility and long-term growth potential.

Short-Term Volatility vs. Long-Term Growth

The immediate aftermath of a major event like Nasdaq 100 inclusion often involves short-term volatility.

- Analyzing market sentiment: Investors should monitor market sentiment surrounding Shopify stock to gauge potential short-term fluctuations.

- Considering industry trends: Understanding broader industry trends in e-commerce is crucial for predicting long-term performance.

- Evaluating risk tolerance: Investors should assess their risk tolerance before making investment decisions, especially in the context of market volatility.

Factors Affecting Future Stock Price

The future performance of Shopify stock will be influenced by several factors:

- Competition from other e-commerce platforms: Competition from other players in the e-commerce market will continue to impact Shopify's growth.

- Overall economic conditions: Macroeconomic factors, such as inflation and recessionary pressures, will affect consumer spending and impact Shopify's performance.

- Shopify's execution of its business strategy: Shopify's ability to execute its strategic plans will be a key determinant of its future success.

Conclusion

Shopify's inclusion in the Nasdaq 100 has undeniably boosted its stock price, reflecting increased investor confidence and market demand for SHOP stock. While short-term fluctuations are expected, Shopify's strong fundamentals and position within the rapidly expanding e-commerce market suggest promising long-term growth potential. Understanding the factors contributing to this surge is crucial for informed investment decisions. Should you be considering adding SHOP stock to your portfolio, thorough research and a well-defined investment strategy are paramount. Stay informed about Shopify stock and the dynamic e-commerce landscape to make the best decisions regarding your Shopify stock investments.

Featured Posts

-

Disney Live Action Remakes Predicting Snow Whites Rotten Tomatoes Score Through Data Analysis

May 14, 2025

Disney Live Action Remakes Predicting Snow Whites Rotten Tomatoes Score Through Data Analysis

May 14, 2025 -

Is This Kanye Wests New Girlfriend Bianca Censori Resemblance Sparks Rumors

May 14, 2025

Is This Kanye Wests New Girlfriend Bianca Censori Resemblance Sparks Rumors

May 14, 2025 -

Neljae Laehes 500 000 Euron Eurojackpot Voittoa Katso Voittopaikkakunnat

May 14, 2025

Neljae Laehes 500 000 Euron Eurojackpot Voittoa Katso Voittopaikkakunnat

May 14, 2025 -

Bayern Onderzoekt Nederlander Prijskaartje Blijkt Schrikbarend

May 14, 2025

Bayern Onderzoekt Nederlander Prijskaartje Blijkt Schrikbarend

May 14, 2025 -

Final De Etapa Para Garcia Pimienta Y Comienzo Para Caparros En El Sevilla

May 14, 2025

Final De Etapa Para Garcia Pimienta Y Comienzo Para Caparros En El Sevilla

May 14, 2025