Should I Buy Palantir Stock Before May 5th? A Comprehensive Review

Table of Contents

Palantir Technologies is a prominent player in the big data analytics industry, known for its powerful software platforms used by government agencies and commercial enterprises alike. Its business model centers around providing advanced data integration, analysis, and visualization tools, enabling clients to make better decisions based on complex datasets. However, the question remains: is Palantir stock a wise investment before May 5th?

Palantir's Recent Financial Performance and Future Earnings Expectations

Q1 2024 Earnings Preview:

Analysts are eagerly anticipating Palantir's Q1 2024 earnings report. The focus will be on revenue growth, profitability, and key performance indicators (KPIs) like operating margins and customer acquisition.

- Analyst Estimates: While precise figures vary, analysts generally predict continued revenue growth, though perhaps at a slightly slower pace than previous quarters. The key will be whether Palantir can demonstrate sustained profitability and improved operating efficiency.

- Potential Surprises: Positive surprises could include exceeding revenue expectations, faster-than-anticipated growth in a specific sector (e.g., commercial partnerships), or announcements of significant new contracts. Negative surprises could involve lower-than-expected revenue, margin compression, or challenges in securing new business.

- Impact on Palantir Stock Price: The market reaction to the Q1 2024 earnings will likely be swift and significant. Positive results could send the Palantir stock price soaring, while disappointing results could lead to a decline. Therefore, understanding the nuances of the earnings report is crucial for making sound investment decisions. Analyzing Palantir revenue and Palantir profitability will be key in assessing the results.

Long-Term Growth Potential:

Palantir operates in a rapidly expanding market. The demand for advanced big data analytics and AI-powered solutions continues to grow across diverse sectors.

- Market Share: Palantir holds a substantial share in the government and intelligence sectors. Its success in expanding into commercial markets will be critical for its long-term growth.

- Competitive Landscape: Palantir faces competition from established players and emerging startups in the big data analytics and AI markets. However, its strong brand recognition and innovative technology offer a competitive advantage. Analyzing Palantir competitors and their strategies is crucial for understanding Palantir's potential.

- New Market Expansion: Palantir's future growth depends heavily on its ability to penetrate new markets and expand its existing customer base. Expansion into healthcare, finance, and other sectors represents significant opportunities for increased Palantir revenue.

Key Risk Factors Affecting Palantir Stock

Government Contract Dependence:

A significant portion of Palantir's revenue comes from government contracts, particularly in the defense and intelligence sectors. This dependence introduces several risks.

- Government Budget Cuts: Changes in government spending priorities could negatively impact Palantir's revenue stream. Defense spending cuts or shifts in budgetary allocations could have a direct effect on Palantir government contracts.

- Regulatory Changes: New regulations or shifts in government policies could affect Palantir's ability to secure and execute contracts. Geopolitical factors can also influence the stability of government contracts.

- Geopolitical Risk: International conflicts and geopolitical instability can impact government spending on defense and intelligence, potentially reducing Palantir's revenue from this sector. Understanding geopolitical risk is crucial when evaluating Palantir stock.

Competition and Market Saturation:

The big data analytics market is becoming increasingly competitive. Several established companies and innovative startups pose a threat to Palantir's market share.

- Key Competitors: Palantir competes with companies like AWS, Microsoft Azure, Google Cloud, and other specialized data analytics firms. Analyzing Palantir competitors and their strengths is crucial for understanding the competitive dynamics.

- Market Share Dynamics: The competition for market share is intense, and Palantir needs to continue innovating and expanding its offerings to maintain its competitive edge.

- Competitive Advantage: Palantir's advanced technology, strong client relationships, and specialized expertise in data analysis provide a degree of competitive advantage. However, maintaining this advantage requires continuous investment in R&D and adaptation to market changes.

Valuation and Stock Price Analysis

Current Stock Price and Historical Performance:

Analyzing the Palantir stock price and historical performance is vital for understanding its valuation.

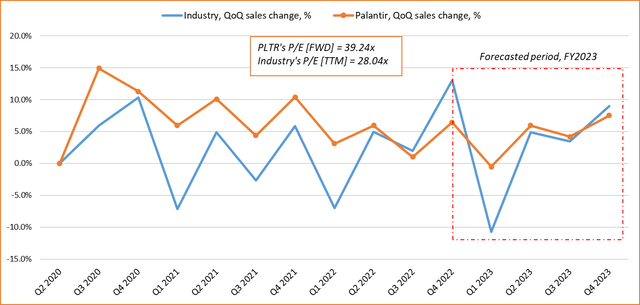

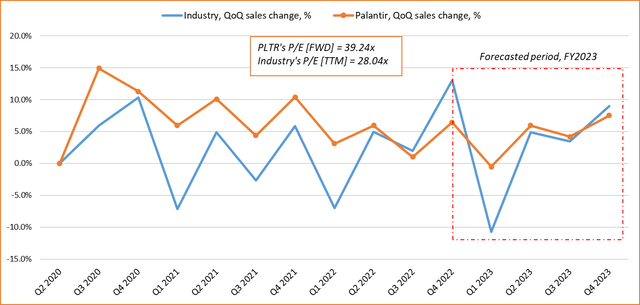

- Palantir Stock Price: The Palantir stock price has experienced significant volatility in the past. Analyzing its historical trends and comparing it to industry benchmarks can give insights into its potential future performance.

- Valuation Metrics: Key valuation metrics such as the price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and other relevant metrics should be examined carefully.

- Palantir Stock Chart: Examining the Palantir stock chart provides a visual representation of its price movements over time, assisting in identifying trends and patterns.

Technical Analysis and Chart Patterns (Optional):

While not always reliable, a brief look at technical analysis can offer supplementary insights. This could include examining support and resistance levels, moving averages, and other relevant indicators. However, it's crucial to use technical analysis cautiously and not rely solely on it for investment decisions.

Conclusion: Should You Buy Palantir Stock Before May 5th?

The decision of whether to buy Palantir stock before May 5th hinges on a careful weighing of potential rewards and risks. While Palantir operates in a high-growth market and possesses strong technology, its dependence on government contracts and increasing competition present significant challenges. The Q1 2024 earnings report will be a critical factor in shaping the future Palantir stock price. Based on the analysis, a cautious approach may be warranted, perhaps leaning toward a "hold" or "wait-and-see" strategy until the earnings report is released and fully analyzed. Remember, always conduct your own thorough research and consider your individual risk tolerance before making any investment decisions. Consult with a qualified financial advisor for personalized guidance. For further information on investing, consider consulting resources like the Securities and Exchange Commission (SEC) website. Ultimately, the decision about Palantir stock is yours.

Featured Posts

-

Implantation D Un Vignoble De 2500 M A Dijon Secteur Des Valendons

May 10, 2025

Implantation D Un Vignoble De 2500 M A Dijon Secteur Des Valendons

May 10, 2025 -

Elizabeth Arden Products Walmart Price Comparisons

May 10, 2025

Elizabeth Arden Products Walmart Price Comparisons

May 10, 2025 -

Vehicle Subsystem Issue Halts Blue Origin Rocket Launch

May 10, 2025

Vehicle Subsystem Issue Halts Blue Origin Rocket Launch

May 10, 2025 -

Rumeysa Ozturk Tufts Student Released From Ice Custody Following Court Order

May 10, 2025

Rumeysa Ozturk Tufts Student Released From Ice Custody Following Court Order

May 10, 2025 -

The Rise Of Otc Birth Control A Post Roe Reality Check

May 10, 2025

The Rise Of Otc Birth Control A Post Roe Reality Check

May 10, 2025